Press release

Digital Payment Market Industry Trends, Future Demands And Growth Factors

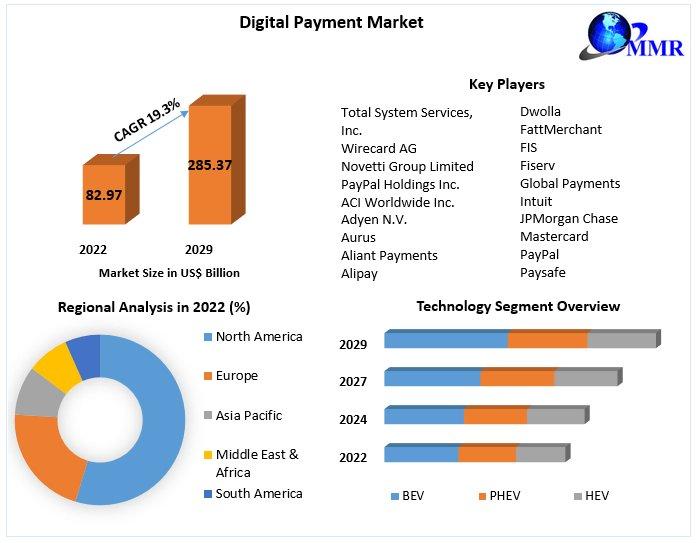

Digital Payment Market expected to reach USD 285.37 Billion by 2029, exhibiting a CAGR of 19.3 % during the forecast period (2023-2029).Digital Payment Market Report Scope and Research Methodology

The comprehensive analysis report offers valuable insights into the dynamics, trends, and future prospects of the Digital Payment industry during the forecast period. It covers key market drivers, challenges, and recent developments, along with demand trends, growth stimulators, spending patterns, and modernization trends across different regions.

Research Methodology:

The research report relies on a combination of primary and secondary data sources. It investigates various factors affecting the digital payment market, including government policies, market dynamics, competitive landscapes, historical data, current trends, technological innovations, and upcoming technologies. Additionally, the report assesses market risks, opportunities, barriers, and challenges. All influencing factors have undergone rigorous analysis, validation through primary research, and evaluation to provide comprehensive quantitative and qualitative data. The report normalizes market sizes for top-level markets and sub-segments while accounting for variables such as inflation, economic downturns, regulatory changes, and more. Detailed inputs and analysis are synthesized to present a comprehensive research report.

Know More About The Report: https://www.maximizemarketresearch.com/market-report/digital-payment-market/16835/

What are Digital Payment Market Dynamics?

Initiatives for the Promotion of Digital Payments: Governments worldwide are utilizing ICT technology to promote digital payments. Measures like Digital India, the introduction of the Unified Payments Interface (UPI), and helpline numbers are driving the transition to digital payments. These initiatives aim to increase productivity, transparency, tax revenue, financial inclusion, and economic opportunities for end users.

Rapid Decline in Unbanked Population: Governments, development organizations, and private sector entities are working to provide financial services to rural and remote populations, resulting in increased access to financial services. Initiatives like the Pradhan Mantri Jan Dhan Yojana in India have significantly reduced the number of unbanked individuals.

Evolving Cyber Attacks on Digital Payments: The rising use of digital payment systems has brought about increased cybersecurity risks, including cyber theft and fraud. Businesses and payment systems are vulnerable to various cyberattacks, affecting security and regulatory compliance. Cyberattacks have the potential to delay the adoption of digital payment systems and services.

Lack of Global Standards for Cross-Border Payments: Cross-border commerce has seen significant growth, but a lack of global payment systems, standardization, and varying government regulations in different countries hinder efficient cross-border payments. This issue negatively impacts banks and businesses and necessitates interventions to collect and restore data for cross-border transactions.

Digital Payment Market Segmentation?

Solution: In 2022, the payment processing segment dominated the digital payment market, accounting for approximately 25.0% of global revenue. Retailers are adopting payment processing solutions to enhance checkout experiences as online shopping preferences continue to rise. Mergers, acquisitions, and collaborations are being pursued by payment processing solution providers to strengthen their market presence.

Mode of Payment: In 2022, the point-of-sale segment led the digital payment market, contributing over 52.0% of global revenue. Point-of-sale systems streamline transactions, offer personalized customer experiences, and provide various payment options, benefiting retailers and restaurants.

Deployment: The on-premise segment held a dominant position in 2022, representing around 65.0% of global revenue. On-premise digital payment solutions offer businesses control over their applications and systems while safeguarding against security threats.

Enterprise Size: In 2022, large enterprises dominated the digital payment market, accounting for over 60.0% of global revenue. Large retailers utilize digital payment systems to facilitate quick checkouts and provide customers with a convenient payment experience.

End-User: In 2022, the BFSI sector led the market, contributing more than 23.0% of global revenue. Remittances to low- and middle-income countries, along with competition from tech giants like Google, Amazon, and Facebook, are driving the growth of the BFSI sector.

Please connect with our representative, who will ensure you to get a report sample here @ : https://www.maximizemarketresearch.com/request-sample/16835

Who are Digital Payment Market Key Players?

1. Total System Services, Inc.

2. Wirecard AG

3. Novetti Group Limited

4. PayPal Holdings Inc.

5. ACI Worldwide Inc.

6. Adyen N.V.

7. Aurus

8. Aliant Payments

9. Alipay

10. Apple Pay

11. Dwolla

12. FattMerchant

13. FIS

14. Fiserv

15. Global Payments

16. Intuit

17. JPMorgan Chase

18. Mastercard

19. PayPal

20. Paysafe

21. PayTrace

22. PayU

23. Spreedly

24. Square

25. Stripe

26. Visa

27. WEX

28. Worldline

29. 2Checkout

Table of content for the Digital Payment Market includes:

Part 01: Executive Summary

Part 02: Scope of the Digital Payment Market Report

Part 03: Global Digital Payment Market Landscape

Part 04: Global Digital Payment Market Sizing

Part 05: Global Digital Payment Market Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

For more Information Click Here @ : https://www.maximizemarketresearch.com/request-sample/16835

Regional Insights:

North America: Dominated the global market in 2022, with over 34.0% of total sales. Increased deployment and technological advancements, such as contactless payments, have driven growth in the region.

Europe: Expected to witness significant growth, driven by initiatives to develop a European payment system and the Italian government's push for electronic payments.

Asia-Pacific: Anticipated to experience rapid growth, with digital wallets becoming the preferred payment method. China, Japan, South Korea, and India are key players in the region's digital payment market.

Key Offerings:

Past Market Size and Competitive Landscape (2018 to 2021)

Past Pricing and price curve by region (2018 to 2021)

Market Size, Share, Size & Forecast by different segment | 2022-2029

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Related Reports:

Automotive Radar Market: https://www.maximizemarketresearch.com/market-report/automotive-radar-market/12957/

Automotive Logistics Market: https://www.maximizemarketresearch.com/market-report/global-automotive-logistics-market/27272/

Cyber Security Market: https://www.maximizemarketresearch.com/market-report/cyber-security-market/12519/

5G Technology Market: https://www.maximizemarketresearch.com/market-report/global-5g-technology-market/29458/

Turbines Market: https://www.maximizemarketresearch.com/market-report/global-turbines-market/148221/

Machine Safety Market: https://www.maximizemarketresearch.com/market-report/global-machine-safety-market/25369/

Global Inbound Support Market: https://www.maximizemarketresearch.com/market-report/global-inbound-support-market/91385/

Global Molten Salt Reactor Market: https://www.maximizemarketresearch.com/market-report/global-molten-salt-reactor-market/102879/

Global Cotton Processing Market: https://www.maximizemarketresearch.com/market-report/global-cotton-processing-market/23790/

Global Costume Jewellery Market: https://www.maximizemarketresearch.com/market-report/global-costume-jewellery-market/21622/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

+1 800 507 4489 +91 9607365656

sales@maximizemarketresearch.com

www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Payment Market Industry Trends, Future Demands And Growth Factors here

News-ID: 3234334 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…