Press release

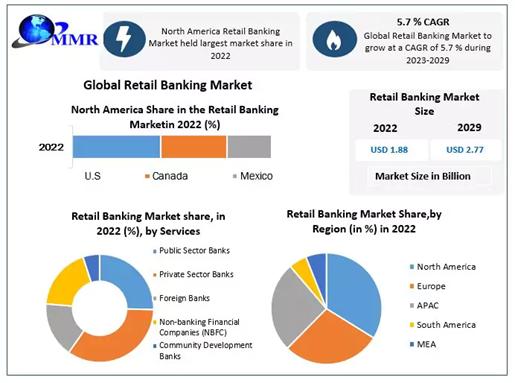

Retail Banking Market to Reach USD 2.77 Bn by 2029, emerging at a CAGR of 5.7 percent and forecast 2023-2029

Retail Banking Market Report Scope:This press release provides a succinct overview of the comprehensive report, shedding light on the market's drivers, restraints, and regional insights.

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/195573

Retail Banking Market Research Methodology:

The insights shared here are a result of rigorous research methods, ensuring a thorough understanding of the Retail Banking Market's current landscape.

What are Retail Banking Market Dynamics:

The retail banking sector is undergoing a digital transformation, driven by the widespread adoption of smartphones, internet connectivity, and user-friendly banking apps. Customers now expect seamless digital banking experiences, and this shift has prompted significant investments in digital infrastructure by banks. Features like mobile banking, online transactions, and round-the-clock customer support have enhanced operational efficiency and expanded customer reach. The integration of artificial intelligence (AI) and machine learning (ML) technologies promises tailored financial products, personalized recommendations, and automated customer service, further improving the overall customer experience.

To Gain More Insights Into The Market Analysis, Browse Summary Of The Research Report:https://www.maximizemarketresearch.com/market-report/retail-banking-market/195573/

What is Retail Banking Market Segmentation:

by Type

Public Sector Banks

Private Sector Banks

Foreign Banks

Community Development Banks

Non-banking Financial Companies (NBFC)

by Services

Saving and Checking Account

Transactional Account

Personal Loan

Home Loan

Mortgages

Debit and Credit Cards

ATM Cards

Certificates of Deposits

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/195573

Who are Retail Banking Market Key Players:

1. Wells Fargo

2. Mitsubishi UFJ Financial Group

3. Bank of America

4. Barclays

5. ICBC

6. China Construction Bank Deutsche Bank

7. HSBC

8. JPMorgan Chase

9. Citigroup

10. NP Paribas

11. BNP Paribas

12. Banco Santander, S.A.

13. The Royal Bank of Scotland Group plc (RBS)

14. Société Générale S.A.

15. ING Groep N.V.

16. BBVA (Banco Bilbao Vizcaya Argentaria)

17. UBS Group AG

18. Standard Chartered PLC

For any Queries Linked with the Report, Ask an Analyst@ :https://www.maximizemarketresearch.com/inquiry-before-buying/195573

Table of content for the Retail Banking Market includes:

Retail Banking Market : Research Methodology

Retail Banking Market : Executive Summary

Market Overview and Definitions

Introduction to the Global Market

Summary

Key Findings

Recommendations for Investors

Recommendations for Market Leaders

Recommendations for New Market Entry

3.Retail Banking Market : Competitive Analysis

MMR Competition Matrix

Market Structure by region

Competitive Benchmarking of Key Players

Consolidation in the Market

MandA by region

Key Developments by Companies

Market Drivers

Market Restraints

Market Opportunities

Market Challenges

Market Dynamics

PORTERS Five Forces Analysis

PESTLE

Regulatory Landscape by region

North America

Europe

Asia Pacific

Middle East and Africa

South America

COVID-19 Impact

4.Company Profile: Key players

Company Overview

Financial Overview

Global Presence

Capacity Portfolio

Business Strategy

Recent Developments

Retail Banking Market Regional Insights:

North America: North American banks dominated the largest market share in 2022. The region's well-established banking systems, technological innovation, and high level of digital adoption have been key drivers of market growth. High smartphone penetration, a growing population, and a focus on improving customer knowledge through user-friendly interfaces and personalized services are expected to drive the growth of digital banking services.

Asia Pacific: The Asia Pacific region is witnessing substantial growth driven by retail savings and investment. Retail investors in APAC allocated 69.7% of their liquid assets to banks. Factors such as population growth, increasing disposable income, and technology penetration are propelling regional market growth. Digital wallets, online banking, and peer-to-peer lending platforms have gained popularity, while artificial intelligence, blockchain, and biometric authentication have influenced the market. However, the proliferation of distribution channels has introduced complexity and a lack of coordination, impacting the customer experience.

Request Free Sample Copy (To Understand the Complete Structure of this Report [Summary + TOC]) @ :https://www.maximizemarketresearch.com/request-sample/195573

Key Offerings:

Past Market Size and Competitive Landscape (2022 to 2029)

Past Pricing and price curve by region (2022 to 2029)

Market Size, Share, Size and Forecast by different segment | 2022-2029

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation - A detailed analysis by growth and trend

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

More Related Reports:

India Mobile Data Consumption Market https://www.maximizemarketresearch.com/market-report/india-mobile-data-consumption-market/44580/

Computerized Maintenance Management Solutions (CMMS) Market https://www.maximizemarketresearch.com/market-report/global-computerized-maintenance-management-solutions-cmms-market/93645/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

✆ +1 800 507 4489

✆ +91 9607365656

🖂 mailto:sales@maximizemarketresearch.com

🌐 https://www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of the majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT and telecom, chemical, food and beverage, aerospace and defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Retail Banking Market to Reach USD 2.77 Bn by 2029, emerging at a CAGR of 5.7 percent and forecast 2023-2029 here

News-ID: 3271594 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Commercial Kitchen Appliances Market Poised for Robust Growth, Expected to Reach …

The global Commercial Kitchen Appliances Market, valued at US$ 101.65 billion in 2023, is witnessing strong momentum driven by the rapid expansion of the foodservice industry, technological innovation, and evolving consumer lifestyles. According to the latest market analysis, the industry is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030, reaching nearly US$ 160.05 billion by the end of the forecast period.

Commercial kitchen…

E-Bike Market Poised for Robust Expansion, Projected to Reach USD 153.42 Billion …

The global E-Bike Market is entering a transformative growth phase, underpinned by accelerating demand for eco-friendly transportation, rapid advances in battery and motor technologies, and strong policy support for sustainable urban mobility. Valued at USD 60.65 Billion in 2024, the market is projected to expand at a compound annual growth rate (CAGR) of 12.3% from 2025 to 2032, reaching nearly USD 153.42 Billion by 2032. As cities worldwide seek to…

Data Center Liquid Immersion Cooling Market Set for Rapid Expansion, Driven by H …

Data Center Liquid Immersion Cooling Market to Grow from USD 640.94 Million in 2023 to USD 3,340.83 Million by 2030, Registering a Robust CAGR of 26.6% (2024-2030)

The global Data Center Liquid Immersion Cooling Market is witnessing a transformative phase as data center operators worldwide seek advanced, energy-efficient cooling solutions to address rising power densities, sustainability mandates, and escalating operational costs. Valued at USD 640.94 million in 2023, the market…

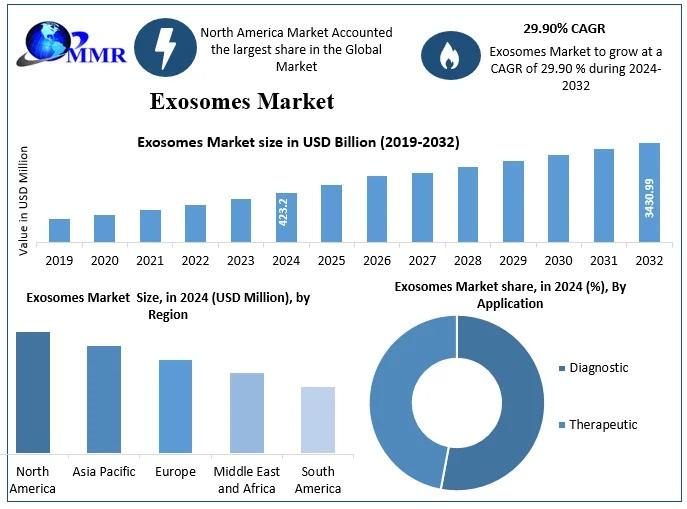

Exosomes Market Forecast: USD 3,430.99 Million Opportunity by 2032

Exosomes Market size was valued at USD 423.2 Mn in 2024 and is expected to reach USD 3430.99 Mn by 2032, at a CAGR of 29.90

The global exosomes market is currently poised for explosive growth, fundamentally driven by the paradigm shift toward non-invasive diagnostics and the rising prominence of "liquid biopsies" in oncology. Once considered mere cellular waste, these extracellular vesicles are now recognized as critical mediators of intercellular communication,…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…