Press release

Proposing New Value Driven US Investment in India

The India Value Investment CompanyThe Whitepaper

Proposing New Value Driven US Investment in India

I. India Policies Toward Direct Foreign Investment.

Foreign Direct Investment in India is regulated primarily by India's Department of Promotion of Industry and International Trade (DPIIT), under its Foreign Exchange Management Act regime (FEMA Regime). India remains one of the most popular FDI destinations in the world, ranking as the seventh-largest recipient of FDI in 2021 according to the World Investment Record 2021. Attracting FDI inflows continue to be a priority for the Indian government, as it continues to shape the FDI legal landscape to make India an investor-friendly jurisdiction.

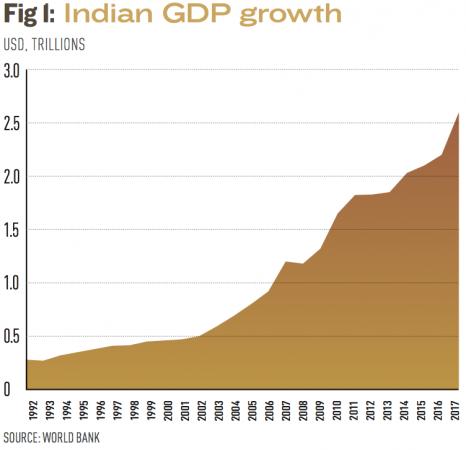

The Indian economy has grown strongly over the past two decades, buoyed in part by the large influx of FDI. Despite decelerating global demand and challenging global economic conditions, the OECD has forecasted that India's GDP will continue to grow at a rate of 5.7 percent for the financial year 2023 - 2024 and expects India to be the second fastest-growing economy in the G20 in 2023 - 2024.

The Indian government will likely continue to take steps to make India an attractive investment destination. Having loosened FDI requirements in recent years, it will come as no surprise if the government were to further liberalize FDI requirements in India and make it easier to invest into certain strategic sectors such as chemicals, healthcare and insurance.

(Excerpts from White & Case Foreign direct investment review 2023: India)

II. India is one of the world's fastest-growing economies.

KEY POINTS

India is poised to become the world's second-largest economy by 2075, Goldman Sachs forecasts.

On top of a burgeoning population, driving the forecast is the country's progress in innovation and technology, higher capital investment, and rising worker productivity.

India is poised to become the world's second-largest economy by 2075, leapfrogging not just Japan and Germany, but the U.S., too, says Goldman Sachs.

Currently, India is the world's fifth-largest economy, behind Germany, Japan, China and the U.S.

On top of a burgeoning population, driving the forecast is the country's progress in innovation and technology, higher capital investment, and rising worker productivity, the investment bank wrote in a recent report.

"Over the next two decades, the dependency ratio of India will be one of the lowest among regional economies," said Goldman Sachs Research's India economist, Santanu Sengupta.

A country's dependency ratio is measured by the number of dependents against the total working-age population. A low dependency ratio indicates that there are proportionally more working-age adults able to support the youth and elderly.

GDP projections by 2075 ($ trillion)

China: 57

India: 52.5

US.51.5

Eurozone: 30.3

Japan: 7.5

Source: Goldman Sachs Research.

Sengupta added that the key to drawing out the potential of India's rapidly growing population is to boost the participation of its labor force. And Sengupta forecasts that India will have one of the lowest dependency ratios among large economies for the next 20 years.

"So that really is the window for India to get it right in terms of setting up manufacturing capacity, continuing to grow services, continuing the growth of infrastructure," he said.

India's government has placed a priority on infrastructure creation, especially in the setting up of roads and railways. The country's recent budget aims to continue the 50-year interest-free loan programs to state governments in order to spur investments in infrastructure.

Goldman Sachs believes that this is an appropriate time for the private sector to scale up on creating capacity in manufacturing and services to generate more jobs and absorb the large labor force.

Tech and investments

Apple's betting big on making iPhones in India.

Spearheading India's economic trajectory is also its progress in technology and innovation, the investment bank said.

India's technology industry revenue is expected to increase by $245 billion by the end of 2023, according to Nasscom, India's nongovernmental trade association. That growth will come from across the IT, business process management and software product streams, Nasscom's report indicated.

Additionally, Goldman predicted capital investment will be another significant driver of India's growth.

"India's savings rate is likely to increase with falling dependency ratios, rising incomes, and deeper financial sector development, which is likely to make the pool of capital available to drive further investment," Goldman's report stated.

Downside risks?

The Achilles' heel to the bank's projection is the labor force participation rate - and whether it increases at the rate which Goldman projects.

"The labor force participation rate in India has declined over the last 15 years," the report noted, underlining that women's participation rate in the labor force is "significantly lower" than men's.

"A mere 20% of all working-age women in India are in employment," the investment bank wrote in a separate report in June, citing that the low figure could be due to women being primarily engaged in piecework, which is not accounted for by the economic measures of formal employment.

Net exports have also been a drag on India's growth, because the country runs a current account deficit, Goldman said. The bank highlighted, however, that services exports have been cushioning current account balances.

India's economy is driven by domestic demand, unlike many more export-dependent economies in the region, with up to 60% of its growth mainly attributed to domestic consumption and investments, according to Goldman's report.

S&P Global and Morgan Stanley have also predicted that India is on course to become the third-largest economy by 2030.

(Excerpts From 2022 Research Report by Goldman Sachs.)

III. A Broad Overview of the Indian Economy & Demographics.

A. Again, India is one of the world's fastest growing economies.

Total FDI inflows in the country in the FY 22-23 is $70.97 Bn and total FDI equity inflows stands at $46.03 Bn.

Source: Department of Promotion of Industry and Internal Trade, Govt. of India.

Hon'ble PM Shri Narendra Modi announced a special economic and comprehensive package of more than $270 bn - equivalent to 10% of India's GDP, under the Atmanirbhar Bharat Abhiyan (Self-reliant India).

Source: Prime Minister's Office, Ministry of Finance.

India to Witness GDP Growth of 6% To 6.8% In 2023-24.

Source: Ministry of Finance.

Finally, the IMF also projects India to be the third largest economy in purchasing power parity by 2024.

B. Largest youth population in the world.

The population of India is expected to rise from 121.1 cr to 152.2 cr during 2011-36 an increase of 25.7% in twenty-five years.

Source: National Commission on Population, Ministry of Health & Family Welfare.

India has its largest ever adolescent and youth population. It will continue to have one of the youngest populations in the world till 2030.

Source: United Nations Population Fund.

India has the third-largest group of scientists and technicians in the world.

Source: All India Management Association, The Boston Consulting Group.

The Ministry of Youth Affairs and Sports signed a Statement of Intent with YuWaah with UNICEF to strengthen resolve to mobilize 1 crore youth volunteers to achieve goals of Atmanirbhar Bharat.

Source: Ministry of Youth Affairs.

By 2030, it is estimated that around 42% of India's population would be urbanized from 31% in 2011.

Source: World Bank.

C. Indian infrastructure story

Hon'ble Finance Minister Smt Nirmala Sitharaman announced the National Infrastructure Pipeline first-of-its-kind initiative to provide world-class infrastructure across the country.

The NIP will attract investments into infrastructure and will be crucial for attaining the target of becoming a $5 Tn economy by FY 2025.

Nearly 7,000 projects across different sectors costing above INR 100 Crore per project and totaling INR 111 Lakh Crore have been identified.

Sectors such as Energy (24%), Roads (18%), Urban (17%) and Railways (12%) amount to around 71% of the projected infrastructure investments in India.

Source: Department of Economic Affairs, Ministry of Finance and India Investment Grid.

An equity infusion of INR 6,000 crores has been made in the National Investment and Infrastructure Fund (NIIF) Infrastructure Debt Financing Platform to attract debt and equity investments in infrastructure.

Source: Prime Minister's Office, Ministry of Finance.

India Industrial Land Bank (IILB), a GIS-based portal, is a repository of all industrial infrastructure-related information containing approximately 4,000 industrial parks mapped across an area of 5.5 lakh hectares of land.

Source: Ministry of Commerce & Industry.

D. Rising Global Competitiveness.

India ranks 40th on the Global Competitiveness Index 2023.

Source: International Institute for Management Development.

India jumps 6 places to Rank 38 in World Bank's Logistics Performance Index 2023 (Source: World Bank)

95% of 1.2 billion Indians are covered under Aadhar Scheme, one of the world's largest social security programs.

Source: Press Information Bureau, Government of India.

Pradhan Mantri Jan Dhan Yojana, a formalization of savings scheme under which 312 mn bank accounts have been opened with savings amounting to $11.6 bn.

Source: Ministry of Finance, Government of India.

Goods and Services Tax (GST), the biggest tax reform since independence, paves way for a common national market by integrating various indirect taxes.

Source: Government of India.

E. Global Innovation Index 2022

India climbs to the 40th rank in the Global Innovation Index; a huge leap of 41 places in 7 years.

Source: World Intellectual Property Organization.

India ranks #1 in the Central & Southern Asia Region.

Source: World Intellectual Property Organization.

India ranks 1st amongst the Lower Middle-Income Economy Group.

Source: World Intellectual Property Organization.

F. Rising Economic Influence.

Centre of global maritime trade to move from the Pacific to the Indian Ocean Region. India and China will be the largest manufacturing hubs of the world by 2030.

Source: Lloyd's Register Marine & University of Strathclyde, Glasgow.

Connectivity to Central Asia and Europe via the International North-South Transport Corridor (INSTC).

Source: Press Information Bureau, Government of India.

In the next five years, India to have greater economic influence across the Asia-Pacific Region.

Source: Baker McKenzie & Mergermarket Group (Source: Baker McKenzie & Mergermarket Group.)

VI. Conclusion: Challenges to Direct Investment for US Investors and The India Value Investment Company Proposal Solution.

First there are not a great deal of options when comes to any liquid equities focused exclusively on investment in India in the US. Further Funds lack the flexibility and long-term commitment necessary to take advantage of the opportunities and to maximize shareholder returns and to manage risk. In fact, of all the exchange traded products available none would meet my criteria for a suitable investment. None are sufficiently contrarian in investment philosophy in my judgement. At best they are typical index or mutual funds.

To me the answer is rather obvious. What is needed is a holding company that acts as an investment partnership in corporate form with equity on a major public exchange. Think Berkshire Hathaway India. I would rather think of a fusion of Berkshire Hathaway and the Virgin Group. Deep Value Investment in Industry Group trends to realize low risk capital gains, Value Investment in High Quality companies for long-term capital appreciation, and a Venture Portfolio of small high growth companies and low risk assets with the potential to produce stellar returns. Railroads, Ports, Wind and Solar Farms are areas of interest through minority investment in local companies to leverage public private partnerships.

My Proposal: The India Value Investment Company. It should have a goal of raising at least a billion dollars in investment capital. It should be run by a professional management team with a strong track record of success. As CEO I must go to India and investigate potential investments firsthand. It should focus on building a portfolio of investments in the following areas: Energy & Infrastructure, Food & Pharma, Retail & Staples, Agriculture & Materials, Industrials & Technology, Consumer Goods & Services, Financial & Insurance operations. In addition, the opportunity for stock, futures and commodities arbitrage between the Indian, US & UK Exchanges is obvious. Finally, Private Equity, Venture Capital, Trade Finance and Insurance operations would also be available to us as a holding company. Reinsurance is much needed and would provide access to low cost float.

An International Business Company incorporated in the The Seychelles, a British Commonwealth Nation in the Indian Ocean. Offices in the US, UK, and India. Listings on the NYSE, LSE & NSE. Also a membership on NSE for direct access to trading in Indian Shares. All this would provide us with a broad international shareholder base, access to global capital markets, and a strong local presence in India. Including exclusive research capabilities to talke with customers, suppliers and financiers of target companies.

This is my answer at any rate. I am enthusiastic to begin. This paper is to gauge interest from the investment and financial communities. If you have interest in partnering on this idea in any way, please contact me. A contact form is provided on the website of serapiscapital.com. Please add IVIC on the form. All inquiries are welcome and appreciated.

Thank-you,

Kevin D. Fulton

CEO, Serapis Capital Corp. & The India Value Investment Company.

243 Big Lake Dr. Andrews, SC 29510

A New Alternative For Alternative Investment. Global Macro Without High Hedge Fund Fees.

Strategic Global Investing Across Asset Classes & Industry Groups.

Long & Short Positions In Stocks, Bonds, Currencies, & Commodities.

Investing For Absolute Returns To Generate High Growth & Income.

Quantitative & Qualitative. Systematic & Discretionary Methodology.

A Primary Focus On Capital Preservation, Risk & Money Management.

Indentifies Long Term Cycles, Trends, & Major Market Inflection Points.

Seeks To Capture Asymmetric Opportunities. Large Profits At Low Risk.

Pre-IPO Private Equity Investment Opportunity in Serapis Capital Stock.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Proposing New Value Driven US Investment in India here

News-ID: 3239193 • Views: …

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…