Press release

Open Banking Market (2023 to 2032) - Industry Analysis, Size, Share, Growth, Trends and Forecast

As per The Business Research Company's Open Banking Opportunities And Strategies Market Report 2023, The global open banking market size reached a value of nearly $15,111.61 million in 2021, having grown at a compound annual growth rate (CAGR) of 36.42% since 2018. The market is expected to grow from $15,111.61 million in 2021 to $ 19,458.39 million at a rate of 26.1%. The global open banking market size is then expected to grow at a CAGR of 23.134% from 2026 and reach $$ 136,153.63 million in 2031.The surge in the usage of online platforms for making payments is contributing to the growth of the open banking market. The digital payment system is rapidly expanding with developing payment methods, increased e-commerce use, improved broadband access, and the advent of new technologies.

View Complete Report @

https://www.thebusinessresearchcompany.com/report/open-banking-market

An emerging trend in open banking is big data analytics. Both organized and unstructured data are gathered, processed, and analyzed by big data analytics. Big data analytics is mostly used to gain business insights from the data. Big data analytics are utilized in the open banking sector to tailor the services and enhance the user experience.

The top opportunities in the open banking market segmented by service type will arise in the transactional services market segment, which will gain $22,389.8 millions of global annual sales by 2026. The top opportunities in the open banking market segmented by distribution channel will arise in the app market segment, which will gain $16,432.9 millions of global annual sales by 2026. The top opportunities in the open banking market segmented by financial services will arise in the payments market segment, which will gain $23,075.3 millions of global annual sales by 2026. The top opportunities in the open banking market segmented by deployment type will arise in the on-premises segment, which will gain $15,860.0 millions of global annual sales by 2026. The top opportunities in the open banking market size will gain the most in the USA at $9,034.6 million.

Open Banking Market Segmentation:

The Open Banking market is segmented By Service Type, By Distribution Channel, By Financial Services and By Deployment Type.

By Service Type -

a) Transactional Services

b) Communicative

c) Informative Services

By Distribution Channel -

a) Bank Channels

b) App Market

c) Distributors

d) Aggregators

By Financial Services -

a) Bank And Capital Markets

b) Payments

c) Digital Currencies

d) Value Added Services

By Deployment Type -

a) Cloud

b) On-Premises

c) Hybrid

Major players in the Open Banking market include Banco Santander S.A., BBVA SA, Credit Agricole, HSBC Bank plc., Citigroup.

The regions covered in the global Open Banking market are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Download FREE SAMPLE Report - https://www.thebusinessresearchcompany.com/sample_request?id=8410&type=smp

The latest report from The Business Research Company, 'Global Open Banking Opportunities And Strategies Market Report - Forecast To 2032,' provides a comprehensive global perspective with data and statistics from 60+ geographies, analyzing 7000+ market segments. The regional and country breakdowns section offers insights into each geography's market analysis, size, historic and forecast growth, and key strategies for industry competitiveness.

Open Banking Market Report Table Of Content

1. Executive Summary

2. Table of Contents

3. List of Figures

4. List of Tables

5. Report Structure

6. Introduction and Market Characteristics

……

19. Company Profiles

20. Key Mergers And Acquisitions

21. Global Open Banking Opportunities And Strategies

22. Open Banking Market, Conclusions And Recommendations

23. Appendix

PURCHASE the report @

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=8410

Get to know us better:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Open Banking Market (2023 to 2032) - Industry Analysis, Size, Share, Growth, Trends and Forecast here

News-ID: 3273265 • Views: …

More Releases from The Business research company

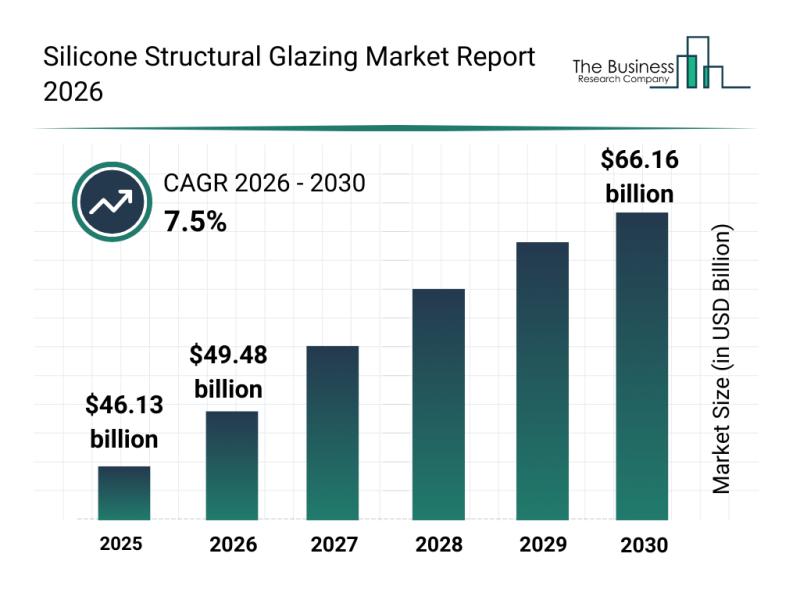

Leading Companies Solidify Their Presence in the Silicone Structural Glazing Mar …

The silicone structural glazing market is positioned for significant expansion in the coming years, driven by advances in building technology and increased environmental awareness. This sector is evolving rapidly as demand grows for more energy-efficient and aesthetically appealing architectural solutions. Let's explore the market's current size, key players, emerging trends, and the main segments that are shaping its future.

Silicone Structural Glazing Market Value Forecast Through 2030

The market for silicone…

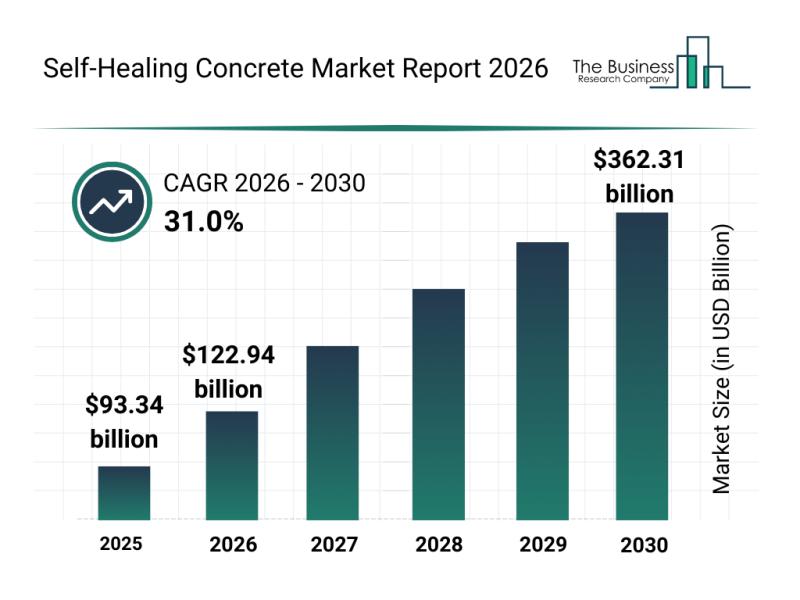

Future Prospects: Key Trends Shaping the Self-Healing Concrete Market up to 2030

The self-healing concrete market is capturing significant attention as innovations and sustainability demands rise in construction. This sector is set to experience remarkable growth due to advancements in materials and technology, shaping the future of durable and intelligent infrastructure solutions. Let's explore the market's size, key players, emerging trends, and segment outlook to understand its trajectory.

Projected Market Size and Growth Prospects for the Self-Healing Concrete Market

The self-healing concrete market…

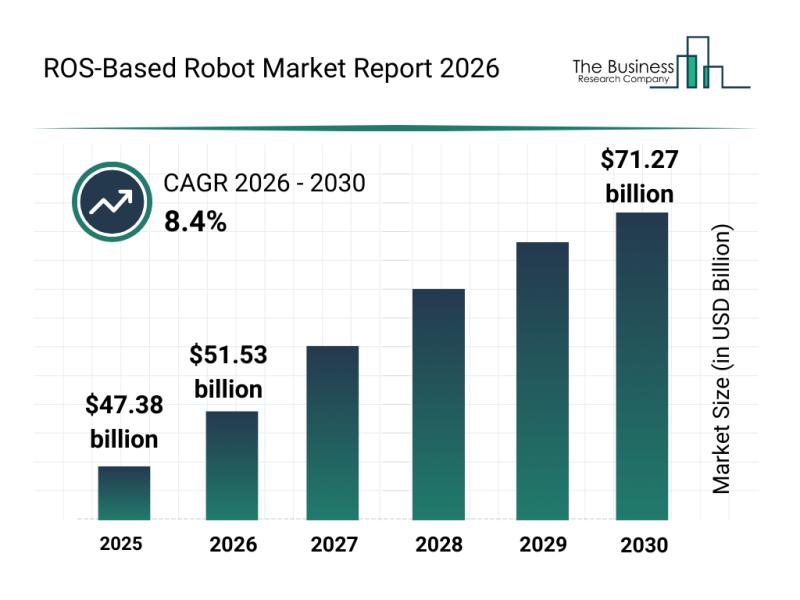

Analysis of Key Market Segments Driving the ROS-Based Robot Industry

The ROS-based robot market is positioned for substantial growth as robotics technology continues to advance rapidly. With increasing innovation in software, hardware, and AI integration, this sector is set to transform multiple industries by 2030. Below, we explore the market's future size, leading companies, key trends, and segmentation details to understand its evolving landscape.

Projected Market Size and Expansion of the ROS-Based Robot Market

The ROS-based robot market is anticipated to…

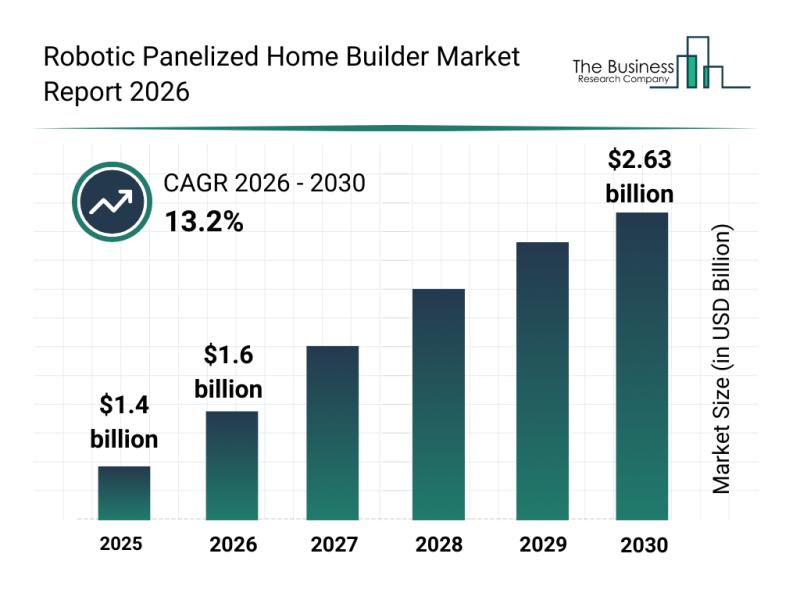

Global Trends Overview: The Rapid Evolution of the Robotic Panelized Home Builde …

The robotic panelized home builder market is positioned for impressive growth in the coming years as automation and robotics increasingly transform construction processes. Driven by technological advancements and expanding prefab housing projects, this market is set to reshape how homes are built with greater speed and efficiency. Let's explore the market's size, leading companies, emerging trends, and key segments that are shaping its future.

Strong Growth Forecast for the Robotic Panelized…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…