Press release

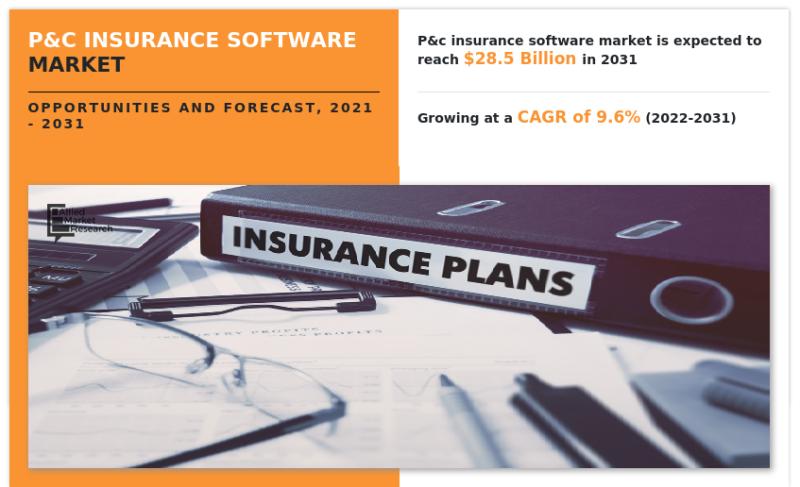

P&C Insurance Software Market Drivers Shaping Future Growth,$28.5 billion by 2031 | CAGR 9.6%

P&C insurance software industry is used by insurance agents and brokers to promote, sell, and administer insurance policies. This insurance policy includes features such as claims management, marketing automation, and underwriting management. In addition, it provides a full suite of digital insurance programs and solutions. Furthermore, the growing property & casualty industry worldwide and the rising adoption of automated software tools to reduce turnaround time are the key drivers fueling the growth of the market.As per the report, the global P&C insurance software industry accounted for $11.6 billion in 2021 and is expected to reach $28.5 billion by 2031, growing at a CAGR of 9.6% from 2022 to 2031. The report provides an in-depth analysis of changing market trends, key investment pockets, top segments, regional landscape, value chain, and competitive scenario.

Request Research Report Sample & TOC:

https://www.alliedmarketresearch.com/request-sample/31774

Major determinants of the market growth

Rise in digital transformation among industries and surge in penetration of internet & mobile devices have boosted the growth of the global P&C insurance software market. Moreover, increase in need for finance among businesses and people to insure property supplemented the market growth. However, strict rules imposed by banks and financial institutions for offering housing finance hinder the market growth. On the contrary, increase in the prices of real estate properties in developing economies and the growth of metropolitan cities are expected to open new opportunities in the future.

Covid-19 scenario:

During the Covid-19 pandemic, the P&C insurance software market suffered significantly due to strict rules of lockdown imposed by several government bodies and shutdown of businesses across the world.

The fact that construction activities were disrupted during the pandemic and people postponed their home purchasing plans due to economic instability hampered the market.

The software segment dominated the market.

By component, the software segment held the largest share in 2021, accounting for nearly three-fifths of the global P&C insurance software market, due to technological advancement and strategies such as cloud technology to provide the insurance services like sales, policy administration, and claims management. However, the service segment is estimated to register the highest CAGR of 10.9% during the forecast period, owing to rise in adoption of the insurer's needs to manage the entire claim lifecycle by reducing costs, increasing productivity, and by providing various P&C insurance software services.

The cloud segment to portray the highest CAGR through 2031

By deployment model, the cloud segment is projected to manifest the highest CAGR of 11.0% from 2022 to 2031, due to number of benefits, such as cost management, resource pooling, and quicker installation, cloud-based solutions are becoming more popular. However, the on-premises segment held the largest share in 2021, contributing to around three-fifths of the global P&C insurance software market, as it allows installation of the software and enables applications to run on existing systems on the premises of organizations, rather than at a distant facility such as server space or cloud.

Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/31774

The claims segment held the largest share.

By application, the claims segment dominated the market in terms of revenue in 2021, accounting for nearly two-fifths of the global P&C insurance software market as it helps insurers to manage and evaluate insurance claims such as litigation, negotiation, settlement communications, relevant policy information, and claim assessments. However, the operations segment is projected to showcase the highest CAGR of 11.6% during the forecast period, due to increased demand for P&C insurance software in sales and distribution management.

North America held the lion's share.

By region, the global P&C insurance software market across North America dominated in 2021, accounting for nearly two-fifths of the market, due to rise in demand for P&C Insurance Software solutions in the North American region and increase in adoption of digital lending platforms among banking and financial services for improving financing services. However, the market across Asia-Pacific is expected to register the highest CAGR of 11.5% during the forecast period, due to increase in awareness related to the significant advantage of P&C insurance software among the population.

Request Customization: https://www.alliedmarketresearch.com/request-for-customization/31774

Major market players

Agency Software Inc.

ClarionDoor

Duck Creek Technologies

Guidewire Software, Inc.

InsuredMine

PCMS Software

Pegasystems Inc.

Quick Silver Systems, Inc.

WTW

Zywave, Inc.

Top Trending Reports:

1.Cryptocurrency Hardware Wallet Market: https://www.alliedmarketresearch.com/cryptocurrency-hardware-wallet-market-A15162

2.Restaurant Point of Sale (POS) Terminal Market: https://www.alliedmarketresearch.com/restaurant-point-of-sale-pos-terminal-market-A30184

3.Venture Capital Investment Market: https://www.alliedmarketresearch.com/venture-capital-investment-market-A19435

4.Loan Servicing Software Market: https://www.alliedmarketresearch.com/loan-servicing-software-market-A19434

5.Italy B2B2C Insurance Market: https://www.alliedmarketresearch.com/italy-b2b2c-insurance-market-A31484

6.Reinsurance Market: https://www.alliedmarketresearch.com/reinsurance-market-A06288

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington,

New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release P&C Insurance Software Market Drivers Shaping Future Growth,$28.5 billion by 2031 | CAGR 9.6% here

News-ID: 3267768 • Views: …

More Releases from Allied Market Research

Aircraft Passenger Exit Path Lighting Market Share to Reach $1.1 Billion by 2032

The aircraft passenger exit path lighting market is dominant in the aerospace industry due to their Ensuring the safety of passengers is a top priority for the aerospace industry. Exit path lighting plays a critical role in guiding passengers to emergency exits during evacuations, especially in low-light conditions or emergencies such as smoke or fire. By providing clear and visible pathways to safety, exit path lighting systems enhance passenger confidence…

On-Orbit Satellite Servicing Market Share to Reach $9.0 Billion by 2032

The on-orbit satellite servicing market is witnessing significant growth propelled by a rising need for advanced maintenance and repair systems in satellite operations

According to a new report published by Allied Market Research, titled, "On-Orbit Satellite Servicing Market," The market size of on-orbit satellite servicing was valued at $3.4 billion in 2022, and is estimated to reach $9.0 billion by 2032, growing at a CAGR of 10.59% from 2023 to 2032.

The…

Smart Card Market Size is to Reach $15.57 Billion By 2027

The smart card market in Asia-Pacific is expected to grow at the highest rate during the forecast period, owing to enormous development of cashless transaction, 5G, & IoT technologies in emerging economies. Moreover, economically developed nations tend to witness high penetration of smart card technology in the BFSI and telecommunications segments, which is projected to significantly contribute to the growth of the market.

According to a new report published by Allied…

Flip Chip Market Size to Reach $39.67 Billion by 2027

Factors such as increase in demand for enhanced performance of smartphones & automotive MCUs and development of the electric vehicle industry & electronics industry in countries such as China, Japan, and India are the key driving factors of the Asia-Pacific flip chip market. In addition, flip chip exhibits advantages such as less space consumption, better process efficiency, more I/O options, and improved heat dissipation, which make them an ideal substitute…

More Releases for P&C

[Latest] India P&C Insurance Market Overview and Investor Guide 2025

India P&C Insurance Market Outlook & Investment Analysis

India's Property and Casualty (P&C) insurance market is poised for strong growth, driven by increasing awareness, regulatory reforms, and rising demand from sectors such as auto, health, agriculture, and commercial infrastructure. With a low penetration rate compared to global averages, the market presents significant untapped potential. Rapid urbanization, climate-related risks, and expanding MSME sectors are also fueling the need for robust risk coverage…

P&C Core Insurance Platforms Market Share and Forecast 2023-2028

P&C insurance refers to property and casualty insurance. It is a broad phrase that encompasses many different forms of insurance. P&C core insurance covers a variety of insurances, including homeowners', renters', vehicle, and powersports insurance. P&C core insurance software offers tools and applications to help insurers manage contact information, procedures, and marketing activities.

P&C Core Insurance Platform includes functions such as policy administration, insurance rating, quotation management, billing and invoicing, and…

Thiocyanate Salt Market | Abbvie, Alembic Pharma, Anuh Pharma, Calyx C & P

The global thiocyanate salt market report is a comprehensive report that provides a detailed analysis of the current status and future trends of the thiocyanate salt market worldwide. This report provides valuable information to industry stakeholders by offering an in-depth perspective on market dynamics, competitive landscape, growth opportunities, and key challenges faced by industry participants.

From the perspective of market dynamics, this report explores the factors driving the growth of the…

Global P&C Insurance Software Market Analysis (2020-2025)

Global Info Research offers a latest published report on P&C Insurance Software Analysis and Forecast 2020-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. This report focuses on the key global P&C Insurance Software Concentrate players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.

Click to view the full report TOC, figure…

P&C Insurance Software Market Share by 2025: QY Research

Global P&C Insurance Software market report is first of its kind research report that covers the overview, summary, market dynamics, competitive analysis, and leading player’s various strategies to sustain in the global market. This report covers five top regions of the globe and countries within, which shows the status of regional development, consisting of market value, volume, size, and price data. Apart from this, the report also covers detail information…

P&C Insurance Software Market to Witness Robust Expansion by 2024

LP INFORMATION offers a latest published report on P&C Insurance Software Market Analysis and Forecast 2019-2024 delivering key insights and providing a competitive advantage to clients through a detailed report.

According to this study, over the next five years the P&C Insurance Software market will register a xx% CAGR in terms of revenue, the global market size will reach US$ xx million by 2024, from US$ xx million in 2019.…