Press release

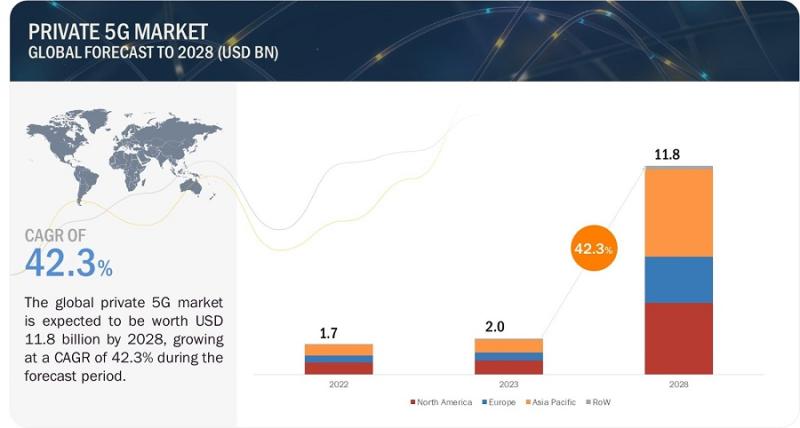

With 42.3% CAGR, Private 5G Market Growth to Surpass USD 11.8 billion

The global private 5G market is expected to be valued at USD 2.0 billion in 2023 and is projected to reach USD 11.8 billion by 2028; it is expected to grow at a CAGR of 42.3% from 2023 to 2028. The market growth is driven by the rising popularity of industrial automation, data security & control, customized network performance, demand for higher network capacity and bandwidth and the integration of IoT devices. The growth of the Private 5G market is driven by its ability to cater to the unique connectivity and data handling needs of various industries, offering enhanced performance, security, and customization compared to traditional networking solutions.Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=213955658&utm_source=Openpr&utm_medium=Refferal&utm_campaign=Paid+PR

Hardware component in private 5G market to account for the largest share during the forecast period. Private 5G networks require a robust physical infrastructure, including base stations, antennas, routers, and other hardware components. The initial establishment of this hardware foundation is a significant investment for businesses looking to deploy Private 5G networks. As a result, hardware components constitute a substantial portion of the market share. Hardware components play a crucial role in ensuring data privacy, network integrity, and consistent connectivity. Businesses may choose to invest more heavily in hardware to ensure a secure and reliable network foundation.

Licensed spectrum in private 5G market is projected to account for the largest share during the forecast period. Private 5G networks often handle sensitive data and proprietary information. Licensed spectrum offers an additional layer of security by minimizing the risk of unauthorized access and eavesdropping, making it more attractive to industries concerned about data security and privacy. Licensed spectrum typically offers better coverage and range compared to unlicensed/shared spectrum. This makes it more suitable for applications that require expansive coverage across large facilities or outdoor areas.

The private 5G market in North America accounted for the highest share in 2023. North America has been at the forefront of technology innovation and adoption. Many pioneering companies and industries are based in the region, and they are quick to embrace new technological advancements. This early adoption mentality has led to a more rapid uptake of Private 5G networks, which offer advanced connectivity and data handling capabilities. The demand for high-speed and reliable connectivity is particularly high in North America due to the prevalence of data-intensive applications and services. From streaming and gaming to IoT devices and smart cities initiatives, Private 5G networks can cater to the region's connectivity needs, driving their adoption.

Inquiry Before Buying @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=213955658&utm_source=Openpr&utm_medium=Refferal&utm_campaign=Paid+PR

Major players operating in the private 5G market are Huawei Technologies Co., Ltd. (China), Telefonaktiebolaget LM Ericsson (Sweden), Nokia (Finland), Samsung Electronics Co., Ltd. (South Korea), ZTE Corporation (China), NEC Corporation (Japan), Oracle (US), Cisco Systems, Inc. (US), Ciena Corporation (US), Juniper Networks, Inc. (US). These companies have reliable manufacturing facilities as well as strong distribution networks across key regions, such as North America, Europe, and Asia Pacific. They have an established portfolio of reputable products, a robust market presence, and strong business strategies. Furthermore, these companies have a significant market share, products with wider applications, broader geographical use cases, and a larger product footprint.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release With 42.3% CAGR, Private 5G Market Growth to Surpass USD 11.8 billion here

News-ID: 3254028 • Views: …

More Releases from MarketsandMarkets

Top Ultrasound Market Trends Driving Growth in 2025 and Beyond | Philips Healthc …

The global ultrasound market is entering a transformative phase in 2025. Once primarily associated with pregnancy scans and basic imaging, ultrasound has now evolved into a powerful, multipurpose diagnostic tool with applications across cardiology, oncology, musculoskeletal care, emergency medicine, and beyond.

As healthcare systems worldwide shift towards non-invasive, affordable, and portable imaging solutions, ultrasound is becoming central to modern diagnostics. According to market insights, the ultrasound industry is poised for steady…

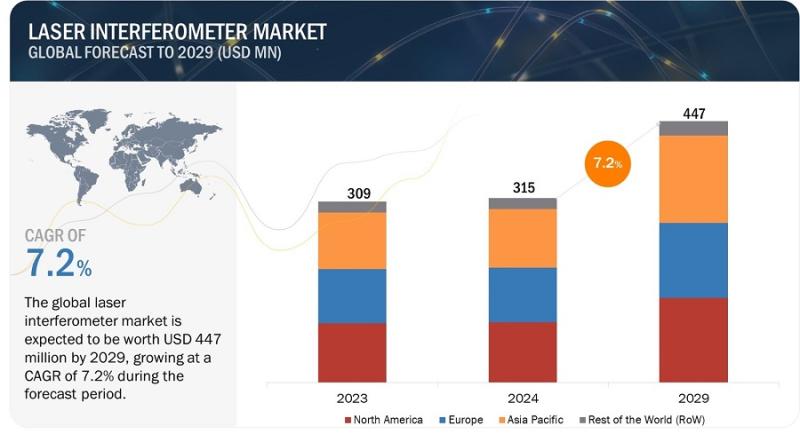

Laser Interferometer Market Set to Grow at the Fastest Rate- Time to Grow your R …

The global laser interferometer market is expected to be valued at 315 million in 2024 and is projected to reach USD 447 million by 2029, at a CAGR of 7.2% from 2024 to 2029. Emerging applications in industries push the market's growth due to the growing demand for precision in the manufacturing sector. However, challenges such as higher initial investments and maintenance costs cause problems. Despite these, opportunities arise for…

With 19.6% CAGR, Battery Testing, Inspection, and Certification Market Growth to …

The battery testing, inspection, and certification market is projected to reach USD 36.7 billion by 2029 from USD 14.9 billion in 2024 at a CAGR of 19.6% during the forecast period. Increasing adoption of EVs and energy storage systems, rising enforcement of stringent standards to ensure battery safety, thriving portable electronics industry, and rapid advances in battery technology are the major factors contributing to the market growth.

Download PDF Brochure @…

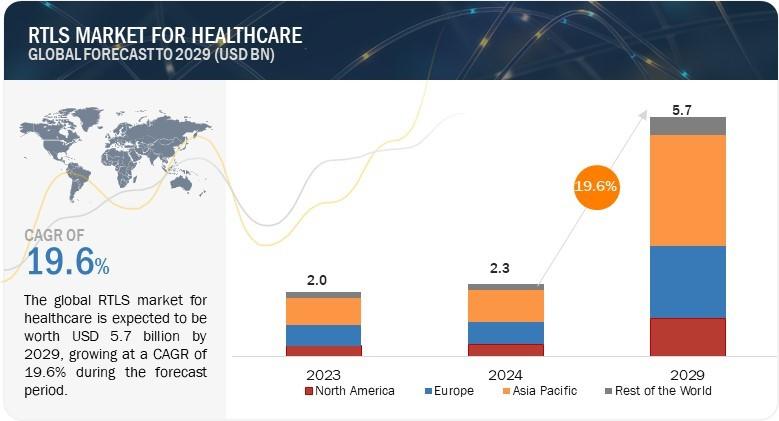

Real-Time Location Systems Revolutionize Healthcare: Insights from MarketsandMar …

The global RTLS market for healthcare is projected to grow from USD 2.3 billion in 2024 to USD 5.7 billion by 2029, at a compound annual growth rate of 19.6% from 2024 to 2029. As it attracts more and more players who enter this market with innovative RTLS features for customers, the market for RTLS technology is rapidly increasing. Top companies in this market focus on healthcare, retail, and manufacturing…

More Releases for Private

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private asset management,private wealth management firms,middle market private e …

Private asset management is the management of assets on behalf of private individuals, families, or institutions. It involves the creation of a customized investment strategy to achieve specific financial goals, such as wealth preservation, growth, income generation, or a combination of these objectives. The assets managed can include cash and cash equivalents, stocks, bonds, real estate, private equity, and alternative investments.

https://tendawholesale.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private asset management is typically provided by…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Financing Consulting, China Private Equity Investment Corpo …

Pandacu China is a venture capital firm that focuses on early-stage investments in technology companies based in China. The firm was founded in 2015 by a group of experienced venture capitalists and entrepreneurs who have a deep understanding of the Chinese market and a strong network of contacts in the tech industry.

http://pandacuads.com/

China Private Equity Financing Consulting

Email:nolan@pandacuads.com

Pandacu China's mission is to help innovative and ambitious entrepreneurs turn their ideas into successful…