Press release

Saudi Arabia Aquaculture Market Size, Share, Growth and Statistics 2023-2028

IMARC Group report titled "Saudi Arabia Aquaculture Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028". The Saudi Arabia aquaculture market size reached a production volume of 397,800 Tons in 2022. Looking forward, IMARC Group expects the market to reach 631,300 Tons by 2028, exhibiting a growth rate (CAGR) of 7.9% during 2023-2028.Request to Get the Sample Report: https://www.imarcgroup.com/saudi-arabia-aquaculture-market/requestsample

Factors Affecting the Growth of the Saudi Arabia Aquaculture Industry:

• Government Initiatives and Investments:

Government initiatives and investments play a pivotal role in the development of the aquaculture market across Saudi Arabia. The Saudi Arabian government has recognized the importance of aquaculture in achieving food security and reducing reliance on seafood imports. To support this, it has introduced a range of policies and incentives, including financial support, subsidies, and infrastructure development. These initiatives encourage local and foreign investments in the aquaculture sector, fostering its growth and sustainability. Government commitment is further exemplified by the establishment of dedicated agencies and research institutions aimed at advancing aquaculture practices and ensuring its long-term success as a vital component of the country's food production and security strategies.

• Rising Seafood Demand:

The Saudi Arabia aquaculture market is witnessing an increase in consumer demand for seafood, driven by both domestic and international factors. Domestically, a growing population and changing dietary preferences have led to an increased appetite for seafood, which is considered a healthy and protein-rich dietary choice. Furthermore, the country's economic diversification efforts and a focus on tourism have fueled demand for seafood in the hospitality sector. Internationally, Saudi Arabia is eyeing seafood exports, particularly to countries with high seafood demand, capitalizing on its strategic location and the quality of its aquaculture products. This dual demand, both at home and abroad, is propelling the growth of the Saudi Arabia aquaculture market.

• Abundant Marine Resources:

Saudi Arabia's suitability for aquaculture operations is underscored by the abundant availability of marine water resources and favorable environmental conditions. With its extensive coastline along the Red Sea and the Arabian Gulf, the country possesses ample access to marine waters. These pristine coastal areas provide an ideal habitat for aquaculture, ensuring a consistent supply of clean and nutrient-rich seawater. Moreover, the region's climate, characterized by warm temperatures and ample sunlight, fosters optimal conditions for aquaculture species. This unique combination of marine water resources and favorable environmental factors has positioned Saudi Arabia as a prime location for sustainable and thriving aquaculture operations, thus making it a key player in the aquaculture market.

Major Companies Covered in Saudi Arabia Aquaculture Industry Report:

• National Aquaculture Group (NAQUA)

• Saudi Fisheries Company (SFC)

• Arabian Shrimp Company

• Asmak Holdings

• Jazan Energy, and Development Company (Jazadco)

• Tabuk Fisheries Company

Saudi Arabia Aquaculture Market Report Segmentation:

Breakup by Fish Type:

• On the Basis of Production

o Freshwater Fishes

o Diadromous Fishes

o Marine Fishes

o Crustaceans

o Others

• On the Basis of Consumption

o Pelagic Fish

o Freshwater and Diadromous Fish

o Crustaceans

o Demersal Fish

o Others

Production (crustaceans) represented the largest fish type segment in the Saudi Arabia aquaculture market due to the high demand for species like shrimp and prawns, which are favored seafood choices among consumers and have gained popularity in domestic and international markets.

Breakup by Environment:

• Marine Water

• Fresh Water

• Brackish Water

Marine water represented the largest environment segment in the market as it aligns with the country's extensive coastline along the Red Sea and the Arabian Gulf, providing abundant access to marine water resources for aquaculture operations.

Breakup by Distribution Channel:

• Traditional Retail

• Supermarkets and Hypermarkets

• Convenience Stores

• Online Channel

• Others

Traditional retail represented the largest distribution channel segment in the market because traditional markets and local retail outlets continue to be a significant channel for the sale of seafood products in Saudi Arabia, reflecting consumer preferences for fresh and locally-sourced seafood.

Saudi Arabia Aquaculture Market Trends:

The growing trend towards diversifying the range of aquaculture species beyond traditional choices represents one of the key factors driving the growth of the aquaculture market across Saudi Arabia. This includes the cultivation of various types of fish, shrimp, and other aquatic organisms, driven by consumer demand for a wider selection of seafood options. Sustainability is becoming a key focus in Saudi Arabia's aquaculture industry. With a commitment to environmentally responsible production, practices, such as recirculating aquaculture systems (RAS) and organic farming methods are gaining prominence to reduce environmental impact and conserve water resources.

The widespread adoption of advanced technology and automation in aquaculture operations, including the use of IoT (Internet of Things) sensors for water quality monitoring, Artificial Intelligence (AI) for feeding optimization, and innovative fish health management systems enhance productivity and efficiency. Saudi Arabia is increasingly targeting international markets for seafood exports. The aquaculture industry's growth is geared towards meeting both domestic and export demand, aligning with the country's economic diversification and food security goals.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=1691&flag=C

Other Key Points Covered in the Report:

• COVID-19 Impact

• Porters Five Forces Analysis

• Value Chain Analysis

• Strategic Recommendations

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Aquaculture Market Size, Share, Growth and Statistics 2023-2028 here

News-ID: 3356385 • Views: …

More Releases from Imarc group

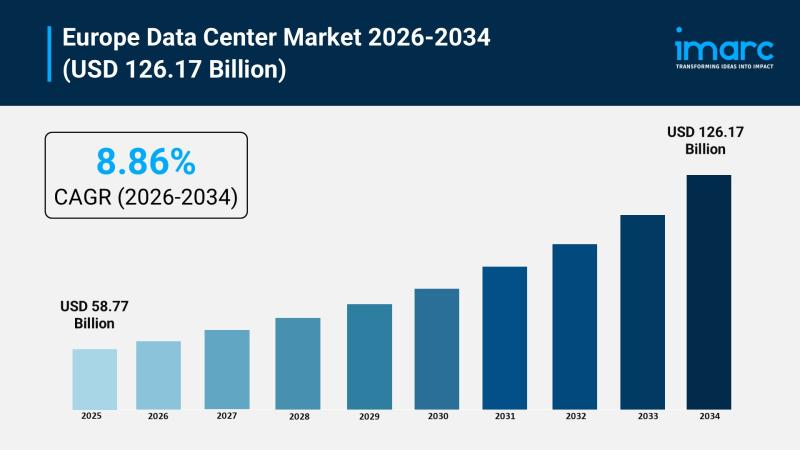

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

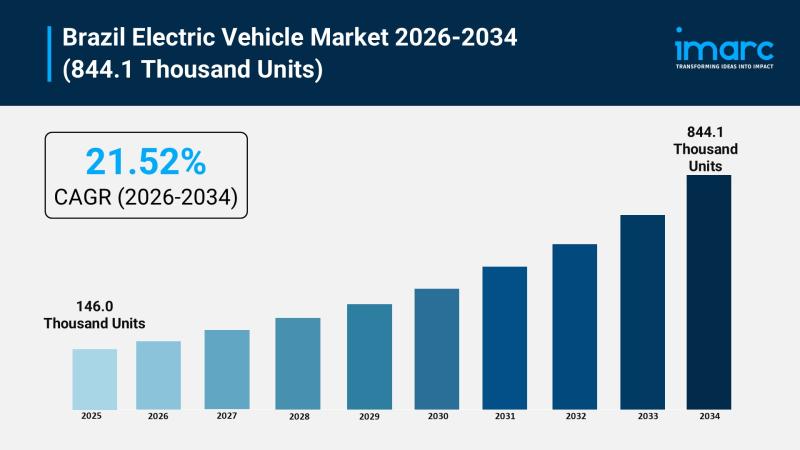

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Arabia

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Health Insurance Market 2021 Strategic Assessment- Bupa Saudi Arabi …

The report presents an in-depth assessment of the Saudi Arabia Health Insurance Market including enabling technologies, key trends, market drivers, challenges, standardization, regulatory landscape, deployment models, operator case studies, opportunities, future roadmap, value chain, ecosystem player profiles and strategies. The report also presents forecasts for Saudi Arabia Health Insurance from 2021 till 2026. The report covers the pre COVID-19 historic data, impact of COVID-19 and post-COVID-19 (Corona Virus) impact on…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Apparel Retail Market Research Report 2022 | Market Reports On Saud …

Market Reports On Saudi Arabia Provides the Trending Market Research Report on “Saudi Arabia Apparel Retail Market” under Consumer Goods category. The Saudi Arabia Apparel Retail Market is projected to exhibit highest growth rate over report offers a collection of superior market research, market analysis, competitive intelligence and industry reports.

Apparel Retail in Saudi Arabia industry profile provides top-line qualitative and quantitative summary information including: market size (value 2013-17, and forecast…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…