Press release

Consumer Banking Service Market May See Big Move | Major Giants Allied Irish Bank, Aldermore Bank, Bank of Ireland

The Latest research study released by HTF MI "Consumer Banking Service Market" with 100+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint and status. Understanding the segments helps in identifying the importance of different factors that aid the market growth. Some of the Major Companies covered in this Research are Allied Irish Bank (Ireland), Aldermore Bank (United Kingdom), Bank of Ireland (Ireland), Close Brothers Group (United Kingdom), The Co-Operative Bank (United Kingdom), CYBG Plc (United Kingdom), First Direct (United Kingdom), Handelsbanken (Sweden), Masthaven Bank (United Kingdom), Metro Bank (United Kingdom), Kent Reliance (United Kingdom), Paragon Bank (United States), Secure Trust Bank (United Kingdom).Click here for free sample + related graphs of the report @: https://www.htfmarketreport.com/sample-report/3249594-global-consumer-banking-service-market-4

Global Consumer Banking Service Market by Type (Traditional, Digital Led), Application (Transactional Accounts, Savings Accounts, Debit Cards, Credit Cards, Loans, Others), Components (Hardware, Software), Bank Types (Community Development Bank, Private Banks, Public Banks, NBFC)

for more information or any query mail at sales@htfmarketreport.com

The past few years have been characterized by challenges in terms of operational excellence and stronger customer loyalty for the banks. While digitization, mobile banking, and open banking dominated the headlines, the modernization, cloudification, and optimization of business processes also had a fair share of the banks' annual IT budgets. Many banks faced challenges in building customer relationships through digital channels. The consumer banking services examine all these challenges and ways banks can differentiate, nurture loyal customers, and strengthen their brands. These survey results were compiled prior to the COVID-19 outbreak. While they provide an overview of how customers may have felt before a pandemic, banks should consider which of these responses can be accelerated by social distancing practices, economic challenges, and personal health concerns. Almost more than 19,000 financial services professionals present in 18 global delivery centers enable the banks to transform their organizations so as to get results faster and create a seamless front, middle, as well as back-office processes. This improves the customer experience, improves competitiveness, accelerates growth, increases agility, and enables sustainable transformation.

If you have any Enquiry please click here @: https://www.htfmarketreport.com/enquiry-before-buy/3249594-global-consumer-banking-service-market-4

Market Drivers

• High Growth in Banking Sector

• Increasing Preferences for Personalized Financial Services

• Advancement in Mobile Payment

Market Trend

• High Adoption from Large Size Organizations

• Increasing Focus on Enhancing the Customer Experience by Providing Better Interest Rates and Increased Customer Connectivity

Opportunities

• Rising Number of New Technology Related Market Entrants

• Increase In Investment in Research and Development Activities

Challenges

• Lack of Awareness Regarding the Services in Under Developed Regions

Geographically, this report is segmented into some key Regions, with manufacture, depletion, revenue (million USD), and market share and growth rate of Consumer Banking Service in these regions, from 2018 to 2028 (forecast), covering China, USA, Europe, Japan, Korea, India, Southeast Asia & South America and its Share (%) and CAGR for the forecasted period 2023 to 2029

Informational Takeaways from the Market Study: The report Consumer Banking Service matches the completely examined and evaluated data of the noticeable companies and their situation in the market considering impact of Coronavirus. The measured tools including SWOT analysis, Porter's five powers analysis, and assumption return debt were utilized while separating the improvement of the key players performing in the market.

Key Development's in the Market: This segment of the Consumer Banking Service report fuses the major developments of the market that contains confirmations, composed endeavours, R&D, new thing dispatch, joint endeavours, and relationship of driving members working in the market.

To get this report buy full copy @: https://www.htfmarketreport.com/buy-now?format=1&report=3249594

Some of the important question for stakeholders and business professional for expanding their position in the Consumer Banking Service Market:

Q 1. Which Region offers the most rewarding open doors for the market Ahead of 2022?

Q 2. What are the business threats and Impact of latest scenario over the market Growth and Estimation?

Q 3. What are probably the most encouraging, high-development scenarios for Consumer Banking Service movement showcase by applications, types and regions?

Q 4.What segments grab most noteworthy attention in Consumer Banking Service Market in 2021 and beyond?

Q 5. Who are the significant players confronting and developing in Consumer Banking Service Market?

For More Information Read Table of Content @: https://www.htfmarketreport.com/reports/3249594-global-consumer-banking-service-market-4

Key poles of the TOC:

Chapter 1 Consumer Banking Service Market Business Overview

Chapter 2 Major Breakdown by Type

Chapter 3 Major Application Wise Breakdown (Revenue & Volume)

Chapter 4 Manufacture Market Breakdown

Chapter 5 Sales & Estimates Market Study

Chapter 6 Key Manufacturers Production and Sales Market Comparison Breakdown

…………………..

Chapter 8 Manufacturers, Deals and Closings Market Evaluation & Aggressiveness

Chapter 9 Key Companies Breakdown by Overall Market Size & Revenue by Type

………………..

Chapter 11 Business / Industry Chain (Value & Supply Chain Analysis)

Chapter 12 Conclusions & Appendix

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, LATAM, Europe or Southeast Asia.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +1 (434) 322-0091

sales@htfmarketreport.com

About Author:

HTF Market Intelligence consulting is uniquely positioned empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist in decision making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Consumer Banking Service Market May See Big Move | Major Giants Allied Irish Bank, Aldermore Bank, Bank of Ireland here

News-ID: 3187191 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Self Service Dog Washes System Market Hits New High | Major Giants- Petco, Pet E …

The latest study released on the Global Self Service Dog Washes System Market by HTF MI evaluates market size, trend, and forecast to 2033. The Self Service Dog Washes System market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges…

LEED-Certified Flooring Materials Market Is Booming Worldwide | Major Giants Int …

The latest analysis of the worldwide LEED-Certified Flooring Materials market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. LEED-Certified Flooring Materials market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report Include:

Interface, Inc.,…

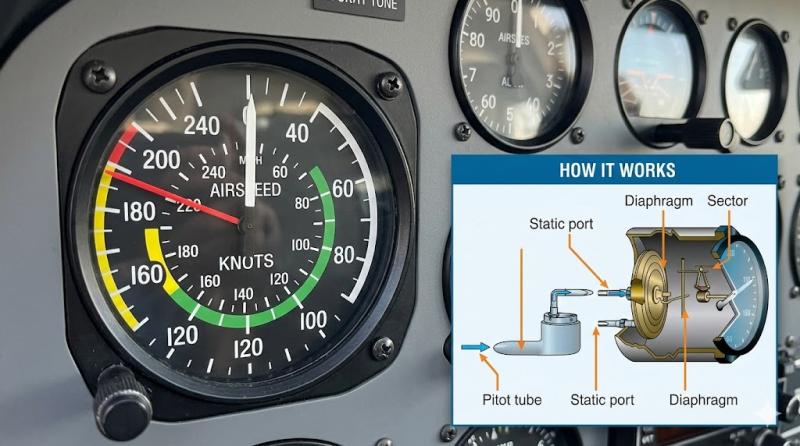

Aircraft Airspeed Indicator Market is Going To Boom | Collins Aerospace, Ametek, …

The latest study released on the Global Aircraft Airspeed Indicator Market by HTF MI evaluates market size, trend, and forecast to 2033. The Aircraft Airspeed Indicator market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key…

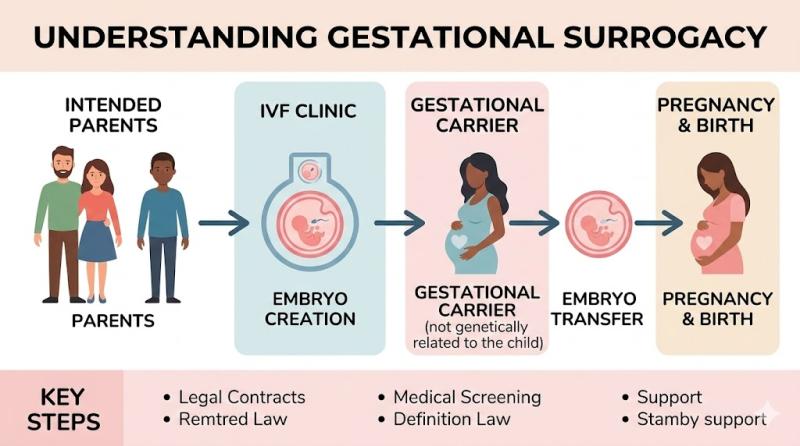

Surrogacy Market to See Stunning Growth with Circle Surrogacy, Surrogacy UK, Con …

The latest study released on the Global Surrogacy Market by HTF MI evaluates market size, trend, and forecast to 2033. The Surrogacy market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players in This Report…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…