Press release

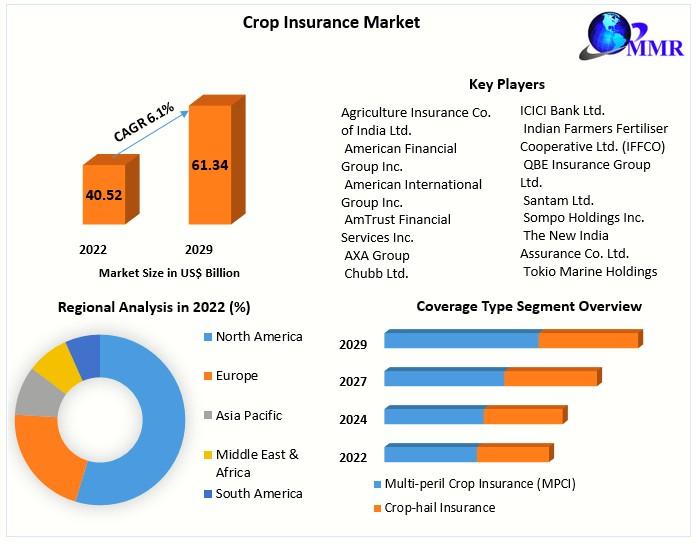

Crop Insurance Market to reach USD 61.34 Bn by 2029, emerging at a CAGR of 6.1 percent and forecast 2023-2029

Crop Insurance Market Report ScopeThe comprehensive Crop Insurance Market report encompasses an in-depth analysis of coverage types, distribution channels, and geographical regions. It delves into Multi-peril Crop Insurance (MPCI) and crop-hail insurance, exploring their market dominance and attributes. The report also scrutinizes applications in banks, insurance companies, brokers/agents, and others.

Request a Free Sample Copy or View Report Summary: https://www.maximizemarketresearch.com/request-sample/148613

Crop Insurance Market Research Methodology

The research methodology involves a meticulous analysis of market dynamics, encompassing both external and internal factors. The report incorporates PORTER and PESTEL analyses, evaluating potential impacts of micro-economic factors on the market. This ensures a comprehensive and forward-looking perspective for decision-makers.

What are Crop Insurance Market Dynamics:

Favorable government initiatives, such as tailored crop insurance options, are becoming more prevalent, supported by increased government backing. The agricultural sector's rising risk complexity, attributed to factors like decreasing agricultural land and global warming, is prompting governments worldwide to implement beneficial programs, fostering market growth.

Crop Insurance Market Regional Insights:

The Asia-Pacific region, driven by rapid population growth and industrial development, is expected to witness substantial market growth, with a forecasted CAGR of 29%. North America, particularly the USA, holds significant potential for market expansion, given the colossal size of its agriculture sector.

Request For Customization Report: https://www.maximizemarketresearch.com/market-report/crop-insurance-market/148613/

What is Crop Insurance Market Segmentation:

by Coverage Type

Multi-peril Crop Insurance (MPCI)

Crop-hail Insurance

by Distribution Channel

Banks

Insurance Companies

Brokers/Agents

Others

by Type

Crop Yield Insurance

Revenue Insurance

Online Stores

To remain 'ahead' of your competitors, request a sample@https://www.maximizemarketresearch.com/inquiry-before-buying/148613

Who are Crop Insurance Market Key Players:

1. Agriculture Insurance Co. of India Ltd.

2. American Financial Group Inc.

3. American International Group Inc.

4. AmTrust Financial Services Inc.

5. AXA Group

6. Chubb Ltd.

7. Groupama Assurances Mutuelles

8. ICICI Bank Ltd.

9. Indian Farmers Fertiliser Cooperative Ltd. (IFFCO)

10. QBE Insurance Group Ltd.

11. Santam Ltd.

12. Sompo Holdings Inc.

13. The New India Assurance Co. Ltd.

14. Tokio Marine Holdings Inc.

15. Zurich Insurance Co. Ltd.

Get Enquiry Report: https://www.maximizemarketresearch.com/market-report/crop-insurance-market/148613/

The table of content for the Crop Insurance Market includes:

Global Crop Insurance Market: Research Methodology

Global Crop Insurance Market: Executive Summary

Market Overview and Definitions

Introduction to the Global Market

Summary

Key Findings

Recommendations for Investors

Recommendations for Market Leaders

Recommendations for New Market Entry

Global Crop Insurance Market: Competitive Analysis

MMR Competition Matrix

Market Structure by Region

Competitive Benchmarking of Key Players

Consolidation in the Market

MandA by region

Key Developments by Companies

Market Drivers

Market Restraints

Market Opportunities

Market Challenges

Market Dynamics

PORTERS Five Forces Analysis

PESTLE

Regulatory Landscape by region

North America

Europe

Asia Pacific

Middle East and Africa

South America

COVID-19 Impact

4. Company Profile: Key players

Company Overview

Financial Overview

Global Presence

Capacity Portfolio

Business Strategy

Recent Developments

Key Offerings:

Past Market Size and Competitive Landscape (2022 to 2029)

Past Pricing and price curve by region (2022 to 2029)

Market Size, Share, Size, and Forecast by Different Segments | 2022-2029

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by Region

Market Segmentation - A detailed analysis by growth and trend

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

More Related Reports:

Oakmoss Extract Market https://www.maximizemarketresearch.com/market-report/oakmoss-extract-market/190585/

Crowdsourced Pen Testing Market https://www.maximizemarketresearch.com/market-report/crowdsourced-pen-testing-market/187685/

Gasification Market https://www.maximizemarketresearch.com/market-report/gasification-market/214423/

Bee Pollen Market https://www.maximizemarketresearch.com/market-report/bee-pollen-market/217443/

Orthopedic Braces and Supports Market https://www.maximizemarketresearch.com/market-report/global-orthopedic-braces-and-supports-market/31956/

High Speed Camera Market https://www.maximizemarketresearch.com/market-report/global-high-speed-camera-market/27473/

Data Center Power Market https://www.maximizemarketresearch.com/market-report/global-data-center-power-market/28182/

Cosmetic Surgery Market https://www.maximizemarketresearch.com/market-report/cosmetic-surgery-market/148553/

Global Brake Pad Market https://www.maximizemarketresearch.com/market-report/global-brake-pad-market/96833/

Surface Disinfectant Market https://www.maximizemarketresearch.com/market-report/global-surface-disinfectant-market/33079/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of the majority of Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT and telecom, chemical, food and beverage, aerospace and defense, healthcare, and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crop Insurance Market to reach USD 61.34 Bn by 2029, emerging at a CAGR of 6.1 percent and forecast 2023-2029 here

News-ID: 3346125 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Commercial Kitchen Appliances Market Poised for Robust Growth, Expected to Reach …

The global Commercial Kitchen Appliances Market, valued at US$ 101.65 billion in 2023, is witnessing strong momentum driven by the rapid expansion of the foodservice industry, technological innovation, and evolving consumer lifestyles. According to the latest market analysis, the industry is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030, reaching nearly US$ 160.05 billion by the end of the forecast period.

Commercial kitchen…

E-Bike Market Poised for Robust Expansion, Projected to Reach USD 153.42 Billion …

The global E-Bike Market is entering a transformative growth phase, underpinned by accelerating demand for eco-friendly transportation, rapid advances in battery and motor technologies, and strong policy support for sustainable urban mobility. Valued at USD 60.65 Billion in 2024, the market is projected to expand at a compound annual growth rate (CAGR) of 12.3% from 2025 to 2032, reaching nearly USD 153.42 Billion by 2032. As cities worldwide seek to…

Data Center Liquid Immersion Cooling Market Set for Rapid Expansion, Driven by H …

Data Center Liquid Immersion Cooling Market to Grow from USD 640.94 Million in 2023 to USD 3,340.83 Million by 2030, Registering a Robust CAGR of 26.6% (2024-2030)

The global Data Center Liquid Immersion Cooling Market is witnessing a transformative phase as data center operators worldwide seek advanced, energy-efficient cooling solutions to address rising power densities, sustainability mandates, and escalating operational costs. Valued at USD 640.94 million in 2023, the market…

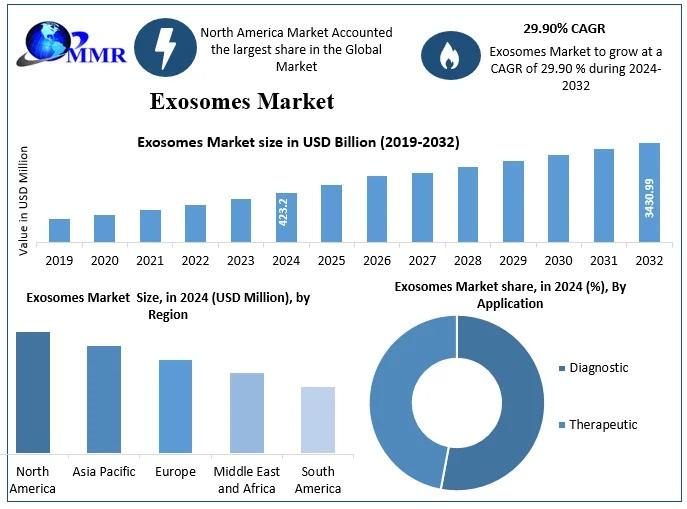

Exosomes Market Forecast: USD 3,430.99 Million Opportunity by 2032

Exosomes Market size was valued at USD 423.2 Mn in 2024 and is expected to reach USD 3430.99 Mn by 2032, at a CAGR of 29.90

The global exosomes market is currently poised for explosive growth, fundamentally driven by the paradigm shift toward non-invasive diagnostics and the rising prominence of "liquid biopsies" in oncology. Once considered mere cellular waste, these extracellular vesicles are now recognized as critical mediators of intercellular communication,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…