Press release

Global Trade Finance Market Research Report 2023

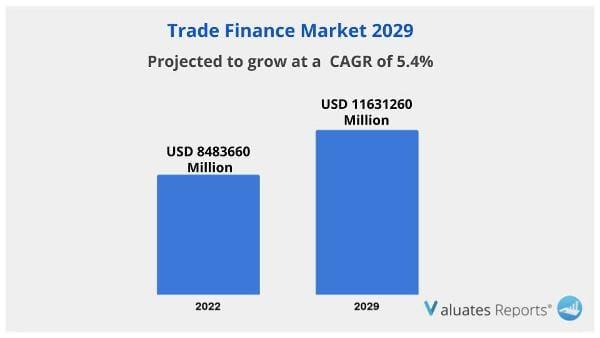

Trade Finance Market Outlook 2029The global Trade Finance market was valued at US$ 8483660 million in 2022 and is anticipated to reach US$ 11631260 million by 2029, witnessing a CAGR of 5.4% during the forecast period 2023-2029. The Trade Finance market space has evolved, with the technological enhancements, switches in corporate behavior, regulatory reforms, and increasing market competition. The world trade finance market size is further expected to be augmented by increasing worldwide import and export. The rise in competition and new trade agreements, and improved inventory management by various companies propel the market growth.

VIEW FULL REPORT

https://reports.valuates.com/market-reports/QYRE-Auto-6X849/global-trade-finance

Trade Finance Market Trends

Digitization is expected to fuel the growth of trade finance market size. Trade finance procedures necessitate a large volume of physical paper documentation. As a result, document-related costs account for the bulk of Trade Finance costs. Banks' Trade Finance offerings must be adaptable, flexible, low-cost, and add value to their customers in order to succeed. Through digitization, banks are automating financial and transactional information exchange through pilot projects in smart contracts.

A typical trade transaction goes through numerous compliance checks during its life cycle, with each review racking up costs along the way. Increased automation, along with artificial intelligence (AI) and machine learning (ML), can help trade finance reduce overall operational costs and improve customer experience.

Technologies such as Distributed ledger technology (DLT) will allow stakeholders to digitally share accurate and reliable trade information, while smart contracts supported by DLT will allow automated execution of payments on meeting pre-defined conditions in the contract. This also means that reconciliation will no longer be a worry for banks as the ledger is shared and updated in real-time.

Furthermore, the incorporation of Blockchain, Artificial intelligence (AI), Machine Learning, and Robotic process automation is expected to provide lucrative growth opportunities for the world trade finance market size. The use of blockchain for identity management and know your customer appears to be very promising. AI innovation is also progressing at a breakneck rate. It, too, has a wide range of applications for solving real-world issues. AI may be used to identify transaction efficiency or cross-channel marketing opportunities, ensuring banks are making the best use of their capital.

Another growth-inducing factor is the use of electronic systems, such as optical character recognition (OCR), fast response (QR) codes, and radio frequency identification (RFID) readers, to improve the digitization of trade financing operations. In contrast to conventional methods, these devices help streamline the manual process of document recognition and simplify trade transactions.

Banks act as intermediaries in the commercial finance ecosystem to provide intercompany trade credits to purchasers, sellers, and other trading parties. Business support provided by banks and their ability to mitigate payment risk by buying trade credit insurance boost market growth.

Trade Finance Market Share Analysis

In terms of service types, Trade Finance can be generally divided into Guarantees, Letters of Credit, Documentary Collection, Supply Chain Financing and Factoring. In 2019, the proportion of Letters of Credit is the largest, accounting for about 39%.

Based on type, the Supply Chain Finance segment is expected to grow at the highest rate during the forecast period. Within the banking industry, Supply Chain Financing (SCF) is becoming a more popular vertical. Corporations benefit from SCF's working capital efficiency and cash conversion period advantages. It also gives banks the chance to form long-term partnerships and cross-sell goods. Data is gathered from industry analysts and peer analysis firms.

Top Major Players in the Trade Finance Market

The key players include BNP Paribas, Bank of China, Citigroup Inc, China Exim Bank, ICBC, JPMorgan Chase & Co, Mizuho Financial Group,Standard Chartered, MUFG, Sumitomo Mitsui Banking Corporation, Credit Agricole, Commerzbank, HSBC, Riyad Bank, Saudi British Bank, ANZ, EBRD, Japan Exim Bank, Banque Saudi Fransi, Afreximbank, AlAhli Bank, Export-Import Bank of India; the Value of top ten manufacturers accounts about 14% of the total Value in 2019.

The trade finance market is highly competitive, with major banks dominating the market. The leading trade finance banks are on the verge of transforming their industry from a paper-based system to a more efficient and transparent digitized model with faster and more reliable service.

Below is a look into some of the top companies in the trade finance report:

BNP Paribas

BNP Paribas is one of the founding members of Voltron, the open platform for documentary trade. The bank has also entered a partnership with Cashforce, a fintech, to offer digital cash flow forecasting and working capital services to corporate treasurers. Greenwich Associates has named BNP Paribas as a quality leader in trade finance in parts of Europe and Asia.

Citigroup inc

Through innovation and with a strong foundation in digitally-enabled strategies, Citi can enable access to highly tailored products and sources of funds while focusing on balance sheet efficiency targets. Strategies include offerings such as Electronic Trade Loans, Receivables and Distribution or Sales Finance, and a variety of enhanced data insight analytics to add value throughout the transaction life cycle.

Citigroup provided over 167 billion USD of annual trade finance in 2019.

INQUIRE FOR SAMPLE

https://reports.valuates.com/request/sample/QYRE-Auto-6X849/Global_Trade_Finance_Market_Size_Status_and_Forecast_2020_2026

SIMILAR REPORT

https://reports.valuates.com/market-reports/QYRE-Othe-4N372/global-trade-credit-insurance

https://reports.valuates.com/market-reports/QYRE-Auto-20F342/global-blockchain-supply-chain-finance

https://reports.valuates.com/market-reports/QYRE-Othe-3A258/non-bank-trade-finance

Valuates Reports

sales@valuates.com

For U.S. Toll-Free Call 1-(315)-215-3225

For IST Call +91-8040957137

WhatsApp: +91-9945648335

Website: https://reports.valuates.com

Twitter - https://twitter.com/valuatesreports

Valuates offers in-depth market insights into various industries. Our extensive report repository is constantly updated to meet your changing industry analysis needs.

Our team of market analysts can help you select the best report covering your industry. We understand your niche region-specific requirements and that's why we offer customization of reports. With our customization in place, you can request for any particular information from a report that meets your market analysis needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Trade Finance Market Research Report 2023 here

News-ID: 3250085 • Views: …

More Releases from Valuates Reports

Global Wafer Bonder and Debonder Market Expands as Advanced Packaging and MEMS A …

Wafer Bonder and Debonder Market Size

The global market for Wafer Bonder and Debonder was valued at US$ 321 million in the year 2024 and is projected to reach a revised size of US$ 449 million by 2031, growing at a CAGR of 5.0% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-9G8597/Global_Wafer_Bonder_and_Debonder_Market_Insights_Forecast_to_2028

By Type

• Fully Automatic

• Semi Automatic

By Application

• MEMS

• Advanced Packaging

• CIS

Key Companies

EV Group, SUSS MicroTec, Tokyo Electron, Applied Microengineering, Nidec Machine Tool, Ayumi Industry, Bondtech, Aimechatec,…

Global Wafer Bonding and Debonding Equipment Market Expands with Rising Demand f …

Wafer Bonding and Debonding Equipment Market Size

The global market for Wafer Bonding and Debonding Equipment was valued at US$ 321 million in the year 2024 and is projected to reach a revised size of US$ 449 million by 2031, growing at a CAGR of 5.0% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-7D16601/Global_Wafer_Bonding_and_Debonding_Equipment_Market_Research_Report_2024

By Type

• Fully Automatic

• Semi Automatic

By Application

• MEMS

• Advanced Packaging

• CIS

Key Companies

EV Group, SUSS MicroTec, Tokyo Electron, Applied Microengineering, Nidec Machine Tool, Ayumi Industry,…

Global GaN HEMT Epitaxial Wafer Market Accelerates as RF and Power Device Innova …

GaN HEMT Epitaxial Wafer Market Size

The global GaN HEMT Epitaxial Wafer revenue was US$ 175.9 million in 2022 and is forecast to a readjusted size of US$ 608.6 million by 2029 with a CAGR of 19.5% during the forecast period (2023-2029).

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-26C15937/Global_and_India_GaN_HEMT_Epitaxial_Wafer_Market_Report_Forecast_2023_2029

By Type

• GaN-on-SiC

• GaN-on-Si

• GaN-on-Sapphire

• GaN on GaN Others

By Application

• GaN HEMT RF Devices

• GaN HEMT Power Devices

Key Companies

Wolfspeed, Inc, IQE, Soitec (EpiGaN), Transphorm Inc., Sumitomo Chemical (SCIOCS), NTT Advanced Technology (NTT-AT), DOWA…

Global 300 mm Wafer Shippers and Carriers Market Advances as Semiconductor Capac …

300 mm Wafer Shippers and Carriers Market Size

The global market for 300 mm Wafer Shippers and Carriers was valued at US$ 521 million in the year 2024 and is projected to reach a revised size of US$ 759 million by 2031, growing at a CAGR of 5.6% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-8C10284/Global_300mm_Wafer_Shippers_and_Carriers_Market_Insights_Forecast_to_2028

By Type

• FOUP

• FOSB

By Application

• Foundry

• IDM

Key Companies

Entegris, Shin-Etsu Polymer, Miraial, Chuang King Enterprise, Gudeng Precision, 3S Korea, Dainichi Shoji

Major Trends

The…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…