Press release

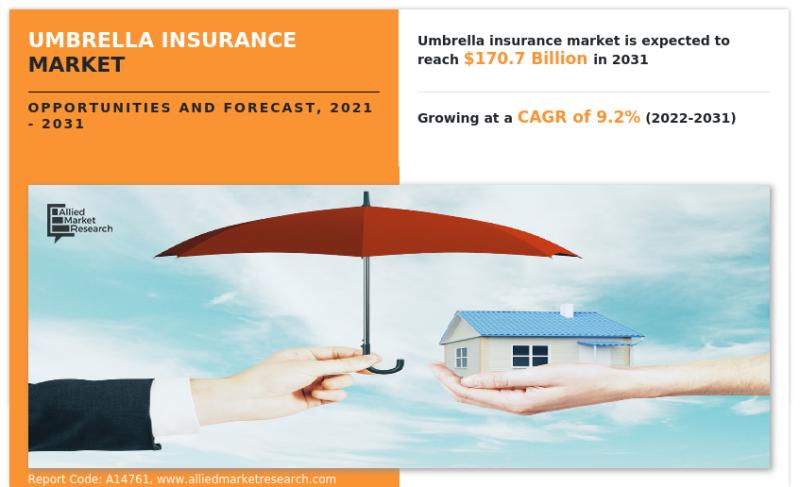

Umbrella Insurance Market 2021 - Global Industry Expected to Grow at CAGR of 9.2% and Forecast to 2031

Umbrella insurance is a type of casualty insurance created to protect customers from fateful liability claims that may exceed the policy limits of their primary commercial general liability coverage under a conventional business insurance policy, business auto policy, and other business insurance solutions. It is a cost-effective strategy to considerably raise liability limits to protect against fateful claims in an uncertain world.Allied Market Research published a report, titled, "Umbrella Insurance Market by Coverage (Bodily Injury, Property Damage, Personal Liability, Lawsuit), by Distribution Channel (Insurance Agents and Brokers, Direct Response, Banks, Others), by End User (Personal, Business): Global Opportunity Analysis and Industry Forecast, 2021-2031" According to the report, the global umbrella insurance industry generated $72.5 billion in 2021, and is estimated to reach $170.7 billion by 2031, witnessing a CAGR of 9.2% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chains, regional landscapes, and competitive scenarios.

Download Sample Report @ https://www.alliedmarketresearch.com/request-sample/15130

Drivers, Restraints, and Opportunities-

Increase in demand for umbrella insurance as it minimizes business risks and surge in consumer awareness among people drive the growth of the global umbrella insurance market. On the other hand, rise in fraudulent activities and lack of knowledge about umbrella insurance policies impede the growth to some extent. However, high-end technological investments in the field of insurance are expected to create lucrative opportunities for the key players in the industry.

The bodily injury segment to maintain its dominance during the forecast period-

By coverage, the bodily injury segment held around two-fifths of the global umbrella insurance market revenue in 2021, and is expected to retain its dominance by 2031. This is because it includes the cost of medical bills and/or liability claims due to injuries caused by accidents where the policyholder is at fault. The lawsuit segment, simultaneously, would display the fastest CAGR of 13.3% from 2022 to 2031. Umbrella insurance policies tend to cover businesses from lawsuits along with other legal problems. Umbrella insurance can be expensive, but it is very useful to run a business smoothly. Moreover, the liability coverage on policy helps cover the cost of lawsuits, including legal defense and any damages they are ordered to pay to a third party.

The insurance agents and brokers segment to rule the roost-

By distribution channel, the insurance agents and brokers segment held the lion's share in 2021, garnering more than two-fifths of the global umbrella insurance market revenue, and is projected to retain its dominance by 2031. This is due to the fact that insurance agents and brokers are investing in digital technologies to provide assistance online and increase sales and margins. The direct response segment, on the other hand, would portray the fastest CAGR of 12.0% from 2022 to 2031. This is attributed to the fact that direct response is easily measured, which makes it easy for insurance agents and companies to assess the performance of a campaign. In addition, direct mail response activities can be hidden from competitors, which is a great benefit for umbrella insurance providers as the insurance industry is highly competitive.

The personal segment maintained the lion's share by 2031-

By end user, the personal segment accounted for the major share in 2021, holding nearly two-thirds of the global umbrella insurance market revenue. Rising number of independent consultants leaving the corporate world or large enterprises to form a sole proprietorship or limited liability company fuels the segment growth. Additionally, risk management is important for every industry including liability coverage that protects the individual from financial crisis and legal consequences. The business segment, however, would display the fastest CAGR of 11.2% throughout the forecast period. This is because business umbrella insurance protects the financial interests of business owners from penalties they may face from litigation waged against them while also covering the associated legal costs.

Interested to Procure the Data? Inquire Here@ https://www.alliedmarketresearch.com/purchase-enquiry/15130

North America garnered the major share in 2021-

By region, North America contributed to nearly two-fifths of the global umbrella insurance market share in 2021, and is expected to rule the roost by 2031. Massive increase in natural hazards across the province drives the market growth. Also, with the rise in security concerns, various small business owners have gained awareness of this insurance policy. Simultaneously, Asia-Pacific would showcase the fastest CAGR of 11.7% from 2022 to 2031. Increase in demand from customers expecting fast, seamless insurance services, as well as customized user experiences, propels the market growth.

Leading Market Players-

GEICO

Insureon

NerdWallet

The Hartford and Travelers

Nationwide

Progressive Casualty Insurance Company

CAN

Tata AIG General Insurance Company Limited

The report analyzes these key players in the global umbrella insurance market. These players have adopted various strategies such as expansion, new product launches, partnerships, and others to increase their market penetration and strengthen their position in the industry. The report is helpful in determining the business performance, operating segments, developments, and product portfolios of every market player.

Similar Reports We Have on the BFSI Industry:

Retail Cash Management Market https://www.alliedmarketresearch.com/retail-cash-management-market-A16646

Balanced Funds Market https://www.alliedmarketresearch.com/balanced-funds-market-A16645

Financial Planning Software Market https://www.alliedmarketresearch.com/financial-planning-software-market-A16422

Liability Insurance Market https://www.alliedmarketresearch.com/liability-insurance-market-A15352

Parametric Insurance Market https://www.alliedmarketresearch.com/parametric-insurance-market-A14966

Europe Open Banking Market https://www.alliedmarketresearch.com/europe-open-banking-market-A16019

U.S. Auto Extended Warranty Market https://www.alliedmarketresearch.com/us-auto-extended-warranty-market-A15995

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow us on LinkedIn and Twitter

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Umbrella Insurance Market 2021 - Global Industry Expected to Grow at CAGR of 9.2% and Forecast to 2031 here

News-ID: 3232366 • Views: …

More Releases from Allied Market Research

![[CAGR of 5.4%] Carbon Molecular Sieves Market Size, 2026 | Growing Demand and Business Outlook by 2031](https://cdn.open-pr.com/L/2/L227367535_g.jpg)

[CAGR of 5.4%] Carbon Molecular Sieves Market Size, 2026 | Growing Demand and Bu …

The global carbon molecular sieves market was estimated at $0.9 billion in 2021 and is expected to hit $1.4 billion by 2031, registering a CAGR of 5.4% from 2022 to 2031.

According to the report published by Allied Market Research, The report provides a detailed analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and evolving market trends. The market study…

![Thermal Interface Material Market [2026-2031], Rapidly Growing Industry at a CAGR of 8.8%](https://cdn.open-pr.com/L/2/L227287363_g.jpg)

Thermal Interface Material Market [2026-2031], Rapidly Growing Industry at a CAG …

According to the report published by Allied Market Research, the global thermal interface material market was estimated at $4.7 billion in 2021, and is projected to reach $10.8 billion by 2031, growing at a CAGR of 8.8% from 2022 to 2031. The report provides a detailed analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and evolving market trends. The market…

![[CAGR of 4.1%] Malic Acid Market Size Prospects 2026: Trends and Growth Analysis, Forecast to 2031](https://cdn.open-pr.com/L/2/L227735373_g.jpg)

[CAGR of 4.1%] Malic Acid Market Size Prospects 2026: Trends and Growth Analysis …

According to the report published by Allied Market Research, the global malic acid market garnered $187.6 million in 2021, and is estimated to generate $279.8 million by 2031, manifesting a CAGR of 4.1% from 2022 to 2031. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers a valuable guidance to leading players, investors, shareholders, and startups in…

Beta-Alanine Market is Anticipated to Generate USD 724.9 Million by 2033 | AMR

Allied Market Research recently published a report titled, "Global Beta-Alanine Market - Opportunity Analysis and Industry Forecast, 2020-2030". According to the report, the recent technological advancements and launch of new products have a significant influence on the growth. The report includes a detailed analysis of the market trends, major driving factors, prime market players, and top investment pockets. It is vital for new market entrants, stakeholders, and shareholders to make…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…