Press release

Fraud Detection and Prevention Market: Safeguarding Digital Landscapes Against Evolving Threats

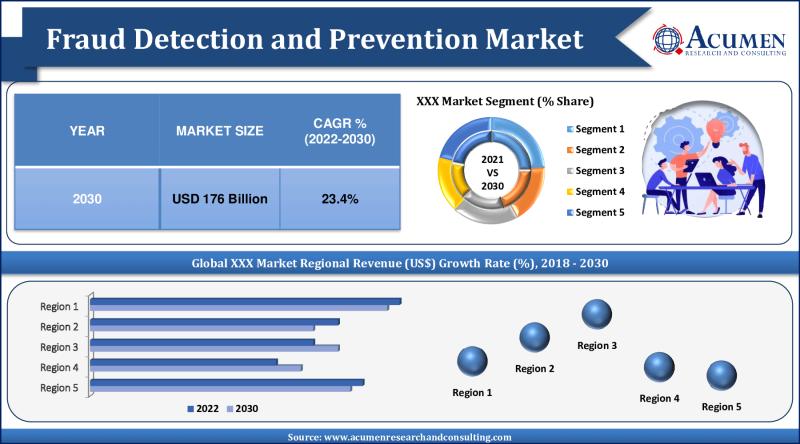

The Fraud Detection and Prevention Market value of USD 27 Billion in 2021 and is projected to reach USD 176 Billion by 2030, with a compound annual growth rate CAGR of 23.4% from 2021 to 2030.The Fraud Detection and Prevention Market is a dynamic and critical sector that plays a pivotal role in protecting businesses and consumers from the ever-evolving landscape of fraud and cyber threats. With the rapid digitization of commerce and the widespread adoption of online services, the risk of fraudulent activities has escalated, necessitating advanced solutions to counter these challenges. Fraud detection and prevention solutions leverage artificial intelligence, machine learning, data analytics, and behavioral analysis to detect, mitigate, and thwart fraudulent activities across various industries. As cybercriminals become increasingly sophisticated, the market continues to experience significant growth, attracting attention from financial institutions, e-commerce businesses, healthcare providers, and other sectors facing high-risk environments. This in-depth examination delves into the factors propelling the market's growth, identifies promising prospects, showcases emerging patterns, and focuses on the significant contributors influencing the Fraud Detection and Prevention Market.

Download Sample Report Copy of This Report from Here: https://www.acumenresearchandconsulting.com/request-sample/3048

Factors Driving Market Growth:

The Fraud Detection and Prevention Market is set to experience robust growth given several key factors, which include the surge in online transactions, the growing adoption of digital payment methods, and the rising sophistication of fraud techniques.

The surge in online transactions propels the market's expansion. As e-commerce and digital transactions continue to flourish, the risk of fraud also escalates. The rise of mobile commerce and online banking has made financial transactions more accessible and convenient for consumers, but it has also created new opportunities for cybercriminals to exploit vulnerabilities. Fraud detection and prevention solutions offer real-time monitoring and analysis of online transactions, ensuring secure and fraud-free experiences for customers and businesses alike.

Moreover, the growing adoption of digital payment methods contributes to the market's growth. With the proliferation of digital wallets, mobile payments, and contactless transactions, consumers expect seamless and secure payment experiences. Fraud detection and prevention solutions bolster confidence in digital payment methods by continuously monitoring and identifying suspicious activities, reducing the risk of unauthorized transactions and financial losses.

The rising sophistication of fraud techniques plays a significant role in the market's expansion. Cybercriminals continuously devise new and sophisticated methods to bypass traditional security measures. Advanced fraud detection and prevention solutions leverage cutting-edge technologies, such as artificial intelligence and machine learning algorithms, to detect and analyze complex patterns, anomalies, and behavioral changes, staying one step ahead of fraudsters.

Growth Potential Opportunities:

Strengthening collaborative efforts and information sharing among businesses and financial institutions. Collaborative fraud detection networks enable real-time data sharing on emerging threats and fraud patterns, enhancing the collective defense against fraudulent activities.

Another market opportunity lies in the integration of multi-layered security solutions. Combining fraud detection and prevention tools with identity verification, biometrics, and device recognition technologies provides a robust defense mechanism against various types of fraud, including account takeover, identity theft, and payment fraud.

Emerging Trends:

Key trends in the Fraud Detection and Prevention Market include the adoption of behavioral biometrics, the incorporation of blockchain technology, and the integration of machine learning-based anomaly detection.

The adoption of behavioral biometrics marks some emerging trends in the industry. Behavioral biometrics analyze unique user behavior, such as typing patterns, keystrokes, and mouse movements, to verify the authenticity of users and detect potential fraudulent activities. By continuously monitoring behavioral patterns, fraud detection systems can differentiate between legitimate users and imposters, enhancing accuracy and security.

Moreover, the incorporation of blockchain technology emerges as a noteworthy trend in fraud prevention. Blockchain's immutable and decentralized ledger system offers enhanced security and transparency in financial transactions. Integrating blockchain technology into fraud detection processes can help create tamper-resistant records and secure digital identities, minimizing the risk of data breaches and fraud.

The integration of machine learning-based anomaly detection represents an emerging trend in Fraud Detection and Prevention Market. Machine learning algorithms analyze vast amounts of data to identify abnormal patterns and behaviors, enabling fraud detection systems to adapt to evolving fraud tactics and new attack vectors.

Get TOC's From Here@ https://www.acumenresearchandconsulting.com/table-of-content/fraud-detection-and-prevention-market

Key Players:

IBM Corporation

FICO

SAS Institute Inc.

Experian Information Solutions, Inc.

Fair Isaac Corporation

NICE Actimize

LexisNexis Risk Solutions

ACI Worldwide Inc.

RSA Security LLC (A Dell Technologies Company)

Kount Inc.

Conclusion:

The Fraud Detection and Prevention Market continues to flourish as a result of the surge in online transactions, growing adoption of digital payment methods, and rising sophistication of fraud techniques. Opportunities lie in collaborative efforts, multi-layered security solutions, and the integration of advanced technologies. Emerging trends, such as behavioral biometrics, blockchain technology, and machine learning-based anomaly detection, redefine the fraud prevention landscape and underscore its critical role in safeguarding businesses and consumers against evolving threats. Key players in the market drive innovation, ensuring that fraud detection and prevention solutions remain at the forefront of securing digital transactions and protecting the integrity of digital ecosystems.

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/3048

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraud Detection and Prevention Market: Safeguarding Digital Landscapes Against Evolving Threats here

News-ID: 3196412 • Views: …

More Releases from Acumen Research and Consulting

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

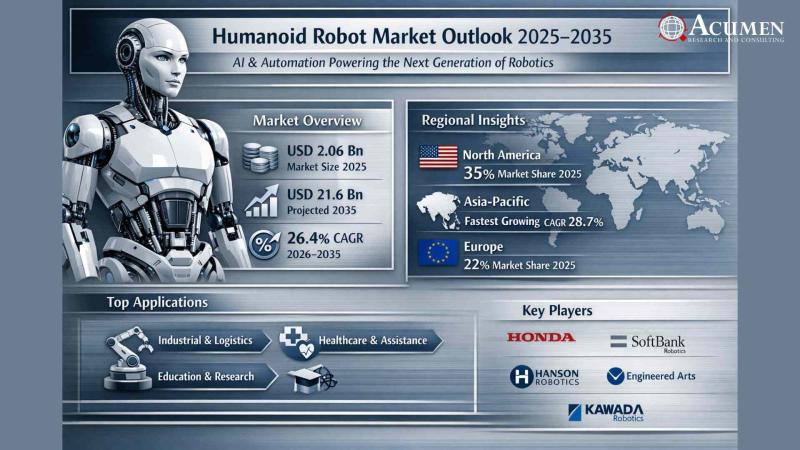

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

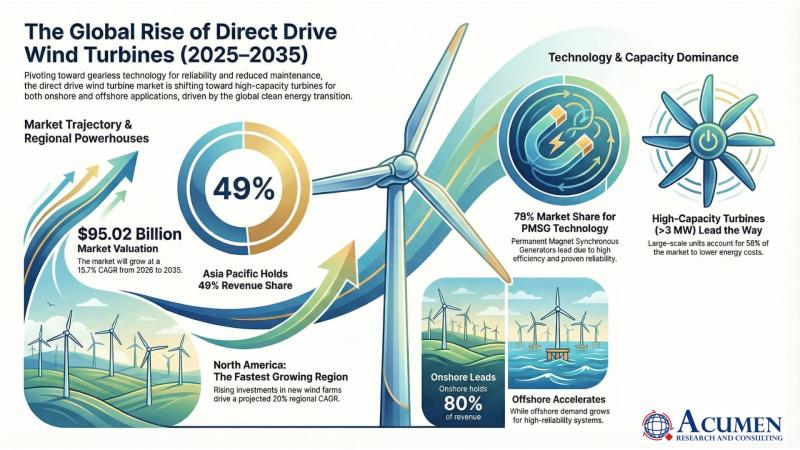

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…