Press release

Financial Crime and Fraud Management Solutions Market 2023-2029: Safeguarding Digital Economies

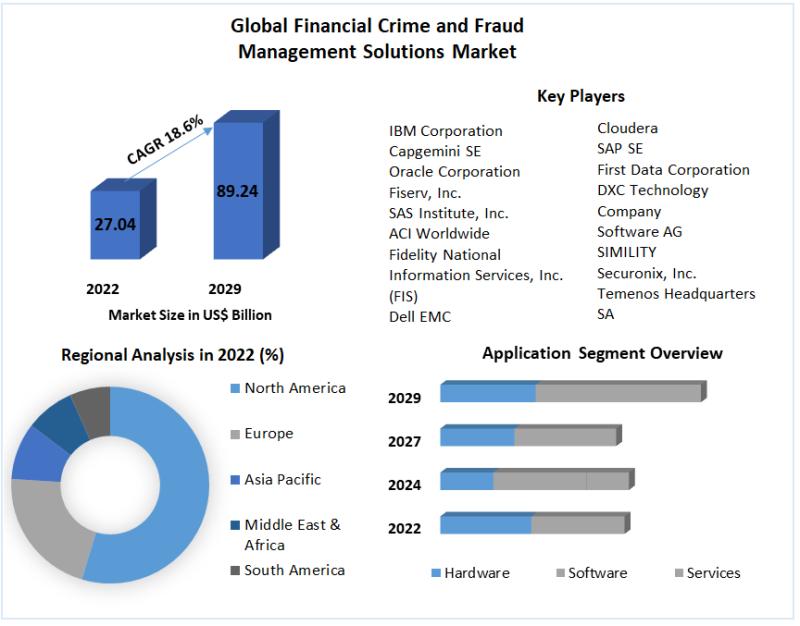

Financial Crime and Fraud Management Solutions Market Poised for Remarkable Growth at 18.6% CAGR, Reaching US$ 89.24 Billion by 2029The global Financial Crime and Fraud Management Solutions Market is on the verge of substantial growth, with a projected value of US$ 89.24 billion by the end of the forecast period, showcasing a robust Compound Annual Growth Rate (CAGR) of 18.6%. This remarkable expansion is fueled by the ever-evolving landscape of financial transactions and the pressing need for innovative solutions to combat the escalating threats of financial crime.

Inquire For More Details: https://www.maximizemarketresearch.com/market-report/global-financial-crime-and-fraud-management-solutions-market/33426/

The Financial Crime Landscape: A $1.28 Trillion Battle

Financial institutions globally have invested a staggering $1.28 trillion over a 12-month period to combat financial crime, emphasizing the significant impact on businesses. The collective revenue loss due to financial crime during the same period is estimated at $1.45 trillion. This underscores the gravity of financial crime, not only for financial organizations but also for their customers.

The report delves into the multifaceted nature of financial crime, spanning fraud, tax evasion, embezzlement, forgery, counterfeiting, and identity theft. Current efforts to combat financial crime primarily rely on extensive monitoring through technology. As financial institutions face losses ranging from 60% to 70% due to fraud and other crimes, the demand for robust Financial Crime and Fraud Management Solutions becomes imperative.

Financial Crime and Fraud Management Solutions Market Report Scope and Research Methodology:

The report provides insights into the emerging trends, market drivers, growth opportunities, and restraints that are shaping the Financial Crime and Fraud Management Solutions industry. It also provides an in-depth analysis of the Financial Crime and Fraud Management Solutions Market segments and their sub-segments, as well as the regional markets.

The report aims to provide historical data and forecast revenue growth at the global, regional, and country levels. The key methodology used by the MMR team is data triangulation, which involves data mining, analysis of the impact of data variables on the Financial Crime and Fraud Management Solutions Market, and primary (industry expert) validation.

Secondary data was collected from the annual or financial reports of market players, as well as paid and free databases. Primary data was collected by interviewing Financial Crime and Fraud Management Solutions industry experts. The bottom-up approach was used to estimate the regional and global Financial Crime and Fraud Management Solutions Market size. PESTLE analysis was used to identify the macro and microeconomic factors influencing the market growth. SWOT analysis was used to assess the strengths, weaknesses, opportunities, and threats of market players and the Financial Crime and Fraud Management Solutions industry.

Available Exclusive Sample Copy of this Report: https://www.maximizemarketresearch.com/request-sample/33426

Financial Crime and Fraud Management Solutions Market Segmentation:

by Application

• Hardware

• Software

• Services

by End User

• Banks

• Credit Unions

• Specialty Finance

• Thrifts

• Others

Financial Crime and Fraud Management Solutions Key Players are:

• IBM Corporation

• Capgemini SE

• Oracle Corporation

• Fiserv, Inc.

• SAS Institute, Inc.

• ACI Worldwide

• Fidelity National Information Services, Inc. (FIS)

• Dell EMC

• ACI Worldwide, Inc.

• Experian PLC

• NICE Ltd.

• Polaris Consulting & Services Limited.

• FICO

• Cloudera

• SAP SE

• First Data Corporation

• DXC Technology Company

• Software AG

• SIMILITY

• Securonix, Inc.

• Temenos Headquarters SA

• Guardian Analytics

Financial Crime and Fraud Management Solutions Market Regional Insights:

Major countries in each region are included in the report according to their revenue contribution to the global Financial Crime and Fraud Management Solutions Market. The study includes a region-wise detailed analysis of the Financial Crime and Fraud Management Solutions Market. The regions are: North America, Asia Pacific, Europe, Latin America, the Middle East, and Africa.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/33426

Key questions answered in the Financial Crime and Fraud Management Solutions Market are:

• What was the Financial Crime and Fraud Management Solutions Market size in 2022?

• What is the expected Financial Crime and Fraud Management Solutions Market size by the end of the forecast period?

• What are the global trends in the Financial Crime and Fraud Management Solutions Market?

• What are the upcoming industry End-Use Industry and trends for the Financial Crime and Fraud Management Solutions Market?

• What are the recent industry trends that can be implemented to generate additional revenue streams for Financial Crime and Fraud Management Solutions Market?

• How is the intervention from regulatory authority shaping the Financial Crime and Fraud Management Solutions Market?

• What growth strategies are the players considering to increase their presence in Financial Crime and Fraud Management Solutions?

• Who are the leading companies and what are their portfolios in Financial Crime and Fraud Management Solutions Market?

• What are the major challenges that the Financial Crime and Fraud Management Solutions Market could face in the future?

• Who held the largest market share in Financial Crime and Fraud Management Solutions Market?

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Crime and Fraud Management Solutions Market 2023-2029: Safeguarding Digital Economies here

News-ID: 3284979 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

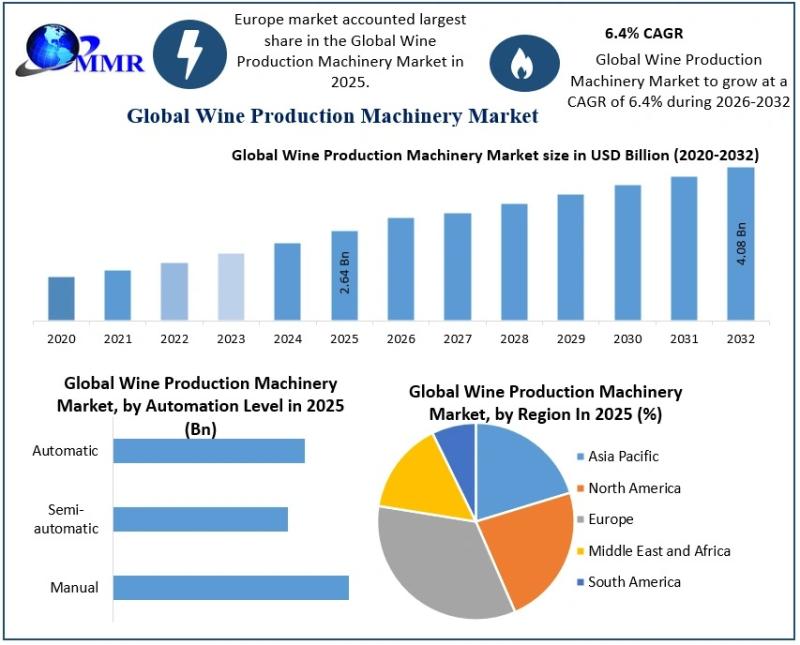

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

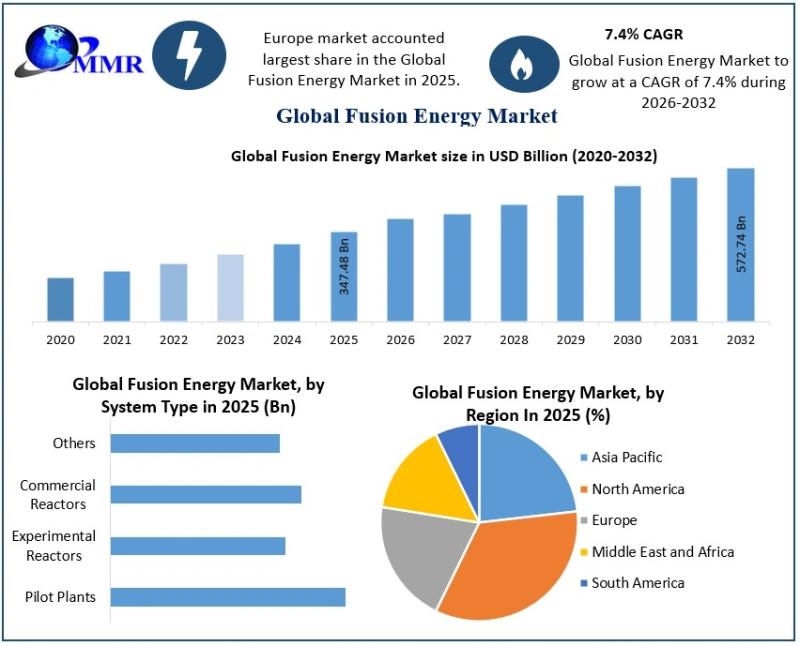

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…