Press release

Dual Interface Payment Card Market: Global Trends, Growth Opportunity To Reach $37.9 Billion by 2032

Dual interface payment card provides both contact less and contact-based capabilities to various industries, reducing operational costs, increasing efficiency & accuracy, and improving customer experience. It is made of a kind of smart card with an embedded chip that can enable both contact and contactless transactions. Moreover, contactless capabilities have become increasingly important as businesses strive to streamline their operations and increase productivity. Such dual interface payment card market trends provide lucartive opportunities for the market growth during the forecast period. In addition, dual interface payment cards provide effective payment processing convenience. With the growth of urbanization, there is an increase in demand for intelligent banking systems that can improve the flow of payment systems. As a result, the dual interface payment card market expansion is driven by the need for intelligent and automated payment systems that can process and analyze vast amounts of data in real-time, enabling organizations to make informed decisions and take actions based on data-driven insights.Allied Market Research published a report, titled, "Dual Interface Payment Card Market by Type (Plastic and Metal) and End User (Retail & E-commerce, Transportation Healthcare, Hospitality & Tourism, and Others): Opportunity Analysis and Industry Forecast, 2023-2032." According to the report, the dual interface payment card industry generated $7.8 billion in 2022, and is anticipated to generate $37.9 billion by 2032, witnessing a CAGR of 17.4% from 2023 to 2032.

Download Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/109287

Prime Determinants of Growth:

The global dual interface payment card market is driven by the increase in demand for contactless payments, the rise in adoption of internet banking, and the growth in adoption of various strategies by government authorities and businesses. However, high initial costs and expenses and a lack of consumer knowledge and awareness restrict market growth. Furthermore, the surge in the integration of advanced technologies offers a strong opportunity for the dual interface payment card industry. In addition, the growing utilization of NFC infrastructure is also expected to provide lucrative opportunities for market growth during the forecast period.

The plastic segment to maintain its leadership status throughout the forecast period-

Based on type, the plastic segment held the highest market share in 2022, accounting for nearly three-fourths of the global dual interface payment card market revenue, and is estimated to maintain its leadership status throughout the forecast period. Several businesses started to provide eco-friendly plastic cards produced from recycled plastic, from BFSI to manufacturing and healthcare. However, the metal segment would display the highest CAGR of 20.7% from 2023 to 2032. Metal-based cards play a vital role in the dual interface payment card market, and due to their endurance compared to plastic-based cards, metal cards are becoming more popular.

Request Customization@ https://www.alliedmarketresearch.com/request-for-customization/109287

The retail segment to maintain its lead position during the forecast period-

Based on end user, the retail segment accounted for the largest share in 2022, contributing to more than two-fifths of the global dual interface payment card market revenue, and is expected to maintain its lead position during the forecast period.

Outdoor dual interface payment card solutions offer a wide range of benefits for the retail industry, including a contactless payment option. These solutions provide detailed and up-to-date payment solutions that help users in the retail sector.

However, the hospitality and tourism segment would portray the fastest CAGR of 23.3% from 2023 to 2032. The increased international travel and growing demand for mobile payment options in these sectors are expected to contribute to market growth.

North America region to maintain its dominance by 2032-

Based on region, the North America segment held the highest market share in terms of revenue in 2022, accounting for more than one-third of the global dual interface payment card market revenue. due to the increase in investment in advanced technologies such as cloud-based services, AI, ML, and IoT to improve banking and finance businesses and the customer experience. Thus, it is anticipated to propel the growth of the market. On the other hand, the Asia-Pacific region is expected to maintain its dominance throughout the forecast period. The same region is expected to witness the fastest CAGR of 19.1% from 2023 to 2032, owing to an increase in penetration of digitalization and higher adoption of advanced technology.

Inquiry before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/109287

Leading Market Players: -

Thales Group

CPI Card Group Inc.

Eastcompeace Technology Co., Ltd.

Giesecke+Devrient GmbH

Goldpac

IDEMIA

Infineon Technologies AG

Paragon Group Limite

Watchdata Co., Ltd.

Wuhan Tianyu Information Industry Co., Ltd.

The report provides a detailed analysis of these key players in the global dual interface payment card market. These players have adopted different strategies, such as new product launches, collaborations, expansion, joint ventures, agreements, and others, to increase their market share and maintain dominant positions in different countries. The report is valuable in highlighting business performance, operating segments, product portfolios, and strategic moves of market players to showcase the competitive scenario.

Top Trending Reports:

Digital Business Card Market https://www.alliedmarketresearch.com/digital-business-card-market-A108801

E-brokerage Market https://www.alliedmarketresearch.com/e-brokerage-market-A15390

Rideshare Insurance Market https://www.alliedmarketresearch.com/rideshare-insurance-market-A74742

Commercial Paper Market https://www.alliedmarketresearch.com/commercial-paper-market-A15386

Credit Default Swaps Market https://www.alliedmarketresearch.com/credit-default-swap-market-A15388

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow us on LinkedIn and Twitter

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms the utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high-quality data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Dual Interface Payment Card Market: Global Trends, Growth Opportunity To Reach $37.9 Billion by 2032 here

News-ID: 3236511 • Views: …

More Releases from Allied Market Research

Americas Paints and Coatings Market Aims to Expand at Double-Digit Growth Rate b …

Allied Market Research published a report, titled, "Americas Paints and Coatings Market By Resin Type (Acrylic, Alkyd, Epoxy, Polyester, Vinyl, and Others), By Product Type (Waterborne Coatings, Solvent-borne Coatings, Powder Coatings, and Others), By Application (Coil and Can Coatings, Automotive Car Refinishing, Automotive Parts (OEM Coatings), Wood Coatings, Industrial Coatings, Architectural Coatings, Marine Protective Coatings, and, Others): Americas Opportunity Analysis And Industry Forecast, 2023-2032". According to the report, the Americas…

Milk Powder Market Size worth USD 50.7 Billion Globally, by 2031 at a CAGR of 4. …

The global milk powder industry was generated $29.6 billion in 2021, and is anticipated to generate $50.7 billion by 2031, witnessing a CAGR of 4.8% from 2022 to 2031.

The global milk powder market is driven by factors such as growth in the expansion of the dairy industry along with the rise in the adoption of organic food among health-conscious consumers. However, the increase in the availability of milk powder alternatives…

U.S Packaging and Protective Packaging Market Growth, Share to 2032

Allied Market Research published a report, titled, "U.S. Packaging and Protective Packaging Market By Material (Paper and Paper Board, Rigid Plastics, Flexible, Metal, Glass, and Others), By Function (Cushioning, Blocking and Bracing, Void-fill, Insulation, Wrapping, and Others), and By Application (Food, Beverage, Healthcare, Cosmetics, Industrial, and Others): Global Opportunity Analysis And Industry Forecast, 2023-2032". According to the report, the U.S. packaging and protective packaging market was valued at $185.3 billion…

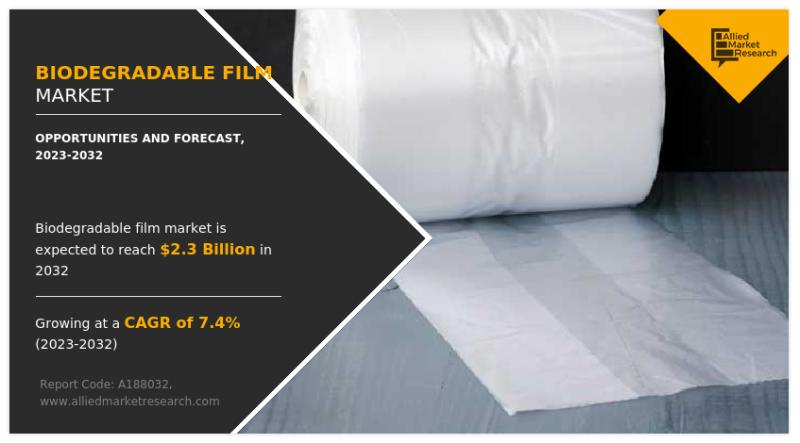

Biodegradable Film Market Forecast 2032 | An overview of Technology with Excitin …

Allied Market Research published a report, titled, "The biodegradable films market is segmented on the basis of raw material, application, and region. On the basis of raw material, the market is categorized into polylactic acid (PLA), biodegradable starch, polyhydroxyalkanoates (PHA), and others. On the basis of application, it is divided into food packaging, agriculture mulching, pharmaceutical packaging, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…