Press release

Term Insurance Market Size Value To Reach USD 2,201.35 Billion By 2032 - According to Polaris Market Research

𝐑𝐞𝐩𝐨𝐫𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰Term Insurance Market refers to the segment of the insurance industry that deals specifically with term life insurance products. Term life insurance is a type of life insurance policy that provides coverage for a specified term or duration. If the policyholder dies during the term, the death benefit is paid out to the beneficiaries. However, if the policyholder survives the term, there is no payout, and the coverage typically expires.

The rise of online platforms has made it easier for individuals to compare and purchase term insurance policies. Online distribution channels have streamlined the application process, making it more convenient for consumers.

Global Term Insurance Market size and share is currently valued at USD 1060.77 billion in 2023 and is anticipated to generate an estimated revenue of USD 2,201.35 billion by 2032, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 8.5% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2024 - 2032

𝐔𝐧𝐥𝐨𝐜𝐤 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐘𝐨𝐮𝐫 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰 @ https://www.polarismarketresearch.com/industry-analysis/term-insurance-market/request-for-sample

The research study aims to assist stakeholders, investors, and businesses in making more informed decisions and formulating effective strategies to stay ahead of the curve. In addition, the impact of technological advancements, changing consumer preferences, and rising demand for innovative services on the market is covered. The report is a must-read for anyone currently involved or interested in the industry.

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐢𝐯𝐞 𝐋𝐚𝐧𝐝𝐬𝐜𝐚𝐩𝐞

The research study analyzes the current competitive environment of the market by providing information regarding Term Insurance Market key players. The competitive landscape section covers several aspects of industry players, including their sales volume, market share, price, and gross margin. Additionally, important information about strategic developments such as mergers, acquisitions, and collaborations is provided in the report.

𝐓𝐡𝐞 𝐤𝐞𝐲 𝐩𝐥𝐚𝐲𝐞𝐫𝐬 𝐨𝐩𝐞𝐫𝐚𝐭𝐢𝐧𝐠 𝐢𝐧 𝐭𝐡𝐞 𝐦𝐚𝐫𝐤𝐞𝐭 𝐚𝐫𝐞:

Aegon Life Insurance Company Limited

American International Group, Inc.

Bajaj Allianz Life Insurance Co. Ltd.

China Life Insurance (Overseas) Company Limited

John Hancock

Lincoln National Corporation

Massachusetts Mutual Life Insurance Company

MetLife Services and Solutions, LLC.

Prudential Financial, Inc.

State Farm Mutual Automobile Insurance Company

The Northwestern Mutual Life Insurance Company

𝐀𝐜𝐜𝐞𝐬𝐬 𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬 𝐰𝐢𝐭𝐡 𝐭𝐡𝐞𝐢𝐫 𝐤𝐞𝐲 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠𝐬 𝐚𝐬 𝐲𝐨𝐮 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐲𝐨𝐮𝐫 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 @ https://www.polarismarketresearch.com/industry-analysis/term-insurance-market/request-for-sample

𝐆𝐫𝐨𝐰𝐭𝐡 𝐃𝐫𝐢𝐯𝐞𝐫𝐬

Affordability: Term insurance is generally more affordable than other types of life insurance, making it an attractive option for individuals seeking basic life coverage without the additional investment components.

Financial Protection: As the primary purpose of term insurance is to provide a death benefit, it appeals to individuals looking for financial protection for their families in the event of their untimely death. This is especially relevant for breadwinners with dependents.

Flexibility: Term insurance policies often offer flexibility in terms of policy duration and coverage amount. Policyholders can choose the term that aligns with their specific needs, such as the period of a mortgage or until children are financially independent.

𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬:

Family Protection: Term insurance is commonly used to protect the financial interests of the insured's family, especially if they rely on the insured's income. The death benefit can help cover living expenses, outstanding debts, and other financial obligations.

Mortgage Protection: Homeowners often opt for term insurance to ensure that their mortgage can be paid off in the event of their death, preventing the family from facing the risk of losing their home.

Business Continuity: Term insurance can be used in business scenarios to provide financial support in case a key person in the company passes away. It can help the business cope with potential financial challenges during such a critical time.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

The Term Insurance Market segmentation is primarily based on type, application, end use, and region. A comprehensive analysis of each of these segments is detailed in the report. Besides, the study sheds light on all the major sub-segments in the market. That way, stakeholders can better understand the needs of their customers and align their business strategies accordingly.

𝐂𝐨𝐧𝐧𝐞𝐜𝐭 𝐰𝐢𝐭𝐡 𝐨𝐮𝐫 𝐑𝐞𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐚𝐭𝐢𝐯𝐞 𝐟𝐨𝐫 𝐑𝐞𝐩𝐨𝐫𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧@ https://www.polarismarketresearch.com/industry-analysis/term-insurance-market/request-for-customization

𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰

The study offers additional insight into the regional market distribution, covering industry trends, revenue sources, and potential opportunities. Also, it offers predictions for revenue growth at regional, national, and global levels. Other important factors like pricing, production capacity, supply and demand ratios, and projected Term Insurance Market sales are detailed in the report.

𝐓𝐡𝐞 𝐆𝐞𝐨𝐠𝐫𝐚𝐩𝐡𝐢𝐜𝐚𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐂𝐨𝐯𝐞𝐫𝐬 𝐅𝐨𝐥𝐥𝐨𝐰𝐢𝐧𝐠 𝐊𝐞𝐲 𝐑𝐞𝐠𝐢𝐨𝐧𝐬:

North America (United States, Canada, and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and the Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and the rest of South America)

The Middle East and Africa (Saudi Arabia, United Arab Emirates, Egypt, South Africa, and the Rest of the Middle East and Africa)

𝐈𝐧𝐢𝐭𝐢𝐚𝐭𝐞 𝐘𝐨𝐮𝐫 𝐑𝐞𝐩𝐨𝐫𝐭 𝐈𝐧𝐪𝐮𝐢𝐫𝐲 𝐇𝐞𝐫𝐞 @ https://www.polarismarketresearch.com/industry-analysis/term-insurance-market/inquire-before-buying

𝐊𝐞𝐲 𝐇𝐢𝐠𝐡𝐥𝐢𝐠𝐡𝐭𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭

A descriptive analysis of the demand-supply gap and forecast in the global market.

Bottom-up and top-down approaches for regional analysis.

Covers a SWOT analysis of key players and the overall Term Insurance Market.

Includes both primary and secondary research methods to provide a thorough market understanding.

Porter's Five Forces model provides an in-depth examination of industry vendors, substitutes, and competition among industry players.

Provides a detailed picture of the market by including value chain analysis.

𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐀𝐜𝐜𝐞𝐬𝐬 𝐭𝐨 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://www.polarismarketresearch.com/buy/3226/2

𝐓𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐀𝐧𝐬𝐰𝐞𝐫𝐬 𝐐𝐮𝐞𝐬𝐭𝐢𝐨𝐧𝐬 𝐒𝐮𝐜𝐡 𝐀𝐬

What is the current size and projected value for the market?

What are the key factors driving the Term Insurance Market demand?

Which is the leading segment in the industry?

What are the potential attractive investment opportunities in the market?

At what CAGR is the market projected to grow over the forecast period?

Where will strategic developments take the Term Insurance Market in the short to long term?

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐔𝐬:

Polaris Market Research

Phone: +1-929-297-9727

Email: sales@polarismarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Polaris Market Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Polaris Market Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We at Polaris are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semiconductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Term Insurance Market Size Value To Reach USD 2,201.35 Billion By 2032 - According to Polaris Market Research here

News-ID: 3359217 • Views: …

More Releases from Polaris Market Research & Consulting

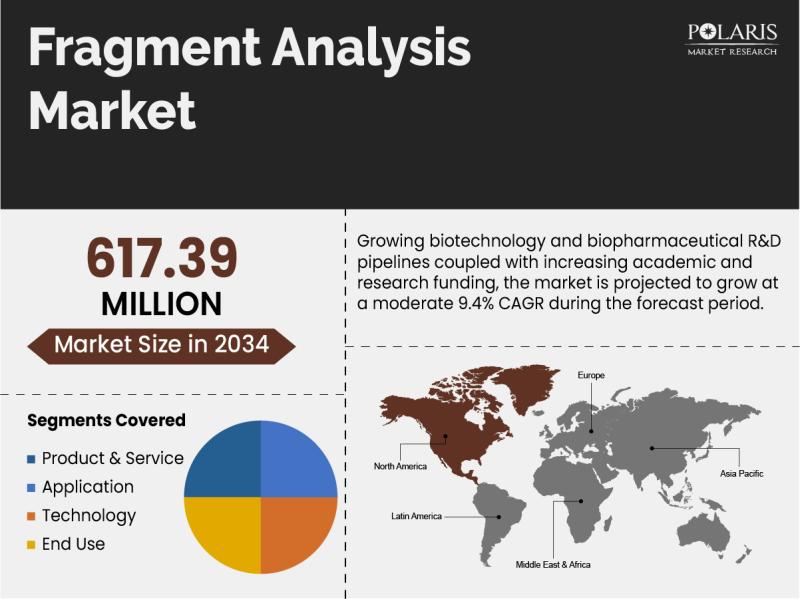

Fragment Analysis Market Size Projected to Reach USD 617.39 Million by 2034, Gro …

Global Fragment Analysis Market is currently valued at USD 275.72 Million in 2025 and is anticipated to generate an estimated revenue of USD 617.39 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 9.4% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034.

Polaris Market Research recently introduced the latest update on Fragment Analysis Market…

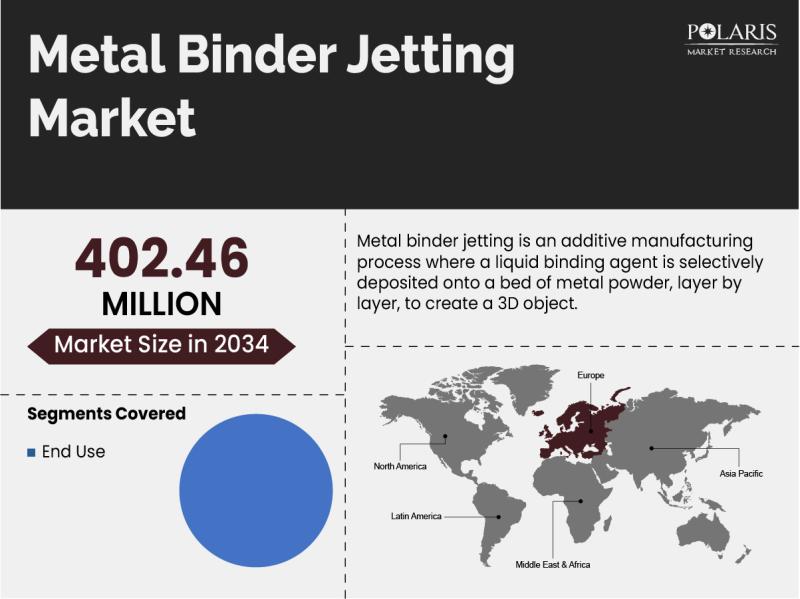

Metal Binder Jetting Market Growth Projected at 10.6% CAGR, Reaching USD 402.46 …

Global Metal Binder Jetting Market is currently valued at USD 147.51 Million in 2024 and is anticipated to generate an estimated revenue of USD 402.46 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 10.6% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 - 2034.

Polaris Market Research recently introduced the latest update on Metal Binder…

Rigid Food Packaging Market to Reach USD 354.25 Billion by 2034, Growing at a CA …

The quantitative market research report published by Polaris Market Research on Rigid Food Packaging Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Rigid Food Packaging Market size, financial data, and projected future growth. All the…

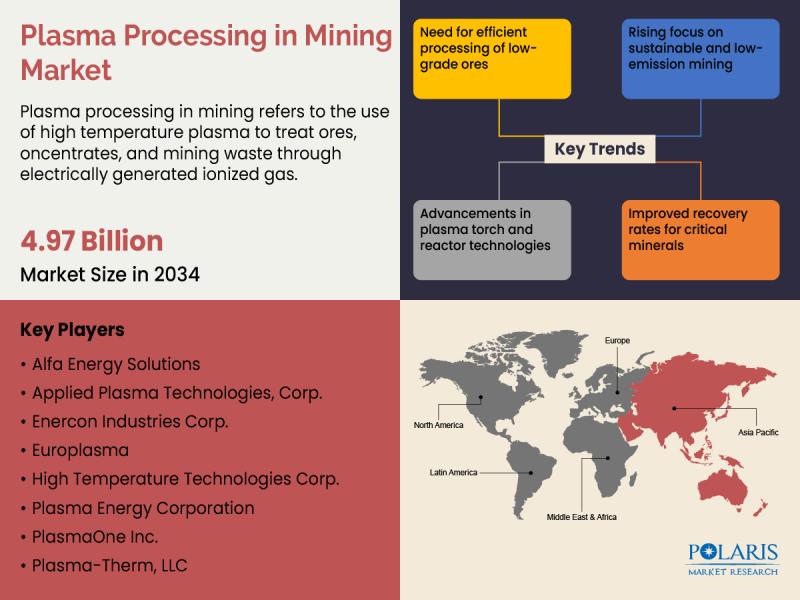

Global Plasma Processing in Mining Market to Reach USD 4.97 Billion by 2034, Reg …

Market Size and Share:

The global plasma processing in mining market is estimated to reach approximately USD 2.62 billion in 2025 and is expected to experience steady growth from 2026 to 2034, expanding at a projected CAGR of 7.4% during the forecast period.

Polaris Market Research has introduced the latest market research report titled Plasma Processing in Mining Market that highlights the major revenue stream for the forecast period. The report contains…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…