Press release

Financial Crime and Fraud Management Solutions Market Current Landscape and Future Projections 2023-2029

In the intricate dance between finance and security, the Global Financial Crime and Fraud Management Solutions Market emerges as a crucial player, projected to reach a formidable value of US$ 89.24 billion at the end of its forecast period. Fuelled by a robust Compound Annual Growth Rate (CAGR) of 18.6%, this market promises a dynamic landscape shaped by technological innovations and a relentless pursuit of financial security.Understanding the Dynamics: A Global Response to Financial Crime

The pervasive impact of COVID-19 looms large in the market analysis, with the lockdown's varied effects on revenue dissected for market leaders, followers, and disruptors. The global financial landscape has witnessed an unprecedented $1.28 trillion investment by financial institutions over a 12-month period to combat financial crime. However, the costs are staggering, with an estimated $1.45 trillion in combined revenue lost due to financial crime during the same period.

Financial crime, an ever-evolving threat encompassing fraud, tax evasion, embezzlement, and identity theft, demands an unwavering response. Recent events, such as the Westpac saga in Australia, underscore the severe repercussions of turning a blind eye to financial crime.

Know More About The Report:

https://www.maximizemarketresearch.com/market-report/global-financial-crime-and-fraud-management-solutions-market/33426/

Dynamic Market Forces Driving Financial Crime and Fraud Management Solutions Adoption

Market Drivers, Restraints, and Segmentation: Navigating the Landscape

The market is propelled by a surge in digital banking services and cashless transactions, driven by the imperative to curb losses in sectors entwined with money and business. Large corporations, facing losses of 60% to 70% due to fraud and other financial crimes, are compelled to adopt advanced fraud detection and mitigation technologies.

Hardware, software, and service segments undergo a transformative shift, with advanced biometrics gaining prominence in the fight against financial crime. Amidst these changes, consumer trust remains paramount. The software segment, experiencing a surge in demand, is projected to account for 45% to 50% in sectors like banking, government, and private enterprises.

For detailed information regarding our Research Methodology, please request the Free Sample Report:

https://www.maximizemarketresearch.com/request-sample/33426

Segmentation Unveiled: Nature, Product Types, and End-Users

by Application

• Hardware

• Software

• Services

by End User

• Banks

• Credit Unions

• Specialty Finance

• Thrifts

• Others

Please connect with our representative, who will ensure you to get a report sample here @ :

https://www.maximizemarketresearch.com/request-sample/33426

Who are Financial Crime and Fraud Management Solutions Market Key Players?

• IBM Corporation

• Capgemini SE

• Oracle Corporation

• Fiserv, Inc.

• SAS Institute, Inc.

• ACI Worldwide

• Fidelity National Information Services, Inc. (FIS)

• Dell EMC

• ACI Worldwide, Inc.

• Experian PLC

• NICE Ltd.

• Polaris Consulting & Services Limited.

• FICO

• Cloudera

• SAP SE

• First Data Corporation

• DXC Technology Company

• Software AG

• SIMILITY

• Securonix, Inc.

• Temenos Headquarters SA

• Guardian Analytics

Table of content for the Financial Crime and Fraud Management Solutions Market includes:

Part 01: Executive Summary

Part 02: Scope of the Financial Crime and Fraud Management Solutions Market Report

Part 03: Financial Crime and Fraud Management Solutions Market Landscape

Part 04: Financial Crime and Fraud Management Solutions Market Sizing

Part 05: Financial Crime and Fraud Management Solutions Market Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

For more Information Click Here @ :

https://www.maximizemarketresearch.com/request-sample/33426

Regional Flourish: Asia Pacific Leading the Charge

The markets for financial crime and fraud solutions worldwide are concentrated in Asia Pacific, North America, Europe, Middle East, and Africa. Given that it is home to more than half of the world's population and is a major player in the demand for financial crime and fraud management solutions, if we take into account the global population as well as the growing youth population in APAC, which will ultimately lead the market with a **% CAGR during the forecast period.

Large amounts of foreign investment are also being made in developing nations, which has prompted the development of infrastructure to lower financial crime and fraud. Victims rage from both individuals and corporations, impacting society as a whole. The segmentation report aims to forecast the benefits of the global market for financial crime and fraud management solutions while focusing on the 80% of large corporations and individuals who experienced the consequences of serious financial crimes in 2021.

Our Top Trending Reports :

Organic Makeup Remover Market https://www.maximizemarketresearch.com/market-report/global-organic-makeup-remover-market/72546/

Global Surface Protection Films Market https://www.maximizemarketresearch.com/market-report/global-surface-protection-films-market/27341/

Banking Cyber Security Market https://www.maximizemarketresearch.com/market-report/global-banking-cyber-security-market/92354/

Graphite Recycling Market https://www.maximizemarketresearch.com/market-report/graphite-recycling-market/185612/

Global Patients Repositioning and Offloading Device Market https://www.maximizemarketresearch.com/market-report/patients-repositioning-and-offloading-device-market/123289/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a swiftly growing enterprise that specializes in market research and corporate advisory services, serving clients globally. With our substantial impact on revenue and unwavering commitment to research excellence, we have positioned ourselves as a trusted partner to a significant portion of Fortune 500 companies. Our comprehensive range of services caters to a diverse array of industries, including but not limited to IT, telecommunications, chemicals, food and beverages, aerospace and defense, healthcare, and beyond.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Crime and Fraud Management Solutions Market Current Landscape and Future Projections 2023-2029 here

News-ID: 3299121 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

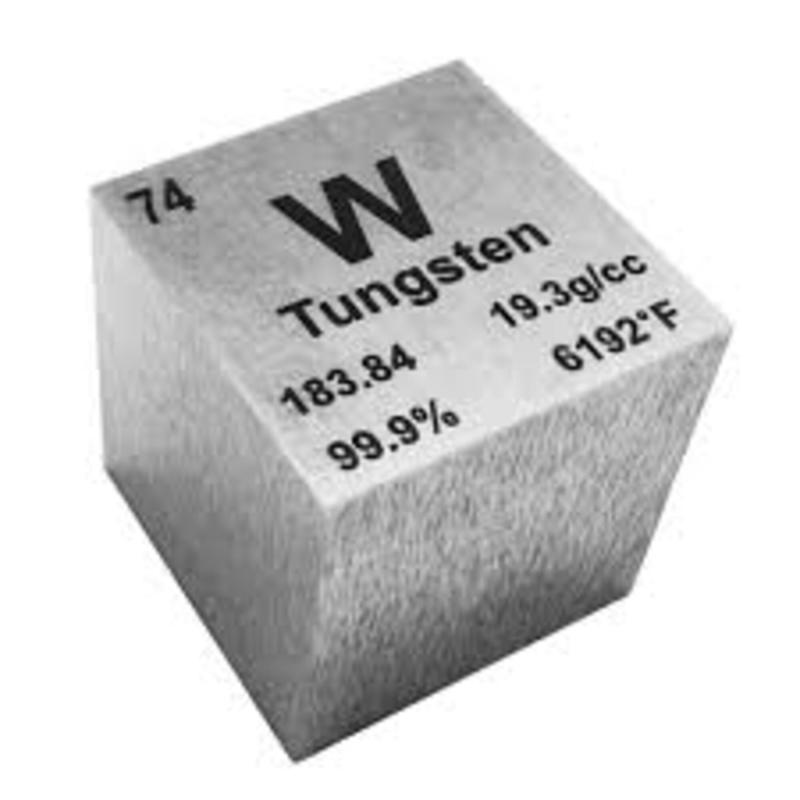

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

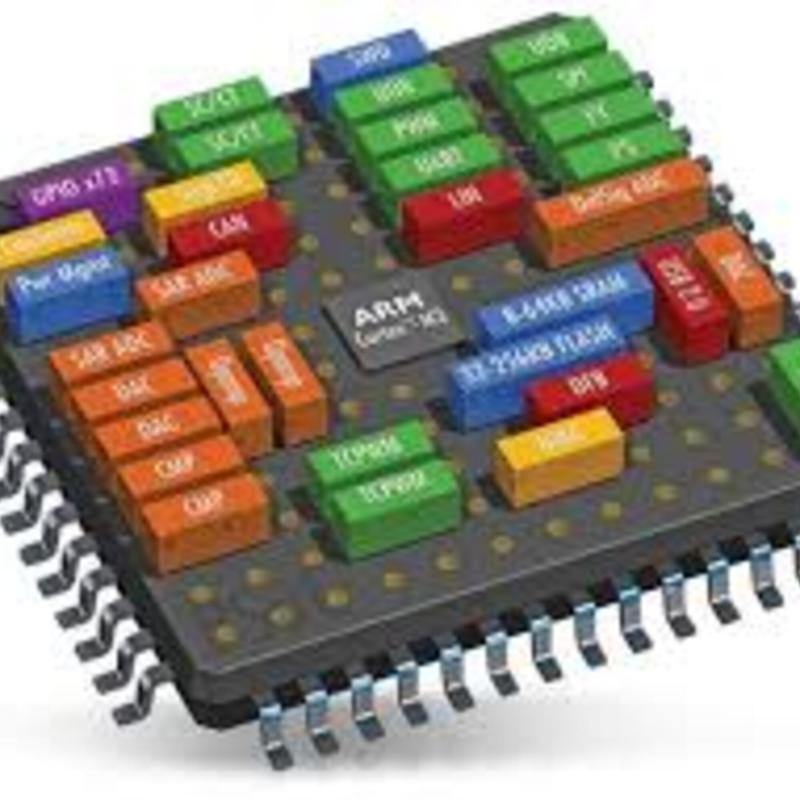

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…