Press release

Video Banking Service Market Trends and Forecast 2023-2029: Shaping the Future of Digital Banking

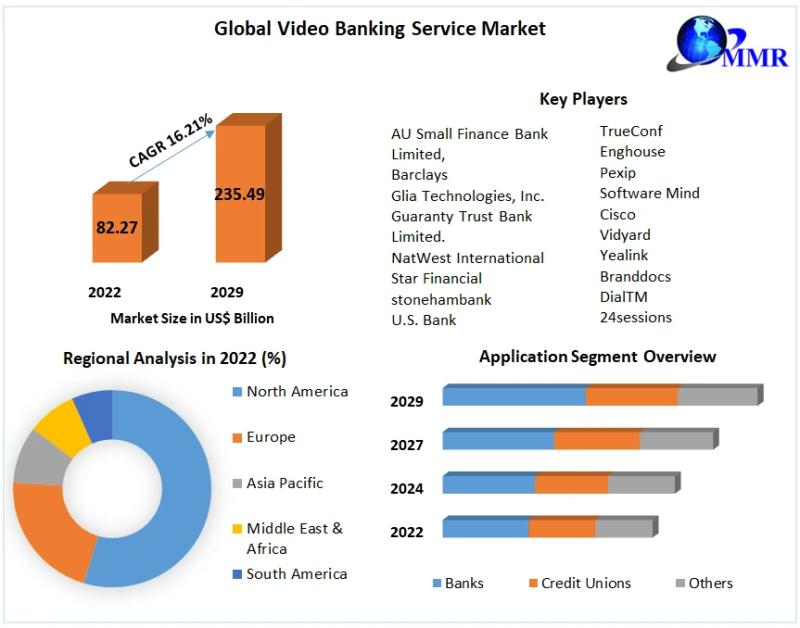

Revolutionizing Banking: Video Banking Service Market Set to Reach USD 235.49 Billion by 2029The global Video Banking Service Market, valued at USD 82.27 Billion in 2022, is poised for remarkable growth, projecting to reach USD 235.49 Billion by 2029 at a robust CAGR of 16.21%, according to the latest market report by Maximize Market Research. The surge is fueled by a paradigm shift in consumer banking preferences, technological advancements, and the transformative impact of the COVID-19 pandemic.

Request Free Sample Copy (To Understand the Complete Structure of this Report [Summary + TOC]) @ https://www.maximizemarketresearch.com/request-sample/167084

Video Banking: Redefining Customer Engagement

Video banking, characterized by virtual interactions between customers and bank representatives, is reshaping the financial landscape globally. Banks, spanning the US, Canada, China, France, and beyond, are adopting video kiosks to serve customers remotely, reducing rental costs and waiting times. This innovation becomes a lifeline for communities with limited access to physical bank branches, especially during times when travel is constrained.

Video Banking Service Market Report Scope and Research Methodology:

The global Video Banking Service market report published by Maximize Market Research is a comprehensive analysis of the market, based on both primary and secondary research. The qualitative and quantitative data in the report is expected to help decision-makers identify the market segments and variables that are driving growth.

The bottom-up approach was used to estimate the global Video Banking Service market size. SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats of the key players in the Video Banking Service industry. The report also includes a PESTLE analysis, which can help investors develop strategies for the Video Banking Service industry. Political factors can help investors understand how much a government is expected to influence the Video Banking Service market during the forecast period. Economic factors can help investors analyze the economic performance drivers that have an impact on the Video Banking Service market. Legal factors can help investors understand the impact of the surrounding environment and the influence of environmental concerns on the Video Banking Service market.

Ensuring Security and Compliance

Governments worldwide have implemented stringent regulations to ensure the security of video communication in the financial services sector. These measures safeguard customer privacy and prevent potential breaches. Financial institutions are tasked with continuous oversight, due diligence, and robust anti-fraud procedures, establishing a secure environment for customer transactions.

For any Queries Linked with the Report, Ask an Analyst @ https://www.maximizemarketresearch.com/market-report/video-banking-service-market/167084/

Video Banking Service Market Segment Analysis:

by Component

1. Solution

2. Service

During the forecast period, the service segment is anticipated to grow at the highest CAGR of 16.55% among all the components. However, the solution segment accounted for nearly two thirds of the market for video banking services in 2022 and is predicted to continue leading the market from 2023 to 2029.

by Deployment Mode

1. On-Premise

2. Cloud

In terms of deployment mode, the on-premise segment held the largest revenue share in the video banking service market in 2022. Nonetheless, over the course of the forecast period, the cloud segment is anticipated to record the highest CAGR of 17.3%.

by Application

1. Banks

2. Credit Unions

3. Others

Major Players are:

1. AU Small Finance Bank Limited,

2. Barclays

3. Glia Technologies, Inc.

4. Guaranty Trust Bank Limited.

5. NatWest International

6. Star Financial

7.stonehambank

8. U.S. Bank

9. ulster bank

10. Royal Bank of Scotland plc

11. Zoom

12. POPio

13. TrueConf

14. Enghouse

15. Pexip

16. Software Mind

17. Cisco

18. Vidyard

19. Yealink

20. Branddocs

21. DialTM

22. 24sessions

23. Sirma

Key Questions answered in the Video Banking Service Market Report are:

• What is Video Banking Service?

• What is the expected CAGR of the Video Banking Service market during the forecast period?

• What is the expected Video Banking Service market size by the end of the forecast period?

• What are the Video Banking Service market segments?

• Which segment in the Video Banking Service market is expected to grow rapidly during the forecast period?

• Which factors are majorly driving the Video Banking Service market growth?

• Which factors are restraining the Video Banking Service market growth?

• Which are the prominent players in the Video Banking Service market?

• Which region dominated the global Video Banking Service market in 2022?

• Which regional market is expected to grow at a high rate during the forecast period?

Want your report customized? Speak to an analyst and personalize your report according to your needs: https://www.maximizemarketresearch.com/request-sample/167084

Regional Insights:

North America holds the largest market share at 36.4%, followed by Europe and APAC. The APAC region is poised for the fastest CAGR of 17.5% during the forecast period, driven by the growing need for video communication and virtual workforce management.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Video Banking Service Market Trends and Forecast 2023-2029: Shaping the Future of Digital Banking here

News-ID: 3294824 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…