Press release

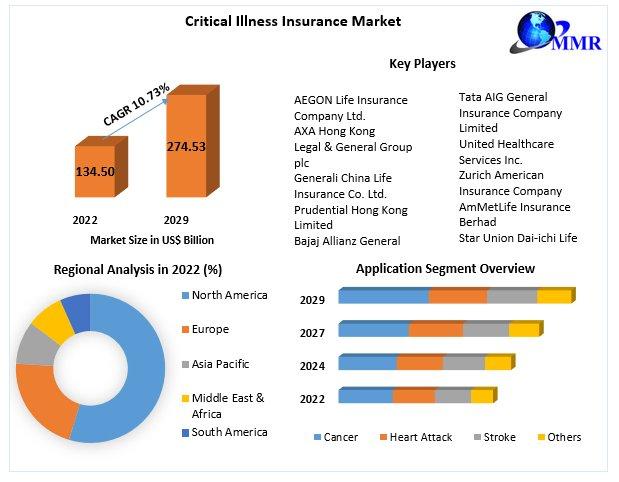

Critical Illness Insurance Market to reach USD 274.43 Bn by 2029, emerging at a CAGR of 10.73 percent and forecast 2023-2029

Critical Illness Insurance Market Report Scope and Research MethodologyCritical illness insurance plays a pivotal role in addressing life-threatening conditions that require intensive care or long-term treatment. Maximize Market Research's report delves into the market's segments, including Type, Application, and Premium Mode, offering insights derived from market participants. The report spans regions such as North America, Asia Pacific, Europe, Middle East & Africa, and South America.

The report utilizes a robust research methodology, presenting key data analysis for the historical period from 2017 to 2020. It explores drivers, limitations, prospects, and barriers, providing investor recommendations based on a thorough examination of the contemporary competitive scenario in the Critical Illness Insurance Market.

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/126758

Critical Illness Insurance Market Dynamics:

In the face of major medical emergencies such as cancer or a heart attack, critical illness insurance emerges as a crucial safeguard against financial devastation. Contrary to the common misconception that a conventional health insurance plan provides comprehensive protection, the expenses associated with treating life-threatening illnesses often surpass the coverage limits. To gain a deeper understanding of critical illness insurance and assess its relevance for you and your family, read on.

Critical illness insurance policies are subject to various restrictions, mirroring the characteristics of other insurance policies. They not only address specific conditions outlined in the policy but also do so under specific criteria stipulated within the policy terms. For example, a mere cancer diagnosis may not trigger the commencement of the policy's payment process if the disease has not progressed beyond the point of discovery or lacks a life-threatening status. Similarly, payment may not be initiated following a stroke diagnosis unless neurological impairment persists for a duration exceeding 30 days. Among other prerequisites, the policyholder must be ill or survive for a specified number of days post-diagnosis.

Critical Illness Insurance Market Regional Insights:

Anticipated to secure the largest market share by 2029, the North American region's growth is closely tied to the surge in medical expenses and the escalating prevalence of chronic diseases, such as cancer, heart attacks, and strokes. The regional market is further expanding due to an increasing death rate and a rise in cancer diagnoses. Europe is poised for significant growth in the coming years, driven by the heightened prevalence of diseases like cancer and heart attacks within the region's expanding guaranteed population. The Asia Pacific region is expected to witness substantial market growth, fueled by the growing elderly population, particularly in populous countries like China and India. Conversely, the Middle East and Africa are forecasted to experience slower expansion rates, primarily attributed to a lack of industry awareness regarding the benefits of critical illness insurance.

The report's objective is to provide stakeholders in the industry with a comprehensive analysis of the Critical Illness Insurance Market. It encompasses the industry's past and current status, along with forecasted market size and trends, presented in an accessible manner through the analysis of intricate data. The report covers all facets of the industry, including a dedicated study of key players, encompassing market leaders, followers, and new entrants.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/126758

Critical Illness Insurance Market Segmentation:

by Type

Disease Insurance

Medical insurance

Income protection insurance.

by Application

Cancer

Heart Attack

Stroke

Others

by Premium Mode

Monthly

Quarterly

Half Yearly

Yearly

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/126758

Critical Illness Insurance Market Key Players:

1. AEGON Life Insurance Company Ltd.

2. AXA Hong Kong

3. Legal & General Group plc

4. Generali China Life Insurance Co. Ltd.

5. Prudential Hong Kong Limited

6. Bajaj Allianz General Insurance Co. Ltd.

7. Tata AIG General Insurance Company Limited

8. United Healthcare Services Inc.

9. Zurich American Insurance Company

10.AmMetLife Insurance Berhad

11.Star Union Dai-ichi Life Insurance Company Limited

12.Sun Life Assurance Company of Canada.

13.AFLAC INCORPORATED

14.Liberty General Insurance Ltd.

15.HCF

16.Future Generali India Insurance Company Ltd.

17.Religare Health Insurance Company Limited

18.Cigna.

19.The Guardian Life Insurance Company of America

20.Mutual of Omaha Insurance Company

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/critical-illness-insurance-market/126758/

Table of content for the Critical Illness Insurance Market includes:

1. Global Critical Illness Insurance Market: Research Methodology

2. Global Critical Illness Insurance Market: Executive Summary

• Market Overview and Definitions

• Introduction to the Global Market

• Summary

• Key Findings

• Recommendations for Investors

• Recommendations for Market Leaders

• Recommendations for New Market Entry

3.Global Critical Illness Insurance Market: Competitive Analysis

• MMR Competition Matrix

• Market Structure by region

• Competitive Benchmarking of Key Players

• Consolidation in the Market

• M&A by region

• Key Developments by Companies

• Market Drivers

• Market Restraints

• Market Opportunities

• Market Challenges

• Market Dynamics

• PORTERS Five Forces Analysis

• PESTLE

• Regulatory Landscape by region

• North America

• Europe

• Asia Pacific

• Middle East and Africa

• South America

• COVID-19 Impact

4 . Company Profile: Key players

• Company Overview

• Financial Overview

• Global Presence

• Capacity Portfolio

• Business Strategy

• Recent Developments

Key Offerings:

• Past Market Size and Competitive Landscape (2022 to 2029)

• Past Pricing and price curve by region (2022 to 2029)

• Market Size, Share, Size and Forecast by different segment | 2022-2029

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Market Segmentation - A detailed analysis by growth and trend

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

✆ +1 800 507 4489

✆ +91 9607365656

🖂 mailto:sales@maximizemarketresearch.com

🌐 https://www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of the majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Critical Illness Insurance Market to reach USD 274.43 Bn by 2029, emerging at a CAGR of 10.73 percent and forecast 2023-2029 here

News-ID: 3297088 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Commercial Kitchen Appliances Market Poised for Robust Growth, Expected to Reach …

The global Commercial Kitchen Appliances Market, valued at US$ 101.65 billion in 2023, is witnessing strong momentum driven by the rapid expansion of the foodservice industry, technological innovation, and evolving consumer lifestyles. According to the latest market analysis, the industry is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030, reaching nearly US$ 160.05 billion by the end of the forecast period.

Commercial kitchen…

E-Bike Market Poised for Robust Expansion, Projected to Reach USD 153.42 Billion …

The global E-Bike Market is entering a transformative growth phase, underpinned by accelerating demand for eco-friendly transportation, rapid advances in battery and motor technologies, and strong policy support for sustainable urban mobility. Valued at USD 60.65 Billion in 2024, the market is projected to expand at a compound annual growth rate (CAGR) of 12.3% from 2025 to 2032, reaching nearly USD 153.42 Billion by 2032. As cities worldwide seek to…

Data Center Liquid Immersion Cooling Market Set for Rapid Expansion, Driven by H …

Data Center Liquid Immersion Cooling Market to Grow from USD 640.94 Million in 2023 to USD 3,340.83 Million by 2030, Registering a Robust CAGR of 26.6% (2024-2030)

The global Data Center Liquid Immersion Cooling Market is witnessing a transformative phase as data center operators worldwide seek advanced, energy-efficient cooling solutions to address rising power densities, sustainability mandates, and escalating operational costs. Valued at USD 640.94 million in 2023, the market…

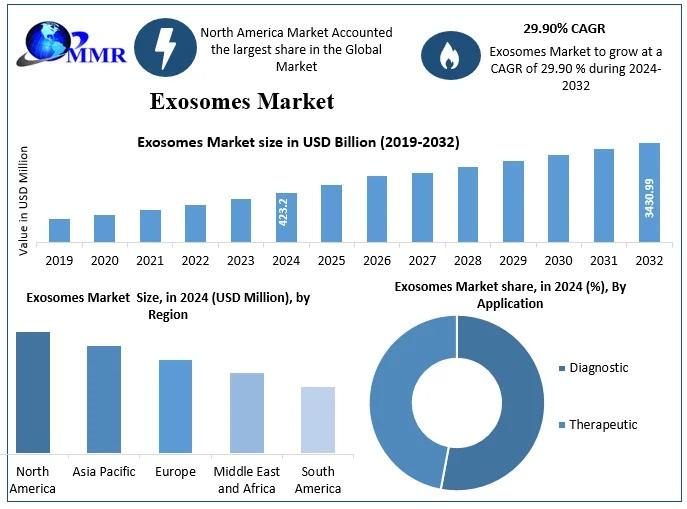

Exosomes Market Forecast: USD 3,430.99 Million Opportunity by 2032

Exosomes Market size was valued at USD 423.2 Mn in 2024 and is expected to reach USD 3430.99 Mn by 2032, at a CAGR of 29.90

The global exosomes market is currently poised for explosive growth, fundamentally driven by the paradigm shift toward non-invasive diagnostics and the rising prominence of "liquid biopsies" in oncology. Once considered mere cellular waste, these extracellular vesicles are now recognized as critical mediators of intercellular communication,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…