Press release

Germans view SCHUFA's influence negatively - SCHUFA's transparency initiative fails

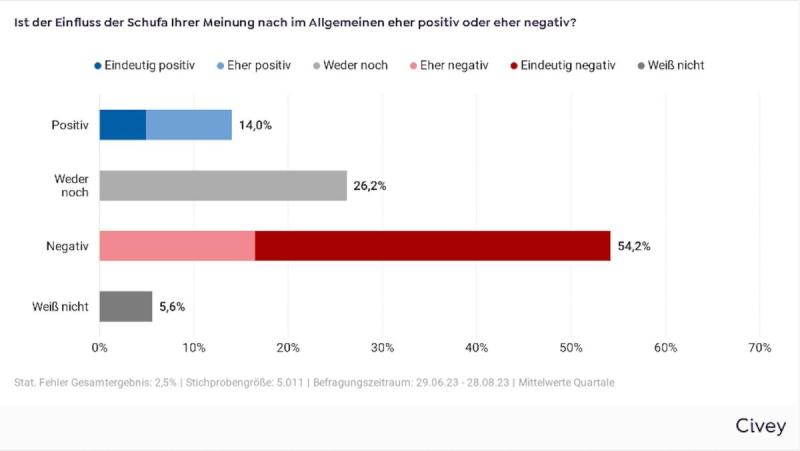

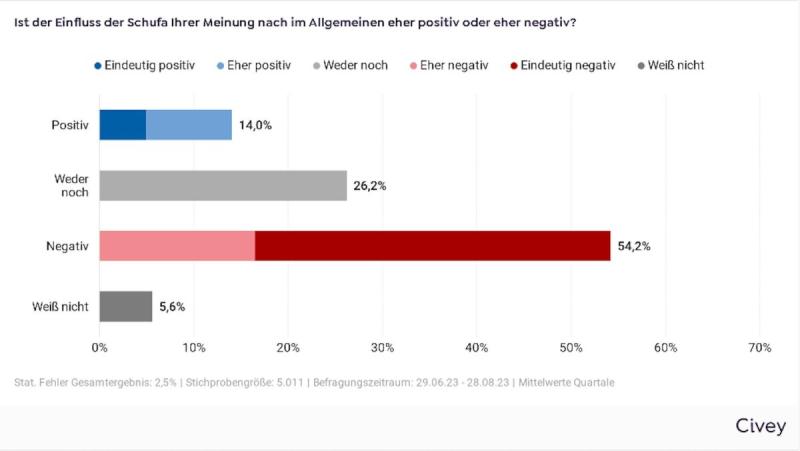

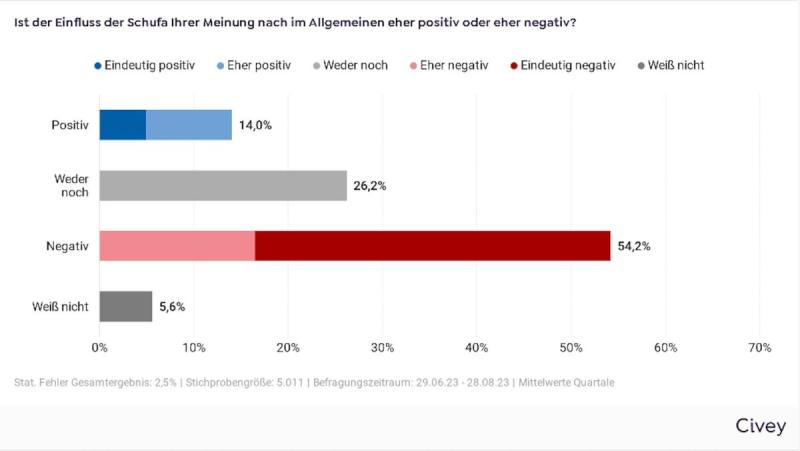

Over half of Germans generally perceive the influence of SCHUFA negatively. This was the finding of a recent survey conducted by opinion research institute, Civey, on behalf of selbstauskunft.de. Only 14% have a positive perspective of SCHUFA's influence, compared to 55% 1who view it negatively. SCHUFA's reputation is notably poor amongst individuals in their middle-age phase, between 30 and 39 years old - 71% of respondents in this age-group perceive SCHUFA's image negatively.Simultaneously, 60% revealed that they deem SCHUFA's methodology for creditworthiness assessment as inappropriate. Compared to March 2023, this proportion has increased by 6 percentage points. Only 16% of participants consider SCHUFA's approach suitable, which represents a decline of 5 percentage points since March 2023.

Frank Drescher, CEO of NLTS Global Analytics, commented, “The results of the current survey underscore the necessity for transparency and fairness in the credit reporting industry. Consumers are eager for a better comprehension of their financial situation. A substantial segment of Germans harbor reservations about SCHUFA and its evaluation methods. But it's pivotal to establish standards for a fairer credit rating assessment and aid consumers in making informed financial decisions. Therefore, SCHUFA must now transform its rhetoric into action. The recent ruling of the European Court of Justice (ECJ) indicates that lawmakers too see the urgent need for action in this area. The fact that SCHUFA “welcomes” this decision is nothing more than PR lip service. The judgement rightly hands a red card to corporations making automated decisions about individuals. It is a death blow to the corresponding B2B product of SCHUFA. To clarify, such automated decisions often stipulate that poorer individuals pay higher energy tariffs, hence more than the affluent. This should gradually come to an end now."

More information and tables: https://selbstauskunft.de/deutsche-sehen-einfluss-der-schufa-negativ-schufa-transparenzoffensive-gescheitert/

NLTS Global Analytics s.r.o.o

Mala 4376

30100 Plzen1

Tschechien

https://selbstauskunft.de

Herr Frank Drescher

info@nlts.eu

About Civey:1 2

Civey is the leading pioneer for real-time digital market and opinion research. We continuouslyo collect and analyze data, combining traditional statistics with Artificial Intelligence (AI). Our representative snapshots and monitoring facilitate a more comprehensive understanding of markets, trends, and positions. Find out more about Civey here.

About selbstauskunft.de:

NLTS Global Analytics is one of the largest providers of legal tech across Europe. With selbstauskunft.de, it becomes straightforward to request your SCHUFA data. The service is designed for individuals who are unable or unwilling to apply independently and prefer a hassle-free service, often including non-native speakers for whom the process of requesting a SCHUFA self-disclosure becomes significantly simplified.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Germans view SCHUFA's influence negatively - SCHUFA's transparency initiative fails here

News-ID: 3323039 • Views: …

More Releases from NLTS Selbstauskunft.de

Germans view SCHUFA's influence negatively - SCHUFA's transparency initiative fa …

Over half of Germans generally perceive the influence of SCHUFA negatively. This was the finding of a recent survey conducted by opinion research institute, Civey, on behalf of selbstauskunft.de. Only 14% have a positive perspective of SCHUFA's influence, compared to 55% 1who view it negatively. SCHUFA's reputation is notably poor amongst individuals in their middle-age phase, between 30 and 39 years old - 71% of respondents in this age-group perceive…

Germans view SCHUFA's influence negatively - SCHUFA's transparency initiative fa …

Over half of Germans generally perceive the influence of SCHUFA negatively. This was the finding of a recent survey conducted by opinion research institute, Civey, on behalf of selbstauskunft.de. Only 14% have a positive perspective of SCHUFA's influence, compared to 55% 1who view it negatively. SCHUFA's reputation is notably poor amongst individuals in their middle-age phase, between 30 and 39 years old - 71% of respondents in this age-group perceive…

More Releases for SCHUFA

Banks refuse "citizen account" - despite clear legal situation

Consumer advocates criticize unlawful practice / Every citizen is entitled to a basic account

Karlsfeld - In Germany, every consumer has a legal right to a so-called basic account ("Bürgerkonto"). Despite this, those affected repeatedly report that banks refuse to open an account for them - often citing poor credit ratings or internal decisions. Consumer advocates speak of an "unlawful practice" that pushes many people into financial hardship.

"The basic account is…

How to find a good tenant as a landlord: Sven Schwarzat from Schwarzat Capital G …

Finding a good tenant can be a challenge for landlords, but with the right strategy and careful preparation, the ideal tenant can be found. Sven Schwarzat has been active in Central Germany for years with his Schwarzat Captial GmbH. He has many properties in his own portfolio, particularly in Leipzig and Magdeburg, and provides tips. A good tenant is characterized by reliability, solvency and a respectful attitude towards the property.…

How to find an affordable rental apartment: Tips from Schwarzat Capital GmbH

Finding a cheap rental apartment can be a challenge, especially in popular urban areas. But with the right strategy and a little patience, you can find your dream home at an affordable price. Here are some tips from Sven Schwarzat to help you in your search.

1. plan and search early

The earlier you start looking for an apartment, the better. Popular rental apartments are often snapped up quickly, so…

Credit Bureaus Global Market Size, Growth, Share, Regional Prospects, Trends, Sa …

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2295

The Business Research Company presents an extensive market research report on the Credit Bureaus Global Market Report 2024, furnishing businesses with a competitive edge through a detailed examination of the market structure, encompassing estimates for various segments and sub-segments.

Furthermore, the report highlights on emerging trends, significant drivers, challenges, and opportunities,…

Germans view SCHUFA's influence negatively - SCHUFA's transparency initiative fa …

Over half of Germans generally perceive the influence of SCHUFA negatively. This was the finding of a recent survey conducted by opinion research institute, Civey, on behalf of selbstauskunft.de. Only 14% have a positive perspective of SCHUFA's influence, compared to 55% 1who view it negatively. SCHUFA's reputation is notably poor amongst individuals in their middle-age phase, between 30 and 39 years old - 71% of respondents in this age-group perceive…

Germans view SCHUFA's influence negatively - SCHUFA's transparency initiative fa …

Over half of Germans generally perceive the influence of SCHUFA negatively. This was the finding of a recent survey conducted by opinion research institute, Civey, on behalf of selbstauskunft.de. Only 14% have a positive perspective of SCHUFA's influence, compared to 55% 1who view it negatively. SCHUFA's reputation is notably poor amongst individuals in their middle-age phase, between 30 and 39 years old - 71% of respondents in this age-group perceive…