Press release

Gloves Market : Investment Opportunities and M&A Trends , Asia-Pacific Is the Fastest Growing Region 2021-2025

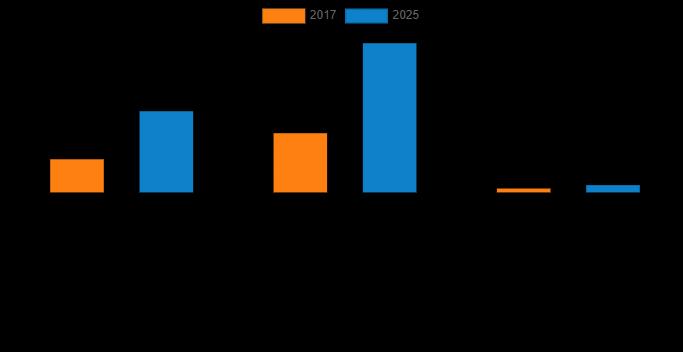

𝑰𝒏𝒕𝒓𝒐𝒅𝒖𝒄𝒕𝒊𝒐𝒏𝘛𝘩𝘦 𝘨𝘭𝘰𝘣𝘢𝘭 𝘨𝘭𝘰𝘷𝘦𝘴 𝘮𝘢𝘳𝘬𝘦𝘵 𝘸𝘢𝘴 𝘷𝘢𝘭𝘶𝘦𝘥 𝘢𝘵 $48.0 𝘣𝘪𝘭𝘭𝘪𝘰𝘯 𝘪𝘯 2017, 𝘢𝘯𝘥 𝘪𝘴 𝘱𝘳𝘰𝘫𝘦𝘤𝘵𝘦𝘥 𝘵𝘰 𝘳𝘦𝘢𝘤𝘩 $118.5 𝘣𝘪𝘭𝘭𝘪𝘰𝘯 𝘣𝘺 2025, 𝘳𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘪𝘯𝘨 𝘢 𝘊𝘈𝘎𝘙 𝘰𝘧 8.6% 𝘧𝘳𝘰𝘮 2021 𝘵𝘰 2025.

• CAGR: 8.6%

• Current Market Size: USD 48.0 Billion

• Forecast Growing Region: APAC

• Largest Market: North America

• Projection Time: 2021- 2025

• Base Year: 2021

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝑪𝒐𝒑𝒚 𝒐𝒇 𝑹𝒆𝒑𝒐𝒓𝒕 - https://www.alliedmarketresearch.com/request-sample/9232

The gloves market has witnessed significant growth in recent years, driven by a multitude of factors such as increased awareness of hygiene and safety, the demand for disposable gloves in healthcare, and growing industrial safety regulations. With this surge in demand, the industry is becoming increasingly attractive to investors and players seeking to expand their market presence. This article delves into the investment opportunities and mergers and acquisitions (M&A) trends within the gloves market.

𝑰𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕 𝑶𝒑𝒑𝒐𝒓𝒕𝒖𝒏𝒊𝒕𝒊𝒆𝒔 𝒊𝒏 𝒕𝒉𝒆 𝑮𝒍𝒐𝒗𝒆𝒔 𝑴𝒂𝒓𝒌𝒆𝒕

Healthcare Sector: The healthcare sector remains a lucrative area for investment. Disposable gloves are essential in medical settings to maintain hygiene and prevent cross-contamination. As healthcare facilities continue to expand globally, the demand for medical gloves is expected to rise. Investing in companies that specialize in medical gloves production can yield substantial returns.

Industrial Safety: With stringent safety regulations in industries such as manufacturing, construction, and chemical, there is a growing demand for industrial gloves. Investing in companies that offer a wide range of specialized industrial gloves could be a strategic move as these regulations continue to evolve.

Sustainability: As environmental concerns gain traction, there is a growing market for sustainable and eco-friendly gloves. Investing in research and development to create biodegradable or reusable gloves can position a company well for the future.

Technological Advancements: Gloves equipped with smart technologies are on the horizon, including sensors for monitoring vital signs and temperature. Investing in companies at the forefront of glove technology can open doors to innovation and new markets.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 (227 𝐏𝐚𝐠𝐞𝐬 𝐏𝐃𝐅 𝐰𝐢𝐭𝐡 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐂𝐡𝐚𝐫𝐭𝐬, 𝐓𝐚𝐛𝐥𝐞𝐬, 𝐚𝐧𝐝 𝐅𝐢𝐠𝐮𝐫𝐞𝐬) @ https://www.alliedmarketresearch.com/gloves-market/purchase-options

𝑴&𝑨 𝑻𝒓𝒆𝒏𝒅𝒔 𝒊𝒏 𝒕𝒉𝒆 𝑮𝒍𝒐𝒗𝒆𝒔 𝑴𝒂𝒓𝒌𝒆𝒕

Vertical Integration: Many companies are looking to vertically integrate their operations to secure their supply chains. This trend has led to mergers between manufacturers, raw material suppliers, and distribution channels.

Global Expansion: To tap into emerging markets and diversify their product offerings, many glove manufacturers are considering M&A activities. Companies from developed countries are merging with or acquiring those in developing economies to expand their reach.

Specialization and Niche Markets: Niche glove markets, such as those focused on specific industries or unique glove materials, are ripe for M&A activities. Specialized companies often attract larger players seeking to diversify their product portfolio.

Innovation Through Acquisition: Companies in the gloves market are increasingly acquiring innovative startups that bring novel technologies and materials to the industry. This approach helps larger companies stay competitive and up-to-date with industry trends.

Consolidation: As the gloves market matures, consolidation is a common trend. Larger companies are acquiring smaller ones to eliminate competition and achieve economies of scale. This can lead to greater market dominance and increased efficiency.

𝑪𝒐𝒏𝒄𝒍𝒖𝒔𝒊𝒐𝒏

The gloves market is evolving rapidly, offering numerous investment opportunities and a dynamic landscape for M&A activities. Whether you are an investor seeking promising ventures or a company looking to expand and innovate, the gloves market presents a wide range of possibilities. As the industry continues to adapt to changing demands and regulatory environments, strategic investment decisions and M&A strategies are crucial for success in this growing market. Staying attuned to emerging trends and sustainability concerns will also be key in navigating the future of the gloves industry.

𝑲𝒆𝒚 𝑩𝒆𝒏𝒆𝒇𝒊𝒕𝒔 𝑭𝒐𝒓 𝑺𝒕𝒂𝒌𝒆𝒉𝒐𝒍𝒅𝒆𝒓𝒔

This report entails a detailed quantitative analysis along with the current global gloves market trends from 2017 to 2025 to identify the prevailing opportunities along with the strategic assessment.

The gloves market forecast is studied from 2021 to 2025.

The gloves market size and estimations are based on a comprehensive analysis of key developments in the industry.

A qualitative analysis based on innovative products facilitates strategic business planning.

The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the market

𝐃𝐨 𝐈𝐧𝐪𝐮𝐢𝐫𝐲 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 - https://www.alliedmarketresearch.com/purchase-enquiry/9232

𝐒𝐨𝐦𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐤𝐞𝐲 𝐦𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐠𝐥𝐨𝐯𝐞𝐬 𝐦𝐚𝐫𝐤𝐞𝐭 𝐢𝐧𝐜𝐥𝐮𝐝𝐞 -

3M Company,

Ansell Limited,

Cardinal Health, INC.,

Honeywell International INC.,

Hartalega Holdings Berhad,

Kimberly-Clark Corporation,

Kossan Rubber Industries BHD,

Semperit AG HOLDING,

and Top Glove Corporation BHD

𝑲𝒏𝒐𝒘 𝑴𝒐𝒓𝒆 https://www.alliedmarketresearch.com/gloves-market-A08867

𝐎𝐭𝐡𝐞𝐫 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐢𝐧 𝐋𝐢𝐟𝐞 𝐒𝐜𝐢𝐞𝐧𝐜𝐞 𝐃𝐨𝐦𝐚𝐢𝐧-

𝑼.𝑺. 𝑷𝒐𝒓𝒕𝒂𝒃𝒍𝒆 𝑽𝒆𝒏𝒕𝒊𝒍𝒂𝒕𝒐𝒓𝒔 𝑴𝒂𝒓𝒌𝒆𝒕 https://www.alliedmarketresearch.com/us-portable-ventilator-market-A09509

𝑪𝒍𝒆𝒂𝒏𝒓𝒐𝒐𝒎 𝑪𝒐𝒏𝒔𝒖𝒎𝒂𝒃𝒍𝒆𝒔 𝒎𝒂𝒓𝒌𝒆𝒕 https://www.alliedmarketresearch.com/cleanroom-consumables-market-A10926

𝑹𝒆𝒔𝒑𝒊𝒓𝒂𝒕𝒐𝒓𝒚 𝑫𝒊𝒔𝒑𝒐𝒔𝒂𝒃𝒍𝒆𝒔 𝑴𝒂𝒓𝒌𝒆𝒕 https://www.alliedmarketresearch.com/respiratory-disposables-market-A11235

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Gloves Market : Investment Opportunities and M&A Trends , Asia-Pacific Is the Fastest Growing Region 2021-2025 here

News-ID: 3244143 • Views: …

More Releases from Allied Market Research

3D Printing Filament Market Comprehensive Growth Outlook and Trend Analysis, 202 …

According to the report, the global 3D printing filament market was valued at $0.9 billion in 2023 and is projected to reach $2.3 billion by 2031, registering a CAGR of 12.8% from 2024 to 2031.

Download Sample Pages of Research Overview: https://www.alliedmarketresearch.com/3d-printing-filament-market-A11572

Key Growth Drivers:

The growth of the 3D printing filament market is fueled by continuous advancements in filament materials-such as carbon fiber-reinforced composites, metal-infused filaments, and high-performance engineering plastics. These innovations…

Wet Chemicals Market Detailed Analysis, Growth Trends, and Future Outlook 2025-2 …

According to a recent report by Allied Market Research (AMR), the global wet chemicals market is poised for substantial growth, projected to reach a value of $5.9 billion by 2031, up from $3.2 billion in 2021. This comprehensive analysis explores market dynamics, growth drivers, and strategic initiatives while highlighting key opportunities across regions and industry segments.

Download Sample Pages of Research Overview: https://www.alliedmarketresearch.com/request-sample/A17425

The study delves into development trends, investment frameworks, and…

Nonwoven Fabrics Market Outlook to 2033 Projected High CAGR and Growth Opportuni …

A new report titled "Nonwoven Fabrics Market by Polymer Type (Polypropylene (PP), Polyethylene (PE), Polyethylene Terephthalate (PET), Wood Pulp, Rayon, and Others), Function (Disposables and Durables), Technology (Spunbond, Dry Laid, Air Laid, Wet Laid, Meltblown, and Others), and Application (Hygiene, Wipes, Medical, Filtration, Automotive, Building & Construction, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033" has been released by Allied Market Research.

Key Highlights:

- Market Size (2023): $58.4 Billion

- Projected…

Utilities Asset Management Market Poised for 11.3% CAGR Growth, Key Players, Mar …

According to the report published by Allied Market Research, the global utilities asset management market generated $4.3 billion in 2021, and is projected to reach $12.4 billion by 2031, growing at a CAGR of 11.3% from 2022 to 2031.

The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape.…

More Releases for M&A

industrials m&a,m&a project management,corporate finance mergers and acquisition …

Mergers and acquisitions (M&A) in the industrial sector refer to the process of one company acquiring another company or assets in the manufacturing, construction, and engineering industries. The industrial sector is characterized by a diverse range of businesses, including heavy machinery, aerospace, and defense, chemicals, and engineering services.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

The industrial sector is characterized by a high level of consolidation, with companies looking to acquire other companies to gain access…

m&a company,m&a integration,cross border merger,m&a due diligence,m&a strategy,m …

Mergers and acquisitions (M&A) are a common way for companies to grow and diversify their business operations. The process of merging or acquiring another company can be complex and time-consuming, but when executed successfully, it can bring significant benefits to the acquiring company, such as access to new markets, technologies, and customers.

https://upworkservice.com

China M&A advisory

E-mail:nolan@pandacuads.com

When it comes to successful M&A, the key is to ensure that the two companies are a…

private equity m&a,international mergers and acquisitions,technology m&a,m&a pro …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. In the M&A process, there are two main parties involved: the buyer and the seller. One type of buyer that is becoming increasingly prevalent in the M&A landscape is private equity firms.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

Private equity firms are investment firms that raise capital from institutional investors and high net…

buy side m&a,global m&a,bank mergers and acquisitions,m&a advisory firms,success …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. In the M&A process, there are two main parties involved: the buyer and the seller. The term "buy side" refers to the party that is acquiring the target company. In contrast, the "sell side" refers to the party that is being acquired.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

The buy side M&A process…

due diligence in mergers and acquisitions,recent m&a deals 2023,m&a management,m …

Due diligence is an investigation process that companies undertake prior to a merger or acquisition (M&A) in order to assess the target company's financial and operational condition. The goal of due diligence is to identify any potential risks or opportunities that may impact the value of the acquisition and to ensure that the deal is in the best interest of the acquiring company. Due diligence is a critical step in…

m&a valuation,corporate mergers,m&a business,merger integration,sell side m&a pr …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. One crucial aspect of the M&A process is the valuation of the target company. Valuation is the process of determining the fair value of a company, and it is an essential step in the M&A process because it helps companies to determine the terms of the acquisition, such…