Press release

Global Embedded Finance Market is projected to reach the value of $290.61 Billion by 2030

According to the report published by Virtue Market Research in 2022, the Global Embedded Finance Market was valued at $54.4 Billion and is projected to reach a market size of $290.61 Billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 23.3%.Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/embedded-finance-market/request-sample

In the world of finance, a transformative trend is taking center stage, reshaping how businesses and consumers interact with financial services.

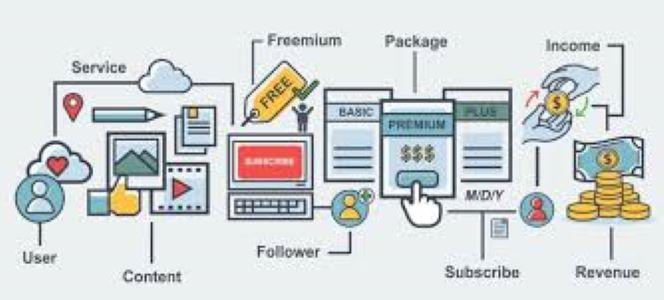

Embedded finance, a concept rooted in seamless integration of financial services into non-financial platforms, is fueled by a long-term vision of convenience and accessibility. The market is driven by the idea of offering financial services right where customers need them, eliminating the need to visit separate platforms. This driver resonates with the market's commitment to enhancing user experiences and simplifying complex financial processes.

The impact of COVID-19 on the embedded finance market has been noteworthy. The pandemic accelerated the shift towards digital services, with businesses and consumers alike seeking contactless solutions. This unprecedented disruption highlighted the value of embedded finance in enabling transactions, payments, and financial management without physical interactions. The pandemic acted as a catalyst, propelling the adoption of embedded finance and cementing its role in the future of finance.

In the short term, the embedded finance market is driven by the surge in ecosystem partnerships. Companies are recognizing the potential of collaborating with non-financial platforms to offer financial services seamlessly. This trend not only expands the reach of financial offerings but also taps into existing user bases, fostering growth for both parties. The short-term driver aligns with the market's emphasis on innovative collaborations to enhance customer experiences.

An opportunity that stands out in the embedded finance market is the democratization of financial services. By integrating financial tools into everyday platforms, companies have the opportunity to reach underserved populations, providing them with access to banking, payments, and investments. This opportunity resonates with the market's pursuit of financial inclusion and has the potential to uplift marginalized communities through greater accessibility.

A prominent trend observed in the embedded finance industry is the rise of API-driven solutions. Application Programming Interfaces (APIs) allow seamless communication between different software systems, enabling the integration of financial services into various platforms. This trend reflects the industry's commitment to creating flexible, modular, and interconnected solutions that cater to the diverse needs of users.

As we navigate the embedded finance landscape, it becomes evident that a fusion of long-term drivers and short-term influences shapes the industry's trajectory. The vision of seamless integration and the transformation brought about by COVID-19 guide the market's long-term direction. Ecosystem partnerships, financial inclusion, and API-driven solutions serve as short-term drivers, pushing the industry towards innovation and accessibility.

With the opportunity to democratize financial services and the trend of API-driven solutions, the embedded finance market holds immense potential. The future envisions a landscape where financial services seamlessly coexist with daily activities, empowering consumers with greater control over their finances. As businesses continue to embrace embedded finance, the industry expert envisions a future where finance is no longer a standalone entity, but an integrated, user-centric experience that enhances convenience and financial well-being.

Segmentation Analysis:

The Global Embedded Finance Market segmentation includes:

By Type: Embedded Banking, Embedded Insurance, Embedded Investments, Embedded Lending, Embedded Payment

Embedded banking, where financial services are seamlessly integrated into non-financial platforms, emerges as the largest segment in the embedded finance market. With the ability to offer banking services directly within applications, websites, or platforms, embedded banking addresses users' financial needs without requiring them to navigate traditional banking interfaces. The convenience and accessibility of embedded banking have propelled it to become the most prominent segment in the market. Among the various types of embedded financial services, embedded payments stand out as the fastest-growing segment. This category involves integrating payment solutions directly into other platforms, allowing users to make transactions without leaving the application or website. The rapid adoption of digital transactions, coupled with the demand for seamless payment experiences, has driven the surge in embedded payment services. As users increasingly embrace cashless transactions, the embedded payments segment continues to experience significant growth.

By End User: Loans Associations, Investment Banks & Investment Companies, Brokerage Firms, Insurance Companies, Mortgage Companies

Among the diverse end users, investment banks and investment companies emerge as the largest segment in the embedded finance market. These entities play a crucial role in managing investments, and the integration of financial services directly into their platforms aligns with their core functions. The seamless accessibility of financial tools enhances their ability to serve clients, manage portfolios, and execute transactions. As a result, investment banks and investment companies stand as the primary contributors to the embedded finance market's size and impact.

When it comes to the fastest-growing segment, insurance companies take the lead in the embedded finance market. The integration of financial services into insurance platforms offers policyholders convenient access to premium payments, claims processing, and policy management. This convenience enhances the overall customer experience and accelerates the adoption of embedded finance solutions within the insurance sector. As insurance companies embrace this trend, they contribute significantly to the market's rapid growth and expansion.

Read More @ https://virtuemarketresearch.com/report/embedded-finance-market/request-sample

Regional Analysis:

North America emerges as a frontrunner in the embedded finance market, driven by its tech-savvy culture and innovation-driven economy. With a robust ecosystem of digital platforms, North America is at the forefront of integrating financial services seamlessly into non-financial platforms. This region boasts the largest segment in the embedded finance market, with companies capitalizing on the strong demand for convenient and user-friendly financial solutions.

Crossing the Atlantic, we step into Europe, a region that embraces the integration of financial services into everyday platforms. With a diverse array of cultures and languages, Europe's adoption of embedded finance reflects its commitment to catering to diverse consumer needs. The region's collaborative spirit fosters partnerships between fintech companies and non-financial platforms, contributing to its significant presence in the embedded finance market.

As we move towards the vibrant Asia-Pacific region, we encounter the fastest-growing segment of the embedded finance market. With a vast population and an increasing appetite for digital services, Asia-Pacific is witnessing a surge in the adoption of embedded finance solutions. The region's tech-forward approach and rising demand for financial accessibility propel its exponential growth in the market.

Turning our focus to Latin America, we uncover a region that pioneers financial inclusion through embedded finance. Despite challenges, Latin America recognizes the potential of integrating financial tools into everyday platforms to reach previously underserved populations. This approach aligns with the region's determination to provide equitable access to financial services, making it a notable player in the embedded finance market.

In the Middle East and Africa, the embedded finance market is poised to transform the financial landscape. This region's growing tech infrastructure and digital adoption pave the way for the integration of financial services into non-financial platforms. As businesses collaborate to offer seamless financial experiences, the Middle East and Africa carve a distinctive space in the embedded finance market.

Latest Industry Developments:

• A prevailing trend in the embedded finance market is the strategic adoption of platform integration. Companies are forging partnerships with non-financial platforms to seamlessly embed financial services within existing ecosystems. This trend allows businesses to tap into new customer bases and extend their reach while providing users with convenient and integrated financial solutions.

• Another significant trend is the diversification of offerings. Companies are expanding their range of embedded financial services to cater to a wider array of needs. By providing services such as payments, lending, insurance, and investments, businesses can capture a broader share of the market and offer comprehensive financial solutions to their users.

• The integration of data-driven personalization is emerging as a strategic approach. Companies are leveraging user data to tailor financial offerings and experiences to individual preferences and behaviors. This trend not only enhances user engagement and satisfaction but also helps companies retain customers and attract new ones through personalized financial solutions.

Customize the Full Report Based on Your Requirements @ https://virtuemarketresearch.com/report/embedded-finance-market/customization

Contact Us:

Virtue Market Research

Kumar Plaza, #103, SRPF Rd, Ramtekadi, Pune, Maharashtra 411013, India

E-mail: megha@virtuemarketresearch.com

Phone: +1-917 436 1025

About Us:

Virtue Market Research stands at the forefront of strategic analysis, empowering businesses to navigate complex market landscapes with precision and confidence. Specializing in both syndicated and bespoke consulting services, we offer in-depth insights into the ever-evolving interplay between global demand and supply dynamics. Leveraging our expertise, businesses can identify emerging opportunities, discern critical trends, and make decisions that pave the way for future success.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Embedded Finance Market is projected to reach the value of $290.61 Billion by 2030 here

News-ID: 3193888 • Views: …

More Releases from Virtue Market Research

The Global Vodka Seltzer Market is projected to reach a market size of USD 16.22 …

The Vodka Seltzer Market was valued at USD 9.4 billion in 2024 and is projected to reach a market size of USD 16.21 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.1%.

Request Sample @ https://virtuemarketresearch.com/report/vodka-seltzer-market/request-sample

The vodka seltzer market has grown from a niche beverage choice into a mainstream favorite, supported by shifting consumer lifestyles and evolving…

The Global Telehealth Services Market and is projected to reach a market size of …

The Global Telehealth Services Market was valued at USD 126.1 billion and is projected to reach a market size of USD 302.49 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.7%.

Request Sample @ https://virtuemarketresearch.com/report/telehealth-services-market/request-sample

The perennial shift towards patient-centric healthcare has been a pivotal long-term market driver for telehealth services. Over the years, the industry has witnessed…

The Subscription Box/Subscription E-Commerce Market is projected to reach a mark …

The Subscription Box/Subscription E-Commerce Market is valued at USD 47.19 billion in 2024 and is projected to reach a market size of USD 97.73 billion by the end of 2030. Over the outlook period of 2025-2030, the market is anticipated to grow at a CAGR of 12.9%.

Request Sample @ https://virtuemarketresearch.com/report/subscription-e-commerce-market/request-sample

The subscription e-commerce market has grown into one of the most dynamic parts of the digital economy. It began as a…

The Global Aramid Fibre Reinforced Polymer Composites Market is projected to rea …

According to the report published by Virtue Market Research in Aramid Fibre Reinforced Polymer Composites Market was valued at USD 5.55 billion and is projected to reach a market size of USD 8.57 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/aramid-fibre-reinforced-polymer-composites-market/request-sample

The Aramid Fibre Reinforced Polymer Composites…

More Releases for Embedded

Embedded Systems Market

According to Market Research Intellect, the global Embedded Systems market under the Aerospace and Defense category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

The embedded systems market is witnessing strong growth, fueled by rapid advancements in electronics, automation, and digital technologies. These…

Embedded Systems Market

According to Market Research Intellect, the global Satellite Communication Terminal market under the Aerospace and Defense category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

The satellite communication terminal market is experiencing steady growth, driven by the rising demand for high-speed connectivity across…

Embedded Motherboard Market 2023 Key Players: Advantech, Kontron, Abaco, Artesyn …

Embedded Motherboard Market 2023 is a wide-ranging and object-oriented report by MarketsandResearch.biz enfolds expansive evaluation of the market offering an analysis of the market revenue, segmentation, and market players. The report covers and determines the market growth and market share for the estimated forecast period of 2029. The report is framed after the combination of an admirable industry experience, talent solutions, industry insight, and most modern tools and technology. The…

The Denmark Embedded Finance Market is Expected to Record a Growth of 29.5% in 2 …

According to PayNXT360's Q4 2021 Embedded Finance Survey, Embedded Finance industry in the country is expected to grow by 29.5% on annual basis to reach US$659.3 million in 2022.

The embedded finance industry is expected to grow steadily over the forecast period, recording a CAGR of 18.0% during 2022-2029. The embedded finance revenues in the country will increase from US$659.3 million in 2022 to reach US$1,617.8 million by 2029.

This report provides…

Embedded Processor Market

The recent report published by Reports and Data comprises of an in-depth assessment of the Global Embedded Processor Market. It assesses the ever-changing market dynamics and overall development of the industry. The report is fabricated with thorough primary and secondary research and is updated with the latest and emerging market trends to offer the readers opportunities to capitalize on the current market environment. For a thorough analysis, the market has…

Embedded System Market (Standalone Embedded Systems, Real Time Embedded Systems, …

Embedded systems is a field derived through a combined study of software and hardware. Both aspects come together to create a functional targeting device that possesses the advantages of adaptability, speed, accuracy, reliability, power, and smaller size. Embedded systems possess a wide array of utility in the fields of mobile communication, electronic payment solutions, railways, aeronautics, and automobiles. They can be designed for specific applications in each field and can…