Press release

U.S. Insurance Third-party Administrator Market Estimated to Lock $243.26 million by 2030

Third-party administrator acts as an intermediary between the insurance company and policyholder to ensure cashless claims, and reimbursement claims are settled effectively. Increase in health insurance customers has accelerated the quantity of work and led to decrease in the quality of services. Therefore, third-party administrators are established to assist insurers to arrange for cashless treatments for customers demanding seamless claim settlements. In addition, third-party administrators scrutinize hospital bills and documents for their accuracy and help in the processing of the claim.According to the report published by Allied Market Research, the U.S. Insurance Third Party Administrator market generated $156.08 million in 2020, and is projected to reach $243.26 million by 2030, witnessing a CAGR of 4.6% from 2021 to 2030. The report provides a detailed analysis of changing market dynamics, top segments, value chain, key investment pockets, regional scenario, and competitive landscape.

𝑹𝒆𝒒𝒖𝒆𝒔𝒕 𝑺𝒂𝒎𝒑𝒍𝒆 𝑪𝒐𝒑𝒚 𝒐𝒇 𝑹𝒆𝒑𝒐𝒓𝒕- https://www.alliedmarketresearch.com/request-sample/14904

Surge in adoption of third-party administration services in the health insurance industry and rise in need for operational efficiency & transparency in insurance business process drive the growth of the U.S. Insurance Third Party Administrator market. However, security issues and privacy concerns restrain the market to some extent. On the other hand, advancements in third-party administrator services presents new opportunities in the upcoming years.

COVID-19 scenario:

The outbreak of the COVID-19 pandemic positively impacted the U.S. Insurance Third Party Administrator market. This is due to rise in digital transformation trend in insurance and surge in demand for third-party administrator solutions that are hosted or managed on the cloud.

Moreover, to effectively handle high number of claims in U.S health insurance, insurance companies started investing in third-party administrator services.

The report offers detailed segmentation of the U.S. Insurance Third Party Administrator Industry based on enterprise type, end user, and service type.

Based on enterprise type, the large enterprises segment held the highest market share in 2020, holding nearly two-thirds of the total market share, and is expected to continue its leadership status during the forecast period. Moreover, the SMEs segment is estimated to register the highest CAGR of 5.6% from 2021 to 2030.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐘𝐨𝐮𝐫 𝐄𝐯𝐞𝐫𝐲 𝐃𝐨𝐮𝐛𝐭 𝐇𝐞𝐫𝐞: https://www.alliedmarketresearch.com/purchase-enquiry/14904

Based on end user, the life & health insurance segment held the highest market share in 2020, holding nearly three-fifths of the total market share, and is expected to continue its leadership status during the forecast period. Moreover, the same segment is estimated to register the highest CAGR of 5.0% from 2021 to 2030.

Based on service type, the claims management segment held the highest market share in 2020, holding more than two-thirds of the total market share, and is expected to continue its leadership status during the forecast period. Moreover, the policy management segment is estimated to register the highest CAGR of 7.5% from 2021 to 2030.

Leading players of the U.S. Insurance Third Party Administrator market analyzed in the research include Charles Taylor, CORVEL, CRAWFORD & COMPANY, ESIS, ExlService Holdings, Inc., GALLAGHER BASSETT SERVICES, INC., Helmsman Management Services LLC, Meritain Health, SEDGWICK, and United HealthCare Services, Inc. .

𝑰𝒇 𝒚𝒐𝒖 𝒉𝒂𝒗𝒆 𝒂𝒏𝒚 𝒔𝒑𝒆𝒄𝒊𝒂𝒍 𝒓𝒆𝒒𝒖𝒊𝒓𝒆𝒎𝒆𝒏𝒕𝒔, 𝒂𝒔𝒌 𝒇𝒐𝒓 𝒄𝒖𝒔𝒕𝒐𝒎𝒊𝒛𝒂𝒕𝒊𝒐𝒏𝒔: https://www.alliedmarketresearch.com/request-for-customization/14904?reqfor=covid

𝐎𝐭𝐡𝐞𝐫 𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐢𝐧 𝗕𝗙𝗦𝗜 𝐃𝐨𝐦𝐚𝐢𝐧 -

Business Insurance Market: https://www.alliedmarketresearch.com/business-insurance-market

Cryptocurrency Market: https://www.alliedmarketresearch.com/crypto-currency-market

Commercial Paper Market: https://www.alliedmarketresearch.com/commercial-paper-market-A15386

Credit Default Swaps Market: https://www.alliedmarketresearch.com/credit-default-swap-market-A15388

Film and Television Producers Package Insurance Market: https://www.alliedmarketresearch.com/film-and-television-producers-package-insurance-market-A15392

Universal Life Insurance Market: https://www.alliedmarketresearch.com/universal-life-insurance-market-A15152

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Insurance Third-party Administrator Market Estimated to Lock $243.26 million by 2030 here

News-ID: 3333844 • Views: …

More Releases from Allied Market Research

Green Airport Market to Exhibit a Remarkable CAGR of 10.2% by 2032 | SITA, ABB, …

Green airport market was valued at $4.6 billion in 2022, and is estimated to reach $12 billion by 2032, growing at a CAGR of 10.2% from 2023 to 2032.

The growth of the global green airport market is driven by factors such as stringent environmental regulations, increase in demand for operational cost savings and efficiency, and rise in awareness and concerns about environmental issues. However, high initial costs and challenges in…

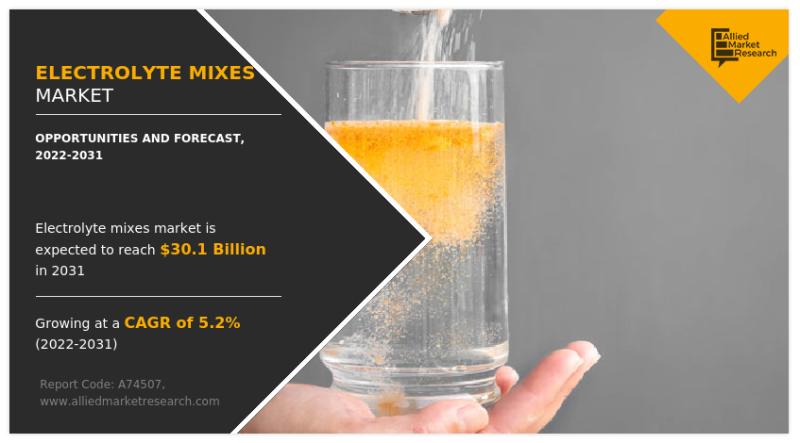

$30.1 + Billion Electrolyte Mixes Market to Grow at 5.2% CAGR by 2031

Electrolyte Mixes Market Size was valued at $17.7 billion in 2022, and is estimated to reach $30.1 billion by 2031, growing at a CAGR of 5.2% from 2022 to 2031.

As people become more aware of the importance of physical exercise, more people are joining health clubs. As a result, the need for hydration and electrolyte mix has increased. Consumers' growing preference for natural and organic ingredients used in electrolyte mix…

Dark Stone Market 2026 Trends: Expected to Grow at a CAGR of 4.8% from 2023 to 2 …

Allied Market Research published a report, titled, "Dark Stone Market by Type (Marble, Granite, Limestone, Others), by Application (Flooring, Memorial Arts, Wall Cladding, Others), by End User (Residential, Commercial): Global Opportunity Analysis and Industry Forecast, 2023-2032."According to the report, the global dark stone industry was estimated at $3.7 billion in 2022 and is anticipated to hit $5.8 billion by 2032, registering a CAGR of 4.8% from 2023 to 2032.

Download Sample…

Automotive Traction Inverter Market to Hit $46.3 Billion by 2032, Growing at 16. …

According to a new report published by Allied Market Research, titled, "Automotive Traction Inverters Market," The automotive traction inverter market size was valued at $10.5 billion in 2022, and is estimated to reach $46.3 billion by 2032, growing at a CAGR of 16.4% from 2023 to 2032.

Asia-Pacific currently dominated the automotive traction inverter market in 2022. This was primarily due to China is actively adopting EVs, investing in EVs and…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…