Press release

The U.S. Short-Term Care Insurance Market 2023-2033: Trends, Coverage, and Demographics

Market Overview:Short-term care insurance is a specialized insurance product designed to provide coverage for individuals who require temporary care and services, typically for a duration of less than one year. These policies offer a valuable alternative for people who do not require long-term care but need assistance with their healthcare needs due to illness, injury, or recovery.

Market Size and Growth:

The U.S. short-term care insurance market has experienced robust growth in recent years, primarily due to the aging population, increased life expectancy, and the desire for flexible healthcare solutions. The market is expected to continue expanding as demand for short-term care insurance policies rises.

The U.S. short-term care insurance market was valued at US$ 41.1 billion in 2022 and is projected to reach US$ 110.1 billion by the end of 2033, expanding at a CAGR of 9.6% over the decade.

Seeking Deeper Insights into Competitor Analysis? Request a Sample of the Report Now! https://www.persistencemarketresearch.com/samples/33452

Market Segmentations:

The U.S. short-term care insurance market can be segmented based on several factors:

Policy Type o Standalone Short-term Care Insurance

o Short-term Care Riders

Coverage Duration o Daily Benefit Policies

o Monthly Benefit Policies

Distribution Channel o Insurance Agents/Brokers

o Online Sales

o Direct Sales

Key Players:

Key players in the U.S. short-term care insurance market include,

• EHealth Insurance Services Inc.

• VitalOne Health

• Cox HealthPlans LLC

• Wisconsin Physicians Service

• Guarantee Trust Life Insurance Company

• Cigna

• Illinois Health Agents, Inc.

• Bankers Fidelity Life Insurance Company

• United HealthCare Services, Inc.

• Everest Re Group, Ltd.

These companies have a significant market presence and contribute to market growth through innovative product offerings and market expansion.

For Customized Insights on Segments, Regions, or Competitors, Request Personalized Purchase Options@ https://www.persistencemarketresearch.com/request-customization/33452

Market Mergers & Acquisitions:

Recent mergers and acquisitions in the U.S. short-term care insurance market have included strategic partnerships and expansions. For instance, Company A acquired Company B to expand its short-term care insurance portfolio and geographic reach, showcasing the market's competitive nature.

Regional Analysis:

The U.S. short-term care insurance market is influenced by regional demographics and healthcare preferences. The market may exhibit variations in growth and adoption rates across different states due to differences in the aging population and healthcare infrastructure.

Market Drivers:

• Aging Population: The increasing number of elderly individuals in the U.S. drives demand for short-term care insurance.

• Changing Lifestyles: Consumers are increasingly seeking flexible healthcare options that align with their lifestyles.

• Cost-Effective Solution: Short-term care insurance provides a cost-effective alternative to long-term care policies.

Restraints:

• Limited Awareness: Lack of awareness about short-term care insurance among potential consumers can hinder market growth.

• Regulatory Challenges: Complex regulatory requirements and variations in state regulations can pose challenges for insurers.

Opportunities:

• Market Expansion: The market presents opportunities for insurers to diversify their product offerings and expand their customer base.

• Customization: Tailoring policies to meet the specific needs of consumers can create new opportunities.

Challenges:

• Competition: Intense competition among insurance companies may lead to pricing pressures and reduced profit margins.

• Risk Assessment: Accurate assessment of policyholders' risk and coverage needs is essential to manage claims effectively.

Market Trends & Latest Developments:

• Digital Transformation: Insurers are increasingly utilizing digital platforms for marketing and policy issuance.

• Hybrid Policies: Hybrid short-term care policies that combine elements of traditional long-term care and short-term care insurance are gaining popularity.

Unlock Exclusive Insights into Business Opportunities and Market Value - Get the Premium Insight Now! https://www.persistencemarketresearch.com/checkout/33452

Future Projections:

The U.S. short-term care insurance market is expected to continue its growth trajectory as the aging population seeks flexible healthcare solutions. Innovations in policy design and distribution channels are likely to shape the market's future.

Key Questions Answered in Reports on U.S. Short-term Care Insurance Market:

• What is the current market size and growth rate in the U.S. short-term care insurance market?

• What are the key segments within the market, and how are they evolving?

• Who are the major players and what strategies are they employing?

• What recent mergers and acquisitions have influenced the market?

• How do regional demographics impact the market?

• What are the primary drivers, restraints, opportunities, and challenges in the market?

• What are the latest trends and developments in the market?

• What are the future projections and growth prospects for the U.S. short-term care insurance market?

Explore the Latest Trend: Dive into the Exclusive "PMR" Article -

• 3D Animation Market - https://www.persistencemarketresearch.com/market-research/3d-animation-market.asp

• Enterprise Governance, Risk and Compliance Market - https://www.persistencemarketresearch.com/market-research/enterprise-governance-risk-compliance-market.asp

Contact Us:

Address - 305 Broadway, 7th Floor, New York City, NY 10007 United States

U.S. Ph. - +1-646-568-7751

USA-Canada Toll-free - +1 800-961-0353

Sales - sales@persistencemarketresearch.com

Website - https://www.persistencemarketresearch.com

About Us:

Persistence Market Research is a U.S.-based full-service market intelligence firm specializing in syndicated research, custom research, and consulting services. Persistence Market Research boasts market research expertise across the Healthcare, Chemicals and Materials, Technology and Media, Energy and Mining, Food and Beverages, Semiconductor and Electronics, Consumer Goods, and Shipping and Transportation industries. The company draws from its multi-disciplinary capabilities and high-pedigree team of analysts to share data that precisely corresponds to clients' business needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The U.S. Short-Term Care Insurance Market 2023-2033: Trends, Coverage, and Demographics here

News-ID: 3268202 • Views: …

More Releases from Persistence Market Research

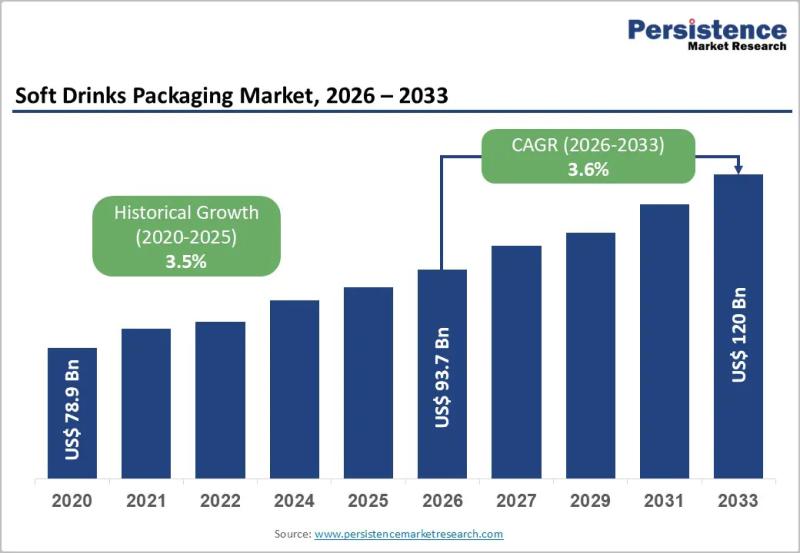

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

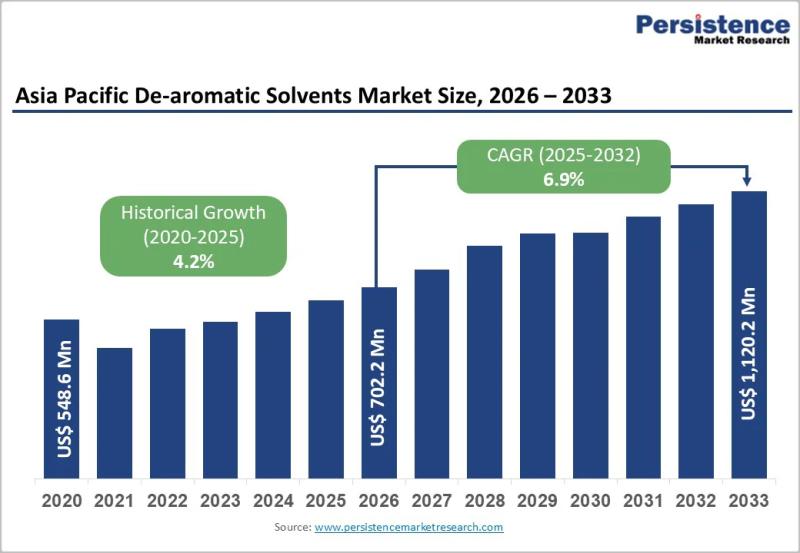

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…