Press release

Global Energy Trading Market is projected to reach the value of $3.6 Billion by 2030

According to the report published by Virtue Market Research in 2022, the Global Energy Trading Market was valued at USD 1.18 billion and is projected to reach a market size of USD 3.6 billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 15%.Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/global-energy-trading-market/request-sample

In the dynamic landscape of energy trading, a long-term market driver of significant influence is the global shift towards renewable energy sources. As nations around the world increasingly prioritize sustainability and environmental responsibility, the demand for clean energy has surged. This shift has led to a transition from traditional fossil fuel-based energy sources to renewables such as solar, wind, and hydropower. The long-term implications of this driver are profound, as it not only addresses environmental concerns but also shapes the future of energy trading.

However, it is essential to recognize the impact of the COVID-19 pandemic on the energy trading market. The pandemic disrupted supply chains, reduced energy consumption in sectors like transportation, and led to fluctuations in energy prices. It forced companies in the industry to reassess their strategies, adapt to changing market dynamics, and explore innovative solutions to navigate through the challenges posed by the pandemic. As the world gradually recovers, the energy trading market is showing resilience and adapting to the new normal, with a renewed focus on sustainability.

In the short term, energy supply disruptions have emerged as a significant market driver. These disruptions can result from various factors, including extreme weather events, geopolitical tensions, and unforeseen technical failures. Such disruptions have the immediate effect of impacting energy availability and prices, prompting energy traders to respond swiftly to maintain a stable supply.

An exciting opportunity within the energy trading market is the rise of decentralized energy trading platforms. These platforms leverage blockchain technology and smart contracts to enable peer-to-peer energy trading among prosumers (consumers who also produce energy). This opportunity aligns with the broader trend of decentralization in the energy sector, where individuals and communities play a more active role in generating and trading energy. Decentralized energy trading offers the potential for greater energy efficiency, reduced costs, and increased energy resilience.

A prominent trend observed in the energy trading industry is the increasing importance of carbon trading. With growing environmental concerns and regulatory frameworks aimed at reducing carbon emissions, companies are actively participating in carbon markets. Carbon trading allows entities to buy and sell carbon credits, providing an economic incentive to reduce greenhouse gas emissions. This trend reflects a broader shift towards sustainability in the energy sector, as companies seek to align their operations with environmental goals.

Segmentation Analysis:

The global Energy Trading Market segmentation includes:

By Type: Software, Services, Others

One significant type within the energy trading market is Software. Energy trading software solutions offer advanced tools and platforms that facilitate the management, analysis, and optimization of energy transactions. These software applications are designed to streamline trading processes, enhance decision-making, and provide real-time insights into energy markets. While software is a vital component of the energy trading landscape, it is not the largest segment in this category.

Services represent the largest segment within the energy trading market by type. Energy trading services encompass a wide array of offerings, including brokerage services, market analysis, risk management, and consulting. These services are essential for market participants seeking expertise, guidance, and support in navigating complex energy markets. As a result of their pivotal role in facilitating energy transactions and market operations, services hold the distinction of being the largest type in the energy trading market.

Additionally, the fastest-growing segment in this category is Software. The energy trading industry is witnessing a rapid adoption of digital solutions and automation, driving the demand for energy trading software. These software applications enable market participants to execute trades efficiently, analyze market data, and manage risk with greater precision. The accelerating growth of software solutions underscores their increasing importance in modernizing the energy trading landscape.

By Application: Power, Natural Gas, Oil & Products, Others

Energy trading finds application across various sectors, each with its unique dynamics and requirements. Understanding these applications is crucial in comprehending the breadth of the energy trading market.

One of the significant applications in the energy trading market is Power. Power trading involves the buying and selling of electricity, making it a fundamental component of the energy industry.

Power markets facilitate the exchange of electrical energy between generators, transmission companies, and distribution utilities. Given the essential nature of electricity in modern society, power trading stands as the largest application segment in the energy trading market.

Furthermore, the fastest-growing application segment in this category is Natural Gas. Natural gas trading plays a pivotal role in the global energy landscape, particularly as nations seek cleaner alternatives to traditional fossil fuels. The natural gas market encompasses the trading of this versatile energy source, which is used for electricity generation, heating, industrial processes, and transportation. The shift towards cleaner energy sources and the increasing demand for natural gas make it the fastest-growing application segment in the energy trading market.

While Power and Natural Gas dominate their respective segments, the energy trading market also caters to other applications, including Oil & Products and various specialized energy commodities. These applications contribute to the industry's diversity and adaptability, reflecting the dynamic nature of energy trading.

Read More @ https://virtuemarketresearch.com/report/global-energy-trading-market

Regional Analysis:

In North America, the energy trading market is characterized by its mature infrastructure and well-established trading practices. The region boasts a diverse energy portfolio, including a substantial reliance on natural gas and a growing presence of renewable energy sources. While North America is not the largest region in the energy trading market, it is poised for significant growth during the forecast period. This growth can be attributed to several factors, including a focus on energy sustainability, the expansion of renewable energy projects, and technological advancements in energy trading platforms. North America's commitment to innovation and environmental responsibility is driving its status as the fastest-growing region in the energy trading market.

Europe, a region known for its progressive approach to renewable energy and climate action, is another key player in the energy trading market. The European Union's ambitious goals for carbon neutrality and the development of interconnected energy markets have driven significant changes in energy trading practices. While Europe is not the largest region in this market, it is an area of active innovation and investment. The adoption of blockchain technology for energy trading and the growth of cross-border electricity exchanges are notable trends that highlight Europe's commitment to enhancing energy trading efficiency and sustainability.

Asia-Pacific emerges as the largest and most influential region in the energy trading market. The region's economic growth, increasing urbanization, and expanding industrial sectors drive significant energy demand. Asia-Pacific's diverse energy mix, which includes coal, natural gas, and a growing emphasis on renewables, contributes to the region's energy trading prominence. The Asia-Pacific region is a hub for energy-intensive industries and is home to some of the world's largest energy consumers. Its status as the largest region in the energy trading market reflects its pivotal role in global energy supply and demand dynamics.

South America, with its vast natural resources, presents unique opportunities and challenges in the energy trading market. The region's energy landscape is characterized by significant hydroelectric power generation, making it a key player in the global energy market. While South America is not the largest region in terms of energy trading, its potential for growth lies in the development of renewable energy projects, regional energy integration initiatives, and a growing focus on sustainability. These factors position South America as an area of interest for energy trading companies seeking to expand their footprint in the region.

The Middle East & Africa region represents a diverse and evolving energy landscape. Rich in fossil fuels and renewable energy potential, the region plays a critical role in global energy markets. The Middle East, in particular, is a major exporter of oil and natural gas, influencing energy prices and supply dynamics worldwide. While the Middle East & Africa is not the largest region in the energy trading market, its strategic importance cannot be understated. The region's investment in renewable energy projects, coupled with its commitment to diversify its energy portfolio, reflects a growing awareness of the need for sustainability and resilience in the energy sector.

Latest Industry Developments:

• One prominent trend in the energy trading market is the strategic investment in renewable energy sources. Companies are increasingly diversifying their energy portfolios by acquiring or developing renewable energy projects such as wind and solar farms. This trend aligns with global efforts to transition to cleaner energy sources and reduce carbon emissions. Recent developments include major energy trading firms expanding their renewable energy capacities, demonstrating a commitment to sustainability and meeting growing demand for green energy.

• Companies in the energy trading market are embracing advanced analytics and artificial intelligence (AI) to enhance their market share. These technologies enable better forecasting of energy supply and demand, optimizing trading strategies, and mitigating risks. Recent developments include the integration of machine learning algorithms and big data analytics into trading platforms, allowing companies to make data-driven decisions and gain a competitive edge in the market.

• An emerging trend is the expansion of energy trading companies into emerging markets with growing energy needs. These markets present untapped opportunities for companies to establish a presence and capture a larger market share. Recent developments include energy trading firms entering markets in Asia, Africa, and Latin America, where rapid economic growth and urbanization are driving increased energy consumption. This trend reflects a strategic approach to global expansion and diversification of market exposure.

Customize the Full Report Based on Your Requirements @ https://virtuemarketresearch.com/report/global-energy-trading-market/customization

Contact Us:

Virtue Market Research

Kumar Plaza, #103, SRPF Rd, Ramtekadi, Pune, Maharashtra 411013, India

E-mail: megha@virtuemarketresearch.com

Phone: +1-917 436 1025

About Us:

Virtue Market Research stands at the forefront of strategic analysis, empowering businesses to navigate complex market landscapes with precision and confidence. Specializing in both syndicated and bespoke consulting services, we offer in-depth insights into the ever-evolving interplay between global demand and supply dynamics. Leveraging our expertise, businesses can identify emerging opportunities, discern critical trends, and make decisions that pave the way for future success.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Energy Trading Market is projected to reach the value of $3.6 Billion by 2030 here

News-ID: 3207997 • Views: …

More Releases from Virtue Market Research

The Global Vodka Seltzer Market is projected to reach a market size of USD 16.22 …

The Vodka Seltzer Market was valued at USD 9.4 billion in 2024 and is projected to reach a market size of USD 16.21 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.1%.

Request Sample @ https://virtuemarketresearch.com/report/vodka-seltzer-market/request-sample

The vodka seltzer market has grown from a niche beverage choice into a mainstream favorite, supported by shifting consumer lifestyles and evolving…

The Global Telehealth Services Market and is projected to reach a market size of …

The Global Telehealth Services Market was valued at USD 126.1 billion and is projected to reach a market size of USD 302.49 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.7%.

Request Sample @ https://virtuemarketresearch.com/report/telehealth-services-market/request-sample

The perennial shift towards patient-centric healthcare has been a pivotal long-term market driver for telehealth services. Over the years, the industry has witnessed…

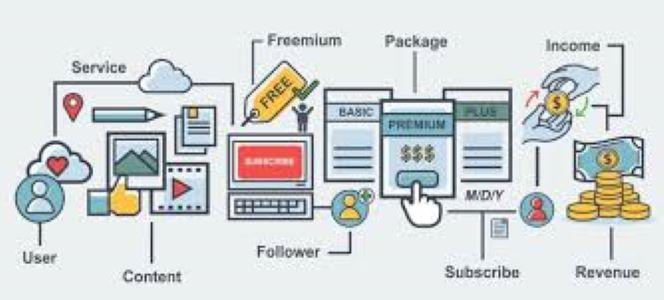

The Subscription Box/Subscription E-Commerce Market is projected to reach a mark …

The Subscription Box/Subscription E-Commerce Market is valued at USD 47.19 billion in 2024 and is projected to reach a market size of USD 97.73 billion by the end of 2030. Over the outlook period of 2025-2030, the market is anticipated to grow at a CAGR of 12.9%.

Request Sample @ https://virtuemarketresearch.com/report/subscription-e-commerce-market/request-sample

The subscription e-commerce market has grown into one of the most dynamic parts of the digital economy. It began as a…

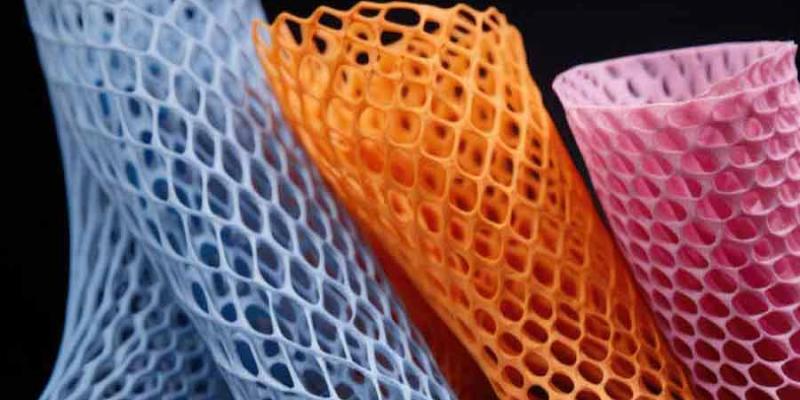

The Global Aramid Fibre Reinforced Polymer Composites Market is projected to rea …

According to the report published by Virtue Market Research in Aramid Fibre Reinforced Polymer Composites Market was valued at USD 5.55 billion and is projected to reach a market size of USD 8.57 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/aramid-fibre-reinforced-polymer-composites-market/request-sample

The Aramid Fibre Reinforced Polymer Composites…

More Releases for Energy

Green Renewable Energy Market Next Big Thing: Enphase Energy, Bloom Energy, Clea …

Advance Market Analytics published a new research publication on "Green Renewable Energy Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Green Renewable Energy market was mainly driven by the increasing R&D spending across the world.

Get inside Scoop of the…

Business Energy Solution Market Size in 2023 To 2029 | SSE Energy Solutions, BES …

The large-scale Business Energy Solution market report provides valuable insights for clients looking to forecast investments in emerging markets, expand market share, or launch new products. The report presents multifaceted Business Energy Solution market insights that are simplified using established tools and techniques, making it a credible marketing report. Data is presented in a clear and easy-to-understand manner, with graphs and charts to aid comprehension. The report employs integrated approaches…

Decentralized Energy Storage Market Is Booming Worldwide | Fuelcell Energy, Enph …

A new business intelligence report released by AMA with title "Decentralized Energy Storage Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Decentralized Energy Storage Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics…

Waste-To-Energy Technologies Market Top Growing Companies: Xcel Energy, Novo Ene …

Qurate Business Intelligence’s up-to-date research study on Waste-To-Energy Technologies was performed by highly qualified research professionals and industry experts. This is to provide an in-depth analysis on the Waste-To-Energy Technologies. The report is comprehensive and includes over 120 pages. The global energy market is witnessing a shift toward waste to energy technologies due to growing energy demands worldwide, the rapid depletion of conventional sources of energy, and concerns over…

Waste To Energy Market ||Novo Energy Ltd., Hitachi Zosen, Foster Wheeler A.G., S …

Zion Market Research published a new 110+ pages industry research "Global Waste to Energy Market Set For Rapid Growth, To Reach Value Around USD 42.74 Billion By 2024" is exhaustively researched and analyzed in the report to help market players to improve their business tactics and ensure long-term success. The authors of the report have used easy-to-understand language and uncomplicated statistical images but provided thorough information and detailed data on…

In-Pipe Hydro Systems Market | key player - Lucid Energy, Rentricity, Tecnoturbi …

Looking at the current market trends as well as the promising demand status of the “In-Pipe Hydro Systems Market” it can be projected that the future years will bring out positive outcomes. This research report added by MRRSE on its online portal delivers clear insight about the changing tendencies across the global market. Readers can gather prime facets connected to the target market which includes product, end-use and application; assisting…