Press release

Treasury and Risk Management System Market Gaining Growth Momentum in Long Run

The latest study released on the Global Treasury and Risk Management System Market by HTF MI evaluates market size, trend, and forecast to 2029. The Treasury and Risk Management System market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.Key Players in This Report Include: SAP (Germany), Oracle (United States), Kyriba (United States), FIS (United States), GTreasury (United States), ION Group (United Kingdom), Reval (United States), Calypso Technology (United States), Murex (France), OpenLink (United States), SunGard (United States), TreasuryXpress (United States), Bellin (Germany), Hedgebook (New Zealand), 360T (Germany)

Get Customized Sample Now @ https://www.htfmarketintelligence.com/sample-report/global-treasury-and-risk-management-system-market?utm_source=Krati_OpenPR&utm_id=Krati

Definition:

A Treasury and Risk Management System (TRMS), often referred to as a Treasury Management System (TMS), is a specialized software solution used by organizations, particularly large corporations, to manage and optimize their financial operations, risk management, and treasury functions. The primary purpose of a TRMS is to provide a centralized platform for monitoring, controlling, and automating various financial and risk-related activities.

Market Trends:

The trend was toward integrated TRMS platforms that offer comprehensive solutions for both treasury and risk management functions. This integration allowed organizations to manage their financial operations more efficiently and holistically.

Market Drivers:

The growing complexity of financial processes in the global business environment

Market Opportunities:

The advent of scalable, subscription-based models and the development of cloud-based solutions have facilitated the adoption of treasury and risk management systems by smaller enterprises.

Market Leaders & Development Strategies:

In June 2023, GTreasury, a leading provider of integrated treasury management and risk management systems, announced a strategic partnership with C2FO, the world's on-demand working capital platform. Together, GTreasury and C2FO are able to provide treasurer customers a comprehensive cash management and early payment solution that improves liquidity forecasting and optimizes cash flow.

Check Special Discount Offer on Complete Report Now @ https://www.htfmarketintelligence.com/request-discount/global-treasury-and-risk-management-system-market

The Global Treasury and Risk Management System Market segments and Market Data Break Down are illuminated below:

By Application (Large Enterprises, Small and Medium-sized Enterprises (SMEs)) by Type (Cloud Based, On Premise) by Industry Vertical (Banking, Financial Services and Insurance (BFSI), Healthcare, Retail, Manufacturing, Others) and by Geography (North America, South America, Europe, Asia Pacific, MEA)

Global Treasury and Risk Management System market report highlights information regarding the current and future industry trends, growth patterns, as well as it offers business strategies to helps the stakeholders in making sound decisions that may help to ensure the profit trajectory over the forecast years.

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Objectives of the Report

• -To carefully analyze and forecast the size of the Treasury and Risk Management System market by value and volume.

• -To estimate the market shares of major segments of the Treasury and Risk Management System

• -To showcase the development of the Treasury and Risk Management System market in different parts of the world.

• -To analyze and study micro-markets in terms of their contributions to the Treasury and Risk Management System market, their prospects, and individual growth trends.

• -To offer precise and useful details about factors affecting the growth of the Treasury and Risk Management System

• -To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Treasury and Risk Management System market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Get Complete Scope of Work @ https://www.htfmarketintelligence.com/report/global-treasury-and-risk-management-system-market

Major highlights from Table of Contents:

Treasury and Risk Management System Market Study Coverage:

• It includes major manufacturers, emerging player's growth story, and major business segments of Treasury and Risk Management System market, years considered, and research objectives. Additionally, segmentation on the basis of the type of product, application, and technology.

• Treasury and Risk Management System Market Executive Summary: It gives a summary of overall studies, growth rate, available market, competitive landscape, market drivers, trends, and issues, and macroscopic indicators.

• Treasury and Risk Management System Market Production by Region Treasury and Risk Management System Market Profile of Manufacturers-players are studied on the basis of SWOT, their products, production, value, financials, and other vital factors.

• Key Points Covered in Treasury and Risk Management System Market Report:

• Treasury and Risk Management System Overview, Definition and Classification Market drivers and barriers

• Treasury and Risk Management System Market Competition by Manufacturers

• Impact Analysis of COVID-19 on Treasury and Risk Management System Market

• Treasury and Risk Management System Capacity, Production, Revenue (Value) by Region (2023-2030)

• Treasury and Risk Management System Supply (Production), Consumption, Export, Import by Region (2023-2030)

• Treasury and Risk Management System Production, Revenue (Value), Price Trend by Type {Cloud Based, On Premise}

• Treasury and Risk Management System Manufacturers Profiles/Analysis Treasury and Risk Management System Manufacturing Cost Analysis, Industrial/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers, Marketing

• Strategy by Key Manufacturers/Players, Connected Distributors/Traders Standardization, Regulatory and collaborative initiatives, Industry road map and value chain Market Effect Factors Analysis.

Buy Treasury and Risk Management System Market Latest Report Edition @ https://www.htfmarketintelligence.com/buy-now?format=1&report=5915

Key questions answered

How feasible is Treasury and Risk Management System market for long-term investment?

What are influencing factors driving the demand for Treasury and Risk Management System near future?

What is the impact analysis of various factors in the Global Treasury and Risk Management System market growth?

What are the recent trends in the regional market and how successful they are?

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +1 (434) 322-0091

sales@htfmarketreport.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to enable businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Treasury and Risk Management System Market Gaining Growth Momentum in Long Run here

News-ID: 3321679 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Fashion Backpack Market Future Growth & Size Projection

The latest study released on the Global Fashion Backpack Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Fashion Backpack study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Ecommerce Platform Market - Global Growth Opportunities 2020-2033

The latest study released on the Global Ecommerce Platform Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Ecommerce Platform study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

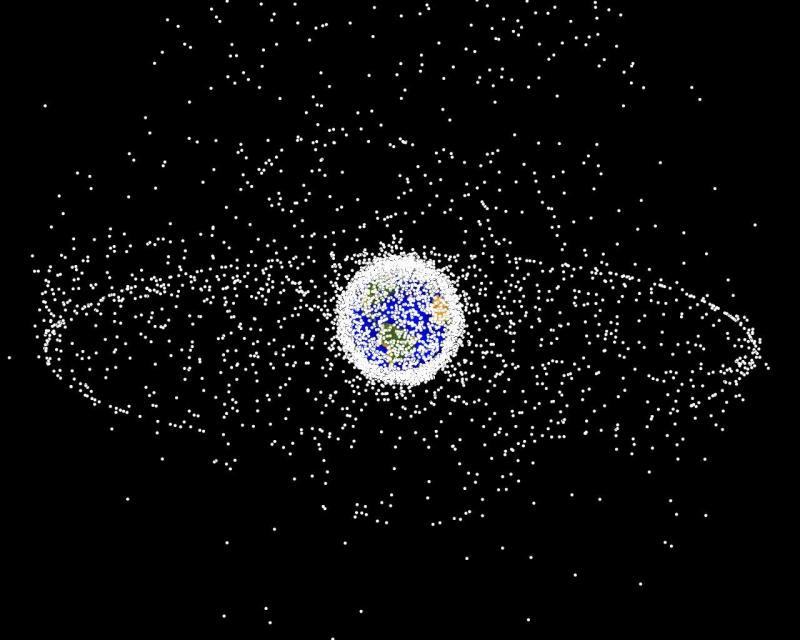

Space Debris Solutions Market - Global Industry Size & Growth Analysis 2020-2033

The latest study released on the Global Space Debris Solutions Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Space Debris Solutions study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

Baby Buggy Market to Witness Unprecedented Growth by 2033

The latest analysis of the worldwide Baby Buggy market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Baby Buggy market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report Include:

Graco, Chicco, Britax, UPPAbaby,…

More Releases for Treasury

Corporate and Treasury bond Market 2025: Top Key Players: U.S. Treasury, U. S. C …

The report "Global Corporate and treasury bond Market" intends to provide innovative market intelligence and help decision makers take comprehensive investment evaluation. Also identifies and analyses the emerging trends along with major drivers, challenges, opportunities and entry strategies for various companies in the global Corporate and treasury bond Industry.

Corporate and treasury bond market research report provides the newest industry data and industry future trends, allowing you to identify the products…

Treasury Software Market 2019-2027 / CRM Treasury Systems, DataLog Finance And F …

The report covers the forecast and analysis of the treasury software market on a global and regional level. The study provides historical data from 2015 to 2018 along with a forecast from 2019 to 2027 based on revenue (USD Million). The study includes drivers and restraints of the Nordic treasury software market along with the impact they have on the demand over the forecast period. Additionally, the report includes the…

Corporate and treasury bond Market Future Demand Analysis and Business Opportuni …

Corporate and treasury bond is where debt securities are issued and traded. The bond market primarily includes government-issued securities and corporate debt securities, and it facilitates the transfer of capital from savers to the issuers or organizations that requires capital for government projects, business expansions and ongoing operations. The bond market is alternatively referred to as the debt, credit or fixed-income market. Although the bond market appears complex, it is…

Global Corporate and Treasury Bond Market, Top key players are U.S.Treasury,,S.C …

Global Corporate and Treasury Bond Market Size, Trends, Applications, Status, Analysis and Forecast Reports 2019 to 2026

Corporate and Treasury Bond market size by players, regions, product types and end industries, history 2014-2018 and forecast data 2019-2026. This report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter’s Five Forces Analysis.

The main goal for the dissemination of…

Corporate and Treasury Bond Market Analysis by Top Key Players U.S.Treasury, U. …

When companies want to expand operations or fund new business ventures, they often turn to the corporate bond market to borrow money. A company determines how much it would like to borrow and then issues a bond offering in that amount; investors that buy a bond are effectively lending money to the company according to the terms established in the bond offering or prospectus.

Get Sample Copy of this Report @…

Corporate and Treasury Bond Market is Booming Worldwide | U.S. Treasury, U. S. C …

HTF MI recently introduced Global Corporate and treasury bond Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are U.S. Treasury, U. S. Corporate and treasury bonding Company,…