Press release

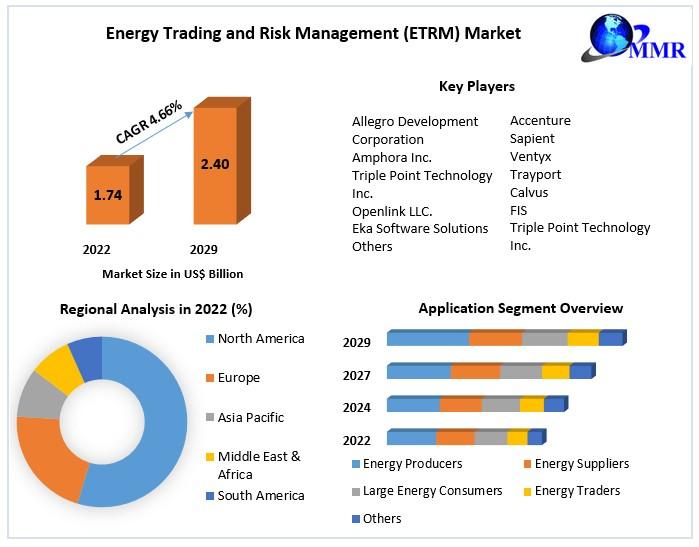

Energy Trading and Risk Management (ETRM) Market Poised to Reach US$ 2.40 Billion by 2029 with a Steady 4.66% CAGR"

Energy Trading and Risk Management (ETRM) Market Report Scope and Research Methodology :The Energy Trading and Risk Management (ETRM) Market Report encompasses a comprehensive scope and employs robust research methodology to provide a thorough analysis of the market dynamics. This report delves into various facets of the ETRM market, covering aspects such as market size, key trends, growth drivers, challenges, and opportunities. The scope extends to a detailed examination of different energy sources, including oil, gas, electricity, and renewables, along with a focus on the integration of advanced technologies in trading platforms. Furthermore, the report investigates the impact of regulatory frameworks on the ETRM market, offering insights into compliance requirements and their influence on market participants. Through a meticulous research methodology that combines primary and secondary data sources, including interviews with industry experts, market surveys, and analysis of historical and current trends, the report ensures accuracy and reliability in presenting a comprehensive overview of the ETRM market landscape.

The research methodology employed in the Energy Trading and Risk Management (ETRM) Market Report involves a systematic and data-driven approach to gather valuable insights. Primary research involves direct interactions with industry stakeholders, including key market players, regulators, and end-users, to gather first-hand information on market trends and challenges. Secondary research includes a thorough analysis of existing literature, market reports, and industry publications, providing a broader context for the primary data. The data collected is then analyzed using advanced statistical tools and techniques, ensuring the derivation of meaningful patterns and trends. This rigorous research methodology ensures the production of a reliable and insightful report, contributing to a comprehensive understanding of the ETRM market dynamics and fostering informed decision-making among stakeholders.

Click here to access the Free Sample Report:https://www.maximizemarketresearch.com/request-sample/70529

Energy Trading and Risk Management (ETRM) Market Dynamics:

The Energy Trading and Risk Management (ETRM) market dynamics are marked by a confluence of factors that shape the industry's landscape and influence its growth trajectory. A key driver propelling the ETRM market is the increasing complexity and volatility in the global energy sector. As energy markets become more interconnected and diverse, organizations are leveraging ETRM solutions to manage and mitigate risks associated with fluctuations in commodity prices, regulatory changes, and geopolitical uncertainties. The integration of advanced technologies such as artificial intelligence, blockchain, and data analytics into ETRM systems is another dynamic force, empowering market participants to make more informed decisions, optimize trading strategies, and enhance overall operational efficiency. Additionally, the growing emphasis on sustainability and the transition towards renewable energy sources are shaping ETRM dynamics, as market players adapt their strategies to navigate the evolving landscape of clean energy trading and risk management.

Despite the positive growth drivers, the Energy Trading and Risk Management market faces challenges that contribute to its dynamic nature. One notable challenge is the increasing regulatory scrutiny and compliance requirements imposed on energy market participants. The evolving regulatory landscape introduces complexities in adhering to guidelines, necessitating continuous adaptation and investment in compliance measures. Moreover, cybersecurity concerns pose a significant threat to the ETRM market, given the critical nature of energy infrastructure. As digitalization becomes more pervasive, the vulnerability to cyber threats increases, requiring robust security measures within ETRM systems. The interplay of these dynamics creates a dynamic environment, urging market participants to stay agile, innovate, and adopt comprehensive ETRM solutions to navigate challenges and capitalize on emerging opportunities in the evolving energy landscape.

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/energy-trading-and-risk-management-etrm-market/70529/

What is Energy Trading and Risk Management (ETRM) Market Segmentation:

by Application

Energy Producers

Energy Suppliers

Large Energy Consumers

Energy Traders

Others

by Operation

Front Office

Back Office

Middle Office

by Type

Software

Service

Other

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/70529

Who are Energy Trading and Risk Management (ETRM) Market Key Players:

1. Allegro Development Corporation

2. Amphora Inc.

3. Triple Point Technology Inc.

4. Openlink LLC.

5. Eka Software Solutions

6. SAP

7. FIS

8. Sapient

9. Ventyx

10. Trayport

11. Calvus

12. Others

Request For Free Sample Report :https://www.maximizemarketresearch.com/request-sample/70529

Energy Trading and Risk Management (ETRM) Market Regional Insights:

The regional insights into the Energy Trading and Risk Management (ETRM) market provide a nuanced understanding of how this industry landscape varies across different geographical areas. North America stands out as a prominent region, characterized by a mature and well-established ETRM market. The region's dominance is attributed to a high level of technological adoption, a diverse energy mix, and a robust regulatory framework. In North America, the focus on leveraging advanced technologies, such as artificial intelligence and machine learning, within ETRM solutions is particularly pronounced. Additionally, the region is witnessing a shift towards cleaner energy sources, driving the demand for ETRM solutions that facilitate the efficient trading and risk management of renewable energy assets.

Europe, as another significant player in the ETRM market, showcases a dynamic landscape influenced by the continent's commitment to renewable energy and sustainability. European countries are actively transitioning towards green energy, with an increased emphasis on wind, solar, and other renewables. This shift necessitates sophisticated ETRM solutions to manage the intricacies of trading and risk associated with these diverse energy sources. Regulatory initiatives, such as the European Union's efforts to create a unified energy market, further contribute to the evolving dynamics of the ETRM market in Europe. The region is witnessing a growing need for flexible and integrated ETRM systems that can adapt to changing market conditions and regulatory requirements, making it a vital area for market participants and solution providers to monitor and engage with.

Table of content for the Energy Trading and Risk Management (ETRM) Market includes:

1. Global Energy Trading and Risk Management (ETRM) Market: Research Methodology

1. Global Energy Trading and Risk Management (ETRM) Market : Executive Summary

• Market Overview and Definitions

• Introduction to the Global Market

• Summary

• Key Findings

• Recommendations for Investors

• Recommendations for Market Leaders

• Recommendations for New Market Entry

3.Global Energy Trading and Risk Management (ETRM) Market: Competitive Analysis

• MMR Competition Matrix

• Market Structure by region

• Competitive Benchmarking of Key Players

• Consolidation in the Market

• M&A by region

• Key Developments by Companies

• Market Drivers

• Market Restraints

• Market Opportunities

• Market Challenges

• Market Dynamics

• PORTERS Five Forces Analysis

• PESTLE

• Regulatory Landscape by region

• North America

• Europe

• Asia Pacific

• Middle East and Africa

• South America

• COVID-19 Impact

4 . Company Profile: Key players

• Company Overview

• Financial Overview

• Global Presence

• Capacity Portfolio

• Business Strategy

• Recent Developments

Key Offerings:

• Past Market Size and Competitive Landscape

• Past Pricing and price curve by region

• Market Size, Share, Size and Forecast by different segment

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Market Segmentation - A detailed analysis by growth and trend

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

More Related Reports:

Global Fuel Dispenser Market https://www.maximizemarketresearch.com/market-report/global-fuel-dispenser-market/50682/

Drill Pipe Market https://www.maximizemarketresearch.com/market-report/drill-pipe-market/14254/

Global Managed Print Services Market https://www.maximizemarketresearch.com/market-report/global-managed-print-services-market/43183/

Alpha Olefin Market https://www.maximizemarketresearch.com/market-report/alpha-olefin-market/13674/

Gaming Hardware Market https://www.maximizemarketresearch.com/market-report/global-gaming-hardware-market/55239/

Endpoint Security Market https://www.maximizemarketresearch.com/market-report/global-endpoint-security-market/57607/

UV LED Market https://www.maximizemarketresearch.com/market-report/global-uv-led-market/30764/

Polyether Polyols Market https://www.maximizemarketresearch.com/market-report/global-polyether-polyols-market/64035/

Carbon Fiber Market https://www.maximizemarketresearch.com/market-report/global-carbon-fiber-market/105705/

Sodium Carbonate Market https://www.maximizemarketresearch.com/market-report/global-sodium-carbonate-market/23565/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Energy Trading and Risk Management (ETRM) Market Poised to Reach US$ 2.40 Billion by 2029 with a Steady 4.66% CAGR" here

News-ID: 3347728 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

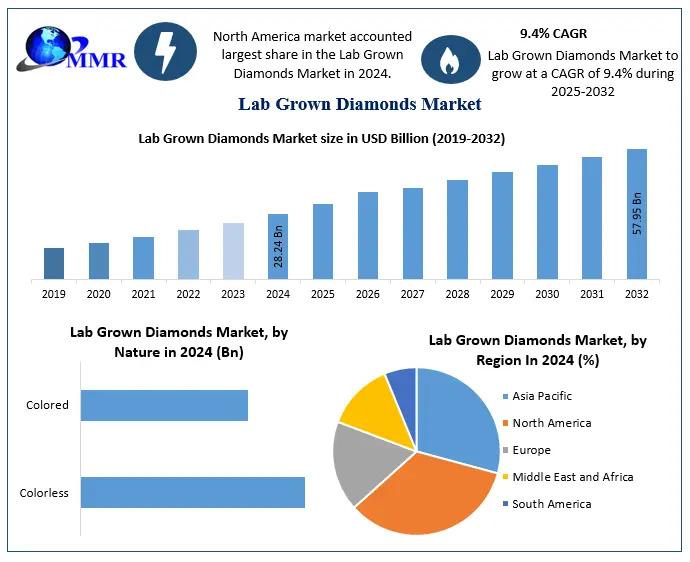

Lab Grown Diamonds Market to Reach USD 57.95 Billion by 2032, Growing at 9.4% CA …

According to a new report by Maximize Market Research, the global Lab Grown Diamonds Market was valued at USD 28.24 Billion in 2024 and is projected to reach USD 57.95 Billion by 2032, growing at a CAGR of 9.4%. The market expansion is fueled by increasing consumer preference for sustainable, affordable alternatives to natural diamonds and technological innovations in manufacturing.

► Get a sample of the report:https://www.maximizemarketresearch.com/request-sample/193972/

♦ Key HighlightsaMarket Size:

Market Size:…

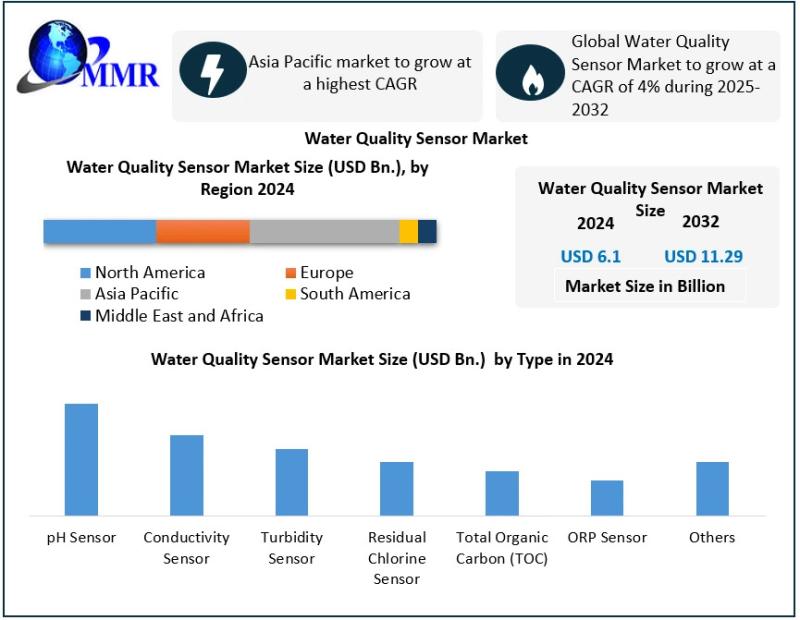

Water Quality Sensor Market to Reach USD 11.29 Billion by 2032, Growing at a 4% …

According to a new report by Maximize Market Research, the global Water Quality Sensor Market was valued at USD 6.1 Billion in 2024 and is projected to reach USD 11.29 Billion by 2032, growing at a CAGR of 4% during 2025-2032. The market growth is driven by the increasing adoption of smart water monitoring systems, stringent environmental regulations, and demand for real-time water quality assessment across industrial, residential, and governmental…

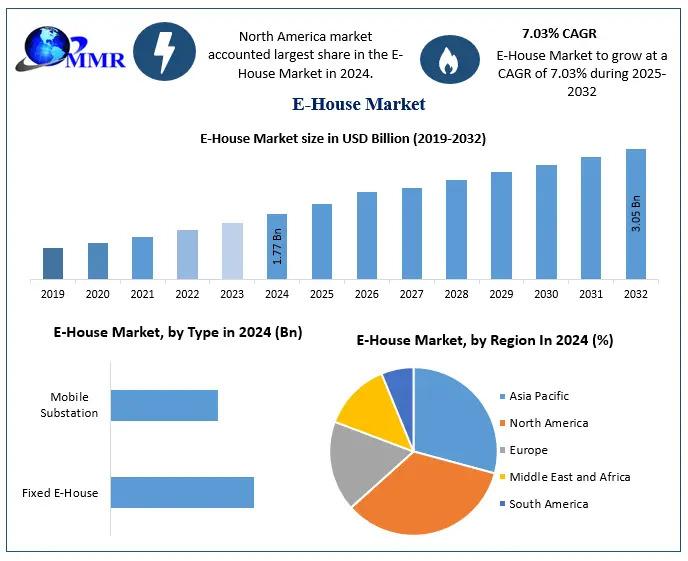

E-House Market to Reach USD 3.05 Billion by 2032, Growing at a CAGR of 7.03% | E …

According to a new report by Maximize Market Research, the global E-House Market was valued at USD 1.77 Billion in 2024 and is projected to reach USD 3.05 Billion by 2032, growing at a CAGR of 7.03%. The market growth is driven by the increasing adoption of pre-assembled, modular electrical houses across industrial, renewable energy, and utility sectors worldwide.

► Get a sample of the report:https://www.maximizemarketresearch.com/request-sample/28068/

♦ Key HighlightsaMarket Size:

Market Size: USD…

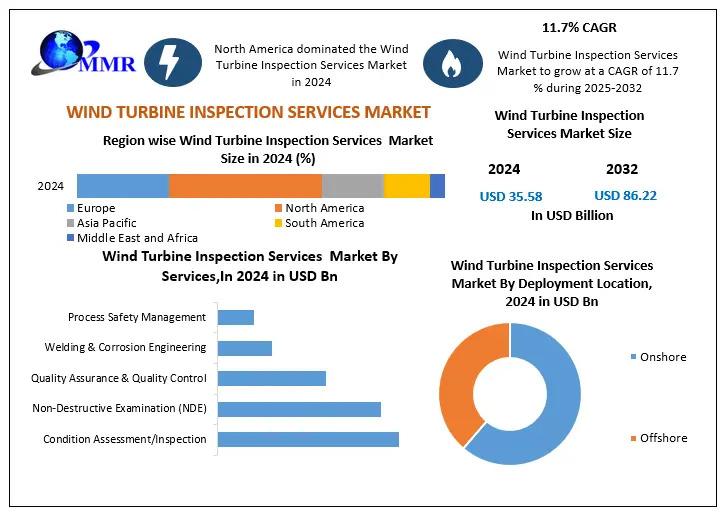

Global Wind Turbine Inspection Services Market to Reach USD 86.22 Billion by 203 …

According to a new report by Maximize Market Research, the global Wind Turbine Inspection Services Market was valued at USD 35.58 billion in 2024 and is projected to reach USD 86.22 billion by 2032, growing at a CAGR of 11.7%. The market growth is fueled by increasing wind power capacity installations worldwide and the adoption of advanced inspection technologies, including drones, AI, and robotics.

► Get a sample of the report:https://www.maximizemarketresearch.com/request-sample/77606/

♦…

More Releases for ETRM

Intellimachs Offers Targeted ETRM Services and Training Solutions for Energy Mar …

Image: https://www.globalnewslines.com/uploads/2025/11/1762411878.jpg

Intellimachs is a technology services company that supports businesses across software development, along with artificial intelligence and enterprise systems. The company works with energy trading firms and risk management teams that need reliable systems to track trades and manage exposure. Intellimachs focuses on delivering solutions that reduce complexity and help teams make better decisions faster. The company has built its reputation by solving real problems for organizations that cannot…

Global CTRM-ETRM Software Market Size, Share and Forecast By Key Players-Openlin …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global CTRM-ETRM Software market is projected to grow at a robust compound annual growth rate (CAGR) of 12.05% from 2024 to 2031. Starting with a valuation of 10.56 Billion in 2024, the market is expected to reach approximately 20.9 Billion by 2031, driven by factors such as CTRM-ETRM Software and CTRM-ETRM Software. This significant growth underscores the expanding demand for…

Energy Trading and Risk Management (ETRM) Market Size

According to a new market research report published by Global Market Estimates, the Global Energy Trading and Risk Management (ETRM) Market is projected to grow at a CAGR of 6.5% from 2023 to 2028.

Allegro Development Corporation, Amphora Inc., Triple Point Technology Inc., Openlink LLC., Eka Software Solutions, SAP, Sapient, Ventyx and Trayport among others, are some of the key players in the global energy trading and risk management (ETRM) market.…

INPEX ENERGY TRADING SINGAPORE PTE. LTD. selects ENTRADE® for ETRM

Singapore (November 2020) — Enuit, LLC announced today that INPEX ENERGY TRADING SINGAPORE PTE. LTD. (IETS) has begun implementing its flagship product, ENTRADE® to manage their trading risk and derivatives for crude oil.

INPEX CORPORATION (INPEX), the ultimate parent company of IETS, is a leading energy company that proactively undertakes oil & gas exploration, development and production activities to contribute to a stable and efficient supply of energy. INPEX is currently…

Energy Trading and Risk Management (ETRM) Market Trends, Insights, Analysis, For …

"Energy Trading and Risk Management (ETRM) Market Scope

“Energy Trading and Risk Management (ETRM) Market is expected to see huge growth opportunities during the forecast period, i.e., 2020 – 2027”, Says Decisive Markets Insights.

The report covers market size and forecast, market share, market share of the key players in the global market, current growth trends and future trends, market segmentation, value chain analysis, market dynamics which includes market drivers, restraints and…

Energy Trading and Risk Management (ETRM) Market 2020 Real Time Analysis And For …

This report studies the Energy Trading and Risk Management (ETRM) Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Energy Trading and Risk Management (ETRM) Market analysis segmented by companies, region, type and applications in the report.

“The final report will add…