Press release

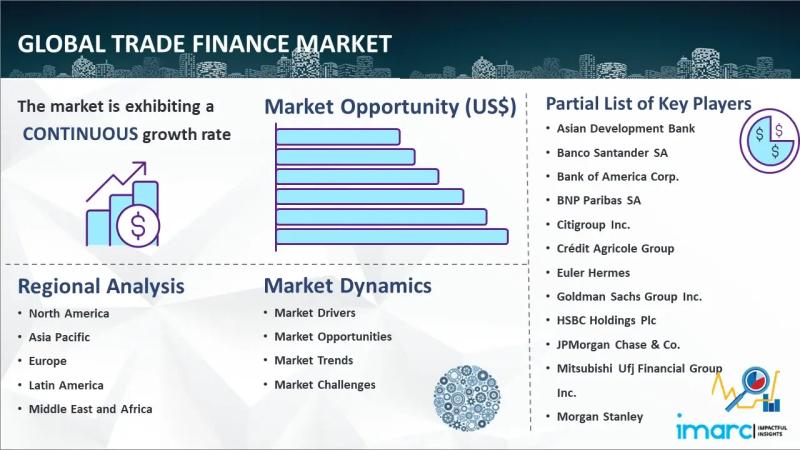

Trade Finance Market Size Witnesses Robust Growth Rate of CAGR 6.2%, Exceeding US$ 70.0 Billion by 2028

How Big is the Trade Finance Market?According to IMARC Group's new report, titled "Trade Finance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028.' the global trade finance market size reached US$ 48.2 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 70.0 Billion by 2028, exhibiting a growth rate (CAGR) of 6.2% during 2023-2028.

𝐇𝐞𝐫𝐞 𝐢𝐬 𝐚𝐧 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐚𝐥𝐤𝐢𝐧𝐠 𝐚𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐬𝐜𝐞𝐧𝐚𝐫𝐢𝐨𝐬 𝐰𝐢𝐭𝐡 𝐚 𝐡𝐢𝐬𝐭𝐨𝐫𝐢𝐜𝐚𝐥 𝐚𝐧𝐝 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐩𝐞𝐫𝐢𝐨𝐝: https://www.imarcgroup.com/trade-finance-market/requestsample

What is Trade Finance?

Trade finance refers to the various financial instruments, practices, and technologies used to facilitate both domestic and international trade transactions. Essentially, it aims to bridge the financial gap between buyers and sellers, enabling the smooth exchange of goods and services. This sector of finance employs a wide array of products such as letters of credit, trade credit, export financing, and documentary collection, among others, to reduce risks, provide liquidity, and ensure timely payments. In an international trade scenario, for instance, the buyer and seller are often separated by geographical distances and varying regulations.

Here, trade finance acts as a safety net for both parties. Instruments like letters of credit offer a guarantee to sellers that they will be paid upon meeting certain conditions, while also assuring buyers that their payment will only be made when those conditions, often related to the delivery and quality of goods, are met. Additionally, trade finance helps businesses manage their working capital more efficiently. Offering credit facilities and financing options allows companies to maintain cash flow and continue operations even while waiting for payments from customers. Moreover, various forms of trade insurance can protect against potential defaults or disruptions in the supply chain.

What are the growth prospects and trends in the trade finance industry?

The increasing interconnectedness of the global economy represents one of the key factors driving the growth of the market across the globe. This is leading to more cross-border transactions, which is creating a higher demand for trade finance solutions. As economies grow and diversify, the need for robust trade financing mechanisms escalates, both for importers seeking to meet domestic demand and exporters looking to tap into new markets. Innovations like blockchain, artificial intelligence, and digital platforms are revolutionizing trade finance, thus making it more efficient, transparent, and accessible. Evolving trade policies and international regulations either facilitate or hamper the flow of trade finance. Compliant and updated financial instruments are, therefore, continually in demand. In an uncertain global economic environment, the role of trade finance in mitigating risks like currency fluctuations, political instability, and payment defaults is becoming increasingly critical.

The growing complexity of global supply chains necessitates sophisticated financial instruments that handle multiple transactions, currencies, and jurisdictions. Small and medium-sized enterprises often struggle with access to credit and working capital. Trade finance can bridge this gap, which is fostering SME growth and inclusion in global trade. The rapid expansion of online commerce platforms, both domestic and cross-border, is introducing new challenges and opportunities for trade financing solutions. Banks and other financial institutions are offering more specialized and flexible trade finance products to meet the diverse needs of businesses, which is driving the market. As businesses compete globally, efficient trade finance becomes a strategic asset, which facilitates quicker transactions and better terms of trade. The increasing consumer demands for variety and speed also push businesses to opt for robust trade financing options that ensure timely delivery and product availability. As sustainability becomes a strategic priority, trade finance instruments that promote environmental and social responsibility are gaining traction.

𝐒𝐩𝐞𝐚𝐤 𝐭𝐨 𝐀𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐭 𝐨𝐫 𝐆𝐞𝐭 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐀𝐛𝐨𝐮𝐭 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/request?type=report&id=2031&flag=E

Who are the key players operating in the industry?

The report covers the major market players including:

Asian Development Bank

Banco Santander SA

Bank of America Corp.

BNP Paribas SA

Citigroup Inc.

Crédit Agricole Group

Euler Hermes

Goldman Sachs Group Inc.

HSBC Holdings Plc

JPMorgan Chase & Co.

Mitsubishi Ufj Financial Group Inc.

Morgan Stanley

Royal Bank of Scotland

Standard Chartered Bank

Wells Fargo & Co.

What is included in market segmentation?

The report has segmented the market into the following categories

Breakup by Finance Type:

Structured Trade Finance

Supply Chain Finance

Traditional Trade Finance

Breakup by Offering:

Letters of Credit

Bill of Lading

Export Factoring

Insurance

Others

Breakup by Service Provider:

Banks

Trade Finance Houses

Breakup by End-User:

Small and Medium Sized Enterprises (SMEs)

Large Enterprises

Breakup by Region:

North America

Asia Pacific

Europe

Latin America

Middle East and Africa

𝐘𝐨𝐮 𝐂𝐚𝐧 𝐁𝐮𝐲 𝐑𝐞𝐩𝐨𝐫𝐭 𝐃𝐢𝐫𝐞𝐜𝐭𝐥𝐲 𝐚𝐧𝐝 𝐆𝐞𝐭 𝐔𝐩-𝐓𝐨 𝟏𝟎% 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭: https://www.imarcgroup.com/checkout?id=2031&method=265

Key Highlights of the Report:

Market Performance (2017-2022)

Market Outlook (2023-2028)

Market Trends

Market Drivers and Success Factors

Impact of COVID-19

Value Chain Analysis

Comprehensive mapping of the competitive landscape

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: https://www.imarcgroup.com/

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market Size Witnesses Robust Growth Rate of CAGR 6.2%, Exceeding US$ 70.0 Billion by 2028 here

News-ID: 3242373 • Views: …

More Releases from IMARC Group

Supercapacitor Market Size to Reach $31.07B by 2033: Trends & Opportunities

Market Overview:

The supercapacitor market is experiencing rapid growth, driven by electrification of automotive systems, renewable energy and grid stabilization, and expansion of industrial automation and robotics. According to IMARC Group's latest research publication, "Supercapacitor Market Size, Share, Trends and Forecast by Product Type, Module Type, Material Type, End Use Industry, and Region, 2025-2033", the global supercapacitor market size was valued at USD 6.41 Billion in 2024. Looking forward, IMARC Group…

Bicycle Market Size to Surpass $102.05B by 2033: Growth & Insights

Market Overview:

The bicycle market is experiencing rapid growth, driven by global expansion of cycling infrastructure, rising health consciousness and preventative wellness, and technological advancements in e-bike propulsion. According to IMARC Group's latest research publication, "Bicycle Market Size, Share, Trends and Forecast by Type, Technology, Price, Distribution Channel, End User, and Region, 2025-2033", The global bicycle market size was valued at USD 67.42 Billion in 2024. Looking forward, IMARC Group estimates…

Baby Food and Infant Formula Market to Reach USD 84.06 Billion by 2033, Growing …

Market Overview:

The Baby Food and Infant Formula Market is experiencing steady expansion, driven by Increasing Awareness of Nutritional Needs for Infants, Rising Number of Working Women, and Technological Advancements and Product Innovation. According to IMARC Group's latest research publication, "Baby Food and Infant Formula Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global baby food and infant formula market size reached USD 53.73 Billion in 2024.…

Breakfast Cereals Market to Reach USD 149.07 Billion by 2033, Growing at a CAGR …

Market Overview:

The Breakfast Cereals Market is experiencing rapid growth, driven by Health and Wellness Awareness, Busy Lifestyles and On-the-Go Demand and Rising Disposable Incomes and Global Market Expansion . According to IMARC Group's latest research publication, "Breakfast Cereals Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global breakfast cereals market size was valued at USD 108.89 Billion in 2024. Looking forward, IMARC Group estimates…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…