Press release

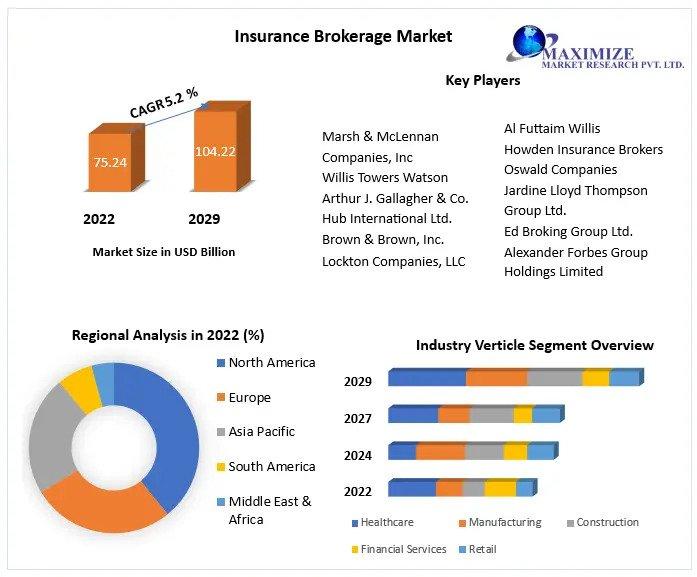

Insurance Brokerage Market is expected to grow to USD 104.22 billion by 2029, Understanding Consumption Dynamics, Customer Preference, Market Trends Analysis

Insurance Brokerage Market Report Scope and Research Methodology:The Insurance Brokerage Market Report provides a comprehensive scope of analysis, offering an in-depth exploration of the current state of the market and its future trajectories. Employing a rigorous research methodology, the report combines qualitative and quantitative assessments to furnish valuable insights into the insurance brokerage industry. The scope of the report encompasses a detailed examination of market dynamics, including factors such as regulatory landscapes, technological advancements, and evolving consumer preferences, providing a holistic understanding of the forces shaping the insurance brokerage market. Additionally, the study delves into the competitive landscape, profiling key players and analyzing their strategies, market share, and contributions to the industry

In terms of research methodology, the Insurance Brokerage Market Report adopts a systematic and thorough approach to ensure the credibility and reliability of its findings. Primary research involves direct interactions with industry experts, insurance professionals, and key stakeholders to gather firsthand information and insights. Secondary research encompasses the analysis of existing literature, market reports, and relevant data sources to provide a well-rounded overview of the insurance brokerage market. The inclusion of expert opinions and analytical tools further enhances the depth of the research. The methodology prioritizes data accuracy and relevance, offering a solid foundation for understanding market trends, making informed decisions, and navigating the dynamic landscape of the insurance brokerage industry.

Grab a Free Report Sample :https://www.maximizemarketresearch.com/request-sample/215727

Insurance Brokerage Market Dynamics:

The insurance brokerage industry is significantly shaped by market dynamics, which influence the behaviors of its participants and dictate the industry's trajectory. Key elements such as market drivers, trends, opportunities, threats, and challenges collectively define the dynamics within the insurance brokerage sector. A primary driver is the increasing awareness and demand for insurance coverage and risk management, with individuals and businesses recognizing the value that insurance brokers bring in providing tailored solutions and expert advice. Regulatory changes also play a crucial role in driving the need for insurance brokers, as evolving regulations create compliance requirements and consumer protection measures. This presents opportunities for brokers to navigate the intricate regulatory landscape on behalf of clients and offer expertise in ensuring compliance and appropriate coverage.

Moreover, the complexity of insurance products serves as another driver for the insurance brokerage market. Insurance policies often feature intricate terms, coverage options, and exclusions that require specialized guidance. Insurance brokers play a pivotal role in helping clients understand these complexities, empowering them to make informed decisions about their insurance coverage. In essence, the market dynamics in the insurance brokerage industry underscore the multifaceted factors that propel its growth, presenting both challenges and opportunities for market participants.

Request a complimentary sample report:https://www.maximizemarketresearch.com/request-sample/215727

Insurance Brokerage Market Segmentation :

by Product Type

Property and Casualty Insurance

Life and Health Insurance

Specialty Insurance

by Distribution Channel

Retail Brokerage

Wholesale and Reinsurance Brokerage

by Customer Segment

Individuals and Families

Small and Medium-sized Enterprises (SMEs)

Large Corporations and Institutions

by Industry Vertical

Healthcare

Manufacturing

Construction

Financial Services

Retail

For More Details Visit :https://www.maximizemarketresearch.com/market-report/insurance-brokerage-market/215727/

Insurance Brokerage Market Key Competitors include:

North America:

Aon plc (United States)

Marsh & McLennan Companies, Inc. (United States)

Willis Towers Watson (United States)

Arthur J. Gallagher & Co. (United States)

Hub International Ltd. (United States)

Brown & Brown, Inc. (United States)

Lockton Companies, LLC (United States)

Gallagher Bassett Services, Inc. (United States)

Integro Insurance Brokers (United States)

USI Insurance Services LLC (United States)

The Hylant Group (United States)

AssuredPartners, Inc. (United States)

Oswald Companies (United States)

Europe:

Jardine Lloyd Thompson Group Ltd. (United Kingdom)

Ed Broking Group Ltd. (United Kingdom)

BMS Group Ltd. (United Kingdom)

JLT Specialty Limited (United Kingdom)

Bluefin Insurance Services Limited (United Kingdom)

Middle East and Africa:

Al Futtaim Willis (UAE)

Howden Insurance Brokers (South Africa)

Alexander Forbes Group Holdings Limited (South Africa)

AJG International B.V. (South Africa)

Griffiths & Armour (South Africa)

Get a Free Sample Report :https://www.maximizemarketresearch.com/request-sample/215727

Insurance Brokerage Market Regional Insights:

The insurance brokerage market in North America is characterized by intense competition, with major firms exerting significant influence over the industry. The region boasts a well-established insurance sector marked by high awareness of insurance products and robust regulatory frameworks. North American insurance brokers offer a broad range of services to cater to diverse customer needs, contributing to the competitiveness of the market. In Europe, the insurance brokerage market is mature and places a premium on professionalism and regulatory compliance.

Key drivers of market growth include the United Kingdom, Germany, and France, where strict regulations, a variety of insurance options, and knowledgeable customers define the industry landscape. European regional insurance brokers are known for their specialized expertise and customized solutions. Meanwhile, the Asia Pacific's insurance brokerage market is experiencing rapid growth, driven by factors such as higher disposable income, urbanization, and increased awareness of insurance products.

Key questions answered in the Insurance Brokerage Market are:

• What is Insurance Brokerage ?

• What are the factors driving the Insurance Brokerage Market growth?

• What are the factors are limiting the Insurance Brokerage Market growth?

• What was the Insurance Brokerage market size in 2022?

• Which trends are expected to generate additional revenue for the Insurance Brokerage market growth?

• What are the recent industry trends that can be implemented to generate additional revenue streams for the Insurance Brokerage Market?

• What growth strategies are the players considering to increase their foothold in the Insurance Brokerage Market?

• Who held the largest market share in the Insurance Brokerage Market?

Key Offerings:

• Past Market Size and Competitive Landscape

• Past Pricing and price curve by region

• Market Size, Share, Size & Forecast by different segment

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Market Segmentation - A detailed analysis by segment with their sub-segments and Region

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

o Competitive landscape - Market Leaders, Market Followers, Regional player

o Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

Related Reports:

Dyslipidaemia Drug Market https://www.maximizemarketresearch.com/market-report/dyslipidaemia-drug-market/209378/

Connected Tires Market https://www.maximizemarketresearch.com/market-report/connected-tires-market/209393/

Rocket and Missiles Market https://www.maximizemarketresearch.com/market-report/rocket-and-missiles-market/209388/

Global Radar Market https://www.maximizemarketresearch.com/market-report/radar-market/210024/

Adventure Tourism Market https://www.maximizemarketresearch.com/market-report/adventure-tourism-market/210051/

Public Transportation Market https://www.maximizemarketresearch.com/market-report/public-transportation-market/210063/

Wool Market https://www.maximizemarketresearch.com/market-report/wool-market/210009/

Pizza Oven Market https://www.maximizemarketresearch.com/market-report/pizza-oven-market/210013/

Enterprise Networking Market https://www.maximizemarketresearch.com/market-report/enterprise-networking-market/210060/

Our Address

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Brokerage Market is expected to grow to USD 104.22 billion by 2029, Understanding Consumption Dynamics, Customer Preference, Market Trends Analysis here

News-ID: 3257711 • Views: …

More Releases from Maximzemarketresearch

Water-Based Inks Market to Reach USD 21.72 Billion by 2030

◉ Global Water-Based Inks Market to Reach USD 21.72 Billion by 2030, Driven by Sustainable Packaging Demand

The global water-based inks market is projected to grow significantly, reaching nearly USD 21.72 billion by 2030, with a robust CAGR of 7.2% during the forecast period. This growth is fueled by increasing demand for eco-friendly printing solutions, particularly in flexible packaging, and heightened environmental and safety concerns.

Download your sample copy of this…

Rising Demand for Usage-Based Insurance Driven by Telematics and Consumer Demand …

Usage Based Insurance Market size was valued at USD 29.46 Billion in 2023 and the total Usage Based Insurance Market revenue is expected to grow at a CAGR of 23.4% from 2024 to 2030, reaching nearly USD 128.36 Billion by 2030.

Usage Based Insurance Market Overview

The global Usage-Based Insurance (UBI) Market is gaining significant traction as insurers leverage telematics and data analytics to offer more tailored and flexible insurance solutions. With…

Biopsy Market Growth Driven by Rising Cancer Cases and Advances in Minimally Inv …

Biopsy Market size is expected to grow from US$ 32.38 Bn in 2023 to US$ 67.83 Bn by 2030. The Global Biopsy Market is expected to grow at a CAGR of 11.14% through the forecast period (2024 to 2030).

Biopsy Market Overview

The global Biopsy Market is experiencing robust growth as healthcare providers increasingly adopt biopsy procedures for early and accurate cancer diagnosis. Biopsies, crucial for detecting and monitoring various cancers, are…

Growing Demand for Nut Products Driven by Health Trends and Versatile Applicatio …

Nut Products Market size was valued at US$ 1.76 Billion in 2023 and the total revenue is expected to grow at 5.8% through 2024 to 2030, reaching nearly US$ 2.62 Billion.

Nut Products Market Overview

The global Nut Products Market is noticing an exponential growth. This growth is fueled by increased health awareness and rising demand for plant-based food alternatives. The report published by Maximize Market Research explains the projected growth by…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…