Press release

Sukuk Market Size Witnesses Robust Growth Rate of CAGR 14.1%, Exceeding US$ 3,619.3 Billion by 2032

The latest report by IMARC Group, titled "Sukuk Market Report by Sukuk Type (Murabahah Sukuk, Salam Sukuk, Istisna Sukuk, Ijarah Sukuk, Musharakah Sukuk, Mudarabah Sukuk, Hybrid Sukuk, and Others), Currency (Turkish Lira, Indonesian Rupiah, Saudi Riyal, Kuwaiti Dinar, Malaysian Ringgit, United States Dollar, and Others), Issuer Type (Sovereign, Corporate, Financial Institutions, Quasi-Sovereign, and Others), and Region 2024-2032", offers a comprehensive analysis of the industry, which comprises insights on the market. The global sukuk market size reached US$ 1,063.3 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 3,619.3 Billion by 2032, exhibiting a growth rate (CAGR) of 14.1% during 2024-2032.Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/sukuk-market

Factors Affecting the Growth of the Sukuk Industry:

● Growing Demand for Islamic Finance:

The sukuk market is primarily driven by the increasing global demand for Islamic finance solutions. As ethical and interest-free investment alternatives, Sukuk appeals to a broad spectrum of investors, including those from both Muslim-majority and non-Muslim-majority countries. This rise in interest has led governments, corporations, and financial institutions worldwide to issue Sukuk to tap into this expanding market. With the rising awareness of Islamic finance principles and the quest for Sharia-compliant investments, the sukuk market continues to grow and diversify, offering a variety of opportunities for investors seeking ethical and profitable ventures.

● Rising Infrastructure Development and Funding Needs:

Sukuk's crucial role in financing infrastructure projects represents the primary factor driving the market growth. Many countries, especially in the Middle East and Asia, are investing heavily in infrastructure development. Sukuk provides an attractive funding source for these projects because they align with Islamic principles and attract a wide range of investors, including sovereign wealth funds and Islamic banks. As the need for infrastructure financing grows globally, Sukuk's compatibility with these projects ensures its continued prominence in the market. Governments and institutions leverage Sukuk to meet their infrastructure funding requirements, further propelling market growth.

● Diversification of Investment Portfolios:

Investors, institutional and retail, are increasingly diversifying their portfolios by including Sukuk. These instruments offer stability and are considered low-risk investments, attracting those seeking predictable returns in uncertain financial markets. Sukuk's asset-backed nature provides security to investors, making them an attractive choice. As investors aim to reduce risk and broaden their investment options, the Sukuk market continues to gain prominence. It is recognized as a reliable and ethical investment avenue, drawing capital from diverse sources and contributing to its growth as a significant asset class in the global financial landscape.

For an in-depth analysis, you can request the sample copy of the report: https://www.imarcgroup.com/sukuk-market/requestsample

Leading Companies Operating in the Sukuk Industry:

● Abu Dhabi Islamic Bank PJSC

● Al Baraka Banking Group

● Al-Rajhi Bank

● Banque Saudi Fransi

● Dubai Islamic Bank

● HSBC Holdings Plc

● Kuwait Finance House

● Malayan Banking Berhad

● Qatar International Islamic Bank

● RHB Bank Berhad

● Samba Financial Group

Sukuk Market Report Segmentation:

By Sukuk Type:

● Murabahah Sukuk

● Salam Sukuk

● Istisna Sukuk

● Ijarah Sukuk

● Musharakah Sukuk

● Mudarabah Sukuk

● Hybrid Sukuk

● Others

Murabahah sukuk represented the leading segment due to their widespread use in Islamic finance.

By Currency:

● Turkish Lira

● Indonesian Rupiah

● Saudi Riyal

● Kuwaiti Dinar

● Malaysian Ringgit

● United States Dollar

● Others

Malaysian Ringgit accounted for the largest market share owing to Malaysia's position as a key hub for Islamic finance.

By Issuer Type:

● Sovereign

● Corporate

● Financial Institutions

● Quasi-Sovereign

● Others

Sovereign represented the largest segment as it includes sukuk issuances by governments and central banks.

Regional Insights:

● North America

○ United States

○ Canada

● Asia-Pacific

○ China

○ Japan

○ India

○ South Korea

○ Australia

○ Indonesia

○ Others

● Europe

○ Germany

○ France

○ United Kingdom

○ Italy

○ Spain

○ Russia

○ Others

● Latin America

○ Brazil

○ Mexico

○ Others

● Middle East and Africa

South East Asia's dominance in the sukuk market is attributed to a robust Islamic finance ecosystem and a strong regulatory framework.

Global Sukuk Market Trends:

The sukuk market is primarily driven by the escalating demand for ethical and Sharia-compliant investments, appealing to a diverse investor base, including those from non-Muslim-majority regions. Apart from this, governments and institutions worldwide, driven by the need for infrastructure development, leverage sukuk as an attractive funding source due to its alignment with Islamic principles, particularly in regions like the Middle East and Asia, thus fueling market growth. Furthermore, the rising role of sukuk in diversifying investment portfolios, offering stability and low-risk returns, has accelerated its adoption as an appealing choice for investors seeking predictable yields amidst market uncertainty, thus supporting market growth.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

People also read:

Wireless Microphone Market: https://www.imarcgroup.com/wireless-microphone-market

Hi-tech Medical Devices Market: https://www.imarcgroup.com/hi-tech-medical-devices-market

E-waste Management Market: https://www.imarcgroup.com/e-waste-management-market

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Sukuk Market Size Witnesses Robust Growth Rate of CAGR 14.1%, Exceeding US$ 3,619.3 Billion by 2032 here

News-ID: 3362149 • Views: …

More Releases from IMARC Group

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

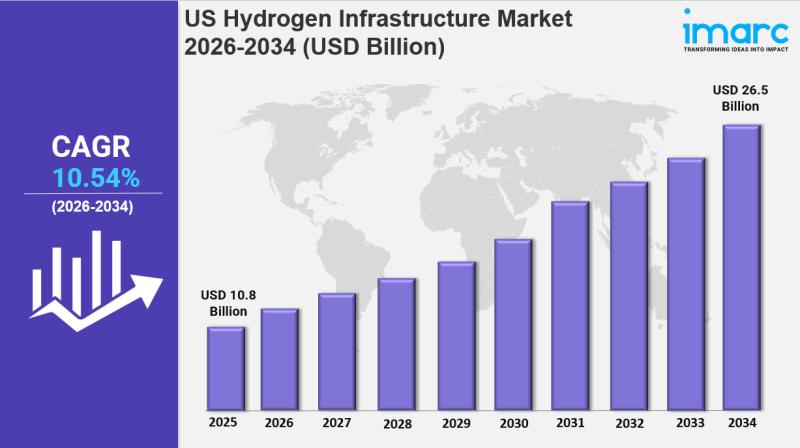

US Hydrogen Infrastructure Market Size, Growth, Latest Trends and Forecast 2026- …

IMARC Group has recently released a new research study titled "US Hydrogen Infrastructure Market Report by Production (Steam Methane Reforming, Coal Gasification, Electrolysis, and Others), Storage (Compression, Liquefaction, Material Based), Delivery (Transportation, Refinery, Power Generation, Hydrogen Refueling Stations), and Region 2026-2034" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The U.S. hydrogen infrastructure market…

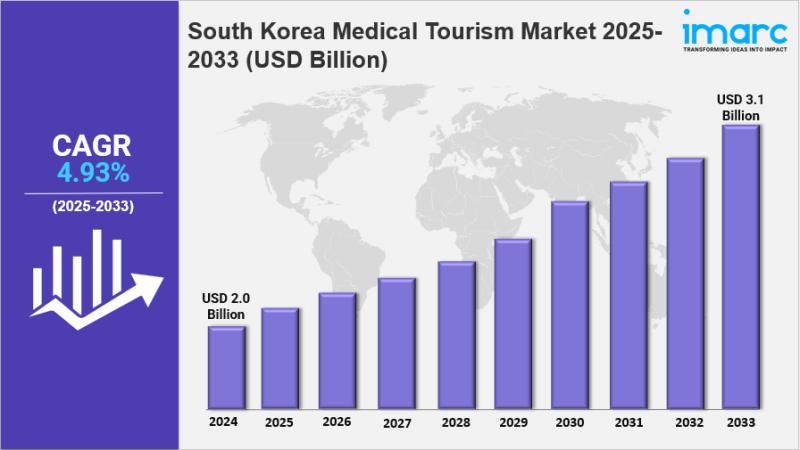

South Korea Medical Tourism Market Size, Share, Industry Overview, Trends and Fo …

IMARC Group has recently released a new research study titled "South Korea Medical Tourism Market Report by Type (Outbound, Inbound, Intrabound), Treatment Type (Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, and Others) 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Medical Tourism Market Overview

The South Korea…

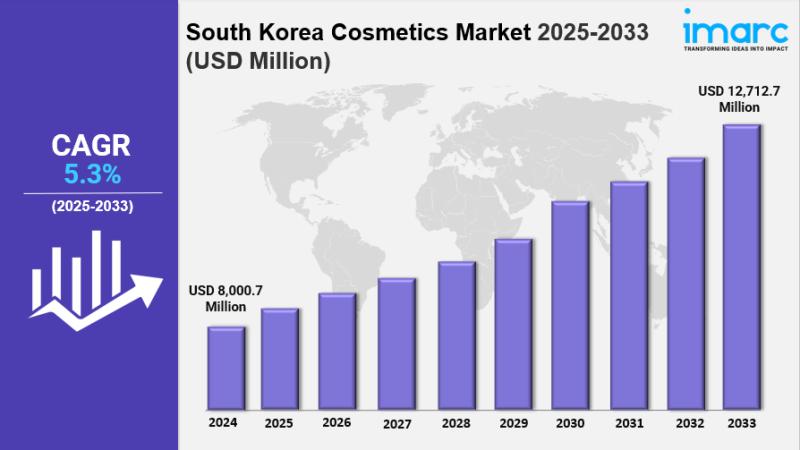

South Korea Cosmetics Market Size, Share, Industry Overview, Trends and Forecast …

IMARC Group has recently released a new research study titled "South Korea Cosmetics Market Report by Product Type (Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, and Others), Category (Conventional, Organic), Gender (Men, Women, Unisex), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, and Others), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and…

More Releases for Sukuk

Prominent Sukuk Market Trend for 2025: Sukuk Market Innovates With Sustainable F …

"What combination of drivers is leading to accelerated growth in the sukuk market?

Middle Eastern nations' swift urbanization is predicted to boost the sukuk market's expansion. Urbanization involves a country's populace steadily transitioning from rural to urban settings, resulting in a faster increase in urban inhabitants compared to rural ones. Urbanization creates a need for infrastructure investment, in turn promoting economic advancement through various means such as reducing transaction charges and…

Sukuk Market Analysis, Trends, Growth, Research And Forecast 2033

The sukuk market size has grown rapidly in recent years. It will grow from $904.5 billion in 2023 to $1084.8 billion in 2024 at a compound annual growth rate (CAGR) of 19.9%. The growth in the historic period can be attributed to islamic finance growth, diversification of funding sources, infrastructure development, government initiatives, global sukuk issuance, increased cross-border transactions.

The sukuk market size is expected to see rapid growth in…

Sukuk Market Grows Exponentially with Key Drivers and Lucrative Opportunities

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2033

The Business Research Company offers in-depth market insights through Sukuk Global Market Report 2024, providing businesses with a competitive advantage by thoroughly analyzing the market structure, including estimates for numerous segments and sub-segments.

Market Size And Growth Forecast:

The sukuk market size has grown rapidly in recent years. It will grow…

Sukuk Market Report, Size, Share, Trends and Forecast 2023-2028

IMARC Group, a leading market research company, has recently releases report titled "Sukuk Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028." The study provides a detailed analysis of the industry, including the global sukuk market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights

How big is the sukuk market?

The global sukuk market size…

Sukuk: Pinpointing the Next Wave of Mega Deals

Dubai, UAE: Industry experts predict Sukuk issuance will reach $100 billion in the next five years. According to recent statistics, Islamic Sukuk issuance in the Gulf and other Arab countries had reached $14 billion by the first quarter of 2006. The growth and development of the Sukuk industry will be under discussion at the World Islamic Funds & Capital Markets Conference. The third edition of the annual conference will…

Sukuk Forum Dubai sponsored by Sanad Sukuk Fund

The Middle East Business Forum will be gathering in Dubai on 25 April 2007 at the Grand Hyatt to focus its members’ attention towards the phenomenal growth of the Sukuk industry across international markets.

The Gold Sponsor, Sanad Sukuk Fund, is the world’s first GCC-oriented, diversified Sukuk fund. Sukuk—which are also known as “Islamic bonds”—have, until now, been difficult to purchase for the vast majority of Muslims leaving them unable…