Press release

Micro Lending Market Size Hit US$ 353.9 Billion by 2028, Growing at a CAGR of 10.75%

IMARC Group, a leading market research company, has recently releases report titled "Micro Lending Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028." The study provides a detailed analysis of the industry, including the global food grade alcohol market growth, trends, size, share and forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.The global micro lending market size reached US$ 189.2 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 353.9 Billion by 2028, exhibiting a growth rate (CAGR) of 10.75% during 2023-2028. The implementation of supportive government policies, rapid technological advancements, widespread prevalence of income inequality, and increasing utilization of micro lending in the agriculture industry are some of the major factors propelling the market.

Request For Sample Copy of Report: https://www.imarcgroup.com/micro-lending-market/requestsample

Factors Affecting the Growth of the Micro Lending Industry:

• Financial Inclusion for Underserved Populations:

The rising focus on financial inclusion, especially in developing and underbanked regions, represents one of the key factors impelling the market growth. Traditional banking systems often overlook low-income individuals and small businesses due to their perceived high risk and low profitability. Micro-lending fills this gap by providing small, uncollateralized loans to these underserved groups. These loans empower individuals and small entrepreneurs by giving them access to capital, which is crucial for starting or expanding small businesses, improving living standards, and fostering economic development in these communities. The success of micro-lending in enhancing financial inclusion is evident in its widespread adoption across various continents.

• Advancements in Technology and Mobile Banking:

Increasing advancements of technology and the proliferation of mobile banking are contributing to the market growth. The growing number of digital platforms is making it easier and more cost-effective to distribute microloans, especially in remote areas where traditional banking infrastructure is lacking. Additionally, mobile technology is allowing borrowers to apply for loans, receive funds, and make repayments directly from their mobile devices, leading to the adoption of micro-financial services. Moreover, the use of fintech and artificial intelligence (AI) in credit scoring is improving the ability of micro-lending institutions to assess the creditworthiness of borrowers who lack a formal credit history, thus reducing the risk of default and enabling more tailored financial products.

• Government Policies and International Aid:

Many governments are recognizing the potential of micro-lending to alleviate poverty and stimulate economic development, resulting in the implementation of favorable policies and regulations. These policies often include reduced licensing fees for microfinance institutions, tax benefits, and supportive legal frameworks. Furthermore, international organizations and foreign governments are providing funding and technical support to micro-lending programs, particularly in developing countries. This external support not only bolsters the financial capacity of micro-lending institutions but also helps in establishing best practices, ensuring transparency, and enhancing the overall effectiveness of microfinance initiatives in promoting sustainable economic growth.

Inquire Before Buying: https://www.imarcgroup.com/request?type=report&id=6412&flag=F

Micro Lending Market Report Segmentation:

Breakup by Provider:

• Banks

• Micro Finance Institute (MFI)

• NBFC (Non-Banking Financial Institutions)

• Others

Banks are the most popular segment due to their well-established financial infrastructure and regulatory compliance, making them a trusted source for micro lending services.

Breakup by End User:

• Small Enterprises

• Micro Enterprises

• Solo Entrepreneurs and Self-Employed

Small enterprises account for the biggest market share as they often require micro loans to support their growth and operational needs.

Breakup by Region:

• North America

o United States

o Canada

• Asia-Pacific

o China

o Japan

o India

o South Korea

o Australia

o Indonesia

o Others

• Europe

o Germany

o France

o United Kingdom

o Italy

o Spain

o Russia

o Others

• Latin America

o Brazil

o Mexico

o Others

• Middle East and Africa

Asia Pacific dominates the market due to the increasing demand for micro loans and the presence of numerous emerging economies where micro lending is a vital financial service.

Global Micro Lending Market Trends:

The growing focus on niche and specialized lending in the micro-lending space for catering to specific segments of the market, such as women entrepreneurs, agricultural businesses, or green energy projects, is offering a favorable market outlook. This specialization allows for more customized loan products that are better suited to the unique needs of these groups. In addition, loans with repayment schedules aligned with agricultural harvest cycles greatly benefit farmers. This approach not only improves the effectiveness of the loans but also helps in addressing specific developmental challenges within communities.

Who Are The Key Players Operating In The Industry?

The report covers the major market players including:

• American Express Company

• BlueVine Inc.

• Funding Circle

• Lendio Inc.

• Lendr

• Manappuram Finance Limited

• NerdWallet

• On Deck Capital (Enova International)

• StreetShares Inc. (MeridianLink)

Other Key Points Covered in the Report:

• COVID-19 Impact

• Porters Five Forces Analysis

• Value Chain Analysis

• Strategic Recommendations

Explore More Reports:

https://www.imarcgroup.com/emotion-detection-recognition-market

https://www.imarcgroup.com/digital-pcr-market

https://www.imarcgroup.com/frozen-bakery-products-market

https://www.imarcgroup.com/residential-energy-storage-system-market

https://www.imarcgroup.com/dialysis-market

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas:- +1 631 791 1145 | Africa and Europe :- +44-702-409-7331 | Asia: +91-120-433-0800

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC Group's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Micro Lending Market Size Hit US$ 353.9 Billion by 2028, Growing at a CAGR of 10.75% here

News-ID: 3317209 • Views: …

More Releases from IMARC Group

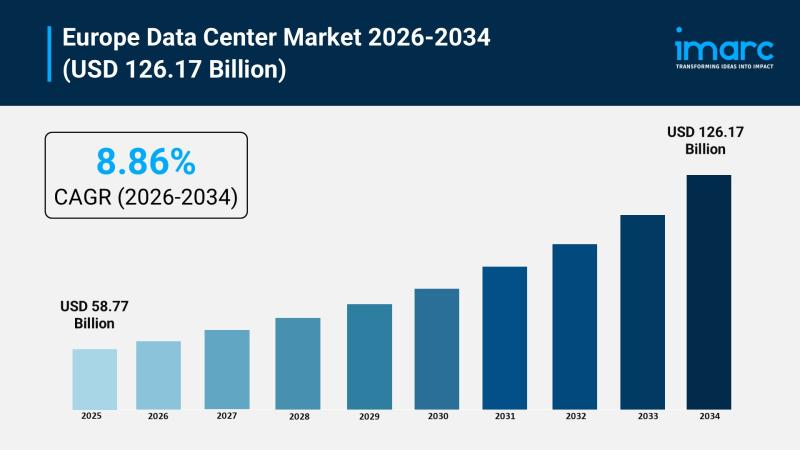

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

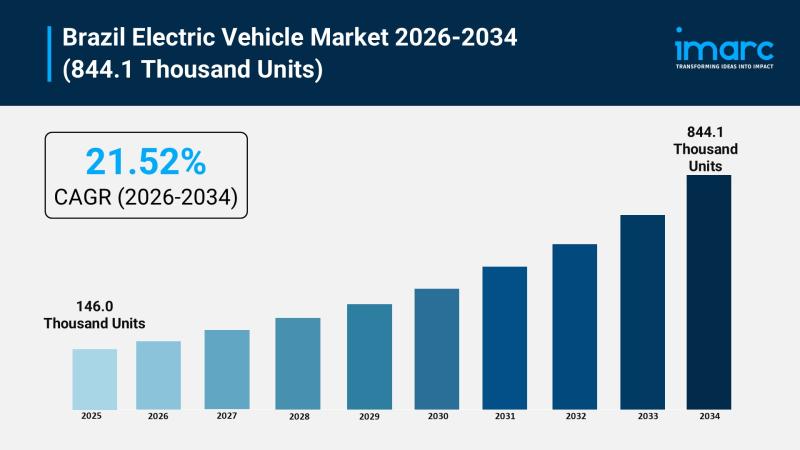

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Micro

Micro and Ultra-Micro Balances Market Size Report 2025

"Global Micro and Ultra-Micro Balances Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" is published by Global Info Research. It covers the key influencing factors of the Micro and Ultra-Micro Balances market, including Micro and Ultra-Micro Balances market share, price analysis, competitive landscape, market dynamics, consumer behavior, and technological impact, etc.At the same time, comprehensive data analysis is conducted by national and regional sales, corporate competition rankings,…

Micro Mobility Revolution: Exploring the Growing Micro Cars Market

The term micro car is used for small-sized and lightweight cars, with an engine small than 700 cc. Bubble cars, cycle cars and quadricycles are defined as micro cars. This is usually three-wheeled and four-wheeled vehicle, available for personal and commercial usage. It is often used as a second or commuter car due to its low cost and fuel efficiency. This car is suitable for urban and suburban environment, as…

Micro Injection Molded Plastic Market worth $1,692 million by 2026 | Key players …

According to recent market research the "Micro Injection Molded Plastic Market by Material Type (Liquid-Crystal Polymer (LCP), Polyether Ether (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM)), Application and Region - Global Forecast to 2026", published by MarketsandMarkets, the micro injection molded plastic market is projected to reach USD 1,692 million by 2026, at a CAGR of 11.2% from USD 995 million in 2021.

Micro injection molded plastics are made of micro…

Micro Combined Heat & Power (Micro CHP) Market 2022 | Detailed Report

The Micro Combined Heat & Power (Micro CHP) research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the Micro Combined Heat & Power (Micro CHP) research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope,…

Micro-Invasive Glaucoma Implants Micro-Invasive Glaucoma Implants

Global Micro-Invasive Glaucoma Implants Market Definition: Micro-invasive glaucoma implants is performed for the treatment of the open- angle glaucoma and is done through an ab- interno approach. It is very safe and provides faster recovery as compared to the traditional methods. They usually lower the intraocular by increasing the flow or reducing the production of the aqueous humor. Increasing cases of the glaucoma worldwide is the major factor fueling the…

Comprehensive Analysis On Micro Welding Equipment Market 2019 : Pro-Fusion, OR L …

Up Market Research added a new Micro Welding Equipment Market research report for the period of 2019 – 2026. Report focuses on the major drivers and restraints providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

Get Sample Copy Of This Report @

https://www.upmarketresearch.com/home/requested_sample/108038

The report contains 112 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing…