Press release

Insurance Platform Market Size, Share, Trends, Opportunities, Growth Factors Analysis

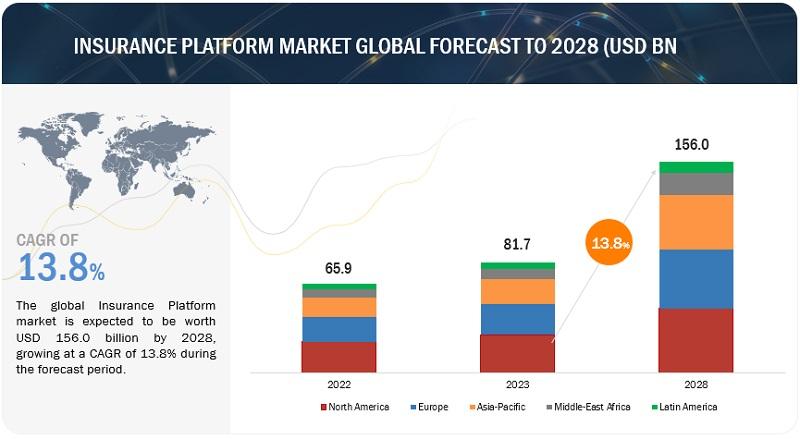

The Insurance Platform Market is set to experience rapid growth, projected to surge from USD 81.7 billion in 2023 to USD 156.0 billion by 2028, at a CAGR of 13.8% during the forecast period of 2023-2028.Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=144303624

This remarkable expansion is driven by a confluence of factors. First and foremost, the insurance industry's relentless pursuit of digitization and automation is reshaping the insurance landscape, reducing operational costs, and enhancing customer experiences. Moreover, the increasing demand for personalized insurance solutions, powered by advanced data analytics and AI, is pushing insurers to invest heavily in platform-based technologies. Additionally, regulatory changes are accelerating the adoption of compliant platforms, while the rising popularity of insurtech startups and the need for seamless customer journeys are shaping the insuance platform market's future. In this dynamic landscape, insurance platforms are poised to revolutionize the industry, providing agility, efficiency, and innovation on an unprecedented scale.

By offering, consulting and advisory services segment to register for the largest market share during the forecast period

Insurance platform consulting and advisory services play a pivotal role in guiding insurers through the ever-evolving landscape of digital transformation. These services, driven by the need for insurers to adapt to changing customer expectations and industry dynamics, offer expert insights and strategies. Growth in this sector is fueled by the increasing demand for customized digital solutions, regulatory compliance, and the pursuit of operational excellence. Key trends include harnessing advanced technologies like AI and blockchain to enhance underwriting and claims processing, as well as a strong emphasis on data analytics to optimize customer experiences.

By insurance type, cybersecurity insurance segment is poised for the fastest growth rate during the forecast period

Cybersecurity insurance is a rapidly evolving segment within the insurance platform market, addressing the need for protection against digital threats. It's driven by the expansion of cyberattacks and data breaches across industries, compelling businesses to safeguard their operations. Moreover, trends like increased demand for ransomware and social engineering coverage, along with stricter regulatory requirements, are reshaping the cybersecurity insurance landscape. As companies recognize the urgency of safeguarding their digital assets, this insurance type is poised for substantial growth within the broader insurance platform market.

By region, Asia Pacific to account for highest growth rate during forecast period

The Asia Pacific insurance platform market is witnessing remarkable growth, fueled by several key drivers and trends. Rapid urbanization and an expanding middle class are boosting insurance demand across the region. Moreover, the COVID-19 pandemic has accelerated the adoption of digital solutions, propelling insurers to invest in advanced insurance platforms for improved customer service and streamlined operations. Data analytics and artificial intelligence are being harnessed to enhance underwriting precision and detect fraudulent claims. Regulatory changes, particularly in markets like China and India, are promoting innovation and opening up opportunities for insurtech firms. As customer expectations evolve, insurers are embracing customer-centric approaches, providing personalized experiences through digital channels.

Some major players in the insurance platform market include Microsoft (US), Adobe (US), Salesforce (US), IBM (US), Oracle (US), SAP (Germany), Pegasystems (US), DXC Technology (US), and Cognizant (US).

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Platform Market Size, Share, Trends, Opportunities, Growth Factors Analysis here

News-ID: 3244694 • Views: …

More Releases from Markets and Markets

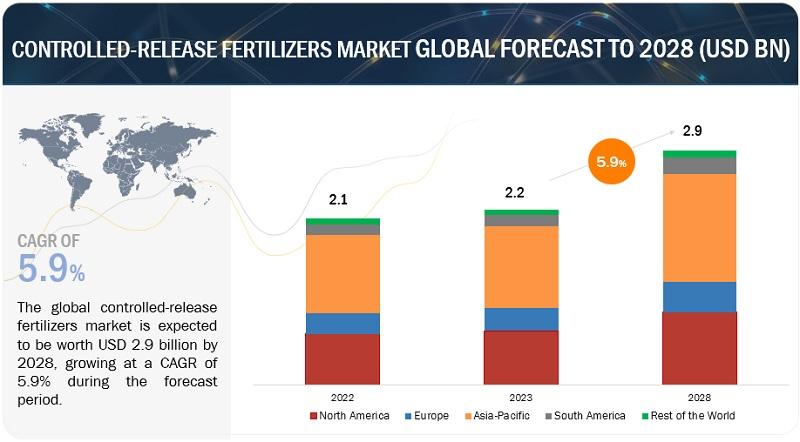

Controlled-release Fertilizers Market Latest Trends, Demands, Overview and Analy …

The controlled-release fertilizers market is experiencing notable growth, estimated at USD 2.2 billion in 2023 and projected to reach USD 2.9 billion by 2028. This reflects a compound annual growth rate (CAGR) of 5.9% during the forecast period. The demand for controlled-release fertilizers is increasing due to their benefits in enhancing nutrient efficiency, reducing environmental impact, and supporting sustainable agricultural practices.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

These fertilizers are prized for their ability…

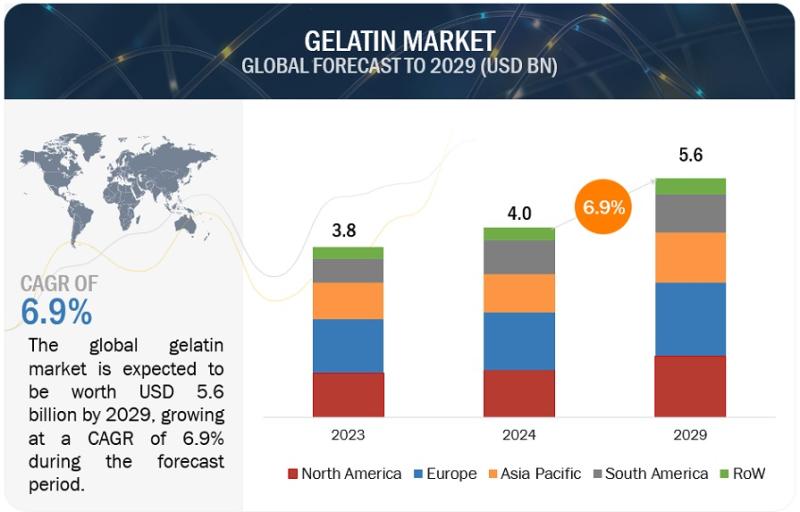

Gelatin Market is Projected to Reach $5.6 billion by 2029, at a CAGR of 6.9% fro …

According to a research report titled "Gelatin Market by Source (Animal, Plants), By Applications (Food & Beverages, Pharmaceuticals, Health & Nutrition, Cosmetics, Personal Care, Animal Feed), Type (Type A, Type B), Function (Thickener, Stabilizer, Gelling Agent) - Global Forecast to 2029," published by MarketsandMarkets, the gelatin market is poised for significant growth. The market, valued at USD 4.0 billion in 2024, is projected to reach USD 5.6 billion by 2029,…

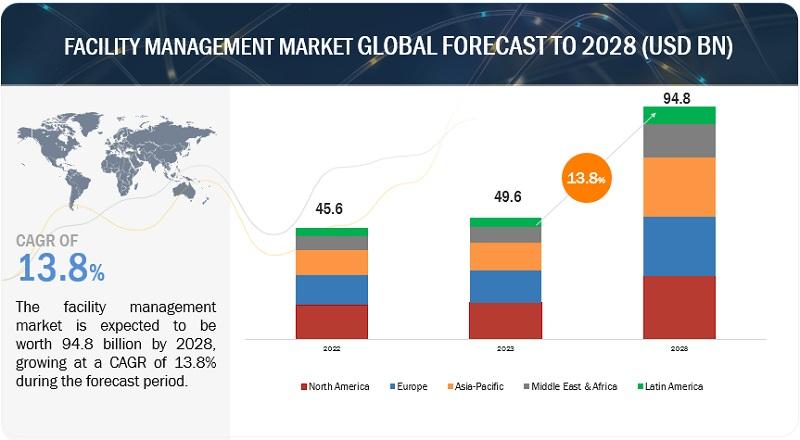

Facility Management Market Status, Revenue, Growth Rate, Services and Solutions

According to a research report "Facility Management Market by Offering (Solutions (IWMS, BIM, Facility Operations & Security Management) and Services), Vertical (BFSI, Retail, Construction & Real Estate, Healthcare & Life sciences) and Region - Global Forecast to 2028" published by MarketsandMarkets, the facility management market is estimated at USD 49.6 billion in 2023 to USD 94.8 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 13.8%.

Download PDF Brochure:…

Endpoint Security Market Size, Revenue, Growth Rate Analysis and Forecast 2024

According to a research report "Endpoint Security Market by Solution (Endpoint Protection Platform and Endpoint Detection and Response), Service, Deployment Mode, Organization Size, Vertical (Healthcare, Retail and eCommerce, and Government), and Region - Global Forecast to 2024", published by MarketsandMarkets, the global endpoint security market size is expected to grow from USD 12.8 billion in 2019 to USD 18.4 billion by 2024, at a Compound Annual Growth Rate (CAGR) of…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…