Press release

Insurance Analytics Market: Trends and Insights

Insurance Analytics Market Overview:A popular tool for risk management in pricing, rating, underwriting, marketing, claims, and reserving in the insurance industry is insurance analytics. In addition to risk management, the analytic solution helps insurance firms to draft better insurance policies in the property, health, and life insurance markets. Improving client engagement processes, reducing expenses, and effectively utilizing predictive analytics in insurance models to provide more accurate and trustworthy reports across a variety of product lines are some of the solution's primary duties.

Market Values:

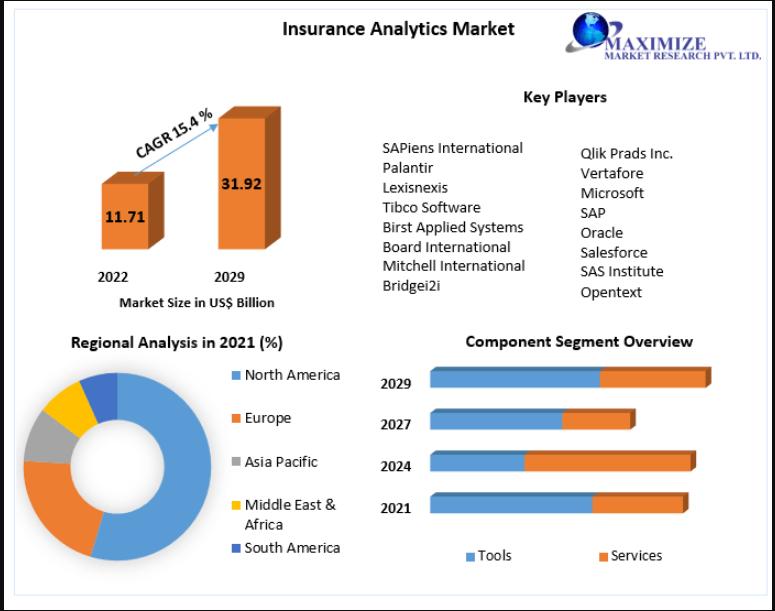

Insurance Analytics Market size was valued at US$ 11.71 Bn. in 2022 and the total revenue is expected to grow at 15.4 % through 2023 to 2029, reaching nearly US$ 31.92 Bn.

Know More About The Report: https://www.maximizemarketresearch.com/market-report/global-insurance-analytics-market/7775/

Insurance Analytics Market Dynamics:

Technology and infrastructure are made available by insurance analytics to process and analyze data and develop decision-making skills. As the market gets more competitive, businesses are being pressured to update their antiquated business models, simplify operations, and enhance procedures. Furthermore, it is anticipated that the need for analytics solutions would grow as digital infrastructure develops and evidence of fraud in the insurance sector surface. Worldwide changes in financial legislation and policies are forcing insurance companies to use analytics to manage their operations

Insurance Analytics Market Segmentation:

The worldwide insurance analytics market is divided into many segments based on the kind of application, including Claims Management, Risk Management, Customer Management and Personalization, Process Optimization, and Others. Institutional investors can get an automated result for improved decision-making by using insurance analytics for risk management. Additionally, it reveals a hidden pattern in the data and offers perceptions into impending dangers, enabling insurers to take preventative measures against risk. The demand for the risk management market will be fueled by these factors. In order to predict possible market risks and put countermeasures in place to reduce losses, insurers must appropriately use their data to further industry development. The growing need for data leveraging is anticipated to propel the market even further.

Large Enterprises and SMEs make up the two sub-segments of the global insurance analytics market based on organization size. A lot of big businesses are concentrating on applying insurance analytics to boost customer loyalty and reduce overall infrastructure expenses. Large firms may also comply with government regulations and standards, such HIPAA, the Payment Card Industry Data Security Standard, and the Federal Government, by using insurance analytics tools. Growth in this category is anticipated as a result. Insurance companies require large volumes of data. By utilising insurance analytics, these businesses are able to get and evaluate both structured data associated with policyholders and unstructured data from public sources, including social media.

Please connect with our representative, who will ensure you to get a report sample here: https://www.maximizemarketresearch.com/request-sample/7775

Insurance Analytics Market Key Players:

1. SAPiens International 2. Palantir 3. Lexisnexis 4. Tibco Software 5. Birst Applied Systems 6. Board International 7. Mitchell International 8. Bridgei2i 9. Qlik Prads Inc. 10.Vertafore 11.Microsoft 12.SAP 13.Oracle 14.Salesforce 15.SAS Institute 16.Opentext 17.Tableau Software 18.Verisk Analytics 19.Pegasystems 20.Guidewire

Table of content for the Insurance Analytics Market includes:

Part 01: Executive Summary

Part 02: Scope of the Insurance Analytics Market Report

Part 03: Global Insurance Analytics Market Landscape

Part 04: Global Insurance Analytics Market Sizing

Part 05: Global Insurance Analytics Market Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

For more Information Click Here: https://www.maximizemarketresearch.com/request-sample/7775

Regional Insights:

Asia Pacific leads the market, driven by rapid industrial sector growth and substantial income potential. China, a prominent industrial hub, contributes significantly to market expansion. North America, with a focus on coal production, holds the second-largest revenue share. The region's electronics sector, technological advancements, growing population, and the automotive industry's expansion all contribute to the global industrial sensors market's growth.

Key Offerings:

Past Market Size and Competitive Landscape (2018 to 2022)

Past Pricing and price curve by region (2018 to 2022)

Market Size, Share, Size & Forecast by different segment | 2023-2029

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Analytics Market: Trends and Insights here

News-ID: 3272199 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…