Press release

Telecommunication Insurance Market New Highs - Current Trends and Growth Drivers Along with Key Industry Players

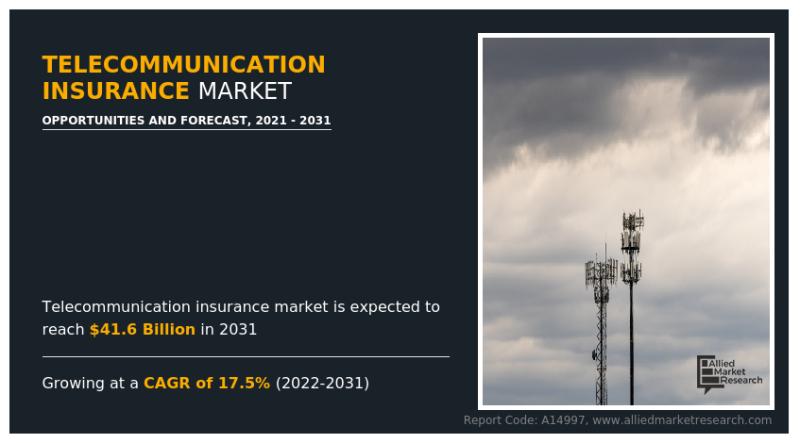

According to the report published by Allied Market Research, the global telecommunication insurance market generated $8.5 billion in 2021, and is projected to reach $41.6 billion by 2031, growing at a CAGR of 17.5% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape. The report is a useful source of information for new entrants, shareholders, frontrunners and shareholders in introducing necessary strategies for the future and taking essential steps to significantly strengthen and heighten their position in the market.Request PDF Brochure: https://www.alliedmarketresearch.com/request-sample/15366

The report offers detailed segmentation of the global telecommunications insurance market based on coverage, enterprise size, application, and region. The report provides a comprehensive analysis of every segment and their respective sub-segment with the help of graphical and tabular representation. This analysis can essentially help market players, investors, and new entrants in determining and devising strategies based on fastest growing segments and highest revenue generation that is mentioned in the report.

Based on application, the equipment manufacturer segment held the dominating market share in 2021, holding more than half of the global telecommunication insurance market share, and is expected to maintain its leadership status during the forecast period. The consultant segment, on the other hand, is expected to cite the fastest CAGR of 21.0% during the forecast period.

Based on coverages, the general liability segment held the dominating market share in 2021, holding nearly two-fifths of the global telecommunication insurance market share, and is expected to maintain its leadership status during the forecast period. The Professional Liability Insurance (E&O) segment, on the other hand, is expected to cite the fastest CAGR of 18.9% during the forecast period.

Based on enterprise size, the large enterprises segment held the dominating market share in 2021, holding three-fourths of the global telecommunication insurance market share, and is expected to maintain its leadership status during the forecast period. The Small and Medium-sized Enterprises segment, on the other hand, is expected to cite the fastest CAGR of 21.7% during the forecast period.

Based on region, the market across North America held the dominating market share in 2021, holding nearly two-fifths of the global telecommunication insurance market share. The Asia-Pacific telecommunication insurance market, on the other hand, is expected to maintain its leadership status during the forecast period. In addition, the same region is expected to cite the fastest CAGR of 20.2% during the forecast period.

The key players analyzed in the global telecommunications insurance market report include Allianz, ANDERSON LLOYD INTERNATIONAL LTD, Aon PLC, Bluestone Insurance Services Ltd., CapriCMW Insurance Services Ltd., Chubb Limited, EMC Enterprises, Farmers Union Insurance, Arthur J. Gallagher & Co., Hartford, Insureon, McGriff Insurance Services, Inc., Sompo International, and Tower Street Insurance.

The report analyzes these key players in the global telecommunications insurance market. These market players have made effective use of strategies such as joint ventures, collaborations, expansion, new product launches, partnerships, and others to maximize their foothold and prowess in the industry. The report is helpful in analyzing recent developments, product portfolio, business performance and operating segments by prominent players in the market.

COVID-19 Scenario:

The outbreak of the COVID-19 has had a positive impact on the growth of the global telecommunications insurance market, owing to the occurrence of lockdowns in various countries across the globe.

Lockdowns subsequently increased overall internet penetration as more and more individuals and companies switched from traditional working culture to work from home culture.

Therefore, to help employees with their medication needs and hospitalization fees, telecommunication businesses provided them with worker's compensation from the telecommunication insurance coverage.

Furthermore, there were cases of data breaches, cyber thefts in the telecommunication industries for which the businesses took the insurance to provide coverage for such risks. Thus, the pandemic had a favourable impact on the market.

Buy This Report@ http://bit.ly/3UzgkIW

Key benefits for stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the telecommunication insurance market forecast from 2021 to 2031 to identify the prevailing telecommunication insurance market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the telecommunication insurance market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the telecommunication insurance market outlook.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global telecommunication insurance market trends, key players, market segments, application areas, and market growth strategies.

Want to Access the Statistical Data and Graphs, Key Players' Strategies: https://www.alliedmarketresearch.com/telecommunication-insurance-market/purchase-options

Telecommunication Insurance Market Key Segments:

Application

Equipment Manufacturer

Service Provider

Consultant

Coverages

General Liability

Commercial Liability

Professional Liability Insurance (E&O)

Others

Enterprise Size

Large Enterprises

Small and Medium-sized Enterprises

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Netherlands, Rest Of Europe)

Asia-Pacific (China, India, Japan, Australia, Singapore, Rest Of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Trending Reports in BFSI Industry:

Augmented Analytics in BFSI Market https://www.alliedmarketresearch.com/augmented-analytics-in-bfsi-market-A11748

Unsecured Business Loans Market https://www.alliedmarketresearch.com/unsecured-business-loans-market-A15157

Asset-Based Lending Market https://www.alliedmarketresearch.com/asset-based-lending-market-A12934

Blockchain in Insurance Market https://www.alliedmarketresearch.com/blockchain-in-insurance-market-A11767

Auto Finance Market https://www.alliedmarketresearch.com/auto-finance-market-A10390

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow us on LinkedIn and Twitter

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Telecommunication Insurance Market New Highs - Current Trends and Growth Drivers Along with Key Industry Players here

News-ID: 3168742 • Views: …

More Releases from Allied Market Research

Very Light Jet Market is Likely to Increase at a Significantly High CAGR of 11.0 …

The global very light jet market was estimated at $4.45 billion in 2020 and is expected to hit $10.44 billion by 2030, registering a CAGR of 11.0% from 2021 to 2030.

Increase in inclination toward private aviation solution and growing concern toward health among individuals drive the growth of the very light jet market. On the other hand, volatile raw material prices, rising environmental concerns, and substitute aviation solutions restrain the…

Luxury Wines and Spirits Market to Garner $414.8 Billion, Globally, By 2031 At 6 …

According to the report, the global luxury wines and spirits industry generated $229.4 billion in 2021 and is anticipated to generate $414.8 billion by 2031, witnessing a CAGR of 6.2% from 2022 to 2031.

The growth in interest in premium and unique products, the rise in demand for organic and sustainable products, and the popularity of experiential marketing drive the growth of the global luxury wines and spirits market. However, high…

Global Brushless DC Motor Market to Garner $72.24 Billion at 8.1% CAGR by 2030: …

Allied Market Research recently published a report, titled, "Brushless DC Motors Market by Rotor type (Inner Rotor, Outer Rotor), by Power range (0-750 W, 751 W- 3 KW, More Than 3 KW), by Speed (Less Than 500 RPM, 501 To 2000 RPM, 2001 To 10,000 RPM, More Than 10,000 RPM), by End user (Industrial Machinery, Automotive, Healthcare, HVAC Industry, Power tools, Others): Global Opportunity Analysis and Industry Forecast, 2020-2030". As…

Global Brushless DC Motor Market to Garner $72.24 Billion at 8.1% CAGR by 2030: …

Allied Market Research recently published a report, titled, "Brushless DC Motors Market by Rotor type (Inner Rotor, Outer Rotor), by Power range (0-750 W, 751 W- 3 KW, More Than 3 KW), by Speed (Less Than 500 RPM, 501 To 2000 RPM, 2001 To 10,000 RPM, More Than 10,000 RPM), by End user (Industrial Machinery, Automotive, Healthcare, HVAC Industry, Power tools, Others): Global Opportunity Analysis and Industry Forecast, 2020-2030". As…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…