Press release

Carbon Black Prices and Price Trends throughout Q1 of 2024

Introduction:Carbon black, a vital industrial material used in the production of tires, plastics, inks, and various other applications, plays a crucial role in numerous industries worldwide. To stay competitive and make informed decisions, businesses need to closely monitor carbon black prices and trends. In this report, we will analyze the prices and price trends of carbon black throughout the first quarter (Q1) of 2024, providing valuable insights for businesses and stakeholders in the industry.

Carbon Black Price: https://www.procurementresource.com/resource-center/carbon-black-price-trends

Q1 2024 Carbon Black Price Overview:

The first quarter of 2024 saw significant fluctuations in carbon black prices, driven by a combination of factors, including supply chain disruptions, raw material costs, and global economic conditions. Here's an overview of the price developments observed during this period:

Supply Chain Challenges:

The ongoing challenges in global supply chains continued to impact carbon black production and distribution. Delays in the procurement of raw materials, transportation bottlenecks, and labor shortages affected the overall supply, leading to upward pressure on prices.

Raw Material Costs:

The cost of feedstock materials, primarily oil and natural gas, had a considerable impact on carbon black prices. Any fluctuations in the prices of these raw materials directly influenced the overall cost structure of carbon black production, which, in turn, reflected in the pricing trends.

Global Economic Factors:

Economic conditions in key carbon black-consuming regions also played a role in pricing. Demand for carbon black in sectors like automotive and construction closely correlated with the economic health of these industries, influencing pricing dynamics.

Price Trends:

Throughout Q1 of 2024, carbon black prices exhibited the following trends:

Price Volatility:

The carbon black market experienced higher price volatility compared to previous quarters. Prices frequently fluctuated as a response to sudden changes in supply and demand dynamics.

Get Free Sample Request Link: https://www.procurementresource.com/resource-center/carbon-black-price-trends/pricerequest

Steady Upward Trend:

Despite the volatility, a general upward trend in carbon black prices was observed over the course of the quarter. This was primarily due to the ongoing supply chain disruptions and increased raw material costs.

Regional Variations:

Regional variations in carbon black pricing remained significant. While some regions experienced sharper price increases due to localized factors, others saw more stable pricing conditions.

Conclusion:

The first quarter of 2024 brought challenges and opportunities for businesses relying on carbon black as a critical input. Supply chain disruptions, raw material costs, and economic conditions continued to influence carbon black prices. To navigate these changes effectively, businesses should remain vigilant and adaptable in their sourcing and pricing strategies.

This report serves as a starting point for understanding the carbon black pricing landscape in Q1 2024. Staying informed about ongoing developments and leveraging market insights will be essential for businesses to make informed decisions and maintain competitiveness in the carbon black industry.

Contact Us:

Company Name: Procurement Resource

Contact Person: Jolie Alexa

Email: sales@procurementresource.com

Toll Free Number: USA & Canada - Phone no: +1 307 363 1045 | UK - Phone no: +44 7537 132103 | Asia-Pacific (APAC) - Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

About Us:

Procurement Resource ensures that our clients remain at the vanguard of their industries by providing actionable procurement intelligence with the help of our expert analysts, researchers, and domain experts. Our team of highly seasoned analysts undertakes extensive research to provide our customers with the latest and up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which aid in simplifying the procurement process for our clientele.

Procurement Resource work with a diverse range of procurement teams across industries to get real-time data and insights that can be effectively implemented by our customers. As a team of experts, we also track the prices and production costs of an extensive range of goods and commodities, thus, providing you with updated and reliable data.

We, at Procurement Resource, with the help of the latest and cutting-edge techniques in the industry, help our clients understand the supply chain, procurement, and industry climate so that they can form strategies that ensure their optimum growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Carbon Black Prices and Price Trends throughout Q1 of 2024 here

News-ID: 3349138 • Views: …

More Releases from Procurement Resource

Vancomycin Production Cost Analysis Report: Cost Model, Process Insights, and Ma …

Vancomycin is a critical glycopeptide antibiotic widely used in the treatment of severe bacterial infections, especially those caused by Gram-positive bacteria resistant to other antibiotics. Due to its essential role in modern healthcare, understanding the Vancomycin Production Cost is vital for pharmaceutical manufacturers, investors, procurement managers, and healthcare stakeholders. A detailed cost analysis not only helps in optimizing manufacturing expenses but also supports strategic pricing and long-term capacity planning.

Vancomycin Production…

Steel Production Cost - Process Economics, Raw Materials, and Cost Drivers

Steel is the backbone of modern industry, and its production cost is one of the most closely tracked indicators across construction, infrastructure, automotive, and manufacturing sectors. Unlike niche chemicals or APIs, steel economics are driven by scale, energy intensity, and raw material volatility.

Here's the thing: steel production cost isn't just about iron ore prices. It's a layered equation involving coking coal, electricity, labor, emissions compliance, logistics, and technology choice. A…

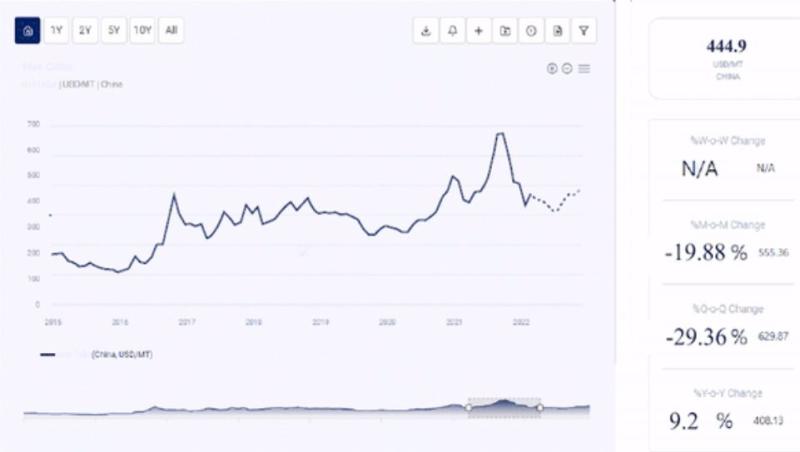

Nitrobenzene Price Trend: Market Drivers, Cost Dynamics, and Global Industry Out …

The Nitrobenzene Price Trend has emerged as a critical indicator for chemical manufacturers, procurement leaders, downstream processors, and investors tracking aromatic chemical markets. As a key intermediate used in the production of aniline, dyes, pharmaceuticals, lubricating oils, and agrochemicals, nitrobenzene plays a foundational role in multiple value chains. Any fluctuation in its pricing directly affects cost structures across industries ranging from automotive and construction to agriculture and specialty chemicals.

Inquire for…

Meropenem Production Cost Analysis: Cost Model, Manufacturing Insights, and Mark …

Meropenem is a broad-spectrum carbapenem antibiotic widely used in the treatment of severe bacterial infections, particularly in hospital and critical care settings. With rising antimicrobial resistance and increasing demand for advanced antibiotics, understanding the Meropenem Production Cost structure has become essential for pharmaceutical manufacturers, investors, and procurement professionals. This article provides an in-depth overview of the Meropenem Production Cost Analysis Report, covering cost models, pre-feasibility assessment, industrial trends, raw materials,…

More Releases for Price

Bitcoin Price, XRP Price, and Dogecoin Price Analysis: Turn Volatility into Prof …

London, UK, 4th October 2025, ZEX PR WIRE, The price movements in the cryptocurrency market can be crazy. Bitcoin price (BTC price), XRP price, and Dogecoin price vary from day to day, which can make it complicated for traders. Some investors win, but many more lose, amid unpredictable volatility. But there's a more intelligent way and that is Hashf . Instead of contemplating charts, Hashf provides an opportunity for investors…

HOTEL PRICE KILLER - BEAT YOUR BEST PRICE!

Noble Travels Launches 'Hotel Price Killer' to Beat OTA Hotel Prices

New Delhi, India & Atlanta, USA - August 11, 2025 - Noble Travels, a trusted name in the travel industry for over 30 years, has launched a bold new service called Hotel Price Killer, promising to beat the best hotel prices offered by major online travel agencies (OTAs) and websites.

With offices in India and USA, Noble Travels proudly serves an…

Toluene Price Chart, Index, Price Trend and Forecast

Toluene TDI Grade Price Trend Analysis - EX-Kandla (India)

The pricing trend for Toluene Diisocyanate (TDI) grade at EX-Kandla in India reveals notable fluctuations over the past year, influenced by global supply-demand dynamics and domestic economic conditions. From October to December 2023, the average price of TDI declined from ₹93/KG in October to ₹80/KG in December. This downward trend continued into 2024, with October witnessing a significant drop to ₹73/KG, a…

Glutaraldehyde Price Trend, Price Chart 2025 and Forecast

North America Glutaraldehyde Prices Movement Q1:

Glutaraldehyde Prices in USA:

Glutaraldehyde prices in the USA dropped to 1826 USD/MT in March 2025, driven by oversupply and weak demand across manufacturing and healthcare. The price trend remained negative as inventories rose and procurement slowed sharply in February. The price index captured this decline, while the price chart reflected persistent downward pressure throughout the quarter.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/glutaraldehyde-pricing-report/requestsample

Note: The analysis can…

Butane Price Trend 2025, Update Price Index and Real Time Price Analysis

MEA Butane Prices Movement Q1 2025:

Butane Prices in Saudi Arabia:

In the first quarter of 2025, butane prices in Saudi Arabia reached 655 USD/MT in March. The pricing remained stable due to consistent domestic production and strong export activities. The country's refining capacity and access to natural gas feedstock supported price control, even as global energy markets saw fluctuations driven by seasonal demand and geopolitical developments impacting the Middle East.

Get the…

Tungsten Price Trend, Chart, Price Fluctuations and Forecast

North America Tungsten Prices Movement:

Tungsten Prices in USA:

In the last quarter, tungsten prices in the United States reached 86,200 USD/MT in December. The price increase was influenced by high demand from the aerospace and electronics industries. Factors such as production costs and raw material availability, alongside market fluctuations, also contributed to the pricing trend.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/tungsten-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific…