Press release

Credit Card Issuance Services Market Research With Size, Growth, Key Players, Segments And Forecast To 2032

The Business Research Company's global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032The Business Research Company's Credit Card Issuance Services Global Market Report 2023 identifies the rise in credit card demand as the major driver for the Credit Card Issuance Services market's growth in the forecast period. A credit card refers to a credit product banks offer that enables users to take out loans up to a pre-approved credit limit. Credit card issuers play an essential role in processing card transactions, paying back previously approved purchases, and handling chargeback requests

The global credit card issuance services market is expected to grow from $437.25 billion in 2022 to $478.09 billion in 2023 at a compound annual growth rate (CAGR) of 9.3%. The Russia-Ukraine war disrupted the chances of global economic recovery from the COVID-19 pandemic. The war between these two countries has led to economic sanctions on multiple countries, a surge in commodity prices, and supply chain disruptions, causing inflation across goods and services and affecting many markets across the globe. The credit card issuance services market is expected to reach $660.81 billion in 2027 at a CAGR of 8.4%.

Download Free Sample Of Credit Card Issuance Services Market Report - https://www.thebusinessresearchcompany.com/sample_request?id=12484&type=smp

Major competitors in the Credit Card Issuance Services market are JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., American Express Company, HSBC Holdings plc., Toronto-Dominion Bank Group, Goldman Sachs Group Inc., Capital One Financial Corporation, Barclays Bank PLC, Visa Inc., U.S. Bancorp, Standard Chartered PLC, PNC Financial Corp., Mastercard Inc., Fiserv Inc., Synchrony Financial, Fidelity National Information Services Inc., Stripe Inc., Wells Fargo & Co., Fifth Third Bank NA, Navy Federal Credit Union, Huntington Bancshares Incorporated, Santander Bank N.A., Giesecke+Devrient GmbH, Synovus Financial Corp., Penfed Federal Credit Union, Marqeta Inc., Entrust Corporation, Comenity Bank, and Nium Pte. Ltd.

A key trend in the Credit Card Issuance Services market includes technological advancement. Major companies operating in the credit card issuance service market are developing new technologies to sustain their position in the market.

Read More On The Global Credit Card Issuance Services Market Report Here:

https://www.thebusinessresearchcompany.com/report/credit-card-issuance-services-global-market-report

The Credit Card Issuance Services market is segmented -

1) By Type: Consumer Credit Cards, Business Credit Cards

2) By Issuers: Banks, Credit Unions, Non-Banking Financial Companies

3) By End-User: Personal, Business

• By Geography: Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. North America was the largest region in the Credit Card Issuance Services market.

The Business Research Company's "Global Credit Card Issuance Services Market Report 2023" provides a thorough understanding of the market across 60 geographies. The report covers market size, growth rate, segments, drivers and trends in every region and country. In addition, the report offers insights on historical and forecast growth, helping players analyze and strategize better.

Explore Buying Options For The Credit Card Issuance Services Market Report Here:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=12484

The Table Of Content For The Credit Card Issuance Services Market Include:

1. Executive Summary

2. Credit Card Issuance Services Market Characteristics

3. Credit Card Issuance Services Market Trends And Strategies

4. Credit Card Issuance Services Market - Macro Economic Scenario

5. Global Credit Card Issuance Services Market Size and Growth

.......

32. Global Credit Card Issuance Services Market Competitive Benchmarking

33. Global Credit Card Issuance Services Market Competitive Dashboard

34. Key Mergers And Acquisitions In The Credit Card Issuance Services Market

35. Credit Card Issuance Services Market Future Outlook and Potential Analysis

36. Appendix

Contact us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Latest Trending Press Releases: https://www.thebusinessresearchcompany.com/press-release.aspx

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Card Issuance Services Market Research With Size, Growth, Key Players, Segments And Forecast To 2032 here

News-ID: 3311606 • Views: …

More Releases from The Business research company

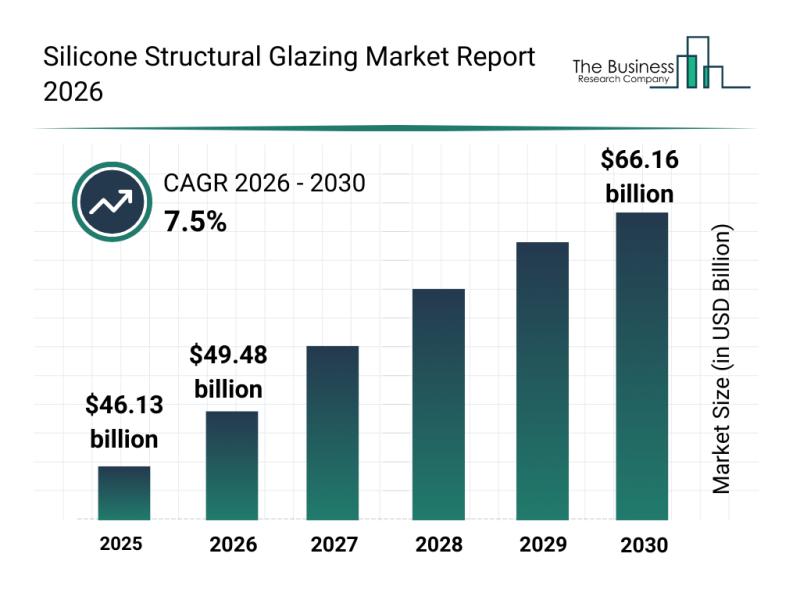

Leading Companies Solidify Their Presence in the Silicone Structural Glazing Mar …

The silicone structural glazing market is positioned for significant expansion in the coming years, driven by advances in building technology and increased environmental awareness. This sector is evolving rapidly as demand grows for more energy-efficient and aesthetically appealing architectural solutions. Let's explore the market's current size, key players, emerging trends, and the main segments that are shaping its future.

Silicone Structural Glazing Market Value Forecast Through 2030

The market for silicone…

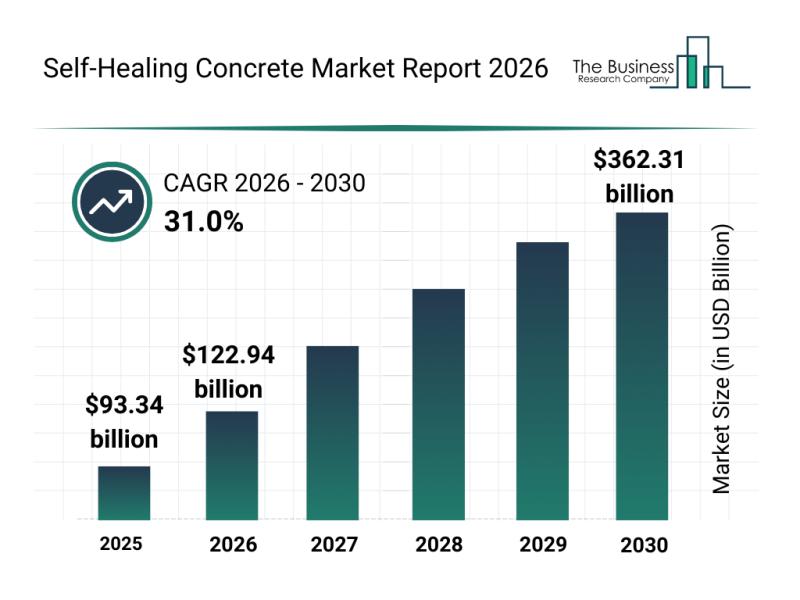

Future Prospects: Key Trends Shaping the Self-Healing Concrete Market up to 2030

The self-healing concrete market is capturing significant attention as innovations and sustainability demands rise in construction. This sector is set to experience remarkable growth due to advancements in materials and technology, shaping the future of durable and intelligent infrastructure solutions. Let's explore the market's size, key players, emerging trends, and segment outlook to understand its trajectory.

Projected Market Size and Growth Prospects for the Self-Healing Concrete Market

The self-healing concrete market…

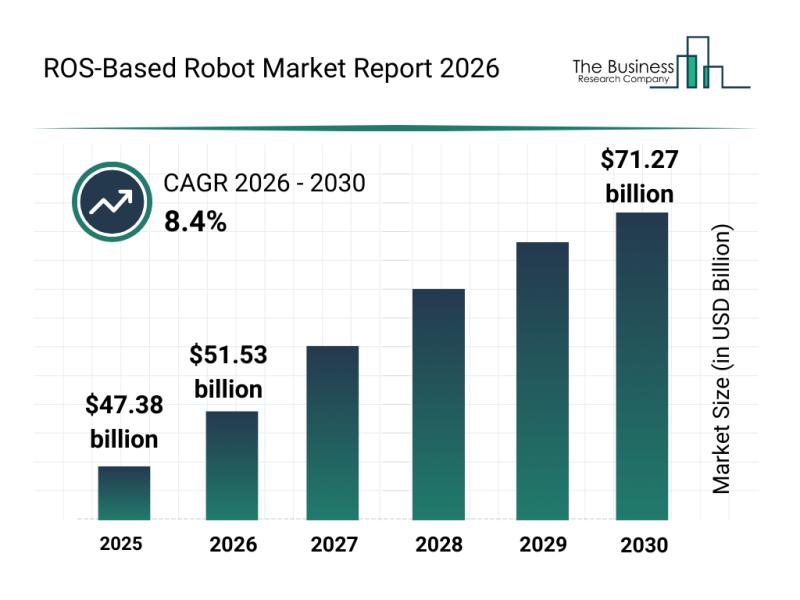

Analysis of Key Market Segments Driving the ROS-Based Robot Industry

The ROS-based robot market is positioned for substantial growth as robotics technology continues to advance rapidly. With increasing innovation in software, hardware, and AI integration, this sector is set to transform multiple industries by 2030. Below, we explore the market's future size, leading companies, key trends, and segmentation details to understand its evolving landscape.

Projected Market Size and Expansion of the ROS-Based Robot Market

The ROS-based robot market is anticipated to…

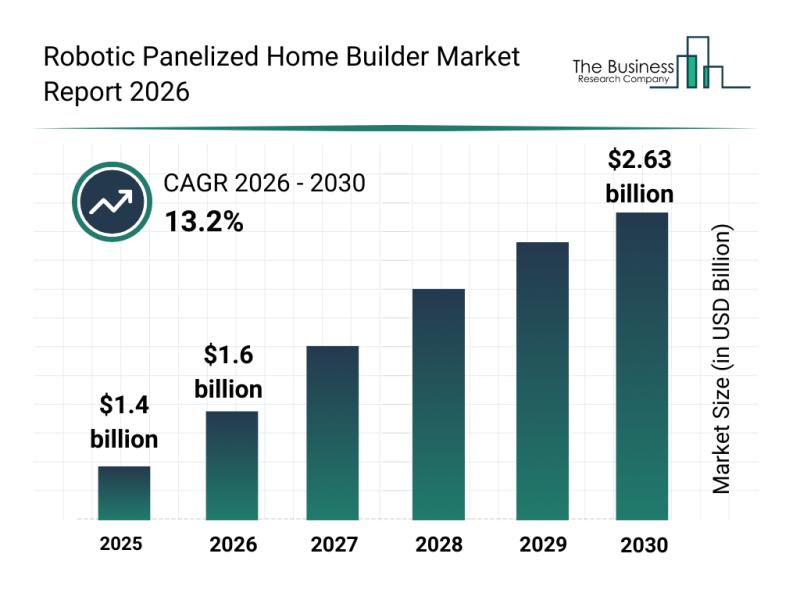

Global Trends Overview: The Rapid Evolution of the Robotic Panelized Home Builde …

The robotic panelized home builder market is positioned for impressive growth in the coming years as automation and robotics increasingly transform construction processes. Driven by technological advancements and expanding prefab housing projects, this market is set to reshape how homes are built with greater speed and efficiency. Let's explore the market's size, leading companies, emerging trends, and key segments that are shaping its future.

Strong Growth Forecast for the Robotic Panelized…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…