Press release

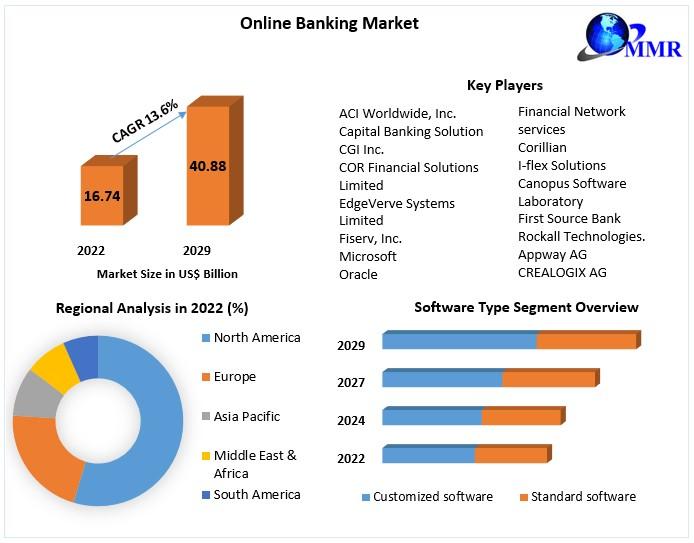

Online Banking Market Projected to Reach US$ 40.88 Billion by 2029 with a 13.6% CAGR from the Valuation of US$ 16.74 Billion in 2022"

Online Banking Market Report Scope and Research Methodology :The Online Banking Market Report delves into a comprehensive analysis of the industry, providing a detailed scope and thorough research methodology to offer valuable insights. The report meticulously examines the dynamic landscape of online banking, encompassing various factors influencing its growth trajectory. It explores market trends, challenges, opportunities, and key drivers that contribute to the market's expansion. With a focus on both current and emerging market players, the report presents a holistic view of the competitive landscape, highlighting strategies adopted by leading entities to maintain a competitive edge.

In terms of research methodology, the report employs a robust and systematic approach to gather and analyze data. It includes both qualitative and quantitative methods, utilizing primary and secondary sources to ensure the accuracy and reliability of the findings. Primary research involves direct interactions with industry experts, key stakeholders, and market participants, obtaining firsthand information on market trends and dynamics. On the other hand, secondary research involves a thorough review of existing literature, reports, and databases, allowing for a comprehensive understanding of the market's historical and present conditions. The combination of these methodologies ensures a well-rounded and insightful examination of the Online Banking Market, providing stakeholders with actionable intelligence for informed decision-making.

Click here to access the Free Sample Report:https://www.maximizemarketresearch.com/request-sample/84177

Online Banking Market Dynamics:

The dynamics of the online banking market are characterized by a continuous interplay of various factors that shape its evolution and growth. One of the primary drivers propelling this market is the increasing digitalization of financial services. With the widespread adoption of smartphones and the internet, consumers are increasingly inclined towards the convenience of accessing and managing their finances online. The seamless integration of mobile applications and user-friendly interfaces further enhances the overall customer experience, driving the demand for online banking services. Additionally, the ongoing technological advancements, such as artificial intelligence and blockchain, play a pivotal role in enhancing the security and efficiency of online banking platforms, fostering trust among users.

However, the online banking market is not without its challenges. Cybersecurity concerns remain a critical issue as digital transactions become more prevalent. The rise in cyber threats, phishing attacks, and data breaches pose risks to the sensitive financial information of users. Consequently, the industry is witnessing a parallel growth in investments in advanced security measures to safeguard against potential threats. Striking a balance between innovation and security will be crucial for the sustainable development of the online banking sector, as market players navigate the complex landscape of evolving customer expectations and the imperative to ensure robust cybersecurity protocols.

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/global-online-banking-market/84177/

What is Online Banking Market Segmentation:

by Service Type

Payments

Processing Services

Customer & Channel Management

Wealth Management

Others

by Banking Type

Retail Banking

Corporate Banking

Investment Banking

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/84177

Who are Online Banking Market Key Players:

1. ACI Worldwide, Inc.

2. Capital Banking Solution

3. CGI Inc.

4. COR Financial Solutions Limited

5. EdgeVerve Systems Limited

6. Fiserv, Inc.

7. Microsoft

8. Oracle

9. Tata Consultancy Services Limited

10. Temenos Headquarters SA

11. Financial Network services

12. Corillian

13. I-flex Solutions

14. Canopus Software Laboratory

15. First Source Bank

16. Rockall Technologies.

17. Appway AG

18. CREALOGIX AG

19. ebankIT

20. Etronika

21. Fidor Solutions AG

22. Finastra

23. Halcom.com

24. Infosys Limited

25. Intellect Design Arena Limited

26. SAP SE

27. Sopra Steria

Request For Free Sample Report :https://www.maximizemarketresearch.com/request-sample/84177

Online Banking Market Regional Insights:

The regional insights into the online banking market provide a nuanced understanding of how this dynamic sector is evolving across different geographical areas. North America stands out as a prominent player in the online banking landscape, attributed to its early adoption of advanced technologies and a high degree of digital literacy among the population. The presence of key market players, coupled with a robust technological infrastructure, fuels the growth of online banking services in this region. Additionally, favorable regulatory frameworks that encourage innovation and competition contribute to the flourishing online banking market in North America. Europe, with its diverse mix of developed and emerging economies, also exhibits significant growth potential. The region benefits from a tech-savvy population and proactive regulatory initiatives aimed at fostering a secure and competitive online banking ecosystem. As financial institutions increasingly embrace digital transformations, Europe is witnessing a surge in online banking adoption, creating a competitive and innovative market landscape.

In the Asia-Pacific region, the online banking market is experiencing rapid expansion driven by factors such as increasing smartphone penetration, rising internet accessibility, and a growing middle-class population with an affinity for digital services. Countries like China and India are particularly noteworthy, where large populations are swiftly transitioning to digital banking platforms for their financial needs. The region's online banking growth is further accelerated by the entry of tech-savvy startups and collaborations between traditional financial institutions and fintech companies. As the Asia-Pacific online banking market continues to mature, it presents a compelling opportunity for market players to capitalize on the evolving financial preferences of consumers in this dynamic and diverse region.

Table of content for the Online Banking Market includes:

1. Global Online Banking Market: Research Methodology

1. Global Online Banking Market : Executive Summary

• Market Overview and Definitions

• Introduction to the Global Market

• Summary

• Key Findings

• Recommendations for Investors

• Recommendations for Market Leaders

• Recommendations for New Market Entry

3.Global Online Banking Market: Competitive Analysis

• MMR Competition Matrix

• Market Structure by region

• Competitive Benchmarking of Key Players

• Consolidation in the Market

• M&A by region

• Key Developments by Companies

• Market Drivers

• Market Restraints

• Market Opportunities

• Market Challenges

• Market Dynamics

• PORTERS Five Forces Analysis

• PESTLE

• Regulatory Landscape by region

• North America

• Europe

• Asia Pacific

• Middle East and Africa

• South America

• COVID-19 Impact

4 . Company Profile: Key players

• Company Overview

• Financial Overview

• Global Presence

• Capacity Portfolio

• Business Strategy

• Recent Developments

Key Offerings:

• Past Market Size and Competitive Landscape

• Past Pricing and price curve by region

• Market Size, Share, Size and Forecast by different segment

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Market Segmentation - A detailed analysis by growth and trend

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

More Related Reports:

global Addiction Treatment Market https://www.maximizemarketresearch.com/market-report/global-addiction-treatment-market/36416/

Spirulina Market https://www.maximizemarketresearch.com/market-report/global-spirulina-market/29894/

Global Wireless Infrastructure Market https://www.maximizemarketresearch.com/market-report/global-wireless-infrastructure-market/34623/

Telecom Cloud Market https://www.maximizemarketresearch.com/market-report/global-telecom-cloud-market/44583/

Aerospace 3d Printing Market https://www.maximizemarketresearch.com/market-report/global-aerospace-3d-printing-market/15382/

Global Virtual Reality Headset Market https://www.maximizemarketresearch.com/market-report/global-virtual-reality-headset-market/54754/

security screening market https://www.maximizemarketresearch.com/market-report/global-security-screening-market/69111/

Data Center Infrastructure Management Market https://www.maximizemarketresearch.com/market-report/global-data-center-infrastructure-management-market/44412/

Smart Lighting Market https://www.maximizemarketresearch.com/market-report/smart-lighting-market/2275/

Global Aquaculture Market https://www.maximizemarketresearch.com/market-report/global-aquaculture-market/65165/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Banking Market Projected to Reach US$ 40.88 Billion by 2029 with a 13.6% CAGR from the Valuation of US$ 16.74 Billion in 2022" here

News-ID: 3352792 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…