Press release

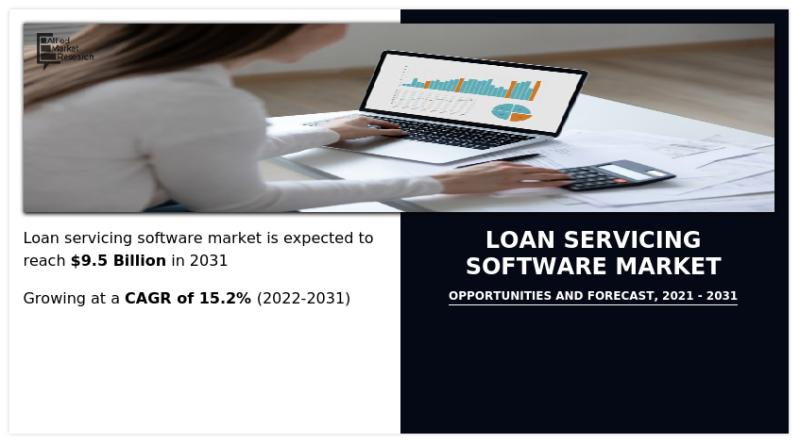

Loan Servicing Software Market Drivers Shaping Future Growth, Revenue $9.5 Billion by 2031 | CAGR of 15.2%

Major market players have undertaken various strategies to increase the competition and offer enhanced services to their customers. For instance, in May 2022, Sagent, a FinTech company modernizing mortgage and consumer loan servicing for North America's top banks and lenders, announced a five-year partnership extension with Fairstone Financial Inc. to continue powering its personal loan servicing ecosystem. Fairstone is expected to continue to drive scale servicing operations using Sagent's cloud-based LoanServ system of record. Fairstone currently uses the nimble, highly configurable LoanServ platform to deliver a better customer experience and adjust in real-time to constantly evolving customer and regulatory needs.Download Sample Report (Get Detailed Analysis in PDF - 382 Pages): https://www.alliedmarketresearch.com/request-sample/19884

According to the report published by Allied Market Research, the global Loan Servicing Software market is set to garner revenue of $2.3 billion in 2021, and is expected to hit $9.5 billion by 2031, registering a CAGR of 15.2% from 2022 to 2031. The market research study provides a detailed analysis of changing industry trends, top-most segments, value chain analysis, key investment business scenarios, regional space, and competitive space. The study is a key information source for giant players, entrepreneurs, shareholders, and owners in generating new strategies for the future and taking steps to enhance their market position. The report displays an in-depth quantitative analysis of the market from 2022 to 2031 and guides investors in allocating funds to the rapidly evolving industry.

Covid-19 Scenario

The Covid-19 pandemic created a moderate impact on the growth of the global loan servicing software market with a rise in unemployment and job loss caused due to the pandemic outbreak leading to less demand for home, mortgage, and personal loans.

Lockdown during the COVID-19 pandemic forced banks and other financial institutions in collecting loans physically, thereby impacting the growth of the global market.

Interested to Procure the Data? Inquire here @ https://www.alliedmarketresearch.com/purchase-enquiry/19884

The report offers detailed segmentation of the global loan servicing software market based on component, deployment mode, enterprise size, application, end-user, and region. It provides an in-depth analysis of every segment and sub-segment in tables and figures through which consumers can derive a conclusion about market trends and insights. The market report analysis aids organizations, investors, and entrepreneurs in understanding which sub-segments are to be tapped for achieving huge growth in the years ahead.

In terms of component, the software segment held the highest market share in 2021. Moreover, it accounted for three-fourths of the overall share of the global loan servicing software market in 2021. Moreover, this segment is predicted to retain its dominant position during the forecast timespan. However, the service segment is set to record the highest CAGR of 19.3% from 2022 to 2031.

On basis of the application, the commercial loan software segment held the largest share in 2021, and contributed more than two-fifths of the overall loan servicing software market share. Moreover, this segment is predicted to account for the highest market share in 2031. However, the loan origination software segment is also anticipated to record the fastest CAGR of 19.1% during the forecast timeframe.

Based on the enterprise size, the large enterprises segment contributed to the largest market share in 2021. Moreover, it contributed over three-fourths of the global loan servicing software market share in 2021. Furthermore, the segment is predicted to retain its dominant status during the forecast timeline. However, the small and medium-sized enterprises (SMEs) segment is expected to register the highest CAGR of 18.5% during the forecast period.

Request Customization

https://www.alliedmarketresearch.com/request-for-customization/19884

Based on region, the Asia-Pacific region is anticipated to contribute the highest market share in 2031. It will account for nearly one-third of the global loan servicing software market share. The Asia-Pacific loan servicing software market is predicted to register the fastest CAGR of 17.9% from 2022 to 2031. The report also analyzes regions including the LAMEA, North America, and Europe.

Key participants in the global loan servicing software market examined in the research include Applied Business Software, Inc., Neofin (SECURITY), Bryt Software LLC, C-Loans, Inc., Emphasys Software, FICS, Fiserv, Inc., Shaw Systems Associates, LLC, GOLDPoint Systems, Inc., Grants Management System (GMS), Graveco Software Inc., LoanPro, Margill, Nortridge Software, LLC, Q2 Software, Inc., The Constellation Mortgage Solutions, and TurnKey Lender.

The report evaluates these major players in the global loan servicing software industry. These players have executed a gamut of major business strategies such as the expansion of regional and customer bases, new product launches, strategic alliances, and joint ventures for expanding product lines across global markets. The market research report supports the performance monitoring of each segment, positioning of each product in respective segments, and the impact of new technology and product innovations on the overall market size.

Key benefits for stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the loan servicing software market forecast from 2022 to 2031 to identify the prevailing loan servicing software market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the loan servicing software market share assists to determine the prevailing market opportunities.

The report includes the analysis of the regional as well as global loan servicing software market trends, key players, market segments, application areas, and market growth strategies.

Inquire Before Buying

https://www.alliedmarketresearch.com/purchase-enquiry/19884

Loan Servicing Software Market Report Highlights

Component

Software

Service

Deployment Mode

On-premises

Cloud

Enterprise Size

Large Enterprises

Small and Medium-sized Enterprises (SMEs)

Application

Commercial Loan Software

Loan Servicing Software

Loan Origination Software

End User

Banks

Credit Unions

Mortgage Lenders and Brokers

Others

More Top Trending Reports:

Takaful Insurance Market : https://www.alliedmarketresearch.com/takaful-insurance-market-A11835

Peer to Peer Lending Market : https://www.alliedmarketresearch.com/peer-to-peer-lending-market

Fuel Cards Market : https://www.alliedmarketresearch.com/fuel-cards-market

RegTech Market : https://www.alliedmarketresearch.com/regtech-market

Gift Cards Market: https://www.alliedmarketresearch.com/gift-cards-market

Impact Investing Market : https://www.alliedmarketresearch.com/impact-investing-market-A53663

Saudi Arabia Personal Loan Market : https://www.alliedmarketresearch.com/saudi-arabia-personal-loan-market-A74407

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms the utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high-quality data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Loan Servicing Software Market Drivers Shaping Future Growth, Revenue $9.5 Billion by 2031 | CAGR of 15.2% here

News-ID: 3292152 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Software

Takeoff Software Market May See a Big Move | Sage Software, Bluebeam Software, Q …

Latest Study on Industrial Growth of Takeoff Software Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Takeoff Software market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments…

Robot Software Market Analysis by Software Types: Recognition Software, Simulati …

The Insight Partners provides you global research analysis on “Robot Software Market” and forecast to 2028. The research report provides deep insights into the global market revenue, parent market trends, macro-economic indicators, and governing factors, along with market attractiveness per market segment. The report provides an overview of the growth rate of the Robot Software market during the forecast period, i.e., 2021–2028.

Download Sample Pages of this research study at: https://www.theinsightpartners.com/sample/TIPRE00007689/?utm_source=OpenPR&utm_medium=10452…

HR Software Market Analysis by Top Key Players Zenefits Software, Kronos Softwar …

HR software automates how companies conduct business with relation to employee management, training and e-learning, performance management, and recruiting and on-boarding. HR professionals benefit from HR software systems by providing a more structured and process oriented approach to completing administrative tasks in a repeatable and scalable manner. Every employee that is added to an organization requires management of information, analysis of data, and ongoing updates as progression throughout the company…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market Analysis by Top Key Players – Zenefits Software, Kronos Sof …

HR software helps HR personnel automate many necessary tasks, such as maintaining employee records, time tracking, and benefits, which allows HR professionals to focus on recruiting efforts, employee performance and engagement, corporate wellness, company culture, and so on. These human management tools can be purchased and implemented as on premise or cloud-based software.

This market studies report on the Global HR Software Market is an all-inclusive study of the enterprise sectors…