Press release

Revolutionizing Protection: Global Usage-Based Insurance Market Accelerates to USD 77.14 billion by 2031, at a CAGR of 12.54% - TMR Study

According to Transparency Market Research, the global Usage-based Insurance (UBI) Market size is expected to grow from USD 23.67 billion in 2021 to USD 77.14 billion by 2031, at a CAGR of 12.54% during the forecast period. Usage-based insurance (UBI) is a form of auto insurance where policy premiums are determined by an individual's driving behaviour, recorded and transmitted via telematics devices installed in their vehicles.Don't miss out on the latest market intelligence, Get your free sample today copy@ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=52104

UBI has gained popularity as it provides incentives for safer driving, allows insurers to better assess risk, and offers more personalized insurance rates. The global usage-based insurance (UBI) market has experienced significant growth due to the integration of telematics technology in the insurance industry, the increasing demand for personalized insurance solutions, and the pursuit of safer driving habits. UBI, also known as pay-as-you-drive or pay-how-you-drive insurance, leverages data from connected vehicles to determine insurance premiums based on individual driving behaviour.

This research report provides a comprehensive analysis of the global UBI market, including market size, trends, drivers, challenges, and future outlook.

Market Size and Growth

• The global UBI market has witnessed substantial growth and is expected to continue expanding. Key factors contributing to this growth include:

• Telematics Integration: The integration of telematics devices in vehicles, which enables data collection and transmission for UBI.

• Consumer Demand: The growing demand for personalized insurance solutions and fair pricing based on individual driving habits.

• Insurer Competitiveness: Insurance companies' adoption of UBI to stay competitive and better manage risk.

Key Players

Key players in the UBI market include insurance companies, technology providers, and telematics device manufacturers. Some prominent organizations in this market include:

• Allianz

• AllState

• Aviva

• AXA

• Generalli

• Gropama

• Insure the Box

• Liberty Mutual

• MAIF and more

Recent Developments

Here are some recent developments of companies in the usage-based insurance (UBI) market, along with the year in which they occurred:

• Progressive: 2023 - Launches a new UBI program for commercial vehicles, Smart Haul Pro, which uses telematics data from electronic logging devices (ELDs) to provide discounts for safe driving.

• State Farm: 2023 - Announces a partnership with Waymo to offer UBI to drivers of Waymo's self-driving cars.

• Allstate: 2022 - Acquires Milewise, a UBI startup, for $400 million.

• Geico: 2022 - Launches a new UBI program, DriveEasy, which uses telematics data from smartphones to provide discounts for safe driving.

Discuss Implications for Your Industry Request Customized Research@ https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=52104

Market Dynamics

Market Drivers

Several factors are driving the growth of the UBI market, including:

• Personalization: The demand for personalized insurance solutions that consider individual driving habits.

• Risk Assessment: UBI's ability to provide insurers with more accurate risk assessment based on actual driving behavior.

• Telematics Growth: The increasing integration of telematics technology in vehicles.

Market Challenges

The UBI market faces certain challenges, such as:

• Privacy Concerns: Concerns about data privacy and the collection of driving behavior data.

• Data Security: The need for robust data security measures to protect the transmitted data.

• Regulatory Complexities: Navigating regulatory and compliance issues in different regions.

Market Opportunities

Opportunities in the UBI market include:

• Technological Advancements: Ongoing technological advancements to improve data collection, analysis, and user experience.

• Customer Engagement: Enhancing customer engagement through data-driven feedback and incentives for safer driving.

• Global Expansion: Expanding UBI offerings to emerging markets and exploring new insurance product opportunities.

Supercharge Your Business Strategy with Market Intelligence: Enquire before Buying@ https://www.transparencymarketresearch.com/sample/sample.php?flag=EB&rep_id=52104

Market Segmentation

The UBI market can be segmented based on various criteria, including type, distribution channel, vehicle type, and region:

• Type: UBI can be classified into pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and manage-how-you-drive (MHYD) insurance.

• Distribution Channel: UBI policies can be distributed through traditional agents, brokers, or digital platforms.

• Vehicle Type: UBI is available for various types of vehicles, including personal autos, commercial fleets, and two-wheelers.

• Region: The market spans regions such as North America, Europe, Asia-Pacific, and Latin America.

More Trending Research Reports -

Usage based Insurance Market - https://www.globenewswire.com/news-release/2023/10/02/2752510/0/en/Usage-based-Insurance-Market-is-Anticipated-to-Reach-USD-77-14-billion-by-2031-Garnering-12-54-CAGR-Exclusive-Report-by-Transparency-Market-Research.html

Automotive Cyber Security Market - https://www.globenewswire.com/news-release/2023/08/21/2728420/32656/en/Automotive-Cyber-Security-Market-to-Register-a-Growth-at-16-6-CAGR-to-Top-US-10-5-Billion-by-2031-Transparency-Market-Research.html

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports

Contact:

Nikhil Sawlani

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Revolutionizing Protection: Global Usage-Based Insurance Market Accelerates to USD 77.14 billion by 2031, at a CAGR of 12.54% - TMR Study here

News-ID: 3249531 • Views: …

More Releases from Transparency Market Research

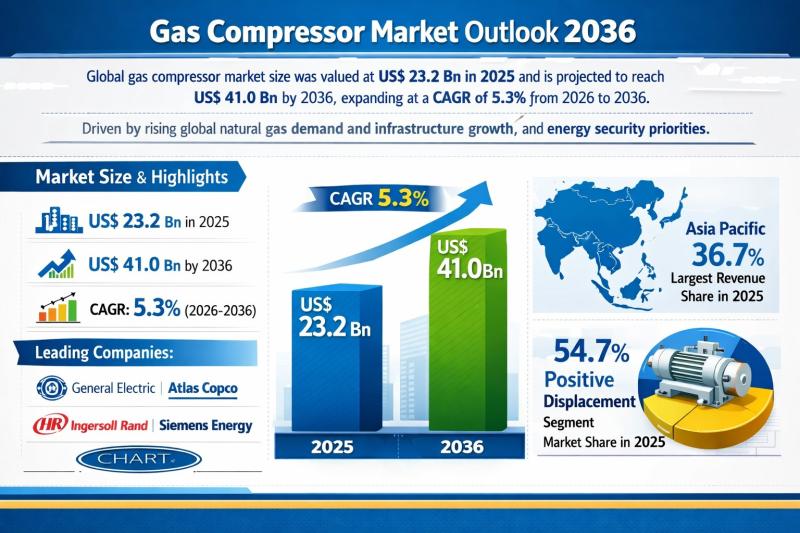

Gas Compressor Market Outlook 2036: Global Industry Expected to Reach US$ 41.0 B …

The global gas compressor market was valued at US$ 23.2 Bn in 2025 and is projected to reach US$ 41.0 Bn by 2036, expanding at a compound annual growth rate (CAGR) of 5.3% from 2026 to 2036. This steady growth trajectory reflects the structural importance of gas compression systems across upstream, midstream, and downstream gas value chains. Rising natural gas consumption, expansion of pipeline and LNG infrastructure, and national energy…

Anesthesia Drugs Market to be Worth USD 12.6 Bn by 2036 - By Drug / By Applicati …

The global anesthesia drugs market was valued at US$ 7.6 billion in 2025 and is projected to reach US$ 12.6 billion by 2036, expanding at a compound annual growth rate (CAGR) of 4.7% from 2026 to 2036. This steady growth trajectory reflects the essential and non-substitutable role of anesthesia drugs in modern healthcare systems. As surgical interventions continue to rise globally-across both elective and emergency procedures-the demand for safe, effective,…

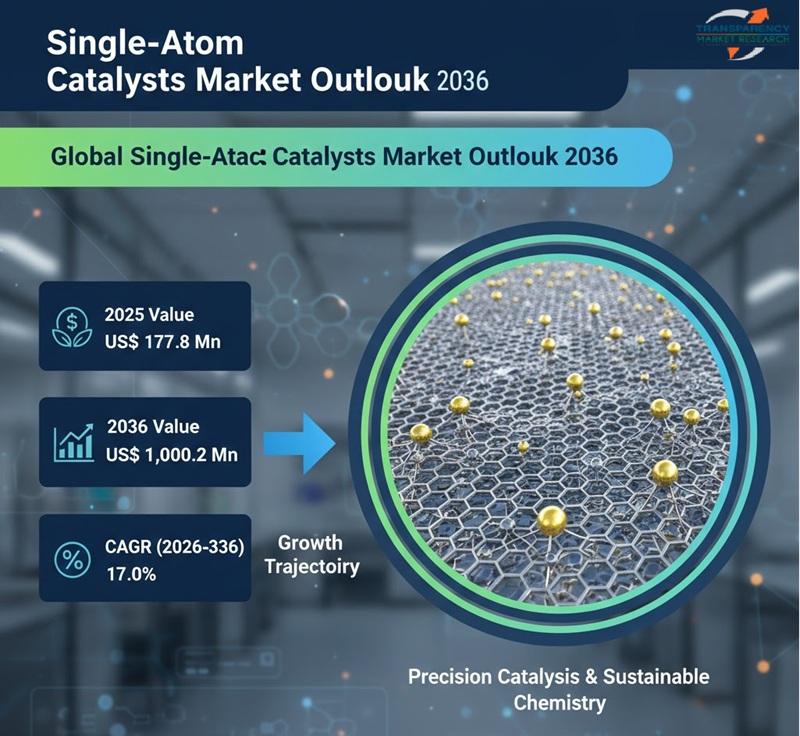

Single-Atom Catalysts Market Size is Expected to Expand from US$ 177.8 Million t …

The global single-atom catalysts (SACs) market is poised for remarkable growth as industries seek highly efficient, cost-effective, and sustainable catalytic solutions. Valued at US$ 177.8 million in 2025, the market is projected to reach US$ 1,000.2 million by 2036, expanding at a robust compound annual growth rate (CAGR) of 17.0% from 2026 to 2036. This rapid expansion reflects the growing importance of advanced catalysis in energy, chemicals, environmental protection, and…

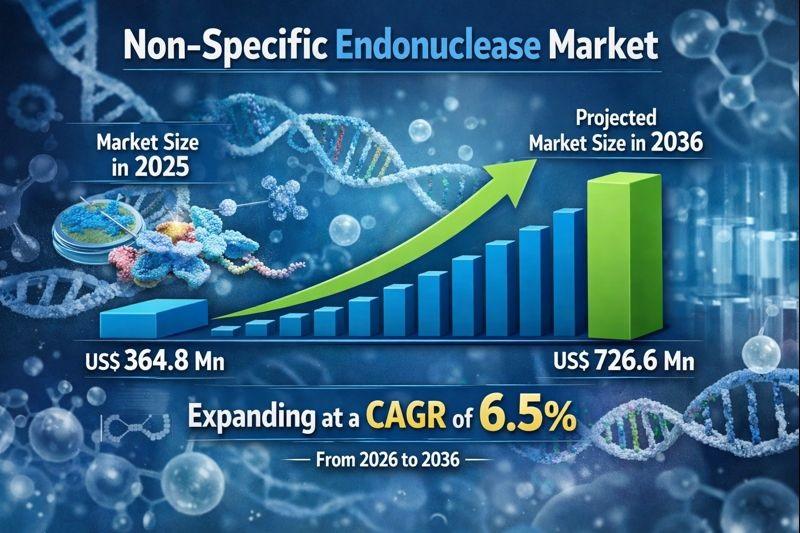

Non-specific Endonuclease Market to Reach USD 726.6 Million by 2036, Supported b …

The non-specific endonuclease market is witnessing steady growth, driven by the expanding use of molecular biology tools across biotechnology, pharmaceuticals, diagnostics, and academic research. Non-specific endonucleases are enzymes that cleave nucleic acids without requiring a specific recognition sequence, making them highly valuable for applications such as DNA/RNA degradation, sample preparation, viscosity reduction, and contamination control. Their broad activity profile differentiates them from restriction enzymes and enables versatile usage across multiple…

More Releases for UBI

Usage Based Insurance (Ubi) Market: A Comprehensive Overview

The Usage-Based Insurance (UBI) Market was valued at USD 43.38 billion in 2023 and is expected to grow to approximately USD 87.0 billion by 2033, reflecting a CAGR of about 7.2% from 2024 to 2033.

Usage Based Insurance (Ubi) Market Overview

The Usage-Based Insurance (UBI) Market is experiencing significant growth, driven by advancements in telematics and the increasing adoption of connected vehicles. UBI models, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), utilize…

Usage Based Insurance (Ubi) Market Size Unlocking New Opportunities for Success

The global Usage-Based Insurance (UBI) Market was valued at approximately USD 33.27 billion in 2023 and is projected to reach around USD 232.94 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.14% from 2024 to 2032.

Usage Based Insurance (Ubi) Market Overview

Usage-Based Insurance (UBI) is an innovative auto insurance model that determines premiums based on individual driving behaviors, such as distance traveled, speed, braking patterns, and time…

Usage-based Insurance (UBI) Market Revenue Sizing Outlook Appears Bright

Global Usage-based Insurance (UBI) Market Report from Market Insights Report highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions…

Usage-based Insurance (UBI) Market Will Generate Record Revenue by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-based Insurance (UBI) Market to Witness Growth Acceleration by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…