Press release

2023 Insurance Brokers Market Report: Market Size, Analysis, Industry Share, Key Trends And Forecast 2032 | Marsh & McLennan Cos Inc, Aon PLC, Arthur J Gallagher & Co, Brown & Brown Inc, Willis Towers Watson PLC

As per The Business Research Company's Insurance Brokers Opportunities And Strategies Market Report 2023, The global insurance brokers market reached a value of nearly $140,432.1 million in 2022, having grown at a compound annual growth rate (CAGR) of 4.4% since 2017. The market is expected to grow from $140,432.1 million in 2022 to $204,304.2 million in 2027 at a rate of 7.8%. The market is then expected to grow at a CAGR of 8.0% from 2027 and reach $300,566.9 million in 2032.The insurance brokers market is expected to be driven by increased incidence rates of chronic diseases and physical disabilities. The increasing number of chronic diseases, particularly among the aging population, will compel consumers to opt for term life insurance, driving the need for insurance brokers. According to the United Nations, the proportion of total global deaths due to chronic diseases is expected to increase to 70%, and the global burden of chronic diseases is expected to reach about 60% by 2030. In addition, by 2050, one in six people in the world will be over age 65 (16%), up from one in 11 in 2019 (9%). By 2050, one in four persons living in Europe and Northern America could be aged 65 or above. Growth of the aging population and the rising incidence of chronic disease will drive the insurance brokers market going forward.

View Complete Report @

https://www.thebusinessresearchcompany.com/report/insurance-brokers-market

Insurance brokers are increasingly adopting advanced technologies to automate the insurance process, reduce the cost of operations and improve efficiency. These technologies include artificial intelligence (AI) applications, such as robot advisors, robotic process automation and blockchain (a distributed decentralized ledger and the underlying technology of bitcoin (a cryptocurrency), not managed by a central authority). These technologies help in the automation of risky and complex processes, providing scope for machine learning, avoiding repetitive and time taking processes, providing quick and error-free services and for secure sending, receiving and storing of information. For instance, in February 2022, Digital insurance marketplace, RenewBuy, an India-based company, acquired India-based fintech start-up, Artivatic.AI, to scale up business and improve technology solutions to better serve customers in insurance claim settlements, risk assessment and underwriting.

The top opportunities in the insurance brokers market segmented by type will arise in the life insurance segment, which will gain $22,902.2 million of global annual sales by 2027. The top opportunities in segment by mode will arise in the offline segment, which will gain $39,112.0 million of global annual sales by 2027. The top opportunities in segment by end user will arise in the offline segment, which will gain $32,172.8 million of global annual sales by 2027. The insurance brokers market size will gain the most in the USA at $35,262.5 million

Insurance Brokers Market Segmentation:

The Insurance Brokers market is segmented by type, By Mode, By End User.

By Type -

The insurance brokers market is segmented by type into:

a) Life Insurance

b) General Insurance

c) Health Insurance

d) Other Types

By Mode-

The insurance brokers market is segmented by mode into:

a) Offline

b) Online.

By End User -

The insurance brokers market is segmented by end user into:

a) Corporate

b) Individual

Major players in the Insurance Brokers market include Marsh & McLennan Cos Inc, Aon PLC, Arthur J Gallagher & Co, Brown & Brown Inc, Willis Towers Watson PLC.

The regions covered in the global Insurance Brokers market are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Download FREE SAMPLE Report - https://www.thebusinessresearchcompany.com/sample_request?id=6469&type=smp

The latest report from The Business Research Company, 'Global Insurance Brokers Opportunities And Strategies Market Report - Forecast To 2032,' provides a comprehensive global perspective with data and statistics from 60+ geographies, analyzing 7000+ market segments. The regional and country breakdowns section offers insights into each geography's market analysis, size, historic and forecast growth, and key strategies for industry competitiveness.

Insurance Brokers Market Report Table Of Content

1. Executive Summary

2. Table Of Contents

3. List Of Figures

4. List Of Tables

5. Report Structure

……

19. Company Profiles

20. Key Mergers And Acquisitions

21. Opportunities And Strategies

22. Insurance Brokers Market, Conclusions And Recommendations

23. Appendix

PURCHASE the report @

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=6469

Get to know us better:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 2023 Insurance Brokers Market Report: Market Size, Analysis, Industry Share, Key Trends And Forecast 2032 | Marsh & McLennan Cos Inc, Aon PLC, Arthur J Gallagher & Co, Brown & Brown Inc, Willis Towers Watson PLC here

News-ID: 3268306 • Views: …

More Releases from The Business research company

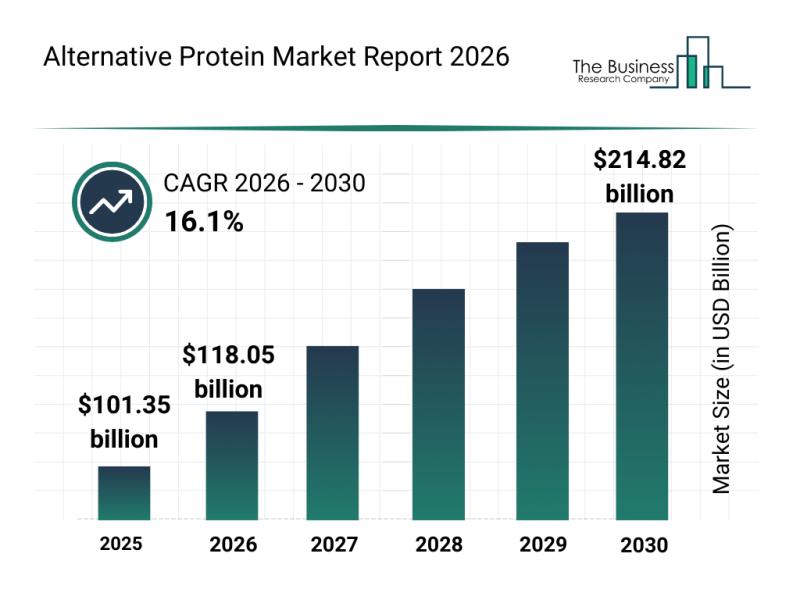

Alternative Protein Market Overview, Key Trends, and Insights on Top Players

The alternative protein sector is on the brink of remarkable expansion, driven by innovation and shifting consumer preferences toward sustainable nutrition. As new technologies emerge and applications broaden, this market is set to transform how protein sources are produced and consumed globally. Let's explore the anticipated market value, key players, influential trends, and segment breakdowns shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Alternative Protein Market …

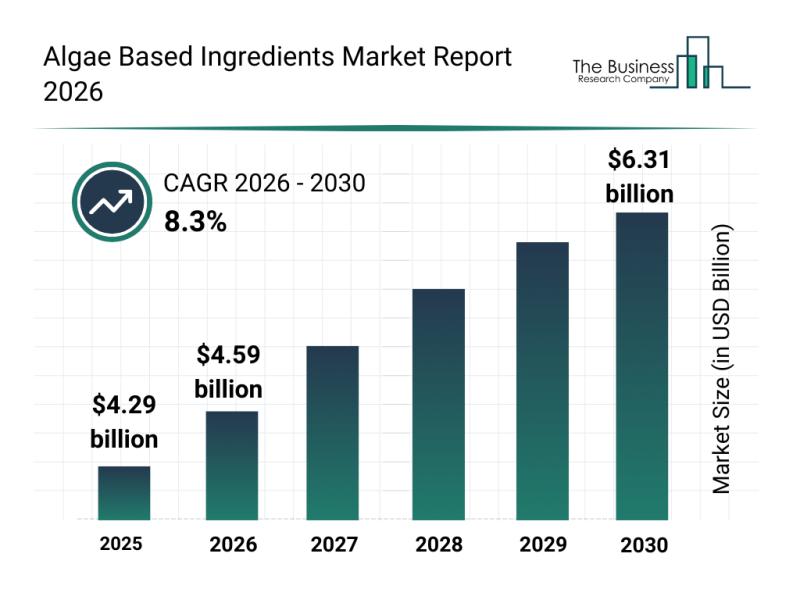

Leading Companies Enhancing Their Presence in the Algae Based Ingredients Market

The algae-based ingredients industry is gaining considerable traction as consumers and manufacturers alike seek more sustainable and innovative alternatives in various sectors. From food to pharmaceuticals, algae-derived components are becoming essential in meeting the rising demand for eco-friendly and health-conscious products. Let's explore the current market outlook, key players, influential trends, and segmentation within this expanding field.

Projected Market Size and Growth of the Algae Based Ingredients Market

The algae-based…

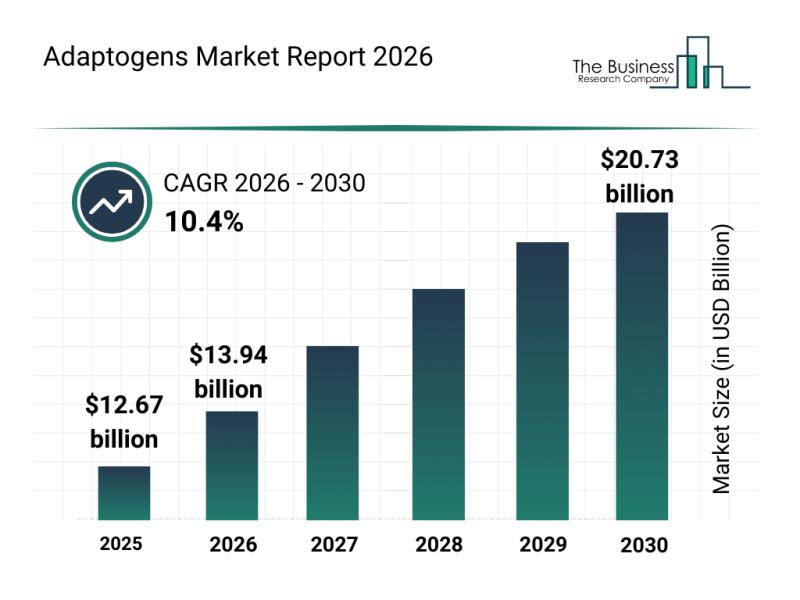

Global Factors Influencing the Rapid Development of the Adaptogens Market

The adaptogens market is on track for significant expansion over the coming years, driven by an increasing consumer interest in natural wellness solutions. As more people seek ways to manage stress and improve mental health, adaptogens are becoming a popular choice in various products. This growing trend is reflecting in the market's promising future outlook.

Projected Growth and Valuation of the Adaptogens Market by 2030

The adaptogens market is anticipated…

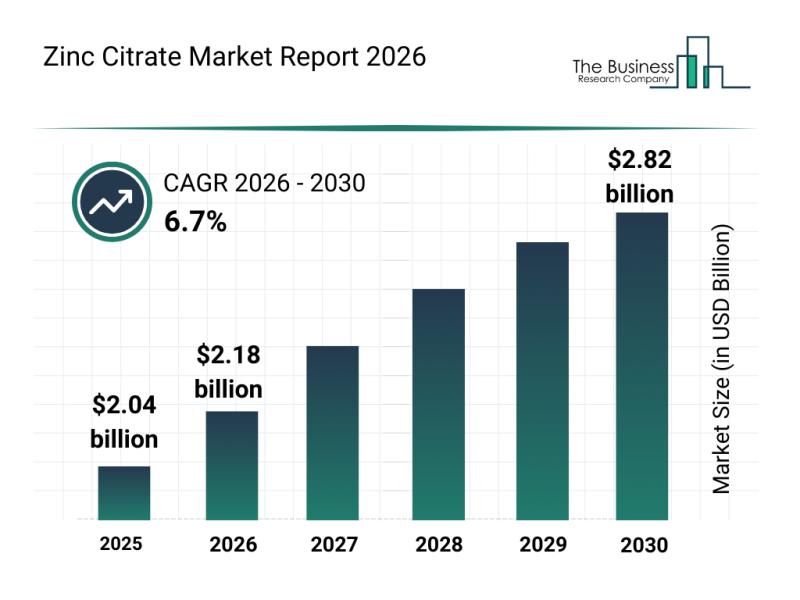

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the Z …

The zinc citrate market is set to experience significant growth over the coming years, driven by several health and regulatory factors. With increasing consumer interest in preventive healthcare and clean-label products, this market is evolving rapidly. Let's explore the current market size, major players, emerging trends, and the segments shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Zinc Citrate Market

The zinc citrate market is anticipated…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…