Press release

Wealth Management Platform Market is expected to experience remarkable growth, reaching US$ 9.3 Billion by 2028

IMARC Group, a leading market research company, has recently releases report titled "Wealth Management Platform Market Report by Advisory Model (Hybrid, Robo Advisory, Human Advisory), Deployment Mode (On-premises, Cloud-based), Business Function (Reporting, Performance Management, Financial Advice Management, Risk and Compliance Management, Portfolio, Accounting and Trading Management, and Others), Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), End Use Industry (Banks, Brokerage Firms, Investment Management Firms, Trading and Exchange Firms, and Others), and Region 2023-2028." The study provides a detailed analysis of the industry, including the global wealth management platform market growth, trends, size, share and forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.The global wealth management platform market size reached US$ 4.4 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 9.3 Billion by 2028, exhibiting a growth rate (CAGR) of 12.7% during 2023-2028. The significant technological advancements, rapidly changing regulatory landscape, increasing customer expectation, rising number of high-net-worth-individuals (HNWIs), internationalization of financial market, integration of automation features, and widespread platform utilization to provide real-time analytics are some of the major factors propelling the market.

Request For Sample Copy of Report: https://www.imarcgroup.com/wealth-management-platform-market/requestsample

Factors Affecting the Growth of the Wealth Management Platform Industry:

• Digital Transformation and Technological Innovation:

The relentless pace of digital transformation represents one of the crucial factors impelling the growth of the market. Wealth management platforms are increasingly leveraging advanced technologies, such as artificial intelligence (AI), machine learning (ML), and blockchain to enhance operational efficiency, provide personalized investment advice, and deliver a seamless client experience. The integration of robo-advisors, for instance, is gaining traction, enabling automated portfolio management and investment recommendations. Wealth management platforms use algorithms to provide financial advice and manage investment portfolios, often with lower fees compared to traditional wealth management services.

• Regulatory Compliance and Security Concerns:

Regulatory compliance remains a key concern in the wealth management industry. As financial markets become more complex, regulators are imposing stringent requirements to ensure transparency, data security, and investor protection. Wealth management platforms are adapting by integrating robust compliance mechanisms, such as automated reporting and audit trails, to meet regulatory standards and enhance overall security. Stringent regulatory requirements and increased focus on transparency are compelling wealth management firms to adopt advanced technology solutions to ensure compliance. Wealth management platforms are incorporating features such as real-time reporting, automated compliance checks, and secure communication channels to meet regulatory standards and build trust among clients.

• Evolving Business Models and Fintech Collaboration:

Traditional business models in wealth management are evolving to embrace technology-driven solutions. Fintech firms are increasingly collaborating with established wealth management platforms to create innovative and agile solutions. This collaboration is fostering the development of hybrid models that combine the experience of traditional wealth managers with the agility and technological prowess of fintech firms. Fintech companies are developing digital platforms tailored for independent financial advisors. These platforms offer tools for portfolio management, client communication, and other services, empowering independent advisors to provide efficient and competitive services.

Inquire Before Buying: https://www.imarcgroup.com/request?type=report&id=5096&flag=F

Wealth Management Platform Market Report Segmentation:

Breakup by Advisory Model:

• Hybrid

• Robo Advisory

• Human Advisory

Human advisory is the most prevalent method due to its broad area coverage and efficiency in distributing seeding agents like silver iodide into the clouds.

Breakup by Deployment Mode:

• On-premises

• Cloud-based

Cloud-based accounted for the largest market share due to its effectiveness in enhancing precipitation.

Breakup by Business Function:

• Reporting

• Performance Management

• Financial Advice Management

• Risk and Compliance Management

• Portfolio, Accounting and Trading Management

• Others

On the basis of business function, the market has been segmented into reporting, performance management, financial advise management, risk and compliance management, portfolio, accounting and trading management, and others.

Breakup by Enterprise Size:

• Large Enterprises

• Small and Medium-sized Enterprises

Based on the enterprise size, the market has been segregated into large enterprises and small and medium-sized enterprises.

Breakup by End Use Industry:

• Banks

• Brokerage Firms

• Investment Management Firms

• Trading and Exchange Firms

• Others

Banks represented the largest segment as they rely on wealth management platforms to help clients set financial goals, assess their current financial situation, and develop strategies to achieve their objectives.

Breakup by Region:

• North America

o United States

o Canada

• Asia Pacific

o China

o Japan

o India

o South Korea

o Australia

o Indonesia

o Others

• Europe

o Germany

o France

o United Kingdom

o Italy

o Spain

o Russia

o Others

• Latin America

o Brazil

o Mexico

o Others

• Middle East and Africa

North America's dominance in the wealth management platform market is attributed to the rising demand for comprehensive security measures to safeguard various confidential information and the increasing focus on maintaining compliance with financial regulations.

Global Wealth Management Platform Market Trends:

The impending transfer of older to younger generations is reshaping the priorities of wealth management platforms. The focus is shifting towards inter-generational planning, with platforms offering tools and services that cater to the unique needs and preferences of younger investors. Digital interfaces and educational resources are being employed to engage and empower the next generation of wealth management clients.

Wealth management platforms are also providing customized solutions by leveraging data analytics and AI algorithms to gain insights into individual client preferences, risk tolerance, and financial goals. The ability to offer customized investment strategies is becoming a critical differentiator, as clients seek a more intimate and responsive relationship with their wealth managers.

Who Are The Key Players Operating In The Industry?

The report covers the major market players including:

• Avaloq (NEC Corporation)

• Backbase

• Broadridge Financial Solutions Inc.

• Comarch SA

• Crealogix AG

• Fidelity National Information Services Inc.

• Fiserv Inc.

• Infosys Limited

• Profile Systems and Software S.A.

• Prometeia S.p.A

• SEI Investments Company

• SS&C Technologies Inc.

• Tata Consultancy Services Limited

• Temenos Headquarters SA.

Other Key Points Covered in the Report:

• COVID-19 Impact

• Porters Five Forces Analysis

• Value Chain Analysis

• Strategic Recommendations

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas:- +1 631 791 1145 | Africa and Europe :- +44-702-409-7331 | Asia: +91-120-433-0800

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC Group's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wealth Management Platform Market is expected to experience remarkable growth, reaching US$ 9.3 Billion by 2028 here

News-ID: 3317403 • Views: …

More Releases from IMARC Group

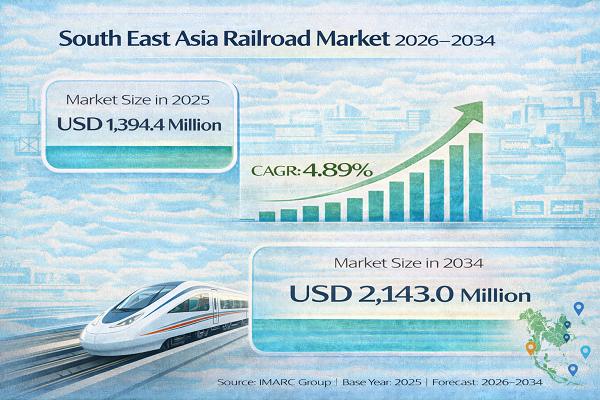

South East Asia Railroad Market Set to Reach USD 2,143.0 Million by 2034, Expand …

South East Asia Railroad Market : Report Introduction

According to IMARC Group's report titled "South East Asia Railroad Market Size, Share | Forecast 2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Get Instant Access to the Free Sample (Corporate Email Required): https://www.imarcgroup.com/south-east-asia-railroad-market/requestsample

South East Asia Railroad Market Overview (2026-2034)

The South East Asia railroad market size reached USD 1,394.4 Million in 2025. The market…

Amino Acid Production Plant Cost 2026: CapEx, OpEx & ROI Analysis

Setting up an Amino Acid Production Plant positions investors in a rapidly growing industrial segment, driven by increasing global demand for amino acids across multiple end-use sectors. Amino acids are organic compounds that form the building blocks of proteins and play critical roles in metabolism, enzyme function, and nutritional supplementation. The integrated manufacturing process involves raw material handling (such as glucose, molasses, or corn syrup), fermentation or chemical synthesis, purification,…

Flow Battery Manufacturing Plant Cost 2026: Feasibility Study and Profitability …

Setting up a Flow Battery Manufacturing Plant positions investors in a rapidly expanding segment of the energy storage industry. Flow batteries are electrochemical storage systems where energy is stored in liquid electrolytes that flow through electrochemical cells. They offer unique advantages including long cycle life, modular scalability, high safety, and the ability to discharge fully without damage. These attributes make them ideal for grid-scale energy storage, renewable energy integration, EV…

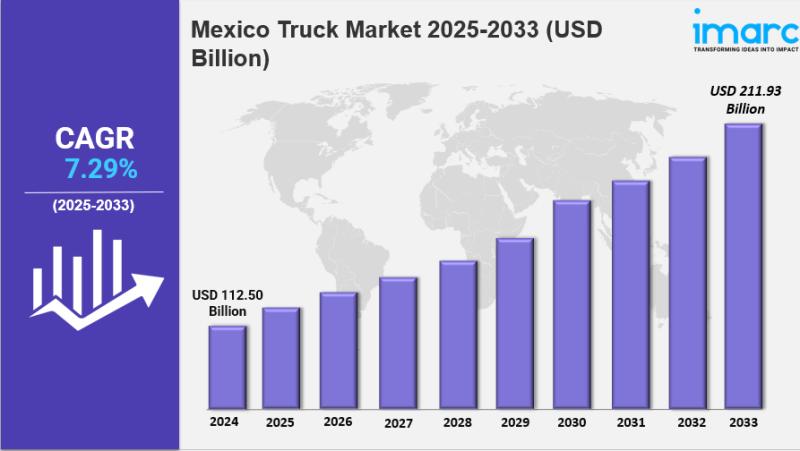

Mexico Truck Market Size, Share, Industry Overview, Trends and Forecast 2033

IMARC Group has recently released a new research study titled "Mexico Truck Market Size, Share, Trends and Forecast by Vehicle Type, Tonnage Capacity, Fuel Type, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Truck Market Overview

The Mexico truck market size reached USD 112.50 Billion in 2024. Looking forward, IMARC Group expects…

More Releases for Management

Gym Management Software Market By Functions - Scheduling Appointments, Waitlist …

MarketResearchReports.Biz announces addition of new report "Gym Management Software Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2017 - 2025" to its database.

Gym management software is a software solution which allows the users to manage the different processes associated with running a gym in an efficient and effective manner. These software solutions are generally multifunctional and can manage all the diverse processes associated with managing a gym…

Water Network Management, Water Network Management trends, Water Network Managem …

MarketStudyReport.com adds a new 2018-2023 Global Water Network Management Market Report focuses on the major drivers and restraints for the global key players providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

This report presents a comprehensive overview, market shares, and growth opportunities of by Water Network Management product type, application, key manufacturers and key regions. Over the next five years, Water Network Management will…

Cloud Project Portfolio Management Market Report 2018: Segmentation by Applicati …

Global Cloud Project Portfolio Management market research report provides company profile for CA Technologies (New York, U.S.), HPE (California, U.S.), Changepoint Corporation (Richmond Hill, Ontario), Clarizen, Inc. (California, U.S.), Microsoft Corporation (Washington, U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…

Prescriptive analytics Market Outlook 2025 focus On: Risk Management, Operation …

A detailed market study on "Global Prescriptive analytics Market" examines the performance of the Prescriptive analytics Market. It encloses an in-depth Research of the Prescriptive analytics Market state and the competitive landscape globally. This report analyzes the potential of Prescriptive analytics Market in the present and the future prospects from various prospective in detail.

Get Free Sample Report@ https://databridgemarketresearch.com/request-a-sample/?dbmr=global-prescriptive-analytics-market

Prescriptive analytics market accounted for USD 1.20 billion growing at a CAGR of…

Facility Management Market Solutions & Services (Real Estate & Lease Management, …

ReportsWeb.com added “Global Facility Management Market to 2025” to its vast collection of research Database. The report classifies the global Facility Management Market in a precise manner to offer detailed insights into the aspects responsible for augmenting as well as restraining market growth.

Facility Management is an essential part which handles all functions related to enterprise and helps in streaming all the operations with reducing cost. Managing life cycle management of…

Telecom Expense Management Market Analysis For Financial Management, Order Manag …

The telecom expense management (TEM) market report provides analysis for the period 2014–2024, wherein the period from 2016 to 2024 is the forecast period and 2015 is the base year. The report covers all the major trends and technologies playing a key role in telecom expense management market growth over the forecast period. It also highlights the drivers, restraints, and opportunities expected to influence the market’s growth during the said…