Press release

Insurtech Market: Innovating Insurance with Technology and Customer-Centric Solutions

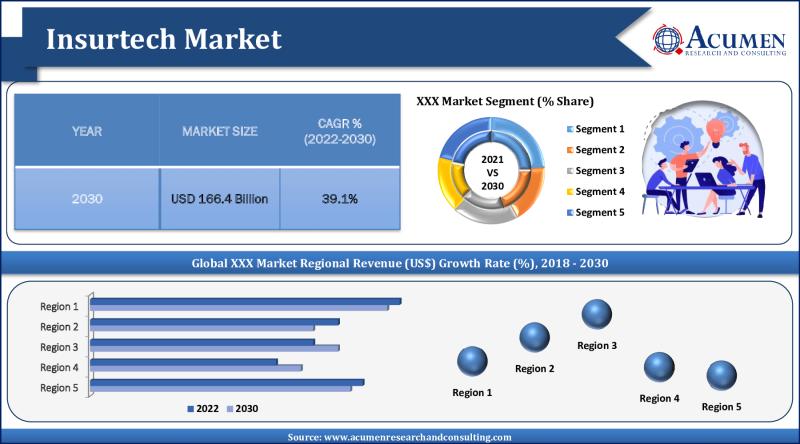

The Insurtech Market at a global level was worth USD 8.8 Billion in 2021 and is anticipated to expand to USD 166.4 Billion by 2030, experiencing a CAGR of 39.1% during the forecast period of 2021-2030.The Insurtech Market is a dynamic and rapidly evolving sector within the insurance industry, revolutionizing traditional insurance processes and enhancing customer experiences. Insurtech, a fusion of insurance and technology, encompasses a wide range of technological innovations that aim to streamline operations, improve underwriting accuracy, and deliver personalized insurance solutions. With the increasing demand for digital experiences, the rise of data analytics, and the desire for more flexible insurance products, the Insurtech Market has witnessed significant growth, attracting interest from insurers, startups, and investors alike.

Download Sample Report Copy of This Report from Here: https://www.acumenresearchandconsulting.com/request-sample/3100

Factors Driving Market Growth:

The shift towards digitalization propels the market's expansion. As consumers increasingly prefer digital interactions and transactions, insurers are compelled to offer seamless online experiences. Insurtech solutions, such as mobile apps for policy management, online claims processing, and virtual insurance advisors, cater to digitally-savvy customers and enable insurers to stay competitive in the digital age.

Moreover, the need for enhanced customer engagement contributes to the market's growth. Insurtech empowers insurers to build deeper relationships with customers through personalized communication, self-service platforms, and real-time interactions. These customer-centric solutions improve satisfaction levels and foster long-term customer loyalty.

Advancements in data analytics play a significant role in the market's expansion. Insurers are leveraging data analytics to assess risk more accurately, determine personalized premiums, and identify fraudulent activities. The integration of artificial intelligence (AI) and machine learning (ML) algorithms further enhances insurers' capabilities to process and analyze vast amounts of data.

Growth Potential Opportunities:

The Insurtech Market offers several growth opportunities for industry players. One critical avenue lies in developing innovative usage-based insurance (UBI) models. UBI leverages telematics and IoT technology to track driving behavior, enabling insurers to offer personalized premiums based on actual driving patterns, promoting safer driving habits, and attracting a wider range of customers.

Another growth opportunity lies in leveraging AI and ML for claims processing and fraud detection. Insurers can utilize AI-powered algorithms to automate claims processing, reducing the time taken to settle claims and improving customer satisfaction. Additionally, AI-driven fraud detection models can identify suspicious activities, minimizing losses due to fraudulent claims.

Emerging Trends:

Parametric insurance represents an emerging trend. This type of insurance pays out a predetermined amount when specific triggers, such as weather conditions or seismic events, occur. Parametric insurance offers swift payouts and is particularly useful for covering risks that are challenging to assess through traditional methods.

Peer-to-peer (P2P) insurance emerges as a noteworthy trend. P2P insurance models involve groups of individuals pooling their resources to cover each other's risks. Insurtech platforms facilitate these arrangements, promoting community-based insurance and enhancing trust among participants.

The integration of blockchain technology marks an emerging trend. Blockchain enhances transparency, security, and efficiency in insurance processes, such as claims settlement and policy issuance. Smart contracts on blockchain can automate claims processing and payouts based on predefined conditions.

Get TOC's From Here@ https://www.acumenresearchandconsulting.com/table-of-content/insurtech-market

Key Players:

Lemonade Inc.

Oscar Health

Root Insurance

ZhongAn Online P&C Insurance Co., Ltd.

Hippo Insurance

Policygenius

Metromile

Snapsheet

CoverWallet (Aon)

Trov

Conclusion:

The Insurtech Market continues to experience significant growth, driven by the shift towards digitalization, the need for enhanced customer engagement, and advancements in data analytics. Opportunities lie in developing innovative UBI models, leveraging AI for claims processing and fraud detection, and integrating blockchain for transparency and security. Emerging trends, such as parametric insurance, P2P insurance, and blockchain integration, redefine the Insurtech Market and underscore its pivotal role in innovating insurance processes and delivering personalized, technology-driven solutions. Key players in the market drive innovation, ensuring that technology continues to reshape the insurance industry and meet the evolving demands of customers in the digital era.

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/3100

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurtech Market: Innovating Insurance with Technology and Customer-Centric Solutions here

News-ID: 3194371 • Views: …

More Releases from Acumen Research and Consulting

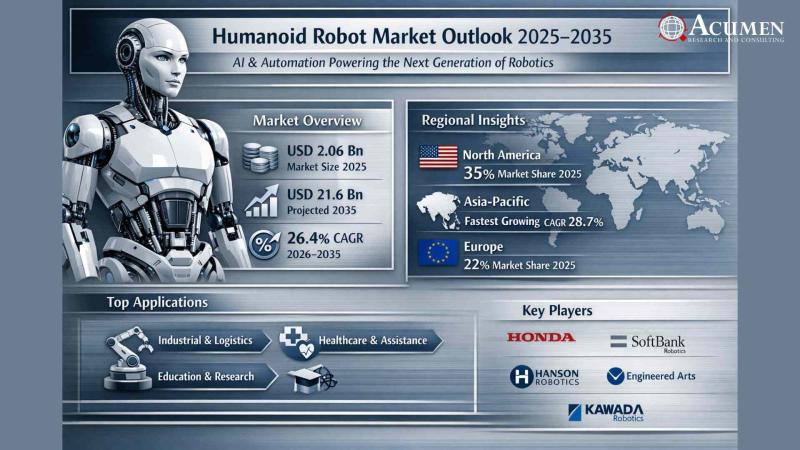

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

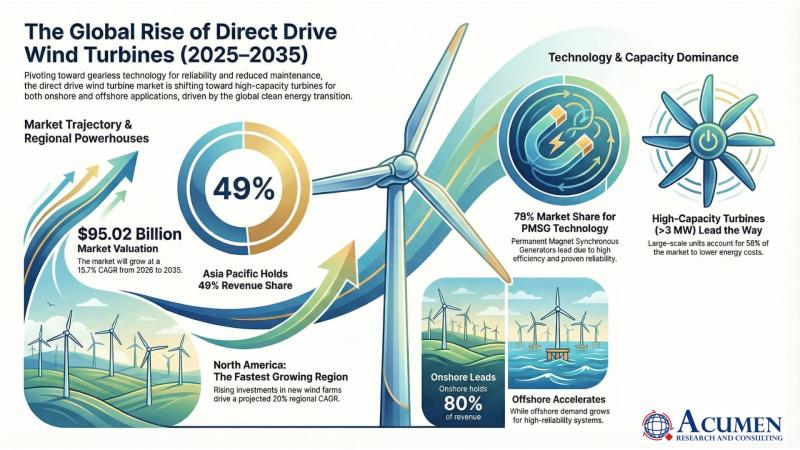

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Insurtech

Insurtech Accelerators Market Hits New High | Major Giants Plug and Play, Startu …

HTF MI just released the Global Insurtech Accelerators Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Insurtech Accelerators Market are: Plug and Play,…

Insurtech Market: A Comprehensive Overview

The global insurtech market was valued at approximately USD 10.3 billion in 2024 and is projected to reach around USD 152.9 billion by 2033, growing at a compound annual growth rate (CAGR) of about 31.5% from 2025 to 2033.

Insurtech Market Overview

The global Insurtech market is undergoing explosive growth, fueled by the insurance industry's rapid digitization and rising customer demand for seamless, personalized digital experiences. Advanced technologies like artificial intelligence (AI),…

Top Trends Transforming the InsurTech (Insurance Technology) Market Landscape in …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the InsurTech (Insurance Technology) Industry Market Size Be by 2025?

The volume of the insurtech (insurance technology) market has expanded significantly in the past few years. The market, currently valued at $19.23 billion in 2024, is projected to reach $25.95 billion in 2025, demonstrating a compound annual…

Emerging Trends Influencing The Growth Of The Insurtech Market: Innovative AI-Po …

The Insurtech Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Insurtech Market Size Expected to Be by 2034?

In recent times, the insurtech market has seen substantial expansion. The projected growth indicates an increase from $17.08 billion in 2024 to $22.08 billion…

Top Factor Driving Insurtech Market Growth in 2025: Rising Tide Of Insurance Cla …

How Are the key drivers contributing to the expansion of the insurtech market?

The expected surge in insurance claims is projected to directly contribute to the expanded growth of the insurtech market. Insurtech plays a critical role in claim management, risk assessment, contract processing, and policy underwriting. The increase in hospitalizations during the COVID-19 pandemic has resulted in a steep rise in insurance claims. An illustrative example of this could be…

Insurtech, Market Dynamics, Global Opportunities, Forecast 2024

The Business Research Company recently released a comprehensive report on the Global Insurtech Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…