Press release

Insurance Analytics Market Report: Unveiling Growth Trends and Opportunities

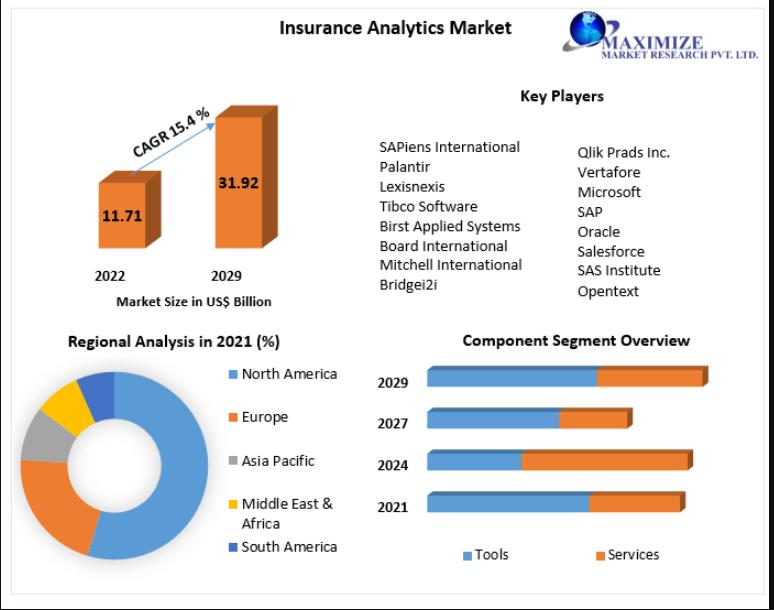

Insurance Analytics Market size was valued at US$ 11.71 Bn. in 2022 and the total revenue is expected to grow at 15.4 % through 2023 to 2029, reaching nearly US$ 31.92 Bn.Insurance Analytics Market Report Scope and Research Methodology

The report covers the market's segments, including application areas like Claims Management, Risk Management, Customer Management and Personalization, and Process Optimization. It also delves into deployment modes (Cloud and On-premises) and organizational sizes (Large Enterprises and SMEs). The study incorporates a thorough analysis of market dynamics, drivers, restraints, and regional insights.

Know More About The Report: https://www.maximizemarketresearch.com/market-report/global-insurance-analytics-market/7775/

What are Insurance Analytics Market Dynamics?

The global Insurance Analytics Market is witnessing substantial growth due to factors such as increasing digitalization within the insurance industry, the adoption of advanced analytics for data-driven decision-making, and the rising popularity of insurance analytics among small and medium-sized businesses. Additionally, the integration of IoT technology in insurance, especially cloud-based solutions, is expected to drive significant growth.

Insurance Analytics Market Segmentation:

Institutional investors can utilize insurance analytics for risk management to get a pre-programmed answer that will help them make better choices. Additionally, it reveals a hidden pattern in the data and offers information on impending dangers, enabling insurers to take risk-aversion procedures. These elements will increase interest in the risk management market. Insurance companies must effectively utilize their data to forecast possible market hazards, put remedies in place to reduce losses, and ultimately foster sector development. The market is anticipated to be further fueled by the increase in demand for data leveraging.

Insurance analytics technology may easily link with third-party apps thanks to cloud deployment, which also ensures the security of their online services. Pay-as-you-go cloud-based analytics solutions are also available, negating the need for up-front infrastructure investments. Cloud apps are being used by businesses more frequently because they satisfy regulatory standards. For instance, Snowflake Inc., a provider of cloud data warehouse software for insurers, offers a cloud-built data warehouse that is FedRAMP Ready, HIPAA compliant, and authorized by the Payment Card Industry Security Standards Council.

The use of insurance analytics is being prioritized by many sizable businesses in an effort to boost customer loyalty while reducing overall infrastructure costs. Large organizations may also adhere to federal regulations and standards including HIPAA, the Payment Card Industry Data Security Standard, and the Federal federal thanks to insurance analytics solutions. The category is anticipated to increase as a result. Insurance companies want a lot of information. By utilizing insurance analytics, these organizations may get and analyze both unstructured data from public sources, such as social media, and structured data associated with policyholders.

Request For Free Sample Report: https://www.maximizemarketresearch.com/request-sample/7775

Who are Insurance Analytics Market Key Players?

1. SAPiens International

2. Palantir

3. Lexisnexis

4. Tibco Software

5. Birst Applied Systems

6. Board International

7. Mitchell International

8. Bridgei2i

9. Qlik Prads Inc.

10.Vertafore

11.Microsoft

12.SAP

13.Oracle

14.Salesforce

15.SAS Institute

16.Opentext

17.Tableau Software

18.Verisk Analytics

19.Pegasystems

20.Guidewire

21.Hexaware

22.Microstrategy

Table of Content: Insurance Analytics Market

Part 01: Executive Summary

Part 02: Scope of the Insurance Analytics Market Report

Part 03: Global Insurance Analytics Market Landscape

Part 04: Global Insurance Analytics Market Sizing

Part 05: Global Insurance Analytics Market Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Get your Sample PDF: https://www.maximizemarketresearch.com/request-sample/7775

Regional Insights:

North America, led by the United States and Canada, exhibits robust expertise in cloud-based enterprise data management deployments. The APAC region is expected to witness the fastest growth, attributed to increased investments in the IT sector. Europe also shows substantial market growth potential.

Key Offerings:

Past Market Size and Competitive Landscape (2018 to 2021)

Past Pricing and price curve by region (2018 to 2021)

Market Size, Share, Size & Forecast by different segment | 2022-2029

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Related Reports:

Global Sourdough Market https://www.maximizemarketresearch.com/market-report/global-sourdough-market/67152/

Global Strain Gauge Load Cell Market https://www.maximizemarketresearch.com/market-report/global-strain-gauge-load-cell-market/33796/

Global Telecom Managed Services Market https://www.maximizemarketresearch.com/market-report/global-telecom-managed-services-market/7319/

Global Translation Service Market https://www.maximizemarketresearch.com/market-report/global-translation-service-market/59434/

Hotels Market https://www.maximizemarketresearch.com/market-report/hotels-market/47478/

Human Resource Management Software Market https://www.maximizemarketresearch.com/market-report/global-human-resource-management-software-market/63765/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

+1 800 507 4489 +91 9607365656

sales@maximizemarketresearch.com

www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Analytics Market Report: Unveiling Growth Trends and Opportunities here

News-ID: 3213966 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

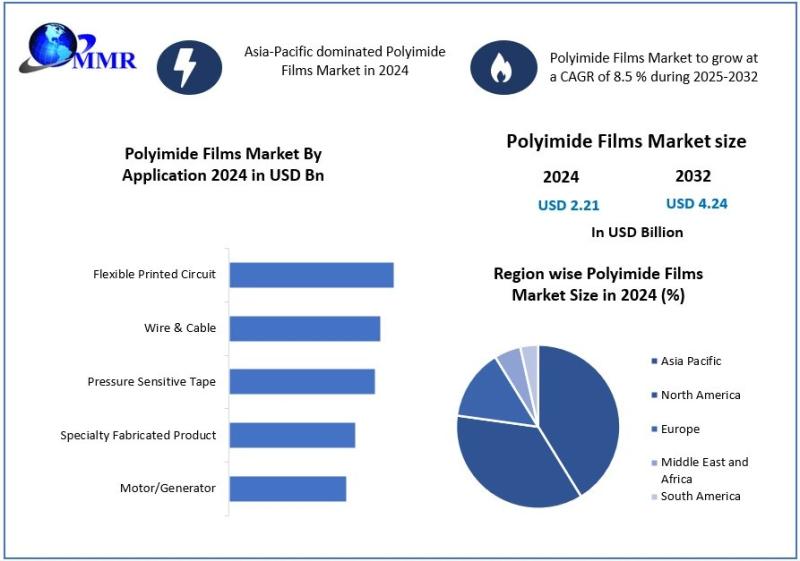

Polyimide Films Market Outlook: USD 2.21 Billion in 2024, Projected Growth to US …

Polyimide Films Market size was valued at USD 2.21 Billion in 2024 and the total Polyimide Films Market revenue is expected to grow at a CAGR of 8.5% from 2025 to 2032, reaching nearly USD 4.24 Billion.

Polyimide Films Market Overview:

The polyimide films market is experiencing robust growth due to the increasing demand for high-performance materials in industries such as electronics, automotive, aerospace, and renewable energy. Polyimide films are known for…

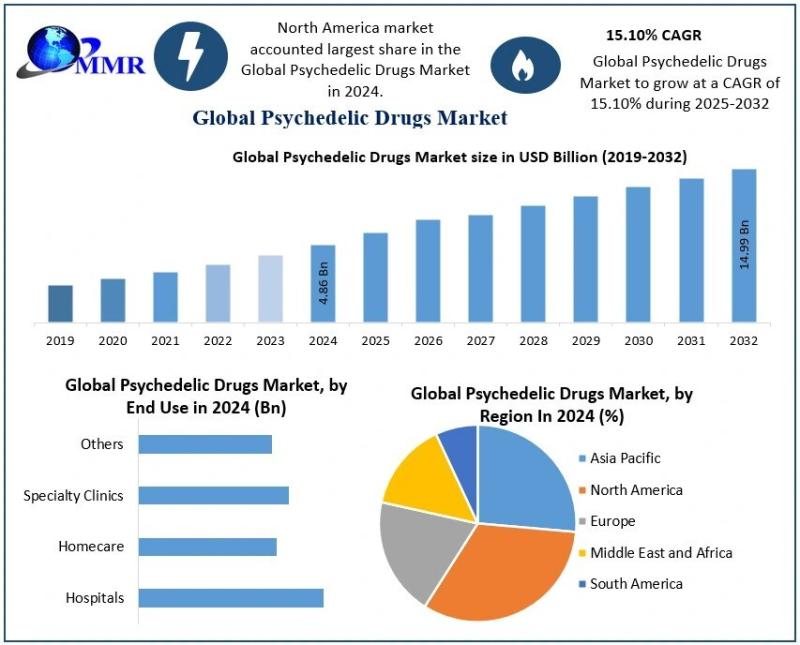

Psychedelic Drugs Market: Expected to Grow from USD 4.86 Billion in 2024 to USD …

Psychedelic Drugs Market size was valued at USD 4.86 Billion in 2024 and the total Psychedelic Drugs revenue is expected to grow at a CAGR of 15.10% from 2025 to 2032, reaching nearly USD 14.99 Billion.

Psychedelic Drugs Market Overview:

The psychedelic drugs market is emerging as a transformative sector in the global pharmaceutical and mental health industries. Psychedelic substances, such as psilocybin (found in magic mushrooms), MDMA, LSD, and DMT, are…

Parcel Delivery Market Projected Growth: USD 5.55 Billion in 2025 to USD 7.40 Bi …

Parcel Delivery Market size was valued at USD 5.55 Billion in 2025 and the total Parcel Delivery revenue is expected to grow at a CAGR of 4.2% from 2025 to 2032, reaching nearly USD 7.40 Billion by 2032.

Parcel Delivery Market Overview:

The parcel delivery market has seen rapid growth, largely driven by the rise of e-commerce, changing consumer behaviors, and increasing demand for fast, reliable shipping solutions. As more consumers shop…

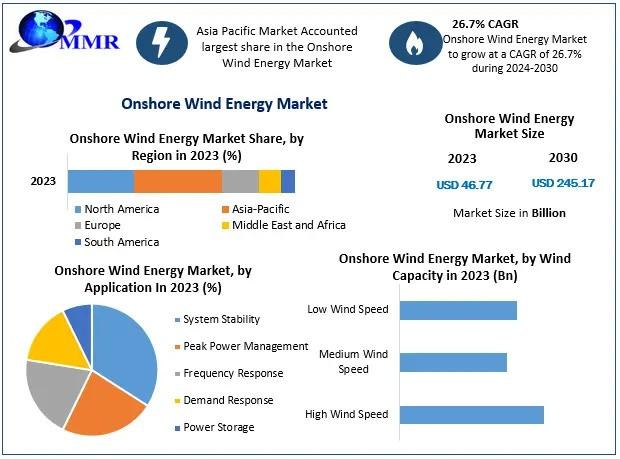

Onshore Wind Energy Market Projected to Hit USD 245.17 Bn by 2030 with 26.7% CAG …

Onshore Wind Energy Market is expected to reach USD 245.17 Bn. at a CAGR of 26.7 % during the forecast period 2030.

Onshore Wind Energy Market Overview:

The onshore wind energy market is one of the fastest-growing segments in the global renewable energy sector. With increasing concerns over climate change and the transition to clean energy, onshore wind energy has become a key solution to meet the world's growing energy demands sustainably.…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…