Press release

Ongoing Digitalization Favorable to Global Cybersecurity Insurance Market

As per a new market research report launched by Inkwood Research, the Global Cybersecurity Insurance Market is expected to reach $xx million by 2032, growing with a CAGR of 19.58% during the forecasting period.Browse 51 Market Data Tables and 48 Figures spread over 238 Pages, along with an in-depth analysis of the Global Cybersecurity Insurance Market by Component, Insurance Type, Coverage Type, Vertical, & by Geography

Refer to the Report Summary Here: https://inkwoodresearch.com/reports/cybersecurity-insurance-market/?utm_source=PaidPRNew&utm_medium=OpenPR&utm_campaign=InkwoodPR

This insightful market research report by Inkwood Research focuses on market trends, leading players, supply chain trends, technological innovations, key developments, and future strategies. The report covers all the aspects of this comprehensive market by assessing major geographies and is a valuable asset for existing players, new entrants, and future investors. The study presents a detailed market analysis, with inputs derived from industry professionals across the value chain.

Global Cybersecurity Insurance Market Scenario

The global cybersecurity insurance market growth is driven by the escalating cyber threat landscape and increased awareness among businesses about the importance of safeguarding against cyber risks.

The proliferation of cyberattacks, including ransomware, data breaches, and phishing, has heightened the demand for cybersecurity insurance. High-profile incidents have underscored the vulnerabilities that organizations face, irrespective of their size or industry. Further, stringent data protection regulations, such as GDPR in Europe and CCPA in California, have made cybersecurity insurance a necessity for businesses to mitigate regulatory fines and penalties associated with data breaches.

Moreover, the ongoing digitalization across industries has expanded the attack surface for cybercriminals. As organizations embrace cloud computing, IoT, and remote work, they become more susceptible to cyber risks, increasing the need for insurance coverage.

The Global Cybersecurity Insurance Market report provides data tables and includes charts and graphs for visual analysis.

Request a Free Sample Report for the Global Cybersecurity Insurance Market by Component, Insurance Type, Coverage Type, Vertical, & by Geography: https://inkwoodresearch.com/reports/cybersecurity-insurance-market/#request-free-sample

Market Segmentation

Market by Component:

• Solution

• Services

Market by Vertical:

• Healthcare

• Retail

• BFSI

• IT & Telecom

• Manufacturing

• Government Agencies

• Other Verticals

Market by Insurance Type:

• First-Party

• Liability Coverage

Market by Coverage Type:

• Standalone

• Tailored

Report Highlights

- The report provides a detailed analysis of the current and future market trends to identify the investment opportunities

- Market forecasts till 2032, using estimated market values as the base numbers

- Key market trends across the business segments, regions, and countries

- Key developments and strategies observed in the market

- Market dynamics such as drivers, restraints, opportunities, and other trends

- In-depth company profiles of key players and upcoming prominent players

- Growth prospects among the emerging nations through 2032

Companies Profiled

• ALLIANZ

• AON PLC

• THE CHUBB CORPORATION

• BEAZLEY GROUP

• BCS FINANCIAL CORPORATION

• CNA FINANCIAL CORPORATION

• AMERICAN INTERNATIONAL GROUP INC

• AXA XL

• LOCKTON COMPANIES INC

• LLOYDS OF LONDON LTD

• THE HANOVER INSURANCE INC

• AXIS CAPITAL HOLDINGS LIMITED

• MUNICH RE

• THE TRAVELERS INDEMNITY COMPANY

• BERKSHIRE HATHAWAY INC

• ZURICH INSURANCE

Related Reports

GLOBAL CYBER SITUATIONAL AWARENESS MARKET -

https://inkwoodresearch.com/reports/cyber-situational-awareness-market/

The global cyber situational awareness market is set to record a CAGR of 17.78% during 2021-2028.

GLOBAL CYBER SECURITY MARKET -

https://inkwoodresearch.com/reports/cyber-security-market/

The global cyber security market will reach $322.73 billion by 2028, growing at a CAGR of 10.34% during the forecast period, 2021-2028.

Inkwood Research

169, Harrison Avenue

Boston, MA 02111

Tel: 1-(857)293-0150

Email: sales@inkwoodresearch.com

Website: www.inkwoodresearch.com

We at Inkwood research provide you with not just consulting services but also with syndicated and customized research reports which help advance your business further.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Ongoing Digitalization Favorable to Global Cybersecurity Insurance Market here

News-ID: 3333577 • Views: …

More Releases from Inkwood Research

United States Wood Coatings Market Analysis 2024-2032

Inkwood Research states that the United States Wood Coatings Market is expected to achieve a compound annual growth rate (CAGR) of 5.02% during the forecast period of 2024-2032, with projected revenues reaching $xx million by 2032.

This growth is driven by a combination of factors, including increasing construction activities, rising consumer preference for aesthetically appealing wood products, and advancements in coating technologies.

Refer to the Report Summary Here: https://inkwoodresearch.com/reports/united-states-wood-coatings-market/?utm_source=PaidPRNew&utm_medium=OpenPR&utm_campaign=InkwoodPR

Prominent companies in the…

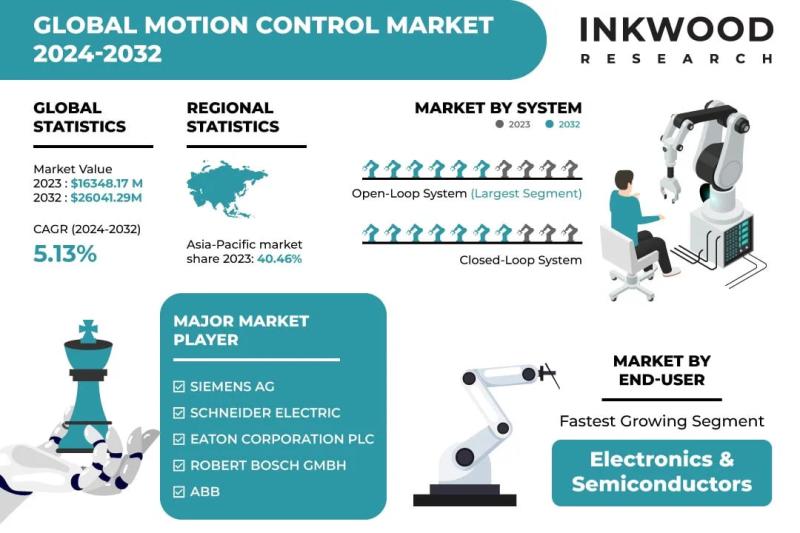

Rising Uptake of Industry 4.0 to Amp Motion Control Market Growth

As per a new market research report launched by Inkwood Research, the Global Motion Control Market is predicted to reach $26041.29 million by 2032, growing at a CAGR of 5.13% during the forecasting period, 2024-2032.

Refer to the Report Summary Here: https://inkwoodresearch.com/reports/global-motion-control-market-forecast-2024-2032/?utm_source=PaidPRNew&utm_medium=OpenPR&utm_campaign=InkwoodPR

This insightful market research report by Inkwood Research focuses on market trends, leading players, supply chain trends, technological innovations, key developments, and future strategies. The report covers all the aspects…

Rise in Golf Tourism to Elevate Golf Cart Market Growth

As per a new market research report launched by Inkwood Research, the Global Golf Cart Market is expected to grow at a CAGR of 5.68% during the forecasting period, 2024-2032.

Refer to the Report Summary Here: https://inkwoodresearch.com/reports/golf-cart-market/?utm_source=PaidPRNew&utm_medium=OpenPR&utm_campaign=InkwoodPR

This insightful market research report by Inkwood Research focuses on market trends, leading players, supply chain trends, technological innovations, key developments, and future strategies. The report covers all the aspects of this comprehensive market by…

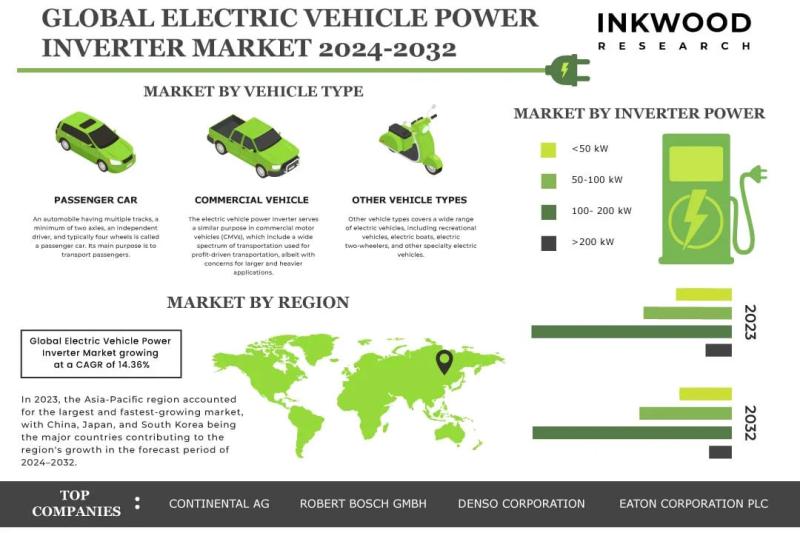

Government Rules to Promote the Growth of the Electric Vehicle Power Inverter Ma …

As per a new market research report launched by Inkwood Research, the Global Electric Vehicle Power Inverter Market is expected to reach $34868.78 million by 2032, growing with a CAGR of 14.36% during the forecasting period, 2024-2032.

Refer to the Report Summary Here: https://inkwoodresearch.com/reports/electric-vehicle-power-inverter-market/?utm_source=PaidPRNew&utm_medium=OpenPR&utm_campaign=InkwoodPR

This insightful market research report by Inkwood Research focuses on market trends, leading players, supply chain trends, technological innovations, key developments, and future strategies. The report covers all…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…