Press release

Supply Chain Finance Market Size, Share, Growth Analysis, Prominent Players and Forecast 2031

Global Supply Chain Finance Market Size Booming to Touch USD 11.8 Billion by 2029The global supply chain finance market is flourishing due to the increasing investments by businesses in supply chain finance solutions for monitoring pre-trade, post-trade, and examining cross-asset and cross-market trades.

Request To Download Sample of This Strategic Report @https://reportocean.com/industry-verticals/sample-request?report_id=bwcc18012

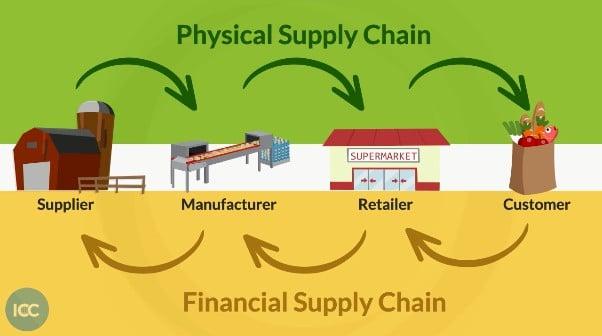

Report Ocean, a leading strategic consulting and market research firm, in its recent study, estimated the global supply chain finance market size at USD 6.68 billion in 2022. During the forecast period between 2023 and 2029, Report Ocean expects to grow at a CAGR of 8.55% reaching USD 11.76 billion by 2029. Supply chain finance helps importers and exporters overcome financial differences. It provides short- to medium-term working capital, which ensures the security of the stock or service being exported or imported through the use of supporting products or structures that mitigate risk. Small organizations are increasing their investments in supply chain finance solutions for monitoring pre-trade, post-trade, and examining cross-asset and cross-market trades, which is driving market growth. Many fintech organizations are implementing supply chain finance systems to increase revenue development opportunities and improve service efficiencies, which promotes supply chain finance adoption. Therefore, these are some of the major factors which will propel market growth.

Opportunity: Increasing number of product launches by major market players

To remain competitive in the marketplace, the top companies in the sector are strongly inclined to implement various growth methods, such as capacity expansion, new product launches, partnerships, mergers & acquisitions, regional expansion, and product innovation. For example, IBSFINtech expanded its product offerings in March 2022 with the launch of VNDZY, a comprehensive SaaS solution for Supply Chain Finance. IBSFINtech is a globally renowned risk, treasury, and trade finance management firm that provides digitized explanations for the end-to-end industrialization of a company's cash flow, treasury, liquidity, risk, and trade finance processes. The SaaS platform VNDZY, powered by AI, enables a linked ecosystem for corporations to establish a win-win solution backed by modern technology.

Overall, the rising product launches by major market players bring advancements, innovation, and increased accessibility to the supply chain finance market. They contribute to the optimization of supply chain operations, risk management, financial stability, and collaboration among supply chain participants. As a result, the global supply chain finance market is poised for growth and offers new opportunities for businesses to optimize their working capital and strengthen their supply chain relationships.

Download Sample Report, SPECIAL OFFER (Avail an Up-to 30% discount on this report ) @https://reportocean.com/industry-verticals/sample-request?report_id=bwcc18012

Challenge: Lack of skilled professionals with proficiency in supply chain finance

The shortage of experienced personnel with supply chain finance expertise can be a significant barrier for organizations in the supply chain finance industry, as supply chain finance necessitates a specialized skill set that integrates knowledge of finance, logistics, and supply chain management. Professionals in this profession must comprehend the complexities of global trade, the various financing options accessible, and the capacity to properly manage risk. Companies may face a number of issues due to a scarcity of competent people with expertise in supply chain financing. As a result, organizations may struggle to develop new solutions and react to changing market conditions, which can lead to a lack of innovation in the industry. Therefore, the shortage of skilled professionals with proficiency in supply chain finance could hamper the growth of the market.

Global Supply Chain Finance Market - By Provider:

Based on provider, the global supply chain finance market is segmented into banks, trade finance house, and others. Banks coverage is expected to be the fastest-growing coverage segment during the forecast period. Banks are still prominent players in the supply chain finance business, and their dominance can be attributable to a variety of factors. Banks have a wealth of experience in offering trade finance solutions, including supply chain financing. They have established relationships with exporters, importers, and other supply chain participants and have the knowledge to manage the risks involved with cross-border transactions.

Global Supply Chain Finance Market - By Distribution Channel:

Based on distribution channel, the global supply chain finance market is split into large enterprises and small and medium-sized enterprises (SMEs). The SMEs segment dominated the market and accounted for a significant share of the global revenue. Smaller enterprises commonly have little access to loans and other forms of interim financing to cover the cost of goods they intend to buy or sell. Supply chain finance bridged the financial gap between importers and exporters by providing short- to medium-term working capital in small and medium-sized enterprises, which ensures the security of the stock or service being exported or imported with accompanying products or structures that mitigate risk.

Get The Insights You Need By Customizing Your Report To Fit Your Unique Needs And Goals:https://reportocean.com/industry-verticals/sample-request?report_id=bwcc18012

Global Supply Chain Finance Market - By Region:

The global supply chain finance market is dominated by the North America region. North America is anticipated to cover a significant share over the forecast period. This is due to the presence of a large number of firms and retailers who are implementing supply chain finance solutions to expand their worldwide supply and logistics network. North America thus dominates the supply chain finance market growth. Furthermore, as enterprises have expanded geographically, they have to reassess their existing supply chain and logistic network. The need to manage safety throughout this supply chain review is likely to drive the supply chain finance market in the United States.

Impact of COVID-19 on the Global Supply Chain Finance Market

The global supply chain finance market has grown in recent years; but, because of the COVID-19 pandemic, the market growth dropped in 2020. This was connected to a rise in remote working and social distancing, which created a problem for supply chain finance in financial organizations in obtaining data from a variety of places and sources. All of these elements enhanced the possibility of danger in the form of an unregistered conduit to communicate misreported trades. However, organizations were increasingly turning to supply chain financing to ensure the safety of their supply chain operations. This, in turn, drove the expansion of the supply chain financing business during the epidemic.

Competitive Landscape:

The global supply chain finance market is highly competitive, with all the players continually competing to gain a larger market share. The key players are Asian Development Bank, Bank of America Corporation, Citigroup, Inc., Eulers Herms (Allianz Trade), HSBC Group, JPMorgan Chase & Co., Mitsubishi UFJ Financial Group, Inc., Royal Bank of Scotland Plc, Standard Chartered, Axis Bank Limited, State Bank of India, ICICI Bank Limited, and HDFC Bank Limited.

Enquire before purchasing this report-https://reportocean.com/industry-verticals/sample-request?report_id=bwcc18012

The report's in-depth analysis provides information about growth potential, upcoming trends, and the Global Supply Chain Finance Market statistics. It also highlights the factors driving forecasts of total market size. The report promises to provide recent technology trends in the Global Supply Chain Finance Market along with industry insights to help decision-makers make sound strategic decisions. Furthermore, the report also analyses the growth drivers, challenges, and competitive dynamics of the market.

Table of Content

Chapter 1: Global Supply Chain Finance Industry Overview

Chapter 3: Market Dynamics

Chapter 4: Top Company Profiles

Chapter 5: Global Supply Chain Finance market Competition, by Players

Chapter 6: Global Market Size by Regions

Chapter 7: Global Market Segment by Application

Chapter 8: Global Supply Chain Finance Industry Segment by Type

Chapter 9: Market Chain, Sourcing Strategy, and Downstream Buyers

Chapter 10: Strategies and key policies by Distributors/Suppliers/Traders

Chapter 11: Key Marketing Strategy Analysis, by Market Vendors

Chapter 12: Market Effect Factors Analysis

Chapter 13: Global Supply Chain Finance market Size Forecast (2023-2031).

Continue….

Reasons to Buy This Report

(A) The research provides valuable insights for top administration, policymakers, professionals, product advancements, sales managers, and stakeholders in the market. It helps them make informed decisions and strategize effectively.

(B) The report offers comprehensive analysis of Supply Chain Finance market revenues on a global, regional, and country level, projecting trends until 2031. This data allows companies to assess their market share, identify growth opportunities, and explore new markets.

(C) The research includes segmentation of the Supply Chain Finance market based on types, applications, technologies, and end-uses. This segmentation enables leaders to plan their products and allocate resources based on the expected growth rates of each segment.

(D) Analysis of the Supply Chain Finance market benefits investors by providing insights into market scope, position, key drivers, challenges, restraints, expansion opportunities, and potential threats. This information helps them make informed investment decisions.

(E) The report offers a detailed analysis of competitors, their key strategies, and market positioning. This knowledge allows businesses to better understand the competition and plan their own strategies accordingly.

(F) The study helps evaluate Supply Chain Finance business predictions by region, key countries, and top companies, providing valuable information for investment planning and decision-making.

Access Full Report Description, TOC, Table of Figure, Chart, etc.-https://reportocean.com/industry-verticals/sample-request?report_id=bwcc18012

About Report Ocean:

Report Ocean is a renowned provider of market research reports, offering high-quality insights to clients in various industries. Their goal is to assist clients in achieving their top line and bottom line objectives, thereby enhancing their market share in today's competitive environment. As a trusted source for innovative market research reports, Report Ocean serves as a comprehensive solution for individuals, organizations, and industries seeking valuable market intelligence.

Contact Information:

Email:sales@reportocean.com

Address: 500 N Michigan Ave, Suite 600, Chicago, Illinois 60611, United States

Telephone: +1 888 212 3539 (US - Toll-Free)

For more information and to explore their offerings, visit their website at:https://www.reportocean.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Supply Chain Finance Market Size, Share, Growth Analysis, Prominent Players and Forecast 2031 here

News-ID: 3298700 • Views: …

More Releases from Report Ocean

Japan Internet Advertising Market CAGR of 24.9%, Behind the Scenes Techniques fo …

The Japan Internet Advertising Market has demonstrated remarkable growth, reaching a valuation of USD 29.49 Billion in 2021. With the digital landscape continually evolving, it is forecasted to soar to an impressive USD 112.04 Billion by 2027. This surge represents an anticipated compound annual growth rate (CAGR) of 24.9% over the projected period, highlighting the dynamic and rapidly expanding nature of the digital advertising sector in Japan.

Internet Advertising are set…

Location Analytics Market Through the Looking Glass Techniques for a Profound Un …

This comprehensive market research report offers an in-depth analysis of the global location analytics market from 2019 to 2026. Valued at USD 10,813.6 million in 2019, the market is forecasted to surge to USD 29,878.5 million by 2026, demonstrating a robust Compound Annual Growth Rate (CAGR) of 15.6% throughout the projection period. This report delves into the key drivers, restraints, opportunities, and challenges that are shaping the market, providing stakeholders…

Affiliate Marketing Platform Market Eyes Wide Open Maximizing the Value of Obser …

The Global Affiliate Marketing Platform Market, valued at USD 19,217.4 million in 2021, is projected to witness significant growth over the next decade, reaching an estimated value of USD 36,902.1 million by 2030.

This report provides an in-depth analysis of the market dynamics, growth drivers, challenges, and opportunities that will influence the affiliate marketing landscape over the forecast period of 2021-2030. With a Compound Annual Growth Rate (CAGR) of 7.7%,…

Global Clear Brine Fluids Market Growth Forecast and Trends (2022-2030)

The global clear brine fluids market was valued at US$ 0.95 billion in 2021. It is anticipated to experience growth, reaching a valuation of US$ 1.39 billion by 2030. This growth trajectory translates to a compound annual growth rate (CAGR) of 3.1% during the forecast period from 2022 to 2030. Clear brine fluids, crucial in the oil and gas industry for drilling and completion processes, are poised for increased demand,…

More Releases for Supply

Driving Agility in Retail Supply Chains with Signavio Supply Chain Modeling

Retail supply chains were developed for stability but are now asked to contend with disruption, variable demand, and the complexity of omnichannel retailing.

Retailers require networks that are fast, transparent, and efficient on all fronts, as long as they do not give away margin. YRC is addressing this through SAP Signavio, transforming these traditional supply chains into adaptable, cost-saving ecosystems that maximize real-time response capabilities.

The core of YRC's initiative is Signavio…

Blockchain Supply Chain Market: Securing and Streamlining Supply Chains

Blockchain Supply Chain Market report 2024-2031 covers the whole scenario of the global including key players, their future promotions, preferred vendors, and shares along with historical data and price analysis. It continues to offer key details on changing dynamics to generate -improving factors. The best thing about the Tax Management report is the provision of guidelines and strategies followed by major players. The investment opportunities in the highlighted here will…

Industrial equipment supply

We stock and sell Compressor, Servo Motor and Drive, HMI, Encoder, Light Curtain, Sensor, VFD, Soft Starter, Thyristor, Solenoid Valve and Coil, Air Cylinder, Gearbox, Linear Guideway, Actuator, Transmitter, Flowmeter, Power Supply, Transformer, Expansion Valve, Circuit Breaker and other necessities all catering to your needs.

Visit out site at okmarts.com for more info.

Address : No. 469, Xinsheng Road, Gaoxin District, Chengdu, China

Email : support@okmarts.com

Email : service@okmarts.com

Tel : +86-28-84166335

Since 2008, we are…

Top players profiled in the Tattoo Market report are WorldWide Tattoo Supply,ELE …

The global Tattoo Market report contains market revenue, market share, and production of the service providers is also mentioned with accurate data. Moreover, the global Tattoo Market report majorly focuses on the current developments, new possibilities, advancements, as well as dormant traps. Furthermore, the market report offers a complete analysis of the current situation and the advancement possibilities of the market across the globe. Tattoo Market size is forecasted to reach…

LED Supply Chain

This report covers market size and forecasts of LED Supply Chain, including the following market information:

Global LED Supply Chain Market Size, 2019-2021, and 2020 (quarterly data), (US$ Million)

Global LED Supply Chain Market Size by Type and by Application, 2019-2021, and 2020 (quarterly data), (US$ Million)

Global LED Supply Chain Market Size by Region (and Key Countries), 2019-2021, and 2020 (quarterly data), (US$ Million)

Global LED Supply Chain Market Size by Company, 2019-…

Advanced Marine Power Supply Market Report 2018: Segmentation by Device (Battery …

Global Advanced Marine Power Supply market research report provides company profile for Emerson Electric Company, Schneider Electric SE, ABB Ltd, Exide Industries Ltd, EnerSys, HBL Power Systems Ltd, Systems Sunlight S.A., Eaton Corporation Plc, Powerbox International AB and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue,…