Press release

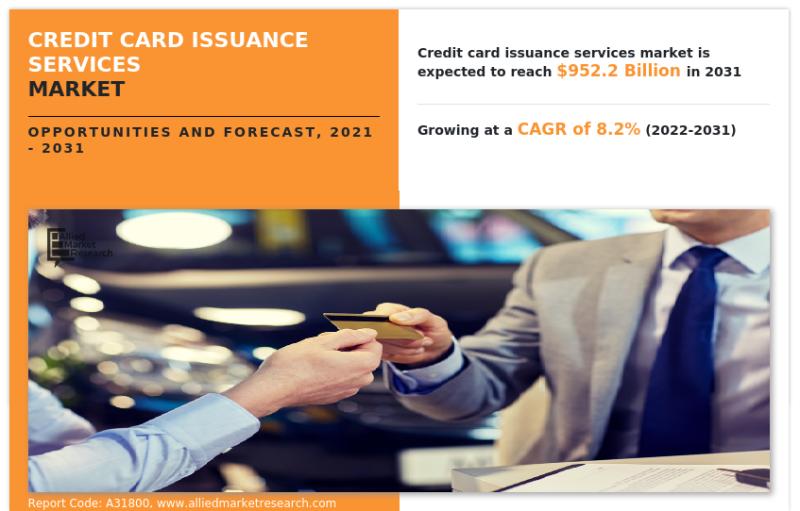

$952.2 Bn Credit Card Issuance Services Market Expected with Companies Offerings By End-User Segments 2031

The increase in demand for credit card services in emerging countries, the rise in contactless and digital credit card services, the surge in demand for cash alternatives, and the availability of low-cost credit cards drive the growth of the global credit card issuance services market. Region-wise, the market in North America was the largest in 2021 and is likely to maintain its leadership status during the forecast period.Download PDF Sample Report @ https://www.alliedmarketresearch.com/request-sample/32250

According to the report published by Allied Market Research, the global credit card issuance services market generated $443.7 billion in 2021 and is estimated to reach $952.2 billion by 2031, witnessing a CAGR of 8.2% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chains, regional landscape, and competitive scenario. The report is a helpful source of information for leading market players, new entrants, investors, and stakeholders in devising strategies for the future and taking steps to strengthen their position in the market.

Covid-19 Scenario:

The outbreak of the COVID-19 pandemic had a notable impact on the credit card issuance services market. This is due to lockdowns imposed by many countries in response to the rapid spread of the COVID-19 virus which impacted activities in banking and many other industries. The rise in pay delays & job losses and a decline in borrowing credit by individuals to cover their daily expenses also impacted the growth of the market.

Moreover, customers stopped taking new credit cards and focused on paying off their debts. This was due to the huge loss of jobs and lockdown by the government of respective countries across the globe.

However, the credit card issuance services market has recovered after the pandemic and it is expected that the industry will see numerous lucrative prospects in the approaching years.

The report offers a detailed segmentation of the global credit card issuance services market based on type, issuers, end users, and region. The report provides an analysis of each segment and sub-segment with the help of tables and figures. This analysis helps market players, investors, and new entrants in determining the sub-segments to be tapped into to achieve growth in the coming years.

Based on type, the consumer credit cards segment held the largest share in 2021, accounting for more than four-fifths of the global credit card issuance services market, and would rule the roost through 2031. The business credit cards segment, however, is estimated to witness the fastest CAGR of 12.6% during the forecast period.

Request Customization

https://www.alliedmarketresearch.com/request-for-customization/32250

Based on issuers, the banks segment held the largest share in 2021, capturing nearly two-thirds of the global credit card issuance services market, and would lead the trail through 2031. The NBFC segment, however, is estimated to witness the fastest CAGR of 12.2% during the forecast period. The report also discusses the credit unions segment.

In terms of end users, the personal segment captured the largest market share of over four-fifths in 2021 and is expected to dominate the market during the forecast period. The business segment, on the other hand, is likely to achieve the fastest CAGR of 12.3% through 2031.

Based on region, the market in North America was the largest in 2021, accounting for nearly two-fifths of the global credit card issuance services market, and is likely to maintain its leadership status during the forecast period. However, the market in Asia-Pacific is expected to manifest the highest CAGR of 11.5% from 2022 to 2031. The other regions analyzed in the study include Europe and LAMEA.

Leading players of the global credit card issuance services market analyzed in the research include Fiserv, Inc., Marqeta, Inc., Stripe, Inc., Giesecke+Devrient GmbH, Entrust Corporation., GPUK LLP., Nium Pte. Ltd., FIS, Thales, and American Express Company.

The report analyzes these key players of the global credit card issuance services market. These players have adopted various strategies such as expansion, new product launches, partnerships, and others to increase their market penetration and strengthen their position in the industry. The report is helpful in determining the business performance, operating segments, product portfolio, and developments of every market player.

Key benefits for stakeholders

• In-depth analysis of the credit card issuance services market segmentation assists in determining the prevailing market opportunities.

• Major countries in each region are mapped according to their revenue contribution to the global market.

• Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

• Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

• The market research is offered along with information related to key drivers, restraints, and opportunities.

• The report includes an analysis of the regional as well as global credit card issuance services market trends, key players, market segments, application areas, and market growth strategies.

• This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the credit card issuance services market analysis from 2021 to 2031 to identify the prevailing credit card issuance services market opportunity.

Inquire Before Buying

https://www.alliedmarketresearch.com/purchase-enquiry/32250

Credit Card Issuance Services Market Key Segments:

Type

• Business Credit Cards

• Consumer Credit Cards

Issuers

• Banks

• Credit Unions

• NBFCs

End User

• Business

• Personal

By Region

• Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

• Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

• LAMEA (Latin America, Middle East, Africa)

• North America (U.S., Canada)

More Reports:

On-Demand Insurance Market : https://www.alliedmarketresearch.com/on-demand-insurance-market-A74482

Gift Cards Market : https://www.alliedmarketresearch.com/gift-cards-market

Digital Lending Market : https://www.alliedmarketresearch.com/digital-lending-market-A74670

Commercial Banking Market : https://www.alliedmarketresearch.com/commercial-banking-market-A06184

Management Consulting Services Market : https://www.alliedmarketresearch.com/management-consulting-services-market-A19875

Real-Time Payments Market : https://www.alliedmarketresearch.com/real-time-payments-market-A19437

Contact US:

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms the utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high-quality data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release $952.2 Bn Credit Card Issuance Services Market Expected with Companies Offerings By End-User Segments 2031 here

News-ID: 3242138 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…