Press release

Wealth Management Market Technology, Key Manufacturers Report 2023-2033: Special Focus on USA, Europe, Japan Market

Allied Market Research published a report, titled, "Wealth Management Market By Business Model (Human Advisory, Robo Advisory, and Hybrid Advisory), Provider (FinTech Advisors, Banks, Traditional Wealth Managers, and Others), and End-user Type (Retail and High Net Worth Individuals (HNIs): Global Opportunity Analysis and Industry Forecast, 2021-2030." According to the report, the global wealth management industry was worth $1.25 trillion in 2020, and is expected to reach $3.43 trillion by 2030, manifesting a CAGR of 10.7% from 2021 to 2030.Download Sample Report@ https://www.alliedmarketresearch.com/request-sample/13433

Prime Drivers of Growth

The rapid demand for alternative investments including private equity, commodities, hedge funds, real estate investment trusts (REITs), and intellectual property drives the growth of the global wealth management market. The emergence of FinTechs has disrupted the wealth management industry and benefits offered by wealth management such as reduced or eliminated financial stress & making financial plans, and digitization of offerings are contributing toward the market growth.

On the other hand, strict rules of the government for wealth management companies, lack of pricing transparency, and high fees are a few factors that limit the market growth. Technological advancements and untapped potential of emerging economies are opening doors of opportunities for the market.

Covid-19 Scenario

Owing to the economic slowdown, unpredictability in global financial sectors, and highly volatile economy, the wealth management market is impacted negatively. The demand for wealth management products is reduced.

The emergence of FinTechs is visible as wealth managers are increasingly investing in new technologies including robo-advisor, robotic process automation, artificial intelligence (AI), and digital identification (ID) technologies for boosting customer experience.

The Human Advisory Business Model will Maintain the Leading Position Throughout the Forecast Period

Based on business model, the human advisory segment held the highest market share in 2020, accounting for more than three-fourths of the global wealth management market, and is anticipated to lead throughout the forecast period. This lead is attributed to the fact that these advisors serve a changing client base in a variety of demographics and offer fluidity in the approach while managing wealth. However, the robo advisory segment is projected to manifest the highest CAGR of 26.4% from 2021 to 2030, owing to easy account setup, comprehensive education, robust goal planning, portfolio management, security features, account services, attentive customer service, and low fees.

The Traditional Wealth Managers Segment to Maintain the Leading Position during the Forecast Period

Based on provider, the traditional wealth manager segment accounted for the largest share in 2020, contributing to nearly two-thirds of the global wealth management market, and is anticipated to maintain its lead position throughout the forecast period. Traditional wealth manager offers convenience and reduces stress towards managing finances of the clients.

The core reason behind hiring a traditional wealth manager is clients' expectation that the investment may lead to an increase in the net returns. However, the fintech advisors segment is expected to portray the largest CAGR of 16.8% from 2021 to 2030, owing to the efforts of fintech advisors to create a solid business plan and market strategy, advice on regulatory compliance that meets state and federal standards, and help in building credible relationships with banks, customers, and investors.

Interested to Procure the Data? Inquire Here @ https://www.alliedmarketresearch.com/purchase-enquiry/13433

North America to Maintain its Dominance by 2030

Based on region, North America held the highest market share in terms of revenue in 2020, accounting for more than half of the global wealth management market, and is expected to maintain its lead by 2030. This is due to the presence of a massive number of high net-worth individuals and increase in number of competitions among banks such as Morgan Stanley, UBS, and Bank of America Corporation to offer the maximum benefits to their clients. However, Asia-Pacific is projected to witness the fastest CAGR of 12.7% during the forecast period, owing to the several high net worth & ultra-high net worth individuals continuing to demand wealth management product lines in the region.

Enquire for Customization with Detailed Analysis of COVID-19 Impact in Report @ https://www.alliedmarketresearch.com/request-for-customization/13433?reqfor=covid

Leading Market Players

Bank of America Corporation,

BNP Paribas,

Charles Schwab & Co., Inc.,

Citigroup Inc.,

CREDIT SUISSE GROUP AG,

Goldman Sachs,

JPMorgan Chase & Co.,

Julius Baer Group,

Morgan Stanley,

UBS

Similar Reports:

Fire Insurance Market https://www.alliedmarketresearch.com/fire-insurance-market-A11106

Dental Insurance Market https://www.alliedmarketresearch.com/dental-insurance-market-A06828

NFC Payment Devices Market https://www.alliedmarketresearch.com/nfc-payment-devices-market-A11317

Insurance Analytics Market https://www.alliedmarketresearch.com/insurance-analytics-market-A07602

Rideshare Insurance Market https://www.alliedmarketresearch.com/rideshare-insurance-market-A74742

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow us on LinkedIn and Twitter

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wealth Management Market Technology, Key Manufacturers Report 2023-2033: Special Focus on USA, Europe, Japan Market here

News-ID: 3171008 • Views: …

More Releases from Allied Market Research

Manual Wheelchair Market Research Report: Unveiling CAGR and USD Projections for …

According to a new report published by Allied Market Research, titled, "Manual Wheelchair Market by Category, Design & Function, and End User: Global Opportunity Analysis and Industry Forecast, 2018 - 2025,"the global manual wheelchair market was valued at $2,609.7 million in 2017 and is projected to reach $4,099.1 million by 2025, registering a CAGR of 5.8% from 2018 to 2025. Manual wheelchairs are specifically designed for use by individuals with…

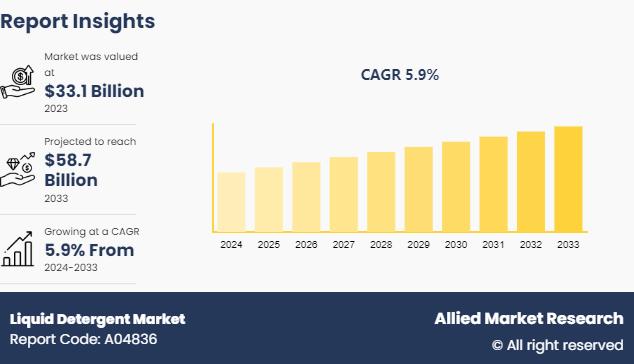

Liquid Detergent Market Research Insights: Uncovering CAGR and USD Growth Driver …

The global liquid detergent market has witnessed substantial growth in recent years, driven by rising consumer demand for convenient and effective cleaning solutions. As households and industries seek more efficient products for their cleaning needs, liquid detergents have emerged as a preferred option due to their ease of use, versatility, and superior cleaning properties compared to traditional powder detergents. The market spans across various sectors, including residential, commercial, and industrial,…

Solid Beverage Market Advancements Highlighted by Trends Opportunities for Inves …

Solid beverages are processed powdered mixes that are mixed with water or milk to make desired beverages and drinks. These beverage powders are made by concentrating and drying various materials and making powder, which can be consumed by diluting with water or milk. Solid beverages are usually made with sweeteners like sucralose, aspartame, saccharin, cyclamates and often include colors and flavors. Solid beverage products are often fortified with vitamins, minerals,…

Near Space Robotics Market Drivers Main Factors Influencing Industry in 2032

Space robots are self-controlled device consisting of mechanical, electrical, and electronic components, which can function in place of a living agent. Space robots are capable of surviving harsh environment of space and can perform functions such as construction, maintenance, exploration, servicing of spatial satellites, etc. Remotely operated vehicles (ROV) and remote manipulator system (RMS) are the two major types of space robots. The space robotics industry is achieving high growth…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…