Press release

Error & Omissions Insurance Market : Global Opportunity Analysis and Industry Forecast, 2023-2032

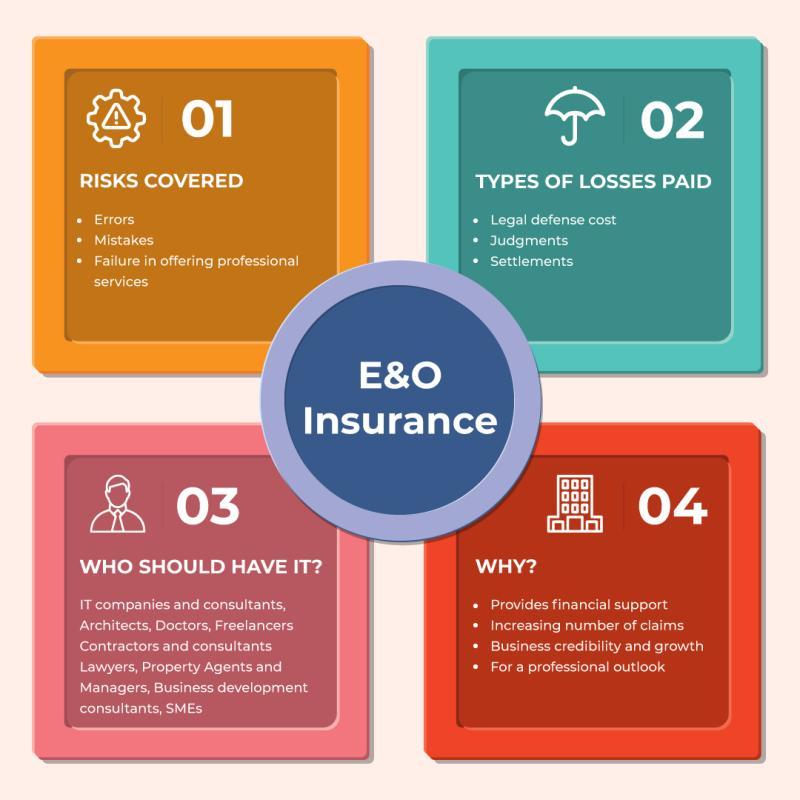

Errors or omissions insurance (E&O), also known as professional indemnity insurance (PII), is a type of liability insurance that protects individuals and businesses who provide professional advice & services from having to pay the full cost of defending against a client's negligence claim, as well as damages awarded in such a civil lawsuit. The coverage focuses on the policyholder's alleged failure to perform, financial loss caused by, and error or omission in the service or product sold. These are legal causes of action that would be excluded from a more general liability insurance policy that covers more direct forms of harm. Professional liability insurance can take many different forms and names depending on the profession, particularly in the medical and legal fields, and is sometimes required by other businesses who benefit from the advice or service. Therefore, the surge in demand is expected to boost the Error & Omissions Insurance Market growth in the upcoming period.Provision of Safety to Customers from Frivolous Lawsuits:

There are times when there is nothing you can do to keep your customers happy, no matter how hard you try. Even if you are upfront and honest from the start, an angry customer may still be unhappy with the service or advice they received and decide to sue for no apparent reason. Even if you are completely innocent, a frivolous lawsuit can cost you thousands of dollars in attorney fees and lost time. Few things can be as costly and inconvenient as defending a frivolous lawsuit filed by a vengeful customer. And if you do not have the right coverage in place, even a single frivolous lawsuit could bankrupt your company. Therefore, the provision of safety to the customers from frivolous lawsuits is driving the growth of the Error & Omissions Insurance Market size during the forecast period.

Rise in Adoption Due to its Lower Insurance Premiums:

One benefit of E&O insurance that is often overlooked is the ability to reduce premium costs. The customer can lower their overall premium by reducing risk in the workplace. Background checks, safety training, and safe working conditions for employees are examples of such actions. Over time, the fewer claims a customer has on their policy, the lower their E&O rates will be. A customer pays a small amount upfront to avoid paying a much larger and crippling sum later on. Furthermore, E&O insurance is, in the end, all about risk management. Therefore, the rise in the adoption of E&O insurance due to its lower insurance premiums is expected to drive the growth of the Error & Omissions Insurance Market revenue during the forecast period.

Request Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-toc-and-sample/15532

COVID-19 Scenario Analysis

The global COVID-19 outbreak has had an impact on everyone's life and business. The pandemic has increased the need for medical professionals, in particular, to purchase medical professional liability insurance to protect themselves from mistakes they made during their practice.

Since, at times, even highly skilled and educated doctors are capable of misdiagnosing an illness or making a mistake, claims for medical malpractice can happen at any time. Therefore, E&O insurance can help pay for a practitioner's legal defense, whether the case is against an individual or a facility.

Inquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/15532

Key Benefits of the Report:

This study presents an analytical depiction of the global Error & Omissions Insurance Market along with the current trends and future estimations to determine the imminent investment pockets.

The report presents information related to key drivers, restraints, and opportunities along with a detailed analysis of the market share.

The current market is quantitatively analyzed to highlight the global Error & Omissions Insurance Market growth scenario.

Porter's five forces analysis illustrates the potency of buyers & suppliers in the market.

The report provides a detailed market analysis depending on the present and future competitive intensity of the market.

Request Customization: https://www.alliedmarketresearch.com/request-for-customization/15532

Error & Omissions Insurance Market Report Highlights

By Type

Medical Liability Insurance

Lawyer Liability Insurance

Construction & Engineering Liability Insurance

Other Liability Insurance

By Application

IT

Accounting

Consulting

Marketing

Property

Others

By End-User

Individual

Corporate

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Spain, Italy, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Top Trending Reports:

1.Commercial Paper Market: https://www.alliedmarketresearch.com/commercial-paper-market-A15386

2.Commodity Contracts Brokerage Market: https://www.alliedmarketresearch.com/commodity-contracts-brokerage-market-A15387

3.Credit Default Swaps Market: https://www.alliedmarketresearch.com/credit-default-swap-market-A15388

4.Cycle insurance Market: https://www.alliedmarketresearch.com/cycle-insurance-market-A15389

5.Electronic Funds Transfer Market: https://www.alliedmarketresearch.com/electronic-funds-transfer-market-A15391

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington,

New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Error & Omissions Insurance Market : Global Opportunity Analysis and Industry Forecast, 2023-2032 here

News-ID: 3281158 • Views: …

More Releases from Allied Market Research

Air Ambulance Services Market Share to Reach $14.24 Billion by 2030

By service operator, the independent segment dominated the global air ambulance services market in 2020, in terms of revenue. On the basis of service type, the domestic segment garnered higher share in 2020. Depending on aircraft type, the fixed-wing segment held majority of the market share in 2020. Presently, North America is the highest revenue contributor, followed by Europe.

According to a recent report published by Allied Market Research, titled, "Air…

Defense IT spending Market Share to Reach $137.65 Billion by 2030

by system, the cybersecurity segment dominated the global defense IT spending market in 2020, in terms of revenue. By type, the services segment is anticipated to witness lucrative growth during the forecast period. By force, the defense forces segment dominated the defense IT spending market in 2020, in terms of revenue. Presently, North America is the highest revenue contributor, followed by Asia-Pacific.

According to a recent report published by Allied Market…

Ethernet Switch Market Size to Reach $26.1 Billion by 2031

The ethernet switch market share is expected to witness considerable growth, owing to rise in application of ethernet switch in industrial infrastructures, such as smart grid, intelligent rail & traffic, security & surveillance, and other utilities.

According to a new report published by Allied Market Research, titled, "Ethernet Switch Market By Type (Modular Ethernet Switches, Fixed Configuration Ethernet Switches), By Configuration (Unmanaged, Smart, Managed L2, Managed L3, Divided), By Speed (1G,…

3D Sensor Market Size to Reach $57 Billion by 2031

Increasing demand for 3D-enabled devices in consumer electronics and the rapid upsurge in the requirement for medical imaging solutions are propelling the growth of the 3D sensor market during the forecast period.

According to a new report published by Allied Market Research, titled, "3D Sensor Market," The 3d sensor market size was valued at $17.6 billion in 2021, and is estimated to reach $57 billion by 2031, growing at a…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…