Press release

Global Reinsurance Market is projected to reach the value of $1.14 Trillion by 2030

According to the report published by Virtue Market Research , in 2022, the Global Reinsurance Market was valued at $503.73 Billion, and is projected to reach a market size of $1.14 Trillion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 10.8%.Read More @ https://virtuemarketresearch.com/report/reinsurance-market

In the intricate world of finance, the reinsurance market stands as a critical pillar, providing a safety net for insurance companies and managing risks that extend across a vast spectrum of sectors. With a history rooted in safeguarding against unforeseen adversities, the reinsurance market is continually shaped by a blend of enduring influences and sudden changes.

Amidst the ever-evolving landscape of the reinsurance market, one long-term driver that remains unwavering is the concept of risk itself. As the global economy becomes increasingly intertwined and complex, insurance companies and reinsurers are presented with the formidable challenge of managing a myriad of risks ranging from natural disasters to economic downturns. This intrinsic demand for risk mitigation has consistently propelled the reinsurance market forward.

However, no discussion on market dynamics can be complete without acknowledging the unparalleled impact of the COVID-19 pandemic. This unforeseen crisis rattled the very foundations of the insurance and reinsurance industry, leading to a critical examination of risk models and pricing strategies. The pandemic's aftermath served as a stark reminder of the need for adaptability and innovation in the reinsurance market, prompting a deeper integration of technology and data-driven approaches.

While long-term stability remains a driving force, the reinsurance market is equally influenced by short-term shifts that shape its trajectory. One such driver is the growing emphasis on climate change resilience. As climate-related disasters become more frequent and severe, reinsurers are compelled to recalibrate their risk assessment strategies to encompass these new realities. This recalibration paves the way for innovative products that cater to the evolving needs of the market.

Amidst these shifts, a notable opportunity arises in the realm of insurtech collaborations. The convergence of insurance and technology introduces novel avenues for enhanced customer experiences, streamlined processes, and improved risk management. Reinsurers who harness the potential of insurtech partnerships can tap into a wellspring of efficiency gains and novel market offerings, thereby solidifying their competitive edge.

A concurrent trend observed in the reinsurance industry is the rise of alternative capital sources. Non-traditional players, such as hedge funds and pension funds, are increasingly participating in the reinsurance market, diversifying its funding landscape. This trend not only infuses fresh capital but also introduces a new layer of complexity in risk assessment and pricing dynamics, necessitating innovative approaches to balance risk and return.

Segmentation Analysis:

The global Reinsurance Market segmentation includes:

By Distribution Channel: Direct Writing, Broker

Direct Writing, also known as the "Ceding" method, involves an insurance company directly ceding a portion of its risks to a reinsurer. This channel stands as a foundation of reassurance, wherein the insurer relies on its in-house expertise to evaluate risks and administer reinsurance. This approach offers a streamlined process, as communication is channeled directly between the insurer and the reinsurer. Within the distribution channels, the Direct Writing segment emerges as the largest, serving as the fundamental route through which insurance companies secure their portfolios. This segment's prevalence underscores the significance of direct engagement between insurers and reinsurers, enhancing the industry's overall stability.

The Broker distribution channel is characterized by intermediaries who act as bridges between insurance companies and reinsurers. Brokers leverage their specialized knowledge to facilitate optimal risk placements, effectively matching insurers' needs with reinsurers' capabilities. This channel ensures a broader view of available options and fosters competitive pricing. Among the distribution channels, the Broker segment has garnered the reputation of being the fastest growing. Its intermediary role not only eases the complexity of risk assessment but also introduces agility in responding to market shifts. The consistent growth of this segment emphasizes its capacity to adapt to evolving market dynamics.

By End User: Life & Health Reinsurance, Non-Life/Property & Casualty Reinsurance

Among these segments, Non-Life/Property & Casualty Reinsurance emerges as the largest, given its wide-ranging scope encompassing numerous tangible assets and liability exposures. The sheer magnitude of risks associated with property and casualty events necessitates a robust reinsurance market, where reinsurers step in to share the financial burden of these unpredictable occurrences. Conversely, the Life & Health Reinsurance segment takes the lead as the fastest-growing segment in recent times. With a growing awareness of health and well-being, coupled with an aging global population, the demand for life and health-related coverage has witnessed a notable surge. This phenomenon has propelled the Life & Health Reinsurance segment into a phase of rapid expansion, as insurance companies and reinsurers collaborate to meet the evolving needs of individuals seeking financial protection against health-related uncertainties.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/reinsurance-market/request-sample

Regional Analysis:

In North America, the reinsurance market spans across vast landscapes and varied industries. This region boasts a mature market characterized by stringent regulations and well-established players. The diverse risks encompassed within this region include natural disasters, health-related claims, and cyber threats. With extensive expertise and a rich history, North America's reinsurance sector stands as the largest segment.

Across the European reinsurance market, tradition and innovation intertwine to create a formidable force. Europe's rich history in insurance and reinsurance lays the foundation for robust risk management practices. The market embraces technological advancements while upholding strong regulatory frameworks. Notably, Europe takes the lead in pioneering climate-related resilience solutions, a reflection of its forward-looking approach.

The Asia Pacific emerges as the fastest growing region brimming with opportunities in the reinsurance landscape. Rapid economic growth, coupled with a burgeoning middle class, drives an increased demand for insurance coverage. Countries within this region grapple with diverse risks, from natural disasters to healthcare needs. The Asia Pacific, though still maturing, holds the promise of becoming a significant player on the global reinsurance stage.

Latin America presents a reinsurance market colored by unique challenges and opportunities. The region grapples with political and economic volatility, leading to fluctuating demand for insurance products. Nonetheless, this market showcases resilience in tackling risks associated with climate change, attracting global players aiming to support sustainable growth.

The Middle East's reinsurance market serves as a nexus of emerging potential. With diverse economies, this region exhibits a mosaic of risks from energy-related challenges to geopolitical uncertainties. While the market remains relatively nascent, it witnesses an influx of investments and partnerships that seek to unlock its latent opportunities. In Africa, the reinsurance market holds immense untapped potential. The continent grapples with unique challenges, including infrastructure deficits and a wide range of risks, from health crises to natural catastrophes. As economies grow and insurance penetration deepens, Africa's reinsurance sector is poised to carve a niche for itself in the global arena.

Latest Industry Developments:

• Companies operating in the reinsurance market are increasingly embracing digital transformation initiatives and integrating insurtech solutions. By leveraging advanced technologies such as artificial intelligence, data analytics, and blockchain, reinsurers aim to streamline their processes, enhance risk assessment accuracy, and improve customer experiences. The adoption of digital tools allows them to respond swiftly to changing market dynamics and offer tailored solutions, thereby gaining a competitive edge.

• Another prominent strategy to enhance market share involves forging strategic collaborations and partnerships. Reinsurance firms are joining forces with insurtech startups, traditional insurance companies, and even alternative capital providers. These alliances enable companies to tap into each other's expertise, expand their product offerings, and access new customer segments. Collaborations also facilitate knowledge sharing and innovation, enabling participants to collectively address evolving risks and market demands.

• Reinsurance companies are increasingly directing their attention toward niche and emerging markets to bolster their market share. By identifying underserved sectors and regions, reinsurers can develop specialized products that cater to specific risks and demands. This strategy not only allows companies to differentiate themselves but also opens up avenues for growth in markets with untapped potential. The pursuit of niche markets often requires a deep understanding of localized risks and regulatory environments, fostering a competitive advantage.

Customize the Full Report Based on Your Requirements @ https://virtuemarketresearch.com/report/reinsurance-market/customization

Contact Us:

Virtue Market Research

Kumar Plaza, #103, SRPF Rd, Ramtekadi, Pune, Maharashtra 411013, India

E-mail: megha@virtuemarketresearch.com

Phone: +1-917 436 1025

About Us:

We are a strategic management firm helping companies to tackle most of their strategic issues and make informed decisions for their future growth. We offer syndicated reports and consulting services. Our reports are designed to provide insights on the constant flux in the global demand-supply gap of markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Reinsurance Market is projected to reach the value of $1.14 Trillion by 2030 here

News-ID: 3188082 • Views: …

More Releases from Virtue Market Research

The Global Vodka Seltzer Market is projected to reach a market size of USD 16.22 …

The Vodka Seltzer Market was valued at USD 9.4 billion in 2024 and is projected to reach a market size of USD 16.21 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.1%.

Request Sample @ https://virtuemarketresearch.com/report/vodka-seltzer-market/request-sample

The vodka seltzer market has grown from a niche beverage choice into a mainstream favorite, supported by shifting consumer lifestyles and evolving…

The Global Telehealth Services Market and is projected to reach a market size of …

The Global Telehealth Services Market was valued at USD 126.1 billion and is projected to reach a market size of USD 302.49 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.7%.

Request Sample @ https://virtuemarketresearch.com/report/telehealth-services-market/request-sample

The perennial shift towards patient-centric healthcare has been a pivotal long-term market driver for telehealth services. Over the years, the industry has witnessed…

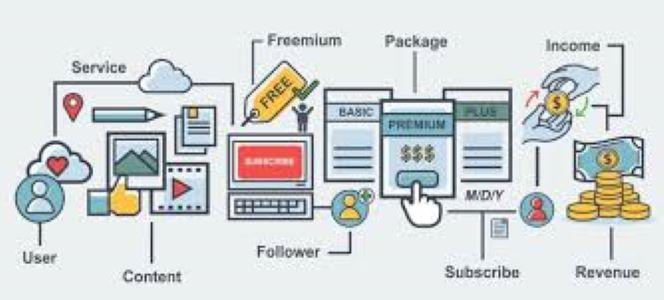

The Subscription Box/Subscription E-Commerce Market is projected to reach a mark …

The Subscription Box/Subscription E-Commerce Market is valued at USD 47.19 billion in 2024 and is projected to reach a market size of USD 97.73 billion by the end of 2030. Over the outlook period of 2025-2030, the market is anticipated to grow at a CAGR of 12.9%.

Request Sample @ https://virtuemarketresearch.com/report/subscription-e-commerce-market/request-sample

The subscription e-commerce market has grown into one of the most dynamic parts of the digital economy. It began as a…

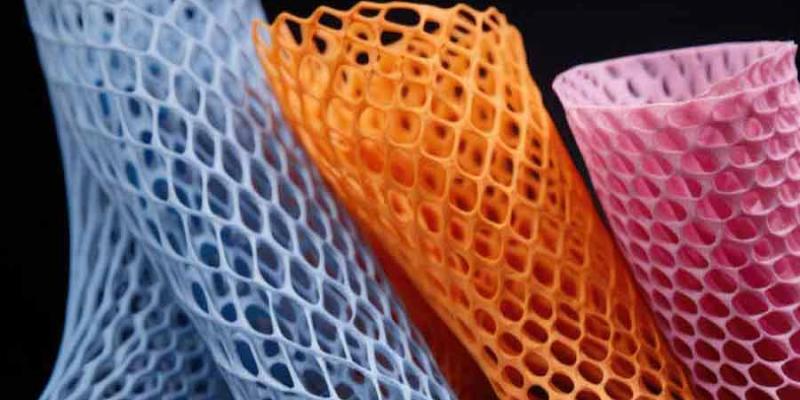

The Global Aramid Fibre Reinforced Polymer Composites Market is projected to rea …

According to the report published by Virtue Market Research in Aramid Fibre Reinforced Polymer Composites Market was valued at USD 5.55 billion and is projected to reach a market size of USD 8.57 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/aramid-fibre-reinforced-polymer-composites-market/request-sample

The Aramid Fibre Reinforced Polymer Composites…

More Releases for Reinsurance

Reinsurance Services Market SWOT Analysis by Key Players Hannover Re, Korean Rei …

The Latest research coverage on Reinsurance Services Market provides a detailed overview and accurate market size. The study is designed considering current and historical trends, market development and business strategies taken up by leaders and new industry players entering the market. Furthermore, study includes an in-depth analysis of global and regional markets along with country level market size breakdown to identify potential gaps and opportunities to better investigate market status,…

Crop Reinsurance Market Is Booming So Rapidly | Munich Reinsurance, Swiss Reinsu …

The Crop Reinsurance Market study with 65+ market data Tables, Pie charts & Figures is now released by HTF MI. The research assessment of the Market is designed to analyze futuristic trends, growth factors, industry opinions, and industry-validated market facts to forecast till 2029. The market Study is segmented by key a region that is accelerating the marketization. This section also provides the scope of different segments and applications that…

Agriculture Reinsurance Market Is Booming Worldwide : Agroinsurance, Swiss Reins …

The Latest Released Agriculture Reinsurance market study has evaluated the future growth potential of Agriculture Reinsurance market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers, challenges,…

Recent Reinsurance Market Investment Activity From Established Companies Are to …

The latest release from WMR titled Reinsurance Market Research Report 2022-2028 (by Product Type, End-User / Application, and Regions / Countries) provides an in-depth assessment of the Reinsurance including key market trends, upcoming technologies, industry drivers, challenges, regulatory policies, key players company profiles, and strategies. Global Reinsurance Market study with 100+ market data Tables, Pie Chat, Graphs & Figures is now released BY WMR. The report presents a complete assessment…

Life Reinsurance Market is Going to Boom | Swiss Re, Munich Reinsurance, Korean …

Advance Market Analytics published a new research publication on “Life Reinsurance Market Insights, to 2026″ with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Life Reinsurance market was mainly driven by the increasing R&D spending across the world.

Some of the key players profiled in…

Reinsurance Market To See Stunning Growth | Munich, Korean Reinsurance, Swiss

Latest Market Research on “Reinsurance Market” is now released to provide hidden gems performance analysis in recent years and years to come. The study explains a detailed overview of market dynamics, segmentation, product portfolio, business plans, and the latest development in the industry. Staying on top of market trends & drivers is always remain crucial for decision-makers and marketers to hold emerging opportunity.

Get the inside scoop with Sample report https://www.htfmarketreport.com/sample-report/3185812-global-reinsurance-market-26

Know…