Press release

Commercial Insurance Market Outlook, Size, Share, Growth, Overview 2023-2028

The global commercial insurance market size reached US$ 793.6 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 1,203.7 Billion by 2028, exhibiting a growth rate (CAGR) of 6.86% during 2023-2028.Increasing awareness of business risks, evolving regulatory requirements, the rise of technology-enabled risk assessment, the growing impact of natural disasters and climate change, and the surge in cyber threats are influencing the market growth.

Request For Sample Copy of Report: https://www.imarcgroup.com/commercial-insurance-market/requestsample

Factors Affecting the Growth of the Commercial Insurance Industry:

• Regulatory Compliance and Risk Management Awareness:

Governments and regulatory bodies worldwide have implemented stricter regulations and compliance requirements for businesses. These regulations often mandate certain types of insurance coverage, such as liability insurance, to protect stakeholders and the public. Moreover, businesses are increasingly recognizing the importance of comprehensive risk management strategies, where commercial insurance plays a pivotal role. As businesses continue to prioritize risk management, they are increasingly relying on commercial insurance as a tool for financial protection and stability.

• Demographic Shifts and Evolving Workforce Dynamics:

The aging population in many developed countries is leading to a rise in health and liability insurance needs as businesses adjust to an older workforce. This demographic change increases the frequency and severity of health-related claims, driving demand for more comprehensive employer-sponsored health and liability insurance plans. Furthermore, the rise of the gig economy and freelance workforce is altering traditional employment patterns, necessitating new insurance models. These workers often lack the safety net provided by employer-based insurance, leading to a potential market for individual and portable insurance plans tailored to their unique needs.

• Emergence of Insurtech:

Insurtech firms, utilizing cutting-edge technologies such as artificial intelligence (AI), the Internet of things (IoT), and blockchain, are transforming how commercial insurance products are designed, priced, and delivered. The rising use of IoT devices in various industries allows for real-time data collection and monitoring of business operations, leading to more accurate risk assessments and customized insurance solutions. AI algorithms enable faster and more efficient processing of claims and underwriting, significantly improving customer experience. Blockchain technology offers enhanced transparency and security in transactions, which is particularly beneficial for trust-building in insurance agreements. These technological innovations streamline operations for insurers and provide cost savings and value-added services to businesses.

Explore Full Report: https://www.imarcgroup.com/commercial-insurance-market

Commercial Insurance Market Report Segmentation:

By Type:

• Liability Insurance

• Commercial Motor Insurance

• Commercial Property Insurance

• Marine Insurance

• Others

Liability insurance represents the largest segment due to its essential role in providing protection to businesses against third-party claims, making it a fundamental component of risk management for various industries.

By Enterprise Size:

• Large Enterprises

• Small and Medium-sized Enterprises

Large enterprises accounted for the largest market share on account of their substantial assets and higher insurance needs, which often encompass broader coverage and more complex risk management strategies.

By Distribution Channel:

• Agents and Brokers

• Direct Response

• Others

Agents and Brokers hold the biggest market share due to their extensive networks and expertise in connecting businesses with suitable insurance policies, providing a trusted and personalized approach to clients.

By Industry Vertical:

• Transportation and Logistics

• Manufacturing

• Construction

• IT and Telecom

• Healthcare

• Energy and Utilities

• Others

Transportation and Logistics commands the largest market share on account of its extensive network and the inherent risks associated with the transportation of goods, making it a key focus for insurance coverage.

Regional Insights:

• North America

o United States

o Canada

• Asia-Pacific

o China

o Japan

o India

o South Korea

o Australia

o Indonesia

o Others

• Europe

o Germany

o France

o United Kingdom

o Italy

o Spain

o Russia

o Others

• Latin America

o Brazil

o Mexico

o Others

• Middle East and Africa

North America's dominance in the market can be attributed to its robust regulatory framework, a diverse range of industries, and a high level of awareness about the importance of insurance coverage among businesses in the region.

Global Commercial Insurance Market Trends:

The adoption of digital and automated solutions increasingly influences the commercial insurance market. Insurance companies are leveraging technologies like AI, machine learning (ML), and automation to streamline underwriting, claims processing, and customer service. This digital transformation enhances efficiency, reduces operational costs, and improves customer experience.

The insurers are developing more tailored insurance solutions, offering flexibility to adapt to specific industry needs and individual business risks. This trend is particularly evident in sectors like cyber insurance, where standard policies often need to be revised. Customization also extends to payment models and coverage options, allowing businesses to select insurance products that align closely with their risk profiles and financial strategies.

Leading Companies Operating in the Global Commercial Insurance Industry:

• Allianz SE

• American International Group Inc.

• Aon plc

• Aviva plc

• Axa S.A.

• Chubb Limited

• Direct Line Insurance Group plc

• Marsh & McLennan Companies Inc.

• Willis Towers Watson Public Limited Company

• Zurich Insurance Group Ltd.

Other Key Points Covered in the Report:

• COVID-19 Impact

• Porters Five Forces Analysis

• Value Chain Analysis

• Strategic Recommendations

Also Browse:

• https://www.digitaljournal.com/pr/news/imarc/construction-equipment-rental-market-size-to-surpass-us-188-2-billion-by-2032-cagr-of-5-3-

• https://www.digitaljournal.com/pr/news/imarc/ar-and-vr-smart-glasses-market-by-type-end-use-insight-top-companies-and-forecast-2023-2028

• https://www.digitaljournal.com/pr/news/imarc/advanced-packaging-market-size-2024-2032-growth-revnenue-forecast-report

• https://www.digitaljournal.com/pr/news/imarc/with-cagr-of-20-3-india-iot-connectivity-market-size-to-reach-us-197-million-by-2028

• https://www.digitaljournal.com/pr/news/imarc/india-fantasy-sports-market-to-grow-44-6-by-2028-top-companies-myteam11-ballebaazi-myfab11-mpl

• https://www.digitaljournal.com/pr/news/imarc/bus-market-outlook-top-leaders-sales-revenue-industry-analysis-2023-2028

• https://www.digitaljournal.com/pr/news/imarc/european-self-storage-market-outlook-report-2023-2028

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

USA: +1-631-791-1145 | Asia: +91-120-433-0800

Email: sales@imarcgroup.com

Follow us on Twitter: @imarcglobal

LinkedIn: https://www.linkedin.com/company/imarc-group/mycompany/

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC Group's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Insurance Market Outlook, Size, Share, Growth, Overview 2023-2028 here

News-ID: 3309813 • Views: …

More Releases from IMARC Group

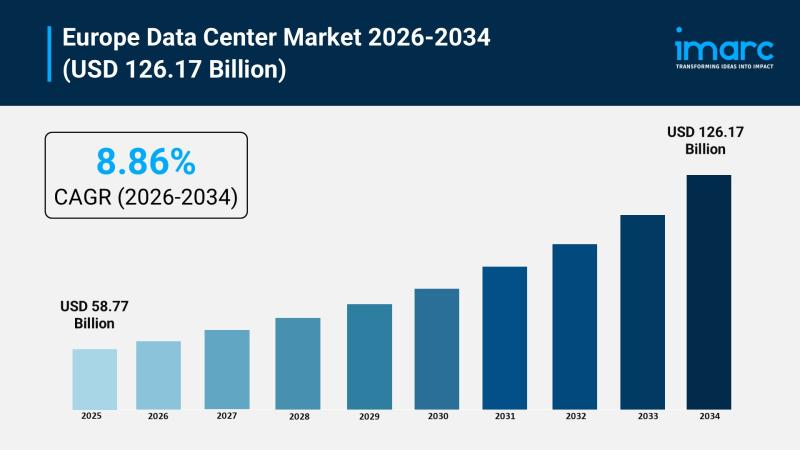

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

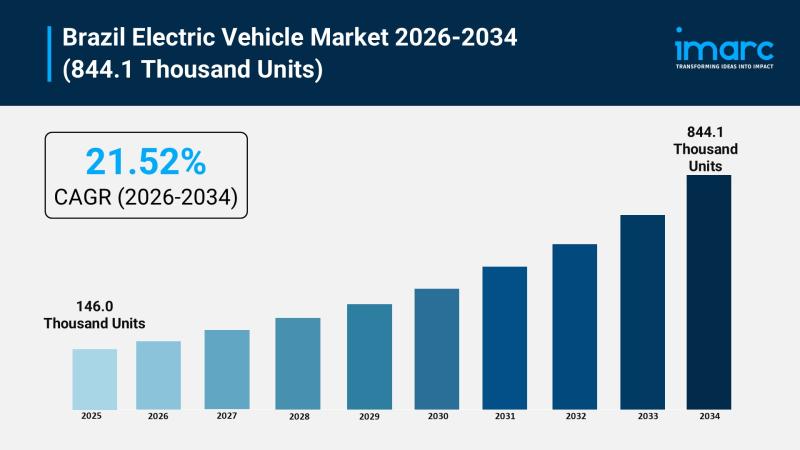

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…