Press release

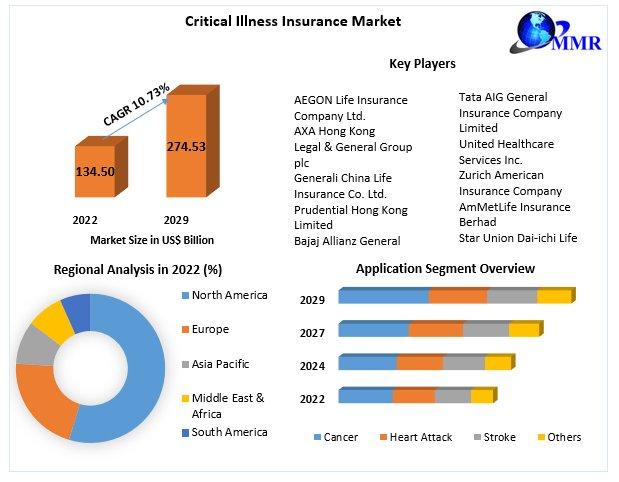

Critical Illness Insurance Market 2023-2029 | Data-driven Growth at 10.73% CAGR

Critical Illness Insurance Market Report Scope and Research Methodology:The Critical Illness Insurance Market Report is a testament to our commitment to providing comprehensive and reliable insights in the domain of insurance. Our research methodology is designed to deliver a thorough and accurate analysis of this critical sector. It encompasses a meticulous process that includes extensive data collection, robust analysis, and in-depth market assessments. Through this approach, we offer valuable information about market dynamics, emerging trends, key players, and growth opportunities within the critical illness insurance landscape. By employing a combination of primary and secondary research sources, as well as advanced analytical tools, our report ensures that businesses, stakeholders, and decision-makers receive a credible and holistic resource to navigate the complexities of the Critical Illness Insurance Market. As the insurance industry continues to evolve, our report remains a vital tool for staying informed and making informed decisions in this ever-changing landscape.

Get to Know More About This Market Study: https://www.maximizemarketresearch.com/market-report/critical-illness-insurance-market/126758/

What are Critical Illness Insurance Market Dynamics:

The dynamics within the Critical Illness Insurance Market are influenced by several pivotal factors, making it a sector of profound importance in the insurance industry. One of the key drivers is the increasing awareness among individuals about the financial risks associated with critical illnesses, such as cancer, heart disease, and stroke. This heightened awareness is prompting more people to seek critical illness insurance as a means to safeguard their financial well-being in the event of a severe health crisis. Additionally, the evolving healthcare landscape, rising medical costs, and the prevalence of high-deductible health plans are driving the demand for critical illness insurance, as it provides a financial safety net for policyholders, covering medical expenses and other costs that traditional health insurance may not fully address.

Moreover, the market is marked by ongoing product innovation and customization by insurance providers. This includes tailoring policies to cater to specific diseases or conditions, offering riders for additional coverage, and incorporating wellness programs to promote healthier lifestyles and reduce the risk of critical illnesses. Regulatory changes and an aging population are also contributing to the market dynamics, with governments and insurers adapting to meet the evolving needs of policyholders. These multifaceted dynamics collectively shape the Critical Illness Insurance Market, highlighting its significance in providing financial security and peace of mind to individuals and families facing severe health challenges.

Request a Free Sample Copy or View Report Summary: https://www.maximizemarketresearch.com/request-sample/126758

Critical Illness Insurance Market Regional Insights:

Regional insights into the Critical Illness Insurance Market unveil a nuanced landscape shaped by varying healthcare systems, economic conditions, and consumer awareness. In North America, particularly the United States, a mature insurance market and the prevalence of high medical costs drive substantial demand for critical illness insurance. The European market showcases growth potential, with countries like the United Kingdom and Germany seeing increased interest in such insurance products due to rising healthcare costs and changing demographics. The Asia-Pacific region, including emerging markets like India and China, presents a growing opportunity as healthcare awareness spreads, and the middle class seeks financial protection against critical illnesses. In Latin America and Africa, while the penetration of critical illness insurance remains lower, there is a rising awareness of the benefits it offers, signaling potential for market expansion. These regional variations underscore the adaptability and importance of critical illness insurance as individuals and families worldwide seek financial security in the face of severe health challenges.

Request For Free Inquiry Report: https://www.maximizemarketresearch.com/inquiry-before-buying/126758

What is Critical Illness Insurance Market Segmentation:

The segmentation of the Critical Illness Insurance Market is structured to provide a comprehensive understanding of its multifaceted landscape. One of the primary segmentation criteria is based on the types of critical illnesses covered. Policies are often categorized to include major conditions such as cancer, heart disease, stroke, and organ transplants, among others. This allows policyholders to choose coverage that aligns with their specific health concerns and financial needs.

Another pivotal segmentation is by policy type, differentiating between standalone critical illness policies and riders attached to life insurance policies. Standalone policies offer comprehensive coverage solely for critical illnesses, while riders provide an additional layer of protection alongside traditional life insurance coverage.

Request For Customization Report: https://www.maximizemarketresearch.com/request-sample/126758

Who are Critical Illness Insurance Market Key Players:

1. AEGON Life Insurance Company Ltd.

2. AXA Hong Kong

3. Legal & General Group plc

4. Generali China Life Insurance Co. Ltd.

5. Prudential Hong Kong Limited

6. Bajaj Allianz General Insurance Co. Ltd.

7. Tata AIG General Insurance Company Limited

8. United Healthcare Services Inc.

9. Zurich American Insurance Company

10.AmMetLife Insurance Berhad

11.Star Union Dai-ichi Life Insurance Company Limited

12.Sun Life Assurance Company of Canada.

13.AFLAC INCORPORATED

14.Liberty General Insurance Ltd.

15.HCF

16.Future Generali India Insurance Company Ltd.

17.Religare Health Insurance Company Limited

18.Cigna.

19.The Guardian Life Insurance Company of America

20.Mutual of Omaha Insurance Company

Table of content for the Critical Illness Insurance Market includes:

1. Global Critical Illness Insurance Market: Research Methodology

2. Global Critical Illness Insurance Market: Executive Summary

● Market Overview and Definitions

● Introduction to the Global Market

● Summary

● Key Findings

● Recommendations for Investors

● Recommendations for Market Leaders

● Recommendations for New Market Entry

3.Global Critical Illness Insurance Market: Competitive Analysis

● MMR Competition Matrix

● Market Structure by region

● Competitive Benchmarking of Key Players

● Consolidation in the Market

● M&A by region

● Key Developments by Companies

● Market Drivers

● Market Restraints

● Market Opportunities

● Market Challenges

● Market Dynamics

● PORTERS Five Forces Analysis

● PESTLE

● Regulatory Landscape by region

● North America

● Europe

● Asia Pacific

● Middle East and Africa

● South America

● COVID-19 Impact

4 . Company Profile: Key players

● Company Overview

● Financial Overview

● Global Presence

● Capacity Portfolio

● Business Strategy

● Recent Developments

Key Offerings:

● Past Market Size and Competitive Landscape (2023 to 2029)

● Past Pricing and price curve by region (2023 to 2029)

● Market Size, Share, Size and Forecast by different segment | 2023-2029

● Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

● Market Segmentation - A detailed analysis by growth and trend

● Competitive Landscape - Profiles of selected key players by region from a strategic perspective

● Competitive landscape - Market Leaders, Market Followers, Regional player

● Competitive benchmarking of key players by region

● PESTLE Analysis

● PORTER's analysis

● Value chain and supply chain analysis

● Legal Aspects of business by region

● Lucrative business opportunities with SWOT analysis

● Recommendations

More Related Reports:

Base Oil Market https://www.maximizemarketresearch.com/market-report/global-base-oil-market/105579/

Modular Construction Materials Market https://www.maximizemarketresearch.com/market-report/modular-construction-materials-market/189237/

Hereditary Angioedema Therapeutic Market https://www.maximizemarketresearch.com/market-report/hereditary-angioedema-therapeutic-market/37140/

Airway Management Devices Market https://www.maximizemarketresearch.com/market-report/global-airway-management-devices-market/10863/

Acrylic Adhesives Market https://www.maximizemarketresearch.com/market-report/global-acrylic-adhesives-market/97225/

Gluten Free Food Market https://www.maximizemarketresearch.com/market-report/gluten-free-food-market/145990/

Global Speech and Voice Recognition Market https://www.maximizemarketresearch.com/market-report/global-speech-and-voice-recognition-market/26054/

Global Artificial Intelligence in Retail Market https://www.maximizemarketresearch.com/market-report/artificial-intelligence-ai-in-retail-market/1893/

Tokenization Market https://www.maximizemarketresearch.com/market-report/global-tokenization-market/22137/

Biofuels Market https://www.maximizemarketresearch.com/market-report/global-biofuels-market/32557/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

At Maximize Market Research, our identity as a versatile and adaptable market research and consulting firm is the cornerstone of our success. What truly sets us apart is the remarkable strength of our team-a collective of seasoned professionals, each bringing a wealth of experience from diverse backgrounds and industries. This rich tapestry of expertise is our greatest asset, empowering us to deliver meticulously researched insights, in-depth analyses of technical trends, strategic guidance, and comprehensive competitive landscape assessments to our valued clients. Our unwavering commitment revolves around arming businesses with the knowledge and foresight they require to not just survive but thrive in today's fast-paced and ever-evolving market landscape. With adaptability and innovation serving as our guiding principles, we are steadfast in our dedication to being the driving force behind our clients' journeys towards success.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Critical Illness Insurance Market 2023-2029 | Data-driven Growth at 10.73% CAGR here

News-ID: 3233938 • Views: …

More Releases from Maximize Market Research

Military Lighting Market to Reach USD 873.02 Million by 2032

◉ Global Military Lighting Market Poised for Strategic Growth Amid Technological Advancements and Regional Developments

The global military lighting market is on a trajectory of steady growth, driven by technological innovations, increased defense budgets, and the modernization of military infrastructures worldwide. Valued at approximately USD 622.42 million in 2024, the market is projected to reach nearly USD 873.02 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.32% during…

Ethylene Vinyl Acetate Market Set to Reach USD 12.92 Billion by 2030 Amidst Stra …

◉ Global Ethylene Vinyl Acetate Market Poised for Robust Growth Amidst Regional Opportunities and Industry Consolidations

The global Ethylene Vinyl Acetate (EVA) market is on a trajectory of significant expansion, with projections indicating a rise from USD 8.31 billion in 2023 to approximately USD 12.92 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period. This growth is primarily driven by escalating demand across various…

Lithium Metal Market Projection: USD 7723.7 Million by 2029, Alpha-En Corporatio …

Anticipated Growth in Revenue:

Lithium Metal Market size was valued at USD 2071.5 Million in 2022 and the total Lithium Metal Market revenue is expected to grow at a CAGR of 20.7% from 2023 to 2029, reaching nearly USD 7723.7 Million.

Lithium Metal Market Overview:

In the realm of the lithium metal market, the substance stands as a pivotal element renowned for its lightweight and highly reactive nature. Its significance is underscored…

Global Coordinate Measuring Machine Market (CMM) Projection: CAGR 8.3% (2029), F …

Anticipated Growth in Revenue:

Coordinate Measuring Machine Market (CMM) size is expected to reach nearly US$ 6.26 Bn by 2029 with the CAGR of 8.3% during the forecast period.

Global Coordinate Measuring Machine Market (CMM) Overview:

The Global Coordinate Measuring Machine (CMM) Market report provides an in-depth analysis of the impact of the COVID-19 lockdown on market leaders, followers, and disruptors. The lockdown measures were implemented differently across regions and countries, resulting…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…